As filed with the Securities and Exchange Commission

on December 10, 2021

Registration No. 333-__________

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF

1933

Applied Energetics, Inc.

(Exact name of registrant

as specified in its charter)

|

Delaware

|

|

77-0262908

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

9070 S. Rita Road, Suite 1500

Tucson, AZ 85747

P 520. 628-7415

(Address, including zip code, and telephone number,

including area code, of registrant’s principal

executive offices)

Applied Energetics, Inc. 2018 Incentive Stock

Plan

Consulting Agreement between the Registrant

and Certain Consultants

(Full title of plan)

Gregory J. Quarles

President and Chief Executive Officer

9070 S. Rita Road, Suite 1500

Tucson, AZ 85747

P 520. 628-7415

(Name, address, and telephone of agent for service)

Copies to:

Mary P. O’Hara, Esq.

Masur Griffitts Avidor LLP

180 Varick St., Suite 1214

New York, NY 10014

(212) 209-5483

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer:

|

☐

|

Accelerated filer:

|

☐

|

|

Non-accelerated filer:

|

☐

|

Smaller reporting company:

|

☒

|

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the exchange act. ☐

CALCULATION OF REGISTRATION FEE

|

Title of Securities to be Registered

|

|

Amount to

be Registered

|

|

Proposed Maximum

Offering Price Per

Share (2)

|

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

|

Amount of

Registration Fee

|

|

|

Common Stock

|

|

71,715,000 Shares (1)

|

|

$

|

2.40

|

|

|

|

172,116,000.00

|

|

|

$

|

15,955.15

|

|

|

|

1.

|

Issued or issuable pursuant

to the 2018 Incentive Stock Plan and Consulting Agreements with certain individuals.

|

|

|

2.

|

Computed pursuant to Rule 457(c) of the Securities Act of 1933, as amended, solely for the purpose of calculating the registration fee and not as a representation as to any actual proposed price based upon the average of the high and the low price on the OTC Markets Group’s OTCQB Market on December 8, 2021.

|

EXPLANATORY NOTE

This Registration Statement on Form S-8 (this “Registration

Statement”) registers an aggregate of 71,715,000 shares of common stock, par value $0.001 per share, of Applied Energetics, Inc.

50,000,000 of such shares have been, or may be, issued and sold under the Applied Energetics, Inc. 2018 Incentive Stock Plan (“2018

Plan”), including certain shares underlying options previously granted to employees through transactions by the Registrant not involving

any public offering, in accordance with the exemption under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities

Act”). This Registration Statement also registers 21,465,000 shares issued to individuals pursuant to Consulting Agreements.

This Registration Statement

includes a prospectus (the “Reoffer Prospectus”) prepared in accordance with General Instruction C of Form S-8 and in accordance

with the requirements of Part I of Form S-3. This Reoffer Prospectus may be used for reofferings and resales of shares of common stock

that may be deemed to be “control securities” under the Securities Act, and the rules and regulations promulgated thereunder

that have been or may be acquired by certain of our “affiliates,” being the Selling Stockholders identified in the Reoffer

Prospectus, pursuant to outstanding stock grants or options under our 2018 Plan. The number of shares of common stock included in the

Reoffer Prospectus represents the total number of shares of common stock that may be acquired by the Selling Stockholders pursuant to

stock grants and option awards made to the Selling Stockholders in accordance with Section 4(a)(2) of the Securities Act and does not

necessarily represent a present intention to sell any or all such shares of Common Stock.

PART I

INFORMATION REQUIRED IN SECTION 10(A) PROSPECTUS

This Registration Statement relates to two separate

prospectuses as follows:

Section 10(a) Prospectus: Items 1 and 2,

appearing below on this page, and the documents incorporated by reference pursuant to Part II, Item 3 of this Form S-8, constitute a

prospectus that meets the requirements of Section 10(a) of the Securities Act.

Reoffer Prospectus: The material that follows

Item 2, numbered pages 1 through 10, up to but not including Part II of this Registration Statement, constitutes a “Reoffer Prospectus,”

prepared in accordance with the requirements of Part I of Form S-3 under the Securities Act. Pursuant to General Instruction C of Form

S-8, the Reoffer Prospectus may be used for reoffers or resales of Shares which are deemed to be “control securities” or

“restricted securities” under the Securities Act that have been acquired by the Selling Stockholders named in the Reoffer

Prospectus.

Item 1. Plan Information.

The Company will provide each of the recipients

(the “Recipients”) of a grant under the 2018 Plan with documents that contain information related to the 2018 Plan, and other

information including, but not limited to, the disclosure required by Item 1 of Form S-8, which information is not required to be and

is not being filed as a part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the

Securities Act. The foregoing information and the documents incorporated by reference in response to Item 3 of Part II of this Registration

Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. A Section 10(a)

prospectus will be given to each Recipient who receives Shares covered by this Registration Statement, in accordance with Rule 428(b)(1)

under the Securities Act.

Item 2. Registrant Information and Employee Plan Annual Information.

We will provide to each Recipient a written statement

advising of the availability of documents incorporated by reference in Item 3 of Part II of this Registration Statement (which documents

are incorporated by reference in this Section 10(a) prospectus) and of documents required to be delivered pursuant to Rule 428(b) under

the Securities Act without charge and upon written or oral request by contacting: Applied Energetics, Inc., 9070 S. Rita Road, Suite

1500, Tucson, AZ 85747, (520) 628-7415.

REOFFER PROSPECTUS

APPLIED ENERGETICS, INC.

36,880,000 Shares of Common Stock, par value

$0.001 per share

This reoffer prospectus relates

to 36,880,000 shares of our common stock, par value $0.001 per share (“Common Stock”), that may be offered and resold from

time to time by the selling stockholders named in this reoffer prospectus for their own account. Eligible participants in our 2018 Plan

consist of employees, directors, officers and consultants of our company or its related entities. Some of the selling stockholders are

“affiliates” of our company (as defined in Rule 405 under the Securities Act).

The selling stockholders may

offer and sell their shares of common stock at various times and in various types of transactions, including sales in the open market,

sales in negotiated transactions and sales by a combination of these methods. Shares may be sold at the market price of the common stock

at the time of a sale, at prices relating to the market price over a period of time, or at prices negotiated with the buyers of shares.

The shares may be sold through underwriters or dealers which the selling stockholders may select. If underwriters or dealers are used

to sell the shares, we will name them and describe their compensation in a prospectus supplement. For a description of the various methods

by which the selling stockholders may offer and sell their common stock described in this prospectus, see the section entitled “Plan

of Distribution” of this prospectus. We will receive no part of the proceeds from sales made under this prospectus. The selling

stockholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection with the registration

and offering and not borne by the selling stockholders will be borne by us.

The shares of common stock will be issued pursuant

to awards granted to the selling stockholders and will be “control securities” under the Securities Act before their sale

under this prospectus. This prospectus has been prepared for the purposes of registering the shares under the Securities Act to allow

for future sales by selling stockholders on a continuous or delayed basis to the public without restriction. Our common stock is traded

on the OTCQB Market, under the symbol “AERG.” On December 9, 2021, the closing sale price of our common stock on the OTCQB

was $2.27 per share.

Investing in our securities involves a high degree of risk. You

should read carefully and consider the information contained in and incorporated by reference under “Risk Factors” beginning

on page 2 of this prospectus, and the risk factors contained in other documents incorporated by reference.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this prospectus is December 10, 2021.

APPLIED ENERGETICS, INC.

TABLE OF CONTENTS

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION

OR TO MAKE ANY REPRESENTATIONS, OTHER THAN THOSE CONTAINED IN THIS PROSPECTUS, IN CONNECTION WITH THE OFFERING MADE HEREBY, AND, IF GIVEN

OR MADE, SUCH INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE COMPANY OR ANY OTHER PERSON. NEITHER

THE DELIVERY OF THIS PROSPECTUS NOR ANY SALE MADE HEREUNDER SHALL UNDER ANY CIRCUMSTANCES CREATE ANY IMPLICATION THAT THERE HAS BEEN

NO CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE HEREOF. THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION

OF AN OFFER TO BUY ANY SECURITIES OFFERED HEREBY BY ANYONE IN ANY JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS NOT AUTHORIZED

OR IN WHICH THE PERSON MAKING SUCH OFFER OR SOLICITATION IS NOT QUALIFIED TO DO SO OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE SUCH

OFFER OR SOLICITATION.

PROSPECTUS SUMMARY

The following is a summary of selected information contained elsewhere

or incorporated by reference. It does not contain all of the information that you should consider before buying our securities. You should

read this prospectus in its entirety, including the information incorporated by reference herein

Business Overview

Applied Energetics, Inc. is a corporation organized

and existing under the laws of the State of Delaware. Our executive office is located at 9070 S. Rita Road, Suite 1500, Tucson, Arizona

85747 and our telephone number is (520) 628-7415.

Applied Energetics specializes in the development

and manufacture of advanced high-performance lasers, high voltage electronics, advanced optical systems, and integrated guided energy

systems for defense, aerospace, industrial, and scientific customers worldwide. AERG has developed, successfully demonstrated and holds

all crucial intellectual property rights to a dynamic Directed Energy technology called Laser Guided Energy (“LGE®”)

and Laser Induced Plasma Channel (“LIPC®”). LGE and LIPC are technologies that can be used in a new generation of high-tech

weapons. The Department of Defense (DOD) previously recognized two key types of Directed Energy Weapon (“DEW”) technologies,

High Energy Lasers (“HEL”), and High-Power Microwave (“HPM”). Neither the HEL nor the HPM intellectual property

portfolio is owned by a single entity. The DOD then designated a third DEW technology, LGE. Applied Energetics’ LGE and LIPC technologies

are wholly owned by Applied Energetics and patent protected with 26 current patents and an additional 11 Government Sensitive Patent

Applications (“GSPA”). These GSPA’s are held under secrecy orders of the US government and allow the company greatly

extended protection rights.

Applied Energetics technology is vastly different

from conventional directed energy weapons, i.e. HEL, and HPM. LGE uses Ultra-Short Pulse (USP) laser technology to combine the speed

and precision of lasers with the overwhelming impact on targeted threats with high-voltage electricity. This unique directed energy solution

allows extremely high peak power and energy, with target and effects tenability, and is effective against a wide variety of potential

targets. A key element of LGE is its novel ability to offer selectable and tunable properties that can help protect non-combatants and

combat zone infrastructure.

As Applied Energetics looks toward the future,

our corporate strategic roadmap builds upon the significant value of the company’s USP capabilities and key intellectual property,

including LGE and LIPC, to offer our prospective partners, co-developers and system integrators a variety of next-generation Ultra Short-Pulse

and frequency-agile optical sources from the ultraviolet to the far infrared portion of the electromagnetic spectrum to address numerous

challenges within the military, medical device, and advanced manufacturing market sectors.

About This Offering

This offering relates to the resale by the selling

stockholders of up to 36,880,000 shares of common stock, including certain unnamed non-affiliates of the Company, each of whom may sell

up to 1,000 shares of common stock. The selling stockholders have acquired, or may acquire, such shares pursuant to grants made pursuant

to the 2018 Plan or under one or more Consulting Agreements.

RISK FACTORS

An investment in our common

stock has a high degree of risk. Before making an investment decision, you should carefully consider the risks discussed in the section

titled “Risk Factors” in our most recent Annual Report on Form 10-K, as well as the risks, uncertainties and additional information

set forth in our SEC reports on Forms 10-K, 10-Q and 8-K and in other documents incorporated by reference in this prospectus as updated

by our subsequent filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Our business, financial condition

or results of operations could be materially adversely affected by any of these risks. The trading price of our common stock could decline

due to any of these risks, and you may lose all or part of your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents

and information incorporated by reference in this prospectus include forward-looking statements within the meaning of Section 27A of

the Securities Act and Section 21E of the Exchange Act. These statements are based on our management’s beliefs and assumptions

and on information currently available to our management. Such forward-looking statements include those that express plans, anticipation,

intent, contingency, goals, targets or future development and/or otherwise are not statements of historical fact.

All statements in this prospectus

and the documents and information incorporated by reference in this prospectus that are not historical facts are forward-looking statements.

We may, in some cases, use terms such as “anticipates,” “believes,” “could,” “estimates,”

“expects,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “will,” “would” or similar expressions or the negative of such

items that convey uncertainty of future events or outcomes to identify forward-looking statements.

Forward-looking statements

are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation

to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may be

required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we

cannot guarantee future results, levels of activity, performance or achievements.

USE OF PROCEEDS

We will receive no proceeds from the sale of any

shares of common stock offered by the selling stockholders. We will receive proceeds from the cash exercise of options, if any. We intend

to use such proceeds for general corporate purposes, including working capital.

SELLING STOCKHOLDERS

The table below sets forth, as of December 1,

2021, (i) the name of each person who is offering shares by this prospectus and their position with us; (ii) the number of shares (and

the percentage, if 1% or more) of Common Stock beneficially owned (as such term is defined in Rule 13d-3 under the Exchange Act) by each

person; (iii) the number of shares that each selling stockholder may offer for sale from time to time pursuant to this prospectus, whether

or not such selling stockholder has a present intention to do so; and (iv) the number of shares (and the percentage, if 1% or more) of

common stock each person will own after giving effect to the offering, assuming they sell all of the shares offered. Unless otherwise

indicated, beneficial ownership is direct and the person indicated has sole voting and investment power. Unless otherwise indicated,

the address for each selling stockholder listed in the table below is c/o Applied Energetics, Inc., 9070 S. Rita Road, Suite 1500, Tucson,

AZ 85747

The table below has been prepared based upon the

information furnished to us by the selling stockholders as of December 1, 2021, and we have not independently verified this information.

The selling stockholders identified below may have sold, transferred or otherwise disposed of some or all of their shares since the date

on which the information in the following table is presented in transactions exempt from or not subject to the registration requirements

of the Securities Act. Information concerning the selling stockholders may change from time to time and, if necessary, we will amend

or supplement this prospectus accordingly. We cannot give an estimate as to the number of shares of common stock that will actually be

held by the selling stockholders upon termination of this offering because the selling stockholders may offer some or all of their common

stock under the offering contemplated by this prospectus or acquire additional shares of common stock. The total number of shares that

may be sold hereunder will not exceed the number of shares offered hereby. Please read the section entitled “Plan of Distribution”

in this prospectus.

|

Name of Selling Stockholder and Relationship to Company

|

|

Shares of

Common Stock

Beneficially

Owned

Prior to this

Offering (1)

|

|

|

Percentage (1)

|

|

|

Shares of

Common Stock

Offered for Resale

|

|

|

Shares of

Common Stock

Beneficially

Owned

After this

Offering

|

|

|

Percentage (1)

|

|

|

Bradford T. Adamczyk, Director and Executive Chairman

|

|

|

7,235,081

|

(2)

|

|

|

3.5

|

%

|

|

|

1,500,000

|

|

|

|

5,735,081

|

|

|

|

2.8

|

%

|

|

Adamczyk Family 2021 LLC

|

|

|

3,500,000

|

(3)

|

|

|

1.7

|

%

|

|

|

3,500,000

|

|

|

|

-0-

|

|

|

|

*

|

|

|

Pedro Alcaraz

|

|

|

30,000

|

(4)

|

|

|

*

|

|

|

|

30,000

|

(4)

|

|

|

-0-

|

|

|

|

*

|

|

|

Dan W. Baer, Consultant

|

|

|

7,811,603

|

(5)

|

|

|

3.8

|

%

|

|

|

100,000

|

(5)

|

|

|

7,711,603

|

|

|

|

3.7

|

%

|

|

Jonathan Barcklow, Director and Vice President

|

|

|

6,000,000

|

(6)

|

|

|

2.9

|

%

|

|

|

5,000,000

|

(6)

|

|

|

1,000,000

|

|

|

|

*

|

|

|

Christopher Donaghey, Consultant

|

|

|

765,000

|

(7)

|

|

|

*

|

|

|

|

765,000

|

(7)

|

|

|

-0-

|

|

|

|

--

|

|

|

James Harrison, SAB Member

|

|

|

2,250,000

|

(8)

|

|

|

1.1

|

%

|

|

|

2,250,000

|

|

|

|

-0-

|

|

|

|

*

|

|

|

Stephen McCahon, Chief Scientist and Consultant

|

|

|

14,677,861

|

|

|

|

7.15

|

%

|

|

|

9,000,000

|

|

|

|

5,677,861

|

|

|

|

2.7

|

%

|

|

Elizabeth McCahon

|

|

|

2,005,000

|

(9)

|

|

|

*

|

|

|

|

2,000,000

|

|

|

|

5,000

|

|

|

|

|

*

|

|

|

John McCahon

|

|

|

2,005,000

|

(9)

|

|

|

*

|

|

|

|

2,000,000

|

|

|

|

5,000

|

|

|

|

|

*

|

|

|

William McCahon

|

|

|

2,005,000

|

(9)

|

|

|

*

|

|

|

|

2,000,000

|

|

|

|

5,000

|

|

|

|

|

*

|

|

|

Stephen McCommon, Finance Manager and Consultant

|

|

|

2,000,000

|

(10)

|

|

|

*

|

|

|

|

2,000,000

|

(9)

|

|

|

-0-

|

|

|

|

--

|

|

|

Mary P. O’Hara

|

|

|

360,000

|

(11)

|

|

|

*

|

|

|

|

360,000

|

(10)

|

|

|

-0-

|

|

|

|

--

|

|

|

Gregory J. Quarles, President and Chief Executive Officer

|

|

|

7,000,000

|

(12)

|

|

|

3.4

|

%

|

|

|

7,000,000

|

(11)

|

|

|

-0-

|

|

|

|

*

|

|

|

John Schultz, Director

|

|

|

4,372,624

|

(13)

|

|

|

2.1

|

%

|

|

|

2,500,000

|

(12)

|

|

|

1,872,624

|

|

|

|

*

|

|

|

Patrick Williams, Consultant

|

|

|

1,250,000

|

(14)

|

|

|

*

|

|

|

|

1,250,000

|

(13)

|

|

|

-0-

|

|

|

|

*

|

|

|

Eric Wilson

|

|

|

125,000

|

(15)

|

|

|

*

|

|

|

|

125,000

|

(14)

|

|

|

-0-

|

|

|

|

*

|

|

|

|

(1)

|

Beneficial ownership is determined in accordance with the rules

of the SEC and generally includes voting or investment power with respect to securities. Shares of Common Stock underlying options currently

exercisable, or exercisable, or restricted stock units that vest, within 60 days after December 1, 2021, (as used in this section, the

“Determination Date”), are deemed outstanding for purposes of computing the beneficial ownership of the person holding such

options and/or restricted stock units but are not deemed outstanding for computing the beneficial ownership of any other person. Except

where we had knowledge of such ownership, the number presented in this column may not include shares held in street name or through other

entities over which the selling stockholder has voting and dispositive power. Percentages are based on the 207,562,471 shares of Common

Stock issued and outstanding as of the Determination Date.

|

|

|

(2)

|

Based on information contained in a Form 4, filed with the SEC

on May 20, 2020. Includes 1,563,599 shares held by Moriah Stone Global L.P., which is controlled by Mr. Adamczyk. Also includes 5,000,000

shares underlying options, 3,500,000 of which are held in the name of the Adamczyk Family 2021 LLC.

|

|

|

(3)

|

All 3,500,000 shares offered hereby underly options. Bradford

T. Adamczyk controls the Adamczyk Family 2021 LLC.

|

|

|

(4)

|

All 30,000 shares underly options which are subject to vesting

over three years.

|

|

|

(5)

|

Includes 100,000 shares and underly options which are offered hereby. Also includes 6,661,603 shares which are being transferred to FSRN, LLC, a Nevada limited liability company which is managed by Mr. Baer.

|

|

|

(6)

|

Based on information contained in a Form 4, filed with the SEC

on December 21, 2018. Includes 5,000,000 shares underlying options which are offered hereby.

|

|

|

(7)

|

Includes 550,000 share underlying options and 215,000 restricted

shares, 110 of which are subject to vesting.

|

|

|

(8)

|

Includes 750,000 shares underlying options that are currently

exercisable (as to which the company has received notice of the holder’s intent to exercise) and an additional 1,500,000 that are

subject to vesting based on revenue milestones.

|

|

|

(9)

|

All such shares were received by

gift from Stephen McCahon, who is the father of each of these holders and received the shares as compensation for services.

|

|

|

(10)

|

Includes 111,160 shares which are

subject to monthly vesting through April 1, 2022.

|

|

|

(11)

|

Based on information contained in

a Form 3 filed with the SEC on August 28, 2021. All such shares underly options.

|

|

|

(12)

|

Includes 2,000,000 shares of common

stock underlying options, some of which are subject to vesting.

|

|

|

(13)

|

Includes 500,000 shares held by

Oak Tree Asset Management Ltd., which is controlled by Mr. Schultz, and 770,322 shares held by Mary Schultz, Mr. Schultz’s wife.

Also includes 2,500,000 shares underlying options which are offered hereby.

|

|

|

(14)

|

Includes 1,000,000 shares underlying

options.

|

|

|

(15)

|

All 125,000 shares underly options

which are subject to vesting.

|

PLAN OF DISTRIBUTION

The shares of common stock covered by this reoffer

prospectus are being registered by Applied Energetics for the account of the selling stockholders. The shares of common stock offered

may be sold from time to time directly by or on behalf of each selling stockholder in one or more transactions on the OTCQB Market or

any other stock exchange on which the common stock may be listed at the time of sale, in privately negotiated transactions, or through

a combination of such methods, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at

fixed prices (which may be changed) or at negotiated prices. The selling stockholders may sell shares through one or more agents, brokers

or dealers or directly to purchasers. Such brokers or dealers may receive compensation in the form of commissions, discounts or concessions

from the selling stockholders and/or purchasers of the shares or both. Such compensation as to a particular broker or dealer may be in

excess of customary commissions.

In connection with their sales, a selling stockholder

and any participating broker or dealer may be deemed to be “underwriters” within the meaning of the Securities Act, and any

commissions they receive and the proceeds of any sale of shares may be deemed to be underwriting discounts and commissions under the

Securities Act. We are bearing all costs relating to the registration of the shares of Common Stock. Any commissions or other fees payable

to brokers or dealers in connection with any sale of the shares will be borne by the selling stockholders or other party selling such

shares. Sales of the shares must be made by the selling stockholders in compliance with all applicable state and federal securities laws

and regulations, including the Securities Act. In addition to any shares sold hereunder, selling stockholders may sell shares of Common

Stock in compliance with Rule 144. There is no assurance that the selling stockholders will sell all or a portion of the Common Stock

offered hereby. The selling stockholders may agree to indemnify any broker, dealer or agent that participates in transactions involving

sales of the shares against certain liabilities in connection with the offering of the shares arising under the Securities Act. We have

notified the selling stockholders of the need to deliver a copy of this reoffer prospectus in connection with any sale of the shares.

The anti-manipulation rules of Regulation M under

the Exchange Act may apply to sales of our common stock and activities of the selling stockholders, which may limit the timing of purchases

and sales of any of the shares of common stock by the selling stockholders and any other participating person. Regulation M may also

restrict the ability of any person engaged in the distribution of the shares of Common Stock to engage in passive market-making activities

with respect to the shares of Common Stock. Passive market making involves transactions in which a market maker acts as both our underwriter

and as a purchaser of our Common Stock in the secondary market. All of the foregoing may affect the marketability of the shares of Common

Stock and the ability of any person or entity to engage in market-making activities with respect to the shares of Common Stock.

Once sold under the registration statement of

which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our affiliates.

State Securities Laws

Under the securities laws of

some states, the shares of common stock may be sold in such states only through registered or licensed brokers or dealers. In addition,

in some states the shares of common stock may not be sold unless the shares have been registered or qualified for sale in the state or

an exemption from registration or qualification is available and is complied with.

Expenses of Registration

We are bearing all costs relating

to the registration of the common stock. The selling stockholders, however, will pay any commissions or other fees payable to brokers

or dealers in connection with any sale of the common stock.

LEGAL MATTERS

The validity of the common

stock has been passed upon by Masur Griffitts Avidor LLP, New York, New York.

EXPERTS

The consolidated financial

statements of Applied Energetics, Inc. and subsidiary, as of and for the year ended December 31, 2020 and 2019, have been incorporated

by reference herein in reliance upon the report of RBSM LLP, independent registered public accounting firm, and upon the authority of

said firm as expert in accounting and auditing.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference”

information into this prospectus, which means that we can disclose important information to you by referring you to another document filed

separately with the SEC. The SEC file number for the documents incorporated by reference in this prospectus is 001-32698. The documents

incorporated by reference into this prospectus contain important information that you should read about us. The following documents are

incorporated by reference into this document:

|

|

●

|

our Annual Report on Form 10-K for the year ended December

31, 2020;

|

|

|

●

|

Current Reports on Form 8-K filed with the SEC on July 16,

18 and 19, October 31, and November 8, 2019, January 6, March 10, June 4 and 15, August 5, September 2, 3, 10 and 29, October 6 and November 12, 2020 and January 7 and February 3 and 9, March 17, April 27, July 14 and 23, August 25, and November 1, 2021.

|

We also incorporate by reference

into this prospectus all documents (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on

such form that are related to such items) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act (i) after the date of the initial filing of the registration statement of which this prospectus forms a part and prior to effectiveness

of the registration statement, or (ii) after the date of this prospectus but prior to the termination of the offering. These documents

include periodic reports, such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well

as proxy statements.

Documents incorporated by

reference are available from us, without charge. You may obtain documents incorporated by reference in this prospectus by requesting them

in writing or by telephone at the following address: Applied Energetics Inc. 9070 Rita Road, Suite 1500, Tucson, AZ 85747, Attn. Stephen

McCommon, Finance Manager

You also may access these

filings on our Internet site at www.aergs.com. Our website and the information contained on or connected to it are not incorporated into

this prospectus or the registration statement of which this prospectus is a part.

Any statement contained in

this prospectus or contained in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed

to be modified or superseded to the extent that a statement contained in this prospectus or any subsequently filed supplement to this

prospectus, or document deemed to be incorporated by reference into this prospectus, modifies or supersedes such statement.

The information about us contained

in this prospectus should be read together with the information in the documents incorporated by reference. You may request a copy of

any or all of these filings, at no cost, by writing or telephoning us at:

INDEMNIFICATION

OF DIRECTORS AND OFFICERS

Article NINTH of our Restated

Certificate of Incorporation states:

All persons who the Corporation

is empowered to indemnify pursuant to the provisions of Section 145 of the General Corporation Law of the State of Delaware (or any similar

provision or provisions of applicable law at the time in effect),shall be indemnified by the Corporation to the full extent permitted

thereby. The foregoing right of indemnification shall not be deemed to be exclusive of any other rights to which those seeking indemnification

may be entitled under any by-law, agreement, vote of stockholders or disinterested directors, or otherwise. No repeal or amendment of

this Article NINTH shall adversely affect any rights of any person pursuant to this Article NINTH which existed at the time of such repeal

or amendment with respect to acts or omissions occurring prior to such repeal or amendment.

Article XIX of our By-Laws

states: All persons who the Corporation is empowered to indemnify pursuant to the provisions of Section 145 of the General Corporation

Law of the State of Delaware (or any similar provision or provisions of applicable law at the time in effect) shall be indemnified by

the Corporation to the full extent permitted thereby. The foregoing right of indemnification shall not be deemed to be exclusive of any

other such rights to which those seeking indemnification from the Corporation may be entitled, including, but not limited to, any rights

of indemnification to which they may be entitled pursuant to any agreement, insurance policy, other by-law or charter provision, vote

of stockholders or directors, or otherwise. No repeal or amendment of this Article shall adversely affect any rights of any person pursuant

to this Article which existed at the time of such repeal or amendment with respect to acts or omissions occurring prior to such repeal

or amendment.

Section 145 of the Delaware

General Corporation Law authorizes us to indemnify any director or officer under prescribed circumstances and subject to certain limitations

against certain costs and expenses, including attorneys’ fees actually and reasonably incurred in connection with any action, suit

or proceedings, whether civil, criminal, administrative or investigative, to which such person is a party by reason of being one of our

directors or officers if it is determined that the person acted in accordance with the applicable standard of conduct set forth in such

statutory provisions.

Insofar as indemnification

for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of Applied Energetics,

Inc. pursuant to the foregoing provisions, or otherwise, we have been advised that, in the opinion of the Securities and Exchange Commission,

such indemnification is against public policy as expressed in such Act and is, therefore, unenforceable.

ADDITIONAL INFORMATION AVAILABLE TO YOU

We file annual, quarterly

and current reports, along with other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at http://www.sec.gov.

This prospectus is part of

a registration statement on Form S-8 that we filed with the SEC to register the securities offered hereby under the Securities Act. This

prospectus does not contain all of the information included in the registration statement, including certain exhibits and schedules. You

may obtain the registration statement and exhibits to the registration statement from the SEC’s internet site.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 3. Incorporation of Documents by Reference.

The Registrant hereby incorporates by reference

into this Registration Statement the documents listed below. In addition, all documents subsequently filed pursuant to Sections 13(a),

13(c), 14 and 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), prior to the filing of a post-effective amendment

which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, shall be deemed

to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing of such documents:

|

|

●

|

our Annual Report on Form 10-K for the year ended December

31, 2020;

|

|

|

●

|

Current Reports on Form 8-K filed with the SEC on July 16,

18 and 19, October 31, and November 8, 2019, January 6, March 10, June 4 and 15, August 5, September 2, 3, 10 and 29, October 6 and November 12, 2020 and January 7 and February 3 and 9, March 17, April 27, July 14 and 23, August 25, and November 1, 2021.

|

We also incorporate by reference into this prospectus

all documents (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are

related to such items) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after

the date of the initial filing of the registration statement of which this prospectus forms a part and prior to effectiveness of the registration

statement, or (ii) after the date of this prospectus but prior to the termination of the offering. These documents include periodic reports,

such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as proxy statements.

Item 4. Description of Securities.

Not Applicable.

Item 5. Interests of Named Experts and Counsel.

Not Applicable.

Item 6. Indemnification of Directors and

Officers.

Under the Delaware General Corporation Law and our Articles of Incorporation,

as amended, and our Bylaws, our directors will have no personal liability to us or our stockholders for monetary damages incurred as the

result of the breach or alleged breach by a director of his “duty of care.” This provision does not apply to the directors’

(i) acts or omissions that involve intentional misconduct or a knowing and culpable violation of law, (ii) acts or omissions that a director

believes to be contrary to the best interests of the corporation or its stockholders or that involve the absence of good faith on the

part of the director, (iii) approval of any transaction from which a director derives an improper personal benefit, (iv) acts or omissions

that show a reckless disregard for the director’s duty to the corporation or its stockholders in circumstances in which the director was

aware, or should have been aware, in the ordinary course of performing a director’s duties, of a risk of serious injury to the corporation

or its stockholders, (v) acts or omissions that constituted an unexcused pattern of inattention that amounts to an abdication of the director’s

duty to the corporation or its stockholders, or (vi) approval of an unlawful dividend, distribution, stock repurchase or redemption. This

provision would generally absolve directors of personal liability for negligence in the performance of duties, including gross negligence.

The effect of this provision in our Articles of Incorporation and Bylaws

is to eliminate the rights of our Company and our stockholders (through stockholder’s derivative suits on behalf of our Company) to recover

monetary damages against a director for breach of his fiduciary duty of care as a director (including breaches resulting from negligent

or grossly negligent behavior) except in the situations described in clauses (i) through (vi) above. This provision does not limit nor

eliminate the rights of our Company or any stockholder to seek non-monetary relief such as an injunction or rescission in the event of

a breach of a director’s duty of care. In addition, our Bylaws provide that if the Delaware General Corporation Law is amended to authorize

the future elimination or limitation of the liability of a director, then the liability of the directors will be eliminated or limited

to the fullest extent permitted by the law, as amended. The Delaware General Corporation Law grants corporations the right to indemnify

their directors, officers, employees and agents in accordance with applicable law.

Insofar as indemnification for liabilities arising under the Securities

Act of 1933 (the “Act” or “Securities Act”) may be permitted to directors, officers or persons controlling our Company

pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Securities and Exchange Commission,

such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

|

4.1

|

|

Applied Energetics, Inc. 2018 Equity Incentive Plan (incorporated by reference to Exhibit 10.1 to the Annual Report on Form 10-K, filed on April 1, 2019) .

|

|

4.2

|

|

Consulting Agreement, dated as of April 24, 2020, by and between the Company and TCM Financial Services

|

|

4.3

|

|

Consulting Agreement, dated as of May 24, 2019, by and between the Company and SWM Consulting LLC (incorporated by reference to exhibit 99.1 filed with the Registrant’s Form 8-K filed with the SEC on May 31, 2019)

|

|

4.4

|

|

Executive Employment Agreement, dated as of April 18, 2019, by and between the Company and Gregory J. Quarles (incorporated by reference to the Registration Statement on Form S-1 filed on May 31, 2019).

|

|

4.5

|

|

Advisory Board Agreement by and between registrant and Christopher Donaghey (incorporated by reference to comparable exhibit filed with the Registration Statement on Form S-1 filed with the SEC on May 31, 2019)

|

|

4.6

|

|

Form of Option Grant Agreement (performance vesting)

|

|

4.7

|

|

Form of Option Grant Agreement (time vesting)

|

|

5.1

|

|

Opinion of.Masur Griffitts Avidor LLP

|

|

23.1

|

|

Consent of Masur Griffitts Avidor LLP is contained in Exhibit 5.1.

|

|

23.2

|

|

Consent of RBSM LLP.

|

Item 9. Undertakings.

(a) The

undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

(i)

|

To include any prospectus required by Section 10(a)(3)

of the Securities Act of 1933;

|

|

|

(ii)

|

To reflect in the prospectus any facts or events arising

after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in

the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing,

any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which

was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus

filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent

change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective

registration statement;

|

|

|

(iii)

|

To include any material information with respect to the plan

of distribution not previously disclosed in the registration statement or any material change to such information in the registration

statement; provided, however, that paragraphs (1)(i), and (1)(ii) do not apply if the Registration

Statement is on Form S-8 and if the information required to be included in a post-effective amendment by those paragraphs is contained

in reports filed with or furnished to the Commission by the Registrant pursuant to section 13 or section 15(d) of the Securities

Exchange Act of 1934 that are incorporated by reference in the registration statement.

|

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(4) That,

for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant

to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

(5) That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

|

(A)

|

Each prospectus filed

by a Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus

was deemed part of and included in the registration statement; and

|

|

|

(B)

|

Each prospectus required

to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating

to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required

by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the

earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities

in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that

is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities

in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be

the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus

that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such

effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such effective date.

|

(6) That,

for the purpose of determining liability of a Registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities, each undersigned Registrant undertakes that in a primary offering of securities of an undersigned Registrant pursuant

to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to

the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

(i)

|

Any preliminary prospectus

or prospectus of an undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

(ii)

|

Any free writing prospectus

relating to the offering prepared by or on behalf of an undersigned Registrant or used or referred to by an undersigned Registrant;

|

|

|

(iii)

|

The portion of any

other free writing prospectus relating to the offering containing material information about an undersigned Registrant or its securities

provided by or on behalf of an undersigned Registrant; and

|

|

|

(iv)

|

Any other communication

that is an offer in the offering made by an undersigned Registrant to the purchaser.

|

Insofar as indemnification for

liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant

pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange

Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against

such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of

the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person

in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled

by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public

policy as expressed in the Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act, Applied Energetics, Inc. certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on

Form S-8 and has duly caused this Registration Statement on Form S-3 to be signed on its behalf by the undersigned, thereunto duly authorized,

on the 10th day of December, 2021.

|

|

APPLIED ENERGETICS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Gregory J. Quarles

|

|

|

|

Gregory J. Quarles

|

|

|

|

Chief Executive Officer and President

|

Pursuant to the requirements

of the Securities Act, this Registration Statement has been signed below by the following persons in the indicated capacities.

|

Name/Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Gregory J. Quarles

|

|

Chief Executive Officer,

|

|

December 10, 2021

|

|

Gregory J. Quarles

|

|

President and Director

|

|

|

|

|

|

|

|

|

|

/s/ Bradford T. Adamczyk

|

|

Chairman and Director

|

|

December 10, 2021

|

|

Bradford T. Adamczyk

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Jonathan Barcklow

|

|

Vice President, Secretary and Director

|

|

December 10, 2021

|

|

Jonathan Barcklow

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John Schultz

|

|

Director

|

|

December 10, 2021

|

|

John Schultz

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Mary P. O’Hara

|

|

Director

|

|

December 10, 2021

|

|

Mary P. O’Hara

|

|

|

|

|

II-6

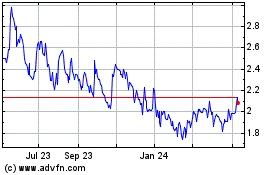

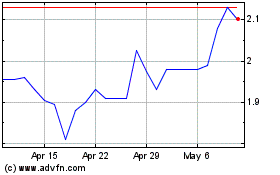

Applied Energetics (QB) (USOTC:AERG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Applied Energetics (QB) (USOTC:AERG)

Historical Stock Chart

From Mar 2024 to Mar 2025