UPDATE: ThyssenKrupp, Outokumpu In Talks On Stainless Steel Sale

January 23 2012 - 5:49AM

Dow Jones News

ThyssenKrupp AG (TKA.XE) said Monday it is in talks with Finnish

rival Outokumpu Oyj (OUT1V.HE) regarding a sale of ThyssenKrupp's

stainless-steel unit Inoxum, naming for the first time a potential

partner in its plan to divest the unit, as the German steelmaker

and engineering group struggles to reduce debt and realign its

portfolio.

The company stressed it is keeping open two other options for

the unit--an initial public offering or a spin-off--given high

macroeconomic uncertainty and current high market volatility.

The company first announced plans to divest a majority stake of

the unit in May last year. ThyssenKrupp's Chief Executive Heinrich

Hiesinger said at the time the company will become a minority

shareholder in the stainless steel business and give up operational

control. It aims to complete the divestment by Sept. 30--the end of

its fiscal year 2012.

Analysts welcomed ThyssenKrupp's moves to minimize cyclical

steel exposure, as well as potential consolidation in the industry

as a whole.

However, some said a tie-up between Inoxum and Outokumpu, two of

the four main players in the European stainless steel market, could

lead to problems obtaining anti-trust clearance.

Equinet said it expects to see a separation of ThyssenKrupp's

Italian Acciai Speciali Terni, or AST, assets due to anti-trust

regulations, adding the most likely scenario is a merger between

stainless steel flat product maker ThyssenKrupp Nirosta GmbH and

Outokumpu, as Outokumpu would profit from Inoxum's strong

distribution network in Europe.

However, BHF-Bank analyst Hermann Reith said a tie-up could be

possible from an anti-trust perspective as Outokumpu is strong in

the U.K., Sweden and Finland while ThyssenKrupp is strong in

Germany and eastern Europe. He added a tie-up between ThyssenKrupp

and Aperam (056997440.LU), the business ArcelorMittal (MT) spun off

a year ago, would be harder as the companies overlap so much.

Inoxum has about 11,500 employees and is made up of a stainless

steel segment and a high performance alloys division. Its sale is

part of a broader effort by ThyssenKrupp to sell assets that

generate around EUR10 billion in annual sales and employ some

35,000 people.

German union IG Metall Monday called on ThyssenKrupp to

safeguard the jobs of Inoxum workers and said it wouldn't approve a

sale without employee protection.

At 1004 GMT, ThyssenKrupp shares traded flat at EUR21.20

compared with an 0.1% lower DAX index, while Outokumpu was up 11%

at EUR7.50.

-By Harriet Torry, Dow Jones Newswires; +49 69 29725 511;

harriet.torry@dowjones.com

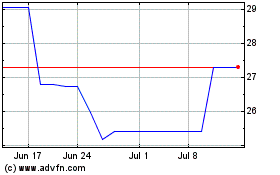

Aperam New York Registry (PK) (USOTC:APEMY)

Historical Stock Chart

From Jan 2025 to Feb 2025

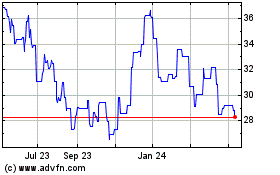

Aperam New York Registry (PK) (USOTC:APEMY)

Historical Stock Chart

From Feb 2024 to Feb 2025