UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the

Securities

Exchange Act of 1934

Check

the appropriate box: ☐

| ☒ |

Preliminary

Information Statement |

| |

|

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| ☐ |

Definitive

Information Statement |

AYALA

PHARMACEUTICALS, INC.

(Name

of Registrant as Specified in Its Charter)

Payment

of Filing Fee (Check the appropriate box):

| ☐ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☒ |

Fee

computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange

Act Rules 14c-5(g) and 0-11. |

PRELIMINARY

COPY - SUBJECT TO COMPLETION

AYALA

PHARMACEUTICALS, INC.

9

Deer Park Drive, Suite K-1

Monmouth

Junction, NJ

NOTICE

OF WRITTEN CONSENT

AND

INFORMATION

STATEMENT

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO

SEND

US A PROXY.

To

our Stockholders:

This

notice of action by written consent and information statement is being furnished to the holders of common stock, par value $0.001 per

share (the “Common Stock”), of Ayala Pharmaceuticals, Inc. (the “Company,” “our,” “we,”

or “Ayala”) in connection with the Asset Purchase Agreement, dated as of February 5, 2024 (the “Asset Purchase Agreement”),

a copy of which is attached as Annex A to this information statement, by and between the Company and Immunome, Inc. (the “Purchaser”).

Pursuant to the Asset Purchase Agreement, the Purchaser will acquire certain of the Company’s assets and liabilities related to

the Company’s AL101 and AL102 programs (the “Asset Sale”), which constitute substantially all of the Company’s

assets. As consideration for the Asset Sale, the Purchaser will pay to the Company (i) an aggregate upfront purchase price of approximately

$50,000,000, of which $20,000,000 is payable in cash at the closing of the Asset Sale (the “Closing”), subject to certain

adjustments, 2,175,489 shares of Purchaser’s common stock, $0.0001 par value per share (the “Purchaser Common Stock”)

issued at Closing, and (ii) up to $37,500,000 in cash due upon the achievement of certain development and commercial milestone

events set forth in the Asset Purchase Agreement. The Purchaser is also assuming certain specified liabilities of Purchaser, including

outstanding liabilities to vendors and the costs of the ongoing Phase 3 clinical trial of AL102 and manufacturing costs and Ayala’s

obligations to Bristol-Meyers Squibb Company, or BMS, under its license agreement.

In

connection with the execution of the Asset Purchase Agreement, certain of the Company’s officers, directors and stockholders who

collectively are the record or beneficial holders of more than a majority of the issued and outstanding shares of capital stock of the

Company (the “Consenting Stockholders”) entered into a stockholder support agreement in favor of the Purchaser (the “Support

Agreement”) providing, among other things, that such officers, directors and stockholders will, among other things, (i) deliver

a written consent (the “Written Consent”) authorizing, approving and adopting the Asset Purchase Agreement and the transactions

contemplated thereby, including the Asset Sale and other transactions contemplated by the Asset Purchase Agreement and the related transaction

documents as defined therein; (ii) vote against any proposal made in opposition to, or in competition with, the Asset Purchase Agreement

or the Asset Sale and (iii) vote against any acquisition proposal involving a third party.

On

February 5, 2024, the board of directors of Ayala (the “Board”): (i) determined that the Asset Purchase Agreement, the Asset

Sale and the other transactions contemplated thereby are expedient and in the best interests of the Company and its

stockholders; (ii) approved the Asset Purchase Agreement, the Asset Sale and the other transactions contemplated thereby; and (iii) approved

the execution, delivery and performance by the Company of the Asset Purchase Agreement and, subject to obtaining the required approval

of the Consenting Stockholders, the consummation of the Asset Sale and the other transactions contemplated thereby.

On

February 7, 2024, the holders of certain notes and warrants that we had previously issued in 2023, including certain of the Consenting

Stockholders, exercised in full their conversion rights under their notes and warrants (the latter on a cashless basis), utilizing a

conversion price, in accordance with the terms of the notes and warrants, equal to 50% of the Common Stock’s price per share as

of market close on November 16, 2023. As a result, an aggregate of 30,736,555 shares of Common Stock were issued by the Company to these

noteholders and warrant holders.

On

February 8, 2024, the Consenting Stockholders delivered the Written Consent authorizing, approving and adopting in all respects the Asset

Purchase Agreement and the transactions contemplated thereby, including the Asset Sale and other transactions contemplated by the Asset

Purchase Agreement and the related transaction documents as defined therein, and voting all of the shares of the Common Stock held by

them in favor of such authorization, approval and adoption. As a result, no further action by any stockholder of the Company is required

under applicable law, the Company’s certificate of incorporation or bylaws or the Asset Purchase Agreement (or otherwise) to adopt

the Asset Purchase Agreement, and the Company will not be soliciting your vote to adopt the Asset Purchase Agreement and will not call

a stockholders meeting for purposes of voting on the adoption of the Asset Purchase Agreement. This notice and the accompanying information

statement shall constitute notice to you from the Company of the Written Consent contemplated by Section 228 of the General Corporation

Law of the State of Delaware (the “DGCL”).

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. NO ACTION IN CONNECTION WITH THIS INFORMATION STATEMENT

IS REQUIRED BY YOU.

The

information statement accompanying this letter provides you with more specific information concerning the Asset Purchase Agreement, the

Asset Sale and the other transactions contemplated by the Asset Purchase Agreement and the related transaction documents.

| BY

ORDER OF THE BOARD OF DIRECTORS, |

|

| |

|

| /s/

Kenneth A. Berlin |

|

| Kenneth

A. Berlin |

|

| President

and Chief Executive Officer |

|

Neither

the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Asset Sale,

passed upon the merits of the Asset Sale or passed upon the adequacy or accuracy of the information contained in this information statement

and any documents incorporated by reference. Any representation to the contrary is a criminal offense.

This

information statement is dated February , 2024 and is first being mailed to stockholders on or about February , 2024.

TABLE

OF CONTENTS

SUMMARY

TERM SHEET

This

summary highlights selected information from this information statement and may not contain all of the information that is important

to you to understand the asset sale (the “Asset Sale”) contemplated by the Asset Purchase Agreement, dated as of February

5, 2024 (the “Asset Purchase Agreement”), by and between Ayala Pharmaceuticals, Inc. (the “Company” or “Ayala”)

and Immunome, Inc. (the “Purchaser” or “Immunome”). For a more complete description of the legal terms of the

Asset Sale, you should carefully read this entire information statement, the annexes attached to this information statement and the documents

referred to or incorporated by reference in this information statement. Any document or agreement referred to in this information statement

is qualified in its entirety by reference to the full text of such document or agreement. In this information statement, the terms “we,”

“us” and “our” refer to the Company. All references in this information statement to terms defined in the notice

to which this information statement is attached have the meanings provided in that notice. All references to capitalized terms not defined

herein or in the notice to which this information statement is attached have the meanings ascribed to them in the Asset Purchase Agreement,

a copy of which is attached as Annex A to this information statement.

The

Parties to the Asset Purchase Agreement (page 10)

Ayala

Pharmaceuticals, Inc.

We

are primarily a clinical-stage oncology company focused on developing and commercializing small molecule therapeutics for patients suffering

from rare and aggressive cancers, primarily in genetically defined patient populations. Our differentiated development approach is predicated

on identifying and addressing tumorigenic drivers of cancer, through a combination of our bioinformatics platform and next-generation

sequencing to deliver targeted therapies to underserved patient populations. Our current portfolio of product candidates, AL101 and AL102,

targets the aberrant activation of the Notch pathway using gamma secretase inhibitors. Gamma secretase is the enzyme responsible for

Notch activation and, when inhibited, turns off the Notch pathway activation. Aberrant activation of the Notch pathway has long been

implicated in multiple solid tumor and hematological cancers and has often been associated with more aggressive cancers. In cancers,

Notch is known to serve as a critical facilitator in processes such as cellular proliferation, survival, migration, invasion, drug resistance

and metastatic spread, all of which contribute to a poorer patient prognosis. AL101 and AL102 are designed to address the underlying

key drivers of tumor growth, and our initial Phase 2 clinical data of AL101 suggest that our approach may address shortcomings of existing

treatment options. We believe that our novel product candidates, if approved, have the potential to transform treatment outcomes for

patients suffering from rare and aggressive cancers. In addition to AL101 and AL102, which are our primary product candidates, we also

own assets relating to programs on which we have not recently placed substantial emphasis, including assets acquired from Biosight relating

to its programs to develop Aspacytarabine (“BST-236”), which is a novel proprietary anti-metabolite, prodrug of cytarabine,

covalently bound to asparagine, as well as assets relating to former Advaxis’ operations as a clinical-stage biotechnology company

focused on the development and commercialization of proprietary Listeria monocytogenes (“Lm”)-based antigen delivery products.

Our

product candidates, AL101 and AL102, are being developed as potent, selective, small molecule gamma secretase inhibitors, or GSIs. We

obtained an exclusive, worldwide license to develop and commercialize AL101 and AL102 from Bristol-Myers Squibb Company, or BMS, in November

2017. BMS evaluated AL101 in three Phase 1 studies involving more than 200 total subjects and AL102 in a single Phase 1 study involving

36 subjects with various cancers who had not been prospectively characterized for Notch activation, and to whom we refer to as unselected

subjects. While these Phase 1 studies did not report statistically significant overall results, clinical activity was observed across

these studies in cancers in which Notch has been implicated as a tumorigenic driver.

The

Company is headquartered in Monmouth Junction, NJ. Ayala’s common stock, par value $0.001 per share (the “Common Stock”),

is quoted on the OTCQX under the symbol “ADXS”. Additional information regarding the Company is contained in our filings

with the Securities and Exchange Commission (the “SEC”), copies of which may be obtained without charge by following the

instructions in the section entitled “Where You Can Find More Information.”

Immunome,

Inc.

Immunome

is a biotechnology company dedicated to developing first-in-class and best-in-class targeted cancer therapies. Immunome selects its targets

with a modality appropriate to its biology, including antibody-drug conjugates, or ADCs; radioligand therapies, or RLTs; and immunotherapies.

Immunome believes that pursuing underexplored targets with appropriate drug modalities leads to transformative therapies. Immunome’s

proprietary memory B cell hybridoma technology allows for the rapid screening and functional characterization of novel antibodies and

targets.

Immunome

has taken a dual-track approach to developing its current pipeline: organic pipeline expansion driven by its proprietary internal discovery

programs and expansion through disciplined strategic transactions. As a result, Immunome is currently advancing three programs with investigational

new drug application submissions expected in Q1 2025: IM-1021, an ADC targeting ROR1; an undisclosed RLT targeting FAP, or fibroblast

activation protein; and IM-4320, an immunotherapy targeting interleukin 38.

Immunome

is headquartered in Bothell, Washington. Immunome’s common stock is listed on The Nasdaq Capital Market under the trading symbol

“IMNM” and its website is www.immunome.com.

The

Asset Sale (page 11)

On

February 5, 2024, we entered into an Asset Purchase Agreement with Immunome pursuant to which the Purchaser will acquire certain of the

Company’s assets and assumed certain of the Company’s liabilities, in each case, related to the Company’s AL101 and

AL102 programs, as contemplated by and more fully described in the Asset Purchase Agreement, a copy of which is attached as Annex

A to this information statement, which under Delaware law constitutes a sale of substantially all of our assets.

Consideration

for the Asset Sale (page 42)

Pursuant

to the Asset Purchase Agreement, the Purchaser will pay to the Company (i) at the closing of the Asset Sale (the “Closing”)

an aggregate purchase price of approximately $50,000,000 consisting of $20,000,000 in cash, subject to certain adjustments and 2,175,489

shares of Purchaser’s common stock, $0.0001 par value (the “Purchaser Common Stock”) issued at Closing, and (ii) up to an aggregate of $37,500,000 in cash due upon

the achievement of certain development and commercial milestone events set forth in the Asset Purchase Agreement. The Purchaser will

also assume certain outstanding liabilities of the Company and reimburse the Company for certain expenditures between signing and Closing

and assume the ongoing expenses of the development, manufacturing and commercialization of AL102 from and after Closing.

Recommendation

of the Board; Reasons for the Asset Sale (page 28)

After

consideration of various factors, at a meeting on February 5, 2024, the board of directors of the Company (the “Board”) (i)

determined that the Asset Purchase Agreement, the Asset Sale and the other transactions contemplated thereby are expedient and in the best interests of the Company and its stockholders; (ii) approved the Asset Purchase Agreement, the Asset Sale and

the other transactions contemplated thereby; and (iii) approved the execution, delivery and performance by the Company of the Asset Purchase

Agreement and, subject to obtaining the required approval of the Consenting Stockholders, the consummation of the Asset Sale and the

other transactions contemplated thereby.

Required

Stockholder Approval for the Asset Sale (page 47)

Under

Delaware law and the Company’s certificate of incorporation and bylaws, the adoption of the Asset Purchase Agreement required the

written consent of the holders of the Common Stock representing a majority of the issued and outstanding shares of capital stock entitled

to vote thereon. As of February 8, 2024, the record date for determining stockholders of the Company entitled to vote on the adoption

of the Asset Purchase Agreement, there were 42,633,400 shares of the Common Stock outstanding. Holders of the Common Stock are entitled

to one vote for each share held of record on all matters on which stockholders are entitled to vote generally, including adoption of

the Asset Purchase Agreement.

On

February 7, 2024, the holders of certain notes and warrants that we had previously issued in 2023, including certain of the Consenting

Stockholders, exercised in full their conversion rights under their notes and warrants (the latter on a cashless basis), utilizing a

conversion price, in accordance with the terms of the notes and warrants, equal to 50% of the Common Stock’s price per share as

of market close on November 16, 2023. As a result, an aggregate of 30,736,555 shares of Common Stock were issued by the Company to these

noteholders and warrant holders. On February 8, 2024, the Consenting Stockholders, who collectively held approximately 78.4% of the voting

power of the outstanding shares of Common Stock at the close of business on such date, which was the record date established by the Board

with respect to the consent of stockholders, delivered the Written Consent authorizing, approving and adopting in all respects the Asset

Purchase Agreement and the transactions contemplated thereby and voting all of the shares of Common Stock held by them in favor of such

authorization, approval and adoption. As a result, no further action by any stockholder of the Company is required under applicable law,

the Company’s certificate of incorporation or bylaws or the Asset Purchase Agreement (or otherwise) to adopt the Asset Purchase

Agreement, and the Company will not be soliciting your vote to adopt the Asset Purchase Agreement and will not call a stockholders meeting

for purposes of voting on the adoption of the Asset Purchase Agreement.

When

actions are taken by written consent of less than all of the stockholders entitled to vote on a matter, Delaware law requires notice

of the action to those stockholders who did not consent in writing and who, if the action had been taken at a meeting, would have been

entitled to notice of the meeting. This information statement and the notice attached hereto constitute notice to you of action by written

consent as required by Delaware law.

Opinion

of A.G.P./Alliance Global Partners (page 30 and Annex B)

In

connection with the Asset Sale, A.G.P./Alliance Global Partners (“A.G.P.”) rendered to the Company’s Board an opinion,

dated February 5, 2024, as to the fairness, from a financial point of view and as of the date of the opinion, to the Company of the Aggregate

Consideration (which was defined in A.G.P.’s opinion as consisting of $20,000,000 in cash, 2,175,489 newly-issued unregistered

shares of Immunome common stock and the contingent payments of $10,000,000, $17,500,000 and $10,000,000 in cash due upon

the achievement of certain development and commercial milestone events set forth in the Asset Purchase Agreement) to be paid to the Company

for certain of the Company’s assets and liabilities related to the Company’s AL101 and AL102 programs in the Asset Sale.

The

full text of A.G.P.’s written opinion, dated February 5, 2024, which describes the assumptions made, procedures followed, matters

considered and limitations on the review undertaken, is attached to this information statement as Annex B and is incorporated by reference

in its entirety. A.G.P.’s opinion was provided for the information and assistance of the Company’s Board (in its capacity

as such) in connection with its consideration of the Asset Sale. A.G.P.’s opinion does not constitute a recommendation to the Company’s

Board, the Company, its stockholders or any other person as to how any of them should vote or act with respect to the Asset Sale or any

other matter. A.G.P.’s opinion does not address the underlying business decision of the Company to engage in the Asset Sale, or

the relative merits of the Asset Sale as compared to any strategic alternatives that may be available to the Company.

The

Asset Purchase Agreement (page 40 and Annex A)

Conditions

to Closing

The

closing of the Asset Sale is subject to the satisfaction or, to the extent permissible under applicable law or pursuant to the Asset

Purchase Agreement, waiver of certain conditions on or prior to the closing. Such conditions include:

Conditions

for both Parties:

● No

temporary restraining order, preliminary or permanent injunction, or other order preventing the consummation of the Asset Sale shall

have been issued by any court of competent jurisdiction and remain in effect, and no material law shall have been enacted that makes

consummation of the Asset Sale illegal.

● Each

of Ayala and Purchaser shall have performed and complied with, in all material respects, all of its covenants contained in the Asset

Purchase Agreement at or before the Closing (to the extent that such covenants require performance by such party at or before the Closing).

Conditions

for Purchaser:

●

The fundamental representations and warranties of Ayala set forth in the Asset Purchase Agreement shall be true and correct in all respects

as of the date of the Asset Purchase Agreement and as of the Closing Date (provided that the accuracy of representations and warranties

that by their terms speak of a specified date will be determined as of such date), and all other representations and warranties

of Ayala set forth in the Asset Purchase Agreement (without giving effect to materiality qualifications) shall be true and correct in

all material respects, except where the failure of such representations and warranties to be so true and correct would not reasonably

be expected to, individually or in the aggregate, have a material adverse effect.

● There

shall not have occurred and be continuing a material adverse effect since the date of the Asset Purchase Agreement.

● Ayala

shall have delivered a certificate to the effect that each of the conditions specified in Sections 7.1, 7.2 and 7.4

of the Asset Purchase Agreement is satisfied in all respects as of the Closing.

● Ayala

shall have delivered to Purchaser each of the documents and materials contemplated to be delivered by Section 4.2(a) of the Asset

Purchase Agreement.

● At

least twenty (20) calendar days shall have elapsed from the date the definitive information statement was mailed to the Company’s

stockholders in accordance with Rule 14c-2 of the Exchange Act.

Conditions

for Ayala:

● The

representations and warranties of Purchaser set forth in the Asset Purchase Agreement (without giving effect to materiality qualifications)

shall be true and correct in all material respects, except where the failure of such representations and warranties to be so true and

correct would not reasonably be expected to, individually or in the aggregate, prevent or materially delay the consummation of the Asset

Sale.

● Purchaser

shall have delivered a certificate to the effect that each of the conditions specified in Sections 8.1 and 8.2 of the Asset

Purchase Agreement is satisfied in all respects as of the Closing.

● Ayala

shall have delivered to Purchaser each of the documents and materials contemplated to be delivered by Section 4.2(b) of the Asset

Purchase Agreement.

Seller

Stockholder Approval

On

February 7, 2024, the holders of certain notes and warrants that we had previously issued in 2023, including certain of the Consenting

Stockholders, exercised in full their conversion rights under their notes and warrants (the latter on a cashless basis), utilizing a

conversion price, in accordance with the terms of the notes and warrants, equal to 50% of the Common Stock’s price per share as

of market close on November 16, 2023. As a result, an aggregate of 30,736,555 shares of Common Stock were issued by the Company to these

noteholders and warrant holders. On February 8, 2024, Ayala stockholders who collectively held approximately 78.4% of the voting power

of the outstanding shares of Common Stock at the close of business on such date, which was the record date established by the Board with

respect to the consent of stockholders, delivered the Written Consent, in the form attached to the Asset Purchase Agreement as Exhibit

F, authorizing, approving and adopting in all respects the Asset Purchase Agreement and the transactions contemplated thereby, including

the Asset Sale and other transactions contemplated by the Asset Purchase Agreement and the related transaction documents as defined therein.

The Written Consent constituted the necessary action by Ayala’s stockholders to authorize, approve and adopt the Asset Sale under

applicable law (including Section 271 of the Delaware General Corporation Law) and Ayala’s certificate of incorporation and bylaws.

As

a result of the execution of the Written Consent on February 8, 2024, the requisite stockholder approval has been obtained and, as such,

the Company will not be soliciting your vote to adopt the Asset Purchase Agreement and will not call a stockholders meeting for purposes

of voting on the adoption of the Asset Purchase Agreement.

Termination

Ayala

and Purchaser may terminate the Asset Purchase Agreement by mutual written consent. In addition, there are certain other circumstances

under which the Asset Purchase Agreement may be terminated prior to the Closing, including:

●

by either Ayala or Purchaser if any government authority of competent jurisdiction issues an order permanently restraining, enjoining,

or otherwise prohibiting the consummation of the Asset Sale, and such order becomes final and non-appealable (provided that a party shall

not be entitled to exercise such termination right if, at the time of such termination, such party is in breach of any of its representations,

warranties or covenants under the Asset Purchase Agreement, which breach has caused or resulting in the imposition of such order or the

failure of such order to be resisted, resolved or lifted);

●

by Purchaser if Ayala has breached any of its representations, warranties or covenants under the Asset Purchase Agreement such that an

applicable condition to Closing shall not be satisfied and which breach is not cured by Ayala within the shorter of 30 days after Ayala

receives written notice of such breach from Purchaser or by the date that is six months following the date of the Asset Purchase Agreement

(such date, the “Outside Date”) (provided that Purchaser shall not be entitled to exercise such termination right if, at

the time of such termination, Purchaser is in breach of any of its representations, warranties or covenants under the Asset Purchase

Agreement, such that an applicable condition to Closing shall not be satisfied);

●

by Ayala if Purchaser has breached any of its representations, warranties or covenants under the Asset Purchase Agreement such that an

applicable condition to Closing shall not be satisfied and which breach is not cured by Purchaser within the shorter of 30 days after

Purchaser receives written notice of such breach from Ayala or by the Outside Date (provided that Ayala shall not be entitled to exercise

such termination right if, at the time of such termination, Ayala is in breach of any of its representations, warranties or covenants

under the Asset Purchase Agreement, such that an applicable condition to Closing shall not be satisfied);

● by

either party if the Closing shall not have occurred on or before the Outside Date (provided that a party shall only be entitled to exercise

such termination right if the terminating party is not in breach of any representation, warranty or covenant such that an applicable

condition to Closing shall not be satisfied); or

● by

Purchaser, if Ayala fails to deliver, by 11:59 p.m. Eastern Time on the date that is three (3) Business Days after the date of the Asset

Purchase Agreement, the Written Consent.

Interests

of Our Directors and Executive Officers in the Asset Sale (page 19)

You

should be aware that the Company’s directors and executive officers have interests in the Asset Sale that are different from or

in addition to your interests as a stockholder and that may present actual or potential conflicts of interest. The Board was aware of

these interests and considered them, among other matters, in approving the Asset Purchase Agreement, Asset Sale, and the transactions

contemplated thereby. You should be aware of these and other interests of our directors and executive officers that are described in

this information statement.

U.S.

Federal Income Tax Consequences of the Asset Sale (page 39)

The

Asset Sale will be treated for U.S. federal income tax purposes as a taxable transaction upon which we will recognize gain or loss. The

amount of gain or loss we recognize with respect to the sale of a particular asset will be measured by the difference between the amount

realized by us on the sale of that asset and our tax basis in that asset. The determination of whether we will recognize gain or loss

will be made with respect to each of the assets to be sold. Accordingly, we may recognize gain on the sale of certain assets and loss

on the sale of certain others, depending on the amount of consideration allocated to an asset as compared with the basis of that asset.

Further, the sale of certain assets may result in ordinary income or loss, depending on the nature of the asset. To the extent the Asset

Sale results in us recognizing a net gain for U.S. federal income tax purposes, we expect to incur income tax with respect to such gain,

which may be offset to a limited degree by available net operating loss carryforwards.

Regulatory

Approvals (page 30)

The

Company is not required to obtain any regulatory approvals in order to consummate the Asset Sale and the Asset Sale is not conditioned

upon any such approvals.

Appraisal

Rights (page 51)

No

appraisal or dissenters’ rights are available to our stockholders under Delaware law or our certificate of incorporation or bylaws

in connection with the Asset Sale.

Anticipated

Accounting Treatment (page 39)

Under

generally accepted accounting principles, upon completion of the Asset Sale, we will remove the net assets and assumed liabilities sold

and add the proceeds from the Asset Sale to our consolidated balance sheet, which we anticipate would result in recording a gain from

the Asset Sale.

Use

of Proceeds (page 39)

Assuming

that the Asset Sale is consummated in accordance with the terms of the Asset Purchase Agreement, Ayala intends to use substantially all

of the after-tax proceeds for general corporate purposes.

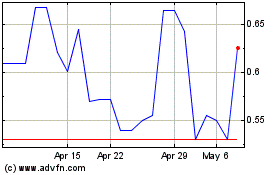

Market

Price of Our Stock (page 50)

Ayala’s

Common Stock is quoted on the OTCQX under the symbol “ADXS”.

The

closing price of shares of the Common Stock on February 5, 2024, the trading day immediately prior to the public announcement of the

Asset Sale on February 6, 2024, as reported on the OTCQX, was $0.5899 per share. Any over-the-counter market quotations reflect inter-dealer

prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

QUESTIONS

AND ANSWERS ABOUT THE ASSET SALE

The

following questions and answers are intended to briefly address commonly asked questions as they pertain to the Asset Purchase Agreement

and the Asset Sale. These questions and answers may not address all questions that may be important to you as an Ayala stockholder. Please

refer to the section entitled “Summary Term Sheet” and the more detailed information contained elsewhere in this information

statement, the annexes to this information statement and the documents referred to or incorporated by reference in this information statement,

each of which you should read carefully. You may obtain information incorporated by reference in this information statement without charge

by following the instructions in the section entitled “Where You Can Find More Information.”

| Q: |

Why

am I receiving this information statement? |

| A: |

On

February 5, 2024, following approval of such action by the Board, the Company entered into an Asset Purchase Agreement with

Immunome. On February 7, 2024, the holders of certain notes and warrants that we had previously issued in 2023, including certain

of the Consenting Stockholders, exercised in full their conversion rights under their notes and warrants (the latter on a cashless

basis), utilizing a conversion price, in accordance with the terms of the notes and warrants, equal to 50% of the Common Stock’s

price per share as of market close on November 16, 2023. As a result, an aggregate of 30,736,555 shares of Common Stock were issued

by the Company to these noteholders and warrant holders. On February 8, 2024, the Consenting Stockholders, who collectively held

approximately 78.4% of the voting power of the outstanding shares of Common Stock at the close of business on such date, which was

the record date established by the Board with respect to the consent of stockholders, delivered the Written Consent authorizing,

approving and adopting in all respects the Asset Purchase Agreement and the transactions contemplated thereby and voting all of the

shares of Common Stock held by them in favor of such authorization, approval and adoption. Applicable provisions of Delaware law

and certain securities regulations require us to provide you with information regarding the Asset Sale, even though your vote or

consent is neither required nor requested to adopt the Asset Purchase Agreement or to complete the Asset Sale. |

| Q: |

What

is the Asset Sale? |

| A: |

Pursuant

to the Asset Purchase Agreement, the Purchaser, Immunome, will acquire certain of the Company’s assets and assume certain of

the Company’s liabilities, in each case, related to the Company’s AL101 and AL102 programs, which constitute substantially

all of the Company’s assets. |

| Q: |

Who

is buying substantially all of the Company’s assets and what is the aggregate purchase price for the assets? |

| A: |

Immunome,

Inc. is the purchaser in the Asset Sale.

Pursuant

to the Asset Purchase Agreement, Immunome will pay to the Company (i) an aggregate purchase price of approximately $50,000,000 at

Closing, consisting of $20,000,000 in cash (subject to certain adjustments) and 2,175,489 shares of Purchaser Common Stock issued

at Closing, and (ii) up to $37,500,000 in cash due upon the achievement of certain development and commercial milestone events

set forth in the Asset Purchase Agreement. Immunome will also assume certain outstanding liabilities of the Company and reimburse

the Company for certain expenditures between signing and Closing and assume the ongoing expenses of the development, manufacturing

and commercialization of AL102 from and after Closing. |

| Q: |

When

do you expect the Asset Sale to be completed? |

| A: |

We

are working to complete the Asset Sale as quickly as possible. We currently expect to complete the Asset Sale promptly after all

of the conditions to the Asset Sale have been satisfied or waived and subject to the other terms and conditions in the Asset Purchase

Agreement. Completion of the Asset Sale is currently expected to occur in late Q1 or early Q2 of 2024, although the Company cannot

assure completion by any particular date, if at all. |

| Q: |

What

happens if the Asset Sale is not completed? |

| A: |

If

the Asset Sale is not completed for any reason, the Company will not receive any payment for the assets and liabilities related to

the Company’s AL101 and AL102 programs, nor will Immunome assume any of the related liabilities, and the Company would be in

a similar position to that of the Company prior to the execution of the Asset Purchase Agreement. |

| Q: |

Why

am I not being asked to vote on the Asset Sale? |

| A: |

No

vote or other action of our stockholders is required by applicable law, our certificate of incorporation or our bylaws or otherwise

in order for the Company to consummate the Asset Purchase Agreement and other transactions contemplated thereby. Therefore, your

vote is not required and is not being sought. We are not asking you for a proxy, and you are requested not to send us a proxy. |

| Q: |

Did

the Board authorize and recommend the Asset Sale and the Asset Purchase Agreement? |

| A: |

Yes.

After fully considering the terms and conditions of the Asset Sale, the Asset Purchase Agreement and the transactions contemplated

thereby, the Board (i) determined that the Asset Purchase Agreement, the Asset Sale and the other transactions contemplated thereby

are expedient and in the best interests of the Company and its stockholders; (ii) approved the Asset Purchase

Agreement, the Asset Sale and the other transactions contemplated thereby; and (iii) approved the execution, delivery and performance

by the Company of the Asset Purchase Agreement and, subject to obtaining the required approval of the Consenting Stockholders, the

consummation of the Asset Sale and the other transactions contemplated thereby. |

| Q: |

What

are the material terms of the Asset Sale Proposal? |

| A: |

In

addition to the cash and equity consideration to be paid and issued at Closing and the cash payable upon the achievement of certain

development and commercial milestone events set forth in the Asset Purchase Agreement, and customary representations and warranties,

the Asset Purchase Agreement contains other important terms and provisions, including: |

| |

● |

By

11:59 p.m. Eastern Time on February 8, 2024, the Consenting Stockholders were required to execute and deliver to the Company the

Written Consent authorizing, approving and adopting the Asset Purchase Agreement and the transactions contemplated thereby, including

the Asset Sale and other transactions contemplated by the Asset Purchase Agreement and the related transaction documents as defined

therein, and vote all the shares of the Common Stock held by them in favor of such authorization, approval and adoption. |

| |

|

|

| |

● |

The

Company has agreed to continue to conduct business in the ordinary course and subject to certain other restrictions during the period

prior to completion of the Asset Sale and other transactions contemplated by the Asset Purchase Agreement. |

| |

|

|

| |

● |

The

obligations of the parties to the Asset Purchase Agreement to close the Asset Sale and other transactions contemplated by the Asset

Purchase Agreement subject thereto are subject to several closing conditions, including the authorization of the Asset Sale by our

stockholders. |

| |

|

|

| |

● |

The

Asset Purchase Agreement may be terminated by the Purchaser or the Company in certain circumstances, in which case the Asset Sale

and other transactions contemplated by the Asset Purchase Agreement will not be completed. |

| Q: |

Am

I entitled to exercise appraisal or dissenters’ rights? |

| A: |

No

appraisal or dissenters’ rights are available to our stockholders under Delaware law or under our certificate of incorporation

or bylaws in connection with the types of actions contemplated under the Asset Sale and other transactions contemplated by the Asset

Purchase Agreement. |

| Q: |

What

are the U.S. federal income tax consequences of the Asset Sale to stockholders of the Company? |

| A: |

The

Asset Sale and other transactions contemplated by the Asset Purchase Agreement are a corporate action of the Company. Therefore,

the Asset Sale will not be a taxable event (for federal income tax purposes) to our stockholders. |

| Q: |

Do

any of the Company’s directors or executive officers have interests in the Asset Sale that may differ from those of Company

stockholders generally? |

| A: |

You

should be aware that the Company’s directors and executive officers have interests in the Asset Sale that may be different

from, or in addition to, the interests of the Company stockholders generally. These interests are described in more detail in the

section entitled “Interests of Our Directors and Executive Officers in the Asset Sale.” The Board was aware of

these interests and considered them, among other matters, in evaluating and approving the Asset Purchase Agreement. |

| Q: |

Where

can I find more information about the Company? |

| A: |

We

file periodic reports and other information with the SEC. You may read and copy this information at the SEC’s public reference

facilities. Please call the SEC at (800) SEC-0330 for information about these facilities. This information is also available on the

website maintained by the SEC at www.sec.gov. For a more detailed description of the available information, please refer to

the section entitled “Where You Can Find More Information.” |

| Q: |

Who

can help answer my other questions? |

| A: |

If

you have any questions about the Asset Sale, this information statement or your ownership of our common stock, please contact Roy

Golan, our Chief Financial Officer, by mail at Ayala Pharmaceuticals, Inc., 9 Deer Park Drive, Suite K-1, Monmouth Junction, NJ 08852,

by telephone at (908)-215-2787 or by e-mail at Roy.g@ayalapharma.com. |

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

To

the extent that statements contained in this information statement are not descriptions of historical facts, they are forward-looking

statements reflecting the current beliefs and expectations of the Company made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, as amended. Forward-looking statements include, but are not limited to, statements that represent

the Company’s beliefs concerning future operations, strategies, financial results or other developments, and contain words and

phrases such as “may,” “expects,” “should,” “believes,” “anticipates,” “estimates,”

“intends” or similar expressions. Such forward-looking statements involve substantial risks and uncertainties that could

cause the Company’s future results, performance or achievements to differ significantly from those expressed or implied by the

forward-looking statements.

The

proposed Asset Sale is subject to risks and uncertainties and factors that could cause the Company’s actual results to differ,

possibly materially, from those in the specific projections, goals, assumptions and statements herein which include, but are not limited

to:

| |

● |

the ability of the parties to consummate the Asset Sale and other transactions contemplated by the Asset Purchase Agreement; |

| |

|

|

| |

● |

satisfaction of closing conditions precedent to the consummation of the Asset Sale and other transactions contemplated by the Asset Purchase Agreement; |

| |

|

|

| |

● |

potential delays in consummating the Asset Sale and other transactions contemplated by the Asset Purchase Agreement; |

| |

|

|

| |

● |

our execution costs in connection with the Asset Sale and other transactions contemplated by the Asset Purchase Agreement; |

| |

|

|

| |

● |

the occurrence of any event, change or other circumstance that could give rise to the termination of the Asset Purchase Agreement; |

| |

|

|

| |

● |

whether

the milestone conditions are satisfied; |

| |

|

|

| |

● |

the possibility that the Purchaser Common Stock issued at Closing diminishes in value; |

| |

|

|

| |

● |

risks related to disruption of management’s attention from the Company’s ongoing business operations due to the Asset Sale; |

| |

|

|

| |

● |

the effect of the announcement of the Asset Sale on the Company’s relationships with its vendors and employees, and its operating results and business generally; |

| |

|

|

| |

● |

the application of, and any changes in, applicable tax laws, regulations, administrative practices, principles and interpretations; and |

| |

|

|

| |

● |

the outcome of any legal proceedings to the extent initiated against the Company or others following the announcement of the Asset Sale, as well as Company management’s response to any of the aforementioned factors. |

The

Company undertakes no obligation to update or revise any forward-looking statements. Forward-looking statements should not be relied

upon as representing the Company’s views as of any date subsequent to the date hereof. For a further description of the risks and

uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating

to the Company’s business in general and ownership of shares of Common Stock, see the “Risk Factors” section of the

Company’s Annual Report on Form 10-K for the year ended October 31, 2022, and the other reports the Company files with the SEC,

as well under the heading “Risk Factors” in the Form 10-K for the fiscal year ended December 31, 2022 of Old Ayala, Inc.

(f/k/a Ayala Pharmaceuticals, Inc.).

THE

PARTIES TO THE ASSET PURCHASE AGREEMENT

The

Company

Ayala

Pharmaceuticals, Inc.

9

Deer Park Drive, Suite K-1

Monmouth

Junction, NJ

Phone:

908-215-2787

We

are a clinical-stage oncology company, incorporated in the state of Delaware, focused on developing and commercializing small molecule

therapeutics for patients suffering from rare and aggressive cancers, primarily in genetically defined patient populations. Our differentiated

development approach is predicated on identifying and addressing tumorigenic drivers of cancer, through a combination of our bioinformatics

platform and next-generation sequencing to deliver targeted therapies to underserved patient populations. Our current portfolio of product

candidates, AL101 and AL102, targets the aberrant activation of the Notch pathway using gamma secretase inhibitors. Gamma secretase is

the enzyme responsible for Notch activation and, when inhibited, turns off the Notch pathway activation. Aberrant activation of the Notch

pathway has long been implicated in multiple solid tumor and hematological cancers and has often been associated with more aggressive

cancers. In cancers, Notch is known to serve as a critical facilitator in processes such as cellular proliferation, survival, migration,

invasion, drug resistance and metastatic spread, all of which contribute to a poorer patient prognosis. AL101 and AL102 are designed

to address the underlying key drivers of tumor growth, and our initial Phase 2 clinical data of AL101 suggest that our approach may address

shortcomings of existing treatment options. We believe that our novel product candidates, if approved, have the potential to transform

treatment outcomes for patients suffering from rare and aggressive cancers. In addition to AL101 and AL102, which are our primary product

candidates, we also own assets relating to programs on which we have not recently placed substantial emphasis, including assets acquired

from Biosight relating to its programs to develop Aspacytarabine (“BST-236”), which is a novel proprietary anti-metabolite,

prodrug of cytarabine, covalently bound to asparagine, as well as assets relating to former Advaxis’ operations as a clinical-stage

biotechnology company focused on the development and commercialization of proprietary Listeria monocytogenes (“Lm”)-based

antigen delivery products.

We

are headquartered in Monmouth Junction, NJ. Ayala’s Common Stock is quoted on the OTCQX under the symbol “ADXS”. Additional

information regarding the Company is contained in our filings with the SEC, copies of which may be obtained without charge by following

the instructions in the section entitled “Where You Can Find More Information.”

The

Purchaser

Immunome,

Inc.

665

Stockton Drive, Suite 300

Exton,

PA 19341

Phone:

(610) 321-3700

The

Purchaser is a biotechnology company, incorporated in the state of Delaware, dedicated to developing first-in-class and best-in-class

targeted cancer therapies. Purchaser selects targets with a modality appropriate to its biology, including immunotherapies, targeted

effectors, radioligand therapies and ADCs. The Purchaser believes that pursuing underexplored targets with appropriate drug modalities

leads to transformative therapies. The Purchaser’s proprietary memory B cell hybridoma technology allows for the rapid screening

and functional characterization of novel antibodies and targets.

The

Purchaser is headquartered in Bothell, Washington. The Purchaser Common Stock is listed on The Nasdaq Capital Market under the trading

symbol “IMNM.” The Purchaser’s website is www.immunome.com.

THE

ASSET SALE

Background

of the Asset Sale

The

following chronology summarizes the key communications and events that led to the signing of the Asset Purchase Agreement. This chronology

is not, and does not purport to be, a catalogue of every interaction among the Company, Immunome, their respective advisors or any other

applicable parties.

The

Company is a clinical stage oncology company primarily focused on developing and commercializing small molecule therapeutics for people

living with rare tumors and aggressive cancers, with several product candidates under development, including AL102 and related drug candidate

AL101. AL102 is an investigational small molecule gamma secretase inhibitor currently being evaluated in the randomized Phase 3 RINGSIDE

international trial for the treatment of desmoid tumors.

The

Company’s board of directors (the “Board”), together with members of the Company’s senior management (“Company

Management”), and with the assistance of the Company’s advisors at the relevant time, regularly evaluate the Company’s

strategic direction and ongoing business plans with the purpose of strengthening the Company’s business and enhancing stockholder

value. As part of this evaluation, the Board has, from time to time, considered various potential strategic and financing alternatives.

References in this Background of the Transaction to the Board and to Company Management refer to the board of directors and management

of the Company at the time contemplated by such reference.

In

early 2022, the Board, in consultation with Company Management, decided, given the Company’s then-current cash position, the early-stage

nature of its clinical programs and lack of near-term value creating milestones, to explore potential strategic opportunities with companies

that had more mature clinical programs. With the assistance of its financial advisor at that time, Company Management and the Board reviewed

and considered a number of potential strategic opportunities for the Company, which at that time was named “Advaxis, Inc.”,

and following such review and consideration, determined that it was in the best interests of the Company and its stockholders to pursue

a merger (the “Old Ayala Merger”) with Old Ayala, Inc., known at such time as Ayala Pharmaceuticals, Inc. (“Old Ayala”).

It was understood at the time that Old Ayala’s late-stage AL102 and AL101 programs would require the investment of amounts greater

than either the Company or Old Ayala was bringing to the merged company. As a result, Company Management, in consultation with the Board,

determined to continue to pursuing strategic and financing opportunities to raise capital.

On

October 18, 2022, the Company and Old Ayala entered into that certain Agreement and Plan of Merger, dated as of October 18, 2022, by

and among the Company, Old Ayala and a wholly owned subsidiary of the Company.

In

late October and early November 2022, Company Management engaged in discussions with several potential investors in connection with a

potential private investment in public equity transaction (the “Potential PIPE”) to obtain additional financing.

On

January 19, 2023, the Company and Old Ayala consummated the Old Ayala Merger. Following the Old Ayala Merger, the Company changed its

name to “Ayala Pharmaceuticals, Inc.”

Following

the consummation of the Old Ayala Merger, Company Management, in consultation with the Board, determined that, given the addition of

Old Ayala’s late-stage program following the consummation of the Old Ayala Merger, the Company would require additional financing.

As a result, in consultation with the Board, Company Management decided to continue to pursue potential financing alternatives, including

combining with a company with clinical stage assets and additional investors who could invest in the combined company and improve the

ability of the Company to raise additional capital. Company Management and the Board reviewed and considered a number of potential strategic

opportunities, and following such review and consideration, determined to engage in discussions with several of such parties, including

Biosight, Ltd. (“Biosight”), a private Phase 2 clinical-stage biotechnology company developing an investigational product,

aspacytarabine (BST-236), as an innovative, proprietary anti-metabolite therapeutic that seeks to address unmet medical needs for hematological

malignancies and disorders. On July 4, 2021, the Company and Biosight had entered into a merger agreement pursuant to which Biosight

would have merged with a wholly owned subsidiary of the Company and survived such merger as a wholly owned subsidiary of Advaxis. Such

transaction was not consummated at that time.

In

the middle of 2023, the Company engaged an additional financial advisor, to reach out to several potential investors in connection with

the Potential PIPE, and Company Management engaged in discussions with approximately ten prospective investors as part of such process.

On

June 14, 2023, representatives of Company Management and representatives of the management of Party A (“Party A Management”)

had an initial call to discuss a potential strategic investment or transaction between the parties (the “Potential Party A Transaction”).

During

the spring and summer of 2023, the Company and Biosight engaged in discussions regarding a potential strategic transaction, including

among other things negotiating potential terms thereof and conducting due diligence.

On

June 21, 2023, Party A commenced due diligence in connection with the Potential Party A Transaction.

On

June 22, 2023, representatives of Company Management provided representatives of Party A Management with access to an online data room

(the “Data Room”), to allow Party A to continue to progress due diligence in connection with the Potential Party A Transaction.

On

July 25, 2023, representatives of Company Management and representatives of Party A Management had a due diligence call to discuss clinical

operations and regulatory related issues.

On

July 26, 2023, the Board determined that it was in the best interests of the Company and its stockholders to pursue a merger (the “Biosight

Merger”) with Biosight, and the Company and Biosight entered into that certain Agreement and Plan of Merger, dated as of July 26,

2023, by and among the Company, Advaxis Israel Ltd. and Biosight Ltd (the “Biosight Merger Agreement”). Following entry into

the Biosight Merger Agreement, the Company continued to explore strategic and financing options for the combined company following the

consummation of the Biosight Merger.

On

August 7, 2023, in order to obtain temporary financing as it pursued its ongoing efforts to achieve longer-term financing, the Company

issued Senior Secured Convertible Promissory Notes to two of its existing stockholders, Israel Biotech Fund I, L.P. (“IBF I”)

and Israel Biotech Fund II, L.P. (“IBF II,” and together with IBF I, “IBF”), in the aggregate principal amount

of $2 million (the “August Secured Convertible Notes”).

On

September 6, 2023, Dr. Pini Orbach, a member of the Board (“Dr. Orbach”), provided an introduction over email between representatives

of Company Management and representatives of the management of Party B (the “Party B Management”) to discuss a potential

strategic transaction between the Company and Party B (the “Potential Party B Transaction”).

On

September 8, 2023, the Chief Business Officer of Party B (the “Party B CBO”) emailed representatives of Company Management,

proposing that the Company and Party B enter into a confidentiality agreement (the “Party B NDA”) in furtherance of Party

B’s due diligence of the Company in connection with the Potential Party B Transaction.

On

September 12, 2023, representatives of Party B Management provided representatives of Company Management with a draft of the Party B

NDA.

On

September 15, 2023, the Company and Party B entered into the Party B NDA.

Also

on September 15, 2023, in furtherance of its ongoing financing efforts, the Company entered into that certain Simple Agreement for Future

Equity, by and among the Company and the investor parties thereto.

On

September 20, 2023, Dr. Orbach provided an introduction over email between representatives of Company Management and representatives

of the management of Party C (“Party C Management”) to discuss a potential strategic transaction between the Company and

Party C (the “Potential Party C Transaction”).

Also

on September 20, 2023, Mr. Roy Golan, Chief Financial Officer of the Company (“Mr. Golan”), provided representatives of Party

C Management with a “teaser” memorandum regarding the Company and its clinical programs, in connection with the Potential

Party C Transaction.

On

September 22, 2023, representatives of Company Management provided representatives of Party C Management with a presentation (the “Management

Presentation”) regarding the Company and its clinical programs.

At

the end of the third quarter of 2023, Dr. David Sidransky, Chairman of the Board (“Dr. Sidransky”), held an initial discussion

with Dr. Vered Bisker-Leib, the Chief Operating Officer (COO) of Party D (the “Party D COO”) to discuss a potential strategic

transaction between the Company and Party D (the “Potential Party D Transaction”). The Party D COO is a member of the Company

Board. The Party D COO was thereafter recused from all discussions and deliberations of the Board relating to the Potential Party D Transaction

and any strategic transaction that might be an alternative to the Potential Party D Transaction.

In

late September and early October, 2023, the Company, with assistance from A.G.P./Alliance Global Partners (“A.G.P.”), conducted

an outreach process in connection with the Potential PIPE (the “Potential PIPE Outreach”), and representatives of Company

Management engaged in discussions with approximately 50 potential investors as part of such process, which included certain of the Company’s

existing investors, as well as new investors contacted by A.G.P. on behalf of the Company. In connection with the Potential PIPE Outreach,

the Company received verbal indications of interest from certain potential investors, as well as a non-binding commitment from certain

of its existing investors of an aggregate amount approximately equal to $15 million. During such time, negotiations took place with certain

of these investors regarding the terms and the amount to be raised, and a deal structure of a $50 million initial investment at closing,

plus an additional $50 million upon the achievement of certain milestones, was discussed. As part of the Potential PIPE Outreach, certain

investors conducted due diligence and received access to the Data Room.

On

October 2, 2023, representatives of Company Management held a meeting with representatives of Party B Management to discuss the Potential

Party B Transaction, and at such meeting, representatives of Company Management provided the Management Presentation to representatives

of Party B Management.

On

October 4, 2023, representatives of Company Management had a discussion with representatives of Party A Management to discuss the Potential

Party A Transaction, including any updates with respect thereto.

On

October 6, 2023, Dr. Yuval Cabilly, a member of the Board (“Dr. Cabilly”), had a telephonic discussion with the Party D COO

to discuss the Potential Party D Transaction. The Party D COO, while recused from Board discussions, continued to negotiate with the

Company on behalf of Party D.

On

October 10, 2023, Mr. Kenneth Berlin, Chief Executive Officer of the Company (“Mr. Berlin”), had a telephonic discussion

with the Party D COO to discuss the Potential Party D Transaction.

On

October 11, 2023, the Party D COO sent an email to representatives of Company Management, requesting access to the Data Room to allow

Party D to continue to progress due diligence in connection with the Potential Party D Transaction.

On

October 12, 2023, representatives of Company Management provided representatives of Party D Management (the “Party D Management”)

with access to the Data Room to allow Party D to continue to progress due diligence in connection with the Potential Party D Transaction.

On

October 17, 2023, representatives of Party B Management provided representatives of Company Management with a due diligence request list

in connection with the Potential Party B Transaction (the “Party B Diligence Request List”).

Also

on October 17, 2023, representatives of Company Management and representatives of Party D Management had an introductory call to discuss

the status and process of the Potential Party D Transaction.

On

October 18, 2023, the Company and Biosight consummated the Biosight Merger, pursuant to which Biosight merged into a wholly-owned subsidiary

of the Company and survived the Biosight Merger as a wholly-owned subsidiary of the Company.

Also

on October 18, 2023, representatives of Company Management emailed the Party B CBO, regarding the status of the Potential Party B Transaction.

On

October 24, 2023, the Party B CBO emailed representatives of Company Management to schedule an introductory call, which email was followed

by an introductory call between representatives of Party B Management and representatives of Company Management to discuss the Potential

Party B Transaction.

On

October 31, 2023, representatives of Company Management provided responses to the Party B Diligence Request List to representatives of

Party B Management.

On

November 1, 2023, Mr. Berlin had a telephonic discussion with the Party B CBO to discuss the Potential Party B Transaction.

On

November 6, 2023, representatives of Company Management had a telephonic discussion with representatives of Party B Management to discuss

the Potential Party B Transaction.

On

November 7, 2023, representatives of A.G.P. provided an introduction over email between representatives of Company Management and representatives

of the management of Party E (the “Party E Management”) to discuss a potential strategic transaction between the Company

and Party E (the “Potential Party E Transaction”).

On

November 9, 2023, the Company and Party E entered into a confidentiality agreement (the “Party E NDA”) in furtherance of

Party E’s due diligence of the Company in connection with the Potential Party E Transaction.

Also

on November 9, 2023, Mr. Berlin reached out to the Chief Executive Officer and Chairman of the Board of Party F (the “Party F CEO”)

to discuss a potential strategic transaction between the Company and Party F (the “Potential Party F Transaction”). Mr. Berlin

also provided the Party F CEO with the Management Presentation.

On

November 10, 2023, representatives of Company Management provided representatives of Party E Management with access to the Data Room

to allow Party E to continue to progress due diligence in connection with the Potential Party E Transaction.

Between

November 10, 2023 and December 15, 2023, Mr. Berlin had several separate telephonic discussions with representatives of Party E Management

to discuss the Potential Party E Transaction.

On

November 14, 2023, Mr. Berlin provided representatives of the management of Party F with the Management Presentation in connection with

the Potential Party F Transaction.

Also

on November 14, 2023, the Party B CEO sent an email to representatives of Company Management requesting a discussion regarding next steps

with respect to the Potential Party B Transaction and requesting access to the Data Room.

On

November 15, 2023, representatives of Company Management provided representatives of Party B Management with access to the Data Room.

On

November 16, 2023, the Board held a meeting. Members of Company Management and representatives of Morgan, Lewis & Bockius LLP (“Morgan

Lewis”), the Company’s legal advisor, also participated. At the meeting, the Board discussed, among other things, the Company’s

cash position and potential strategic transactions and financing options, including the Potential PIPE, and a proposed bridge financing,

whereby certain investors would lend up to $4 million to the Company, which amount would be convertible into shares of Company Common

Stock, upon the terms and subject to the conditions of the relevant loan documents (the “Senior Convertible Promissory Notes”).

After discussion, the Board authorized the issuance of the Senior Convertible Promissory Notes.

On

November 17, 2023, in furtherance of its ongoing financing efforts, the Company issued the Senior Convertible Promissory Notes to each

of IBF I, IBF II, Arkin Bio and Biotel, in the aggregate principal amount of $4 million. The Company also issued to (a) the holders of

the Senior Convertible Promissory Notes warrants to purchase up to 15 million shares of Company Common Stock, and (b) the holders of

the August Secured Convertible Notes warrants to purchase up to 7.5 million shares of Company Common Stock. The Company also amended

and restated the August Secured Convertible Notes to conform to the terms of the Senior Convertible Promissory Notes. The Company also

entered into that certain Side Letter Agreement (New Notes), pursuant to which the investor parties thereto were provided with the right

to lend an additional $4 million to the Company on the same terms, including warrant coverage, as the Senior Convertible Promissory Notes,

and entered into that certain Side Letter Agreement For Conversion, pursuant to which the investor parties thereto were provided with

the right to lend an additional $1.48 million to the Company on the same terms, including warrant coverage, as the Senior Convertible

Promissory Notes.

On

November 20, 2023, representatives of Party B Management requested estimates of research and development costs for the clinical trials

of AL102 and BST-236 (in each case for 2023 and forecasted costs to filing).

On

November 22, 2023, representatives of the Party B clinical team provided a series of follow-up questions to the Party B Diligence Request

List (the “Party B Follow-Up Questions”).

Also

on November 22, 2023, Dr. Cabilly and the Party D COO held a telephonic discussion regarding potential terms of the Potential Party D

Transaction, and Dr. Cabilly indicated to the Party D COO that the Company would be interested in consideration consisting of cash, equity

and post-Closing payments determined based on the achievement of certain post-Closing milestones.

On

November 23, 2023, the Company and Party F entered into an amendment to the Party F NDA, extending the term of the Party F NDA.

On

November 28, 2023, representatives of Party B Management sent an email to representatives of Company Management, requesting patient-level

data, and requesting the opportunity to speak with key opinion leaders (KOLs) for the Company’s clinical trial.

On

November 29, 2023, as part of routine industry coverage activities, a representative of A.G.P. had a telephonic conversation with a

representative of the board of directors of Immunome during which, among other things, Immunome’s potential interest in

acquiring a late-stage oncology program was discussed. A potential strategic transaction between the Company and

Immunome was not specifically discussed at the time.

On

December 1, 2023, representatives of Party B Management, including the Chief Financial Officer of Party B, had a telephonic discussion

with representatives of Company Management to discuss the Potential Party B Transaction. Following such call, representatives of Company

Management provided representatives of Party B Management with certain pro forma calculations.

On

December 5, 2023, representatives of Party B Management had a telephonic discussion with representatives of Company Management to discuss

Party B’s request for patient level data.

Also

on December 5, 2023, representatives of Company Management provided additional responses to the Party B Follow-Up Questions.

On December 6, 2023, further to their prior discussion on November 29, 2023, a representative of A.G.P. had a telephonic conversation

on behalf of the Company with a representative of the board of directors of Immunome to discuss a potential strategic transaction between

the Company and Immunome.

On

December 7, 2023, representatives of A.G.P. provided an introduction over email between representatives of Company Management and representatives

of the management (“Immunome Management”) and the board of directors of Immunome to further discuss a potential Immunome

transaction.

Later

that day, Dr. Cabilly provided an introduction over email between representatives of Company Management and representatives of the management

of Party G (“Party G Management”) to discuss a potential strategic transaction between the Company and Party G (the “Potential

Party G Transaction”). Representatives of Company Management provided representatives of Party G Management with the Management

Presentation.

Also

on December 7, 2023, the Company and Party G entered into a confidentiality agreement (the “Party G NDA”).

Also

on December 7, 2023, following the execution of the Party G NDA, representatives of Company Management provided representatives of Party

G Management with access to certain folders in the Data Room, to allow Party G to continue to progress due diligence in connection with

the Potential Party G Transaction. Representatives of Party G Management were only provided access to Data Room folders containing material

related to AL102.

Also

on December 7, 2023, at the direction of the Company, representatives of A.G.P. sent the Management Presentation to representatives of

Immunome Management.

Also

on December 7, 2023, representatives of Company Management provided representatives of Party G Management with access to the Data Room

folders.

On

December 8, 2023, the Party D COO sent Mr. Berlin an initial draft of a term sheet with respect to the Potential Party D Transaction

(the “Initial Party D Proposal”). The Initial Party D Proposal provided for, among other things, a cash purpose price of

$10 million payable at closing, with the Company retaining all current liabilities with respect to vendor obligations of the AL102 program.

On

December 10, 2023, Dr. Cabilly provided an introduction over email between representatives of Company Management and representatives

of the management of Party H (“Party H Management”) to discuss a potential strategic transaction between the Company and

Party H (the “Potential Party H Transaction”).

Also

on December 10, 2023, representatives of the Company provided representatives of Party H with an initial draft confidentiality agreement

(the “Party H NDA”).

Also

on December 10, 2023, Ms. Dana Gelbaum, General Manager and Chief Business Officer of the Company (“Ms. Gelbaum”), had a

telephonic discussion with Party A’s vice president, business and corporate development, who indicated to Ms. Gelbaum that Party

A was not interested in a strategic transaction with the Company that would involve the acquisition or assumption by Party A of the Company’s

assets related to AL102.

On

December 11, 2023, representatives of A.G.P. had a follow-up telephonic discussion with representatives of Immunome regarding

the potential Immunome transaction.

Also

on December 11, 2023, Mr. Berlin and the Party D COO had a telephonic discussion regarding the Potential Party D Transaction.

Also

on December 11, 2023, Mr. Berlin and the Party B CBO had a telephonic discussion regarding the Potential Party B Transaction.

Also

on December 11, 2023, the Company and Immunome entered into a confidentiality agreement (the “Immunome NDA”), which did not

contain a standstill. Representatives of the Company then shared certain information related to the Company’s intellectual property

with representatives of Immunome.

On

December 12, 2023, Representatives of Company Management terminated access to the Data Room for Party D.

On

December 13, 2023, the Board held a meeting. Members of Company Management and representatives of Morgan Lewis also participated. At

the meeting, the Board discussed, among other things, the Company’s cash position and potential strategic transactions and financing

options, including the Potential Party D Transaction, the Potential Party H Transaction and the Potential PIPE.

Also

on December 13, 2023, representatives of Company Management had a telephonic discussion with representatives of Immunome Management to

discuss the potential Immunome transaction and indicated that the Company could be open to different structures.

Also

on December 13, 2024, Mr. Berlin sent an email to the Party D COO outlining a revised structure for the Potential Party D Transaction

and certain proposed revisions to the Initial Party D Proposal. Following such email, Mr. Berlin and the Party D COO had a telephonic

discussion regarding the Potential Party D Transaction.

Between

December 13, 2023 and December 22, 2023, Mr. Berlin had several separate telephonic discussions with representatives of Immunome Management

to discuss the potential Immunome transaction.

On

December 14, 2024, Dr. Bridget Martell, a member of the Board, contacted representatives of management of each of Party I, Party J, Party

K and Party L regarding their participation in the Potential PIPE.

Also

on December 14, 2023, representatives of management of Party M (the “Party M Management”) sent an email to representatives

of Company Management, which included a number of preliminary due diligence questions (the “Initial Party M Questions”) in

connection with Party M’s potential participation in the Potential PIPE.

Also

on December 14, 2023, representatives of Company Management provided representatives of Immunome Management with access to materials