US Activist Loses Hyundai Proxy Fight

March 22 2019 - 7:04AM

Dow Jones News

By WSJ City

US hedge-fund manager Elliott Management lost its battle to

boost dividends and gain board seats at South Korean auto giant

Hyundai Motor Group, highlighting the challenge activist firms face

in proxy fights with Asia's family-run businesses.

KEY FACTS

--- Elliott is one of the biggest shareholder activists, with

around $35bn in assets.

--- In Asia, it previously targeted Samsung and Hong Kong's Bank

of East Asia, with mixed results.

--- Shareholders at Hyundai Motor and its auto-parts affiliate

Hyundai Mobis rejected proposals for a much higher one-time

dividend.

--- Shareholders sided with the two companies' combined five

independent board nominees.

What They Said:

"Elliott's proposals were too extreme," said Lee Sung-won, vice

president at Truston Asset Management, a longtime investor in both

Hyundai companies.

Elliott accentuated the positive.

"Elliott is encouraged by the support that the shareholder

proposals received from independent shareholders of HMC and Mobis.

We are confident that the future holds further improvements at

Hyundai."

Spokesperson for Elliott

Why This Matters

This clash is the latest in a series between Elliott and a

family-run Asian company. In Hong Kong, it has engaged in a

multiyear battle to force Bank of East Asia, run by chairman and

chief executive David Li, to sell itself. Shareholder activism has

surged in Asia, with more than 10 times as many campaigns in 2017

as in 2011, according to a JP Morgan report. That reflects growth

in foreign shareholdings and local regulations promoting corporate

governance.

A fuller story is available on WSJ.com

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

March 22, 2019 06:49 ET (10:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

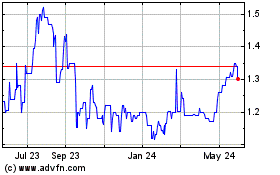

Bank East Asia (PK) (USOTC:BKEAY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Bank East Asia (PK) (USOTC:BKEAY)

Historical Stock Chart

From Jan 2024 to Jan 2025