By Laura Stevens and Amrith Ramkumar

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 5, 2018).

Amazon.com Inc. followed Apple Inc. to become the second U.S.

company to reach $1 trillion in market value, reflecting the online

retailer's striking transformation from a profitless bookseller

into a disruptive force of commerce.

Shares of Amazon climbed 1.9% in midday trading Tuesday, briefly

topping the $2,050.27 needed to push the company's value above $1

trillion. The stock, which ended the day up 1.3%, has surged nearly

75% in 2018 and added roughly $430 billion to the company's market

capitalization -- about the size of Walmart Inc., Costco Wholesale

Corp. and Target Corp. combined.

Investors have rewarded the Seattle-based company as it

demonstrated better financial discipline in recent quarters,

reporting record profits because of lucrative businesses such as

cloud computing despite aggressively spending on industries from

health care to grocery delivery.

"They've proven they can make it work," said Michael Lippert,

who manages the Baron Capital Opportunity Fund that counts Amazon

as its largest holding. "They're spending a lot on all these things

to build and enforce their competitive advantages."

Amazon and Apple, which hit the trillion-dollar milestone on

Aug. 2, symbolize the growing influence of tech companies on

markets and the economy. The industry is amassing wealth and power,

creating a new order in business where the most valuable resource

is no longer oil, but data. Not far behind in market value are

Google owner Alphabet Inc. and Microsoft Corp., both approaching

$900 billion, while Facebook Inc. -- which crossed $500 billion in

July 2017, a day after Amazon -- has stalled at those levels amid a

data-privacy scandal and growth concerns.

The companies' increasing clout have prompted lawmakers to

scrutinize the tech sector more closely. Amazon, which captures

nearly half of all U.S. dollars spent online, is simultaneously

drawing the ire of President Trump over its effect on traditional

retail and its use of the U.S. Postal Service. Sen. Bernie Sanders

has also criticized the company for the way it pays and treats its

warehouse workers, something Amazon has said is an inaccurate

portrayal.

Investors also worry about the tech companies' outsize impact on

the stock market. Amazon, Apple and Microsoft have accounted for

more than 35% of the S&P 500's total return this year,

according to S&P Dow Jones Indices data through Aug. 28.

One of the biggest beneficiaries of Amazon's growth is its

54-year-old leader, Jeff Bezos, who has surpassed Bill Gates to

become the richest man in the world, according to multiple indices

that track the world's wealthiest people. Mr. Bezos owned roughly

16% of Amazon, as of an August regulatory filing, and is worth

about $166 billion, according to the Bloomberg Billionaires

Index.

Amazon has expanded rapidly since its humble founding as an

online bookstore in Mr. Bezos's garage in 1994. The internet then

was just becoming a viable platform, and the most valuable

companies at the time included industrial conglomerate General

Electric Co., oil giant Exxon Inc. and telecommunications power

AT&T Inc.

Amazon was valued at less than $500 million when it went public

in 1997. A $1,000 investment in the IPO would be worth roughly $1.4

million today, adjusted for stock splits.

Tom Alberg, founding managing director for Madrona Venture

Group, invested in Mr. Bezos's initial $1 million round of funding

in 1995 and has served on the board since the beginning. At the

time, "I don't think that any of us saw that [the internet] or

Amazon would become as significant as they've become," Mr. Alberg

said. He preferred to buy his books in stores, and many believed

consumers would balk at paying with a credit card online.

Mr. Bezos and Amazon have been successful by staying intensely

focused on customers, working to retain top talent, innovating and

taking big risks on projects -- even if they fail, Mr. Alberg said.

"People have asked me, 'What's Amazon's secret to success?'" he

said. "There are no secrets."

Mr. Bezos has built his business by keeping prices low and

expanding quickly. Opening the company's site to millions of small

businesses, retailers and manufacturers accelerated growth, helping

capturing sales from other retail chains. Last year, the company's

online store sales topped $108 billion, and the services it sold

other merchants added to that total.

Amazon along the way has created popular electronic devices,

produced award-winning films and shows, and built a cash cow by

renting computer power on its servers to other companies. Amazon

Web Services made more than $17 billion in revenue last year and

has become the company's biggest profit driver.

In recent months, Amazon has acquired grocery chain Whole Foods

Market -- giving it roughly 470 brick-and-mortar locations -- and

online pharmacy PillPack. It has enabled logistics drivers to

deliver inside consumers' homes and cars, and is working on a

delivery service expected to one day compete with FedEx Corp. and

United Parcel Service Inc.

Amazon is also searching for a second headquarters, known as

HQ2, where it is planning to create as many as 50,000 jobs and

invest more than $5 billion dollars over nearly two decades. The

search, which launched a year ago, has been narrowed down to 20

finalists and a decision is expected in the coming weeks.

It took Amazon just 165 trading days to grow its market value

from $600 billion in January to $1 trillion, pushing it past the

more established Microsoft and Alphabet. By comparison, Apple

needed 183 sessions to hit $1 trillion after piercing $900 billion

in November.

Amazon is more expensive than many of its peers. It trades at

about 90 times projected earnings for the next 12 months, compared

with valuations of roughly 25 for Alphabet and Microsoft and 17 for

Apple and the broader S&P 500. Part of the discrepancy is

because Amazon's record second-quarter earnings of $2.53 billion

are still billions below the profits generated by Apple, Alphabet

and Microsoft.

The higher market multiple is a reminder of how much investors

have embraced Mr. Bezos' strategy of heavy spending in the past 20

years. Some analysts expect Amazon to soon overtake Apple as the

largest U.S. company, which would mark the first such change since

2016, when Alphabet briefly passed the iPhone maker.

Mr. Bezos' initial shareholder letter in 1997 -- which he

resends every year -- touted the company's indifference to

"short-term Wall Street reactions." At all-hands meetings with

employees, Mr. Bezos has quoted legendary investor Benjamin Graham:

"In the short run, the market is a voting machine, but in the long

run, it is a weighing machine."

Corrections & Amplifications Shares of Amazon crossed the

$2,050.27 needed to push the company's value above $1 trillion in

midday trading Tuesday. An earlier version of this article

incorrectly stated that it happened Monday. (Sept. 4, 2018)

Write to Laura Stevens at laura.stevens@wsj.com and Amrith

Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

September 05, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

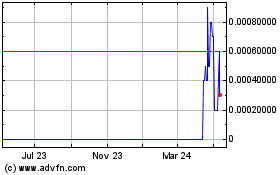

Baron Capital Enterprise (CE) (USOTC:BCAP)

Historical Stock Chart

From Jan 2025 to Feb 2025

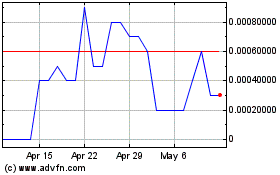

Baron Capital Enterprise (CE) (USOTC:BCAP)

Historical Stock Chart

From Feb 2024 to Feb 2025