false

0001508348

0001508348

2024-05-03

2024-05-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 3, 2024

AMERICANN, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

000-54231 |

|

27-4336843 |

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File No.) |

|

(IRS Employer

Identification No.)

|

1555 Blake Street, Unit 502

Denver, CO 80216

(Address of principal executive offices, including Zip Code)

Registrant's telephone number, including area code: (303) 862-9000

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.02 TERMINATION OF A MATERIAL DEFINITIVE AGREEMENT

On July 26, 2019, the Company entered into a 15-Year Triple Net lease of Building 1 of the Massachusetts Cannabis Center with BASK, Inc. The lease commenced on September 1, 2019 and included a monthly base rent of $11,563.50 and a revenue participation fee equivalent to 15% of BASK’s gross revenues derived from products produced in the building.

On May 3, 2024:

| |

●

|

The Company and BASK mutually agreed to modify the lease to conclude on August 31, 2024;

|

| |

●

|

After August 31, 2024, AmeriCann intends to operate the building as a regulated cannabis cultivation and manufacturing operator;

|

| |

●

|

AmeriCann and BASK have agreed that, for the last five months of the lease effective April 1, the new monthly payment by BASK will be $57,587.78 per month, inclusive of property taxes and Host Community Agreement fees;

|

| |

●

|

Bask agreed to transfer to the Company its provisional Cultivation and provisional Product Manufacturing licenses. BASK will receive a credit of $40,000 for each license transferred. Any transfer of licenses is contingent upon approval from the Massachusetts Cannabis Control Commission;

|

| |

●

|

BASK granted the Company the option to purchase any furniture and equipment located in the space currently occupied by BASK. The Company and BASK will agree on the items that the Company intends to purchase on or before June 1, 2024.

|

Any licenses, furniture and equipment purchased will serve as a credit towards reducing the amounts due to the Company from Bask ($623,244 as of March 31, 2024). Any remaining balances will be converted to a promissory note which will be paid in 24 equal monthly non interest bearing installment payments. The current promissory note from BASK dated September 30, 2023 (which had an outstanding balance of $369,869 as of March 31, 2024) will be converted into this new consolidated promissory note.

The Company believes that there are potential benefits associated with operating the facility and becoming a regulated operator. These include a transition to a much simpler and direct business model, greater control over building operations and potentially substantially increased revenue and cash flow.

Additionally, the recent announcement by the US Department of Justice of its intention to reclassify cannabis from Schedule I to Schedule III could make returns even more attractive by removing many of the obstacles cannabis operators currently encounter.

The Mutual Lease Modification Agreement is attached as an exhibit to this 8-K report.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 7, 2024

|

|

AMERICANN, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Timothy Keogh

|

|

|

|

|

Timothy Keogh, Chief Executive Officer

|

|

Exhibit 10.16

MUTUAL LEASE MODIFICATION AGREEMENT

THIS MUTUAL LEASE MODIFICATION AGREEMENT (the “Agreement”) is made as of the 3rd of May, 2024 (the “Effective Date”) by and between AmeriCann, Inc., a Colorado corporation with an address of 1555 Blake Street, Unit 502, Denver, CO 80202 (hereinafter the "Landlord") and Bask, Inc., a Massachusetts corporation with an address of 2 Pequod Road, Fairhaven, MA 02719 (hereinafter the “Tenant”). Landlord and Tenant sometimes hereinafter the “Parties” or individually as a “Party.”

RECITALS

WHEREAS, Landlord and Tenant entered into a Commercial Lease dated as of August 2, 2019 (hereinafter the “Lease”) for the rental of commercial space located at 7 Campanelli Drive, Freetown, Massachusetts (hereinafter the “Premises”); and

WHEREAS, Tenant seeks to reset and downsize its operations to better serve the patients and customers of the South Coast of Massachusetts; and

WHEREAS, Landlord seeks to take back possession and explore alternative opportunities for the Premises; and

WHEREAS, the Parties seek to execute a new short-term lease agreement for the Premises, commencing on April 1, 2024 and terminating on August 31, 2024 (“Amended Lease Term”); and

WHEREAS, the Parties agree to the terms and conditions set forth herein.

AGREEMENT

FOR AND IN CONSIDERATION of the foregoing Recitals, which are specifically incorporated by reference herein, the mutual covenants contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties mutually agree as follows:

| |

1.

|

Tenant acknowledges and agrees that, as of March 31, 2024, Tenant owed a past due balance in the sum of $623,244.39 to Landlord (the “Outstanding Balance”) pursuant to the Lease. Tenant agrees to pay the Outstanding Balance due to Landlord, with certain deductions as agreed to by the Parties, as set forth below.

|

| |

2.

|

In lieu of additional payments under the Lease, Tenant shall make payments to Landlord as set forth in this Agreement.

|

| |

a.

|

Tenant shall pay to the Landlord a total of Fifty-Seven Thousand Five Hundred Eighty-Seven and 78/100 Dollars ($57,587.78) on or before April 25, 2024. Tenant shall then make monthly payments to Landlord in the amount of Fifty-Seven Thousand Five Hundred Eighty-Seven and 78/100 Dollars ($57,587.78) each on May 15, 2024, on June 15, 2024, on July 15, 2024, and on August 15, 2024.

|

| |

b.

|

Upon approval from the Cannabis Control Commission, Tenant agrees to transfer its provisional Cultivation (Cultivation (MCN282211) and provisional Product Manufacturing (MPN281702) licenses (“Bask Provisional Licenses”) at a value of Forty Thousand Dollars ($40,000) for each license, for a total of Eighty Thousand Dollars ($80,000) to Landlord, or its assignee. Tenant and Landlord’s assignee have executed a Binding Letter of Intent to Pursue Change of Control with the Cannabis Control Commission (attached as Exhibit A) for the licenses. The Eighty Thousand Dollars ($80,000) payment will be in the form of a reduction to the Outstanding Balance and will be specifically contingent upon approval of a Change of Control by the Cannabis Control Commission (“License Transfer Credit”). Tenant has been in communication with the Cannabis Control Commission regarding the change of control and shall immediately commence the change of control application to obtain permission for the contemplated transfer from the Cannabis Control Commission for the Cultivation (MCN282211) and Product Manufacturing (MPN281702) licenses from Tenant to Landlord, or its assignee. The License Transfer Credit shall be applied to the then amount due under an Amended and Restated Promissory Note to be executed by the Parties on or before July 31, 2024, as set forth below. Should the Cannabis Control Commission refuse to approve the transfer, and such refusal is not due to an act or omission of Landlord or the proposed transferee, the Eighty Thousand Dollars shall be added to the amount due to Landlord and Tenant agrees to execute an amendment to the Amended and Restated Promissory Note to include the repayment of the Eighty Thousand Dollars ($80,000) due to Landlord. Any balance due with respect to each license for any outstanding balance, penalty, or fees will remain the responsibility of the Tenant.

|

| |

c.

|

In an effort to support Landlord’s use of the Bask Provisional Licenses, Tenant shall make available for purchase by Landlord certain furniture and equipment located in the Premises (“Personal Property”). Landlord and Tenant shall agree on the Personal Property items that Landlord intends to purchase on or before June 1, 2024. Landlord agrees to engage a third-party to provide its best estimate of the fair market value (“FMV”) of each item. Following such valuation, Landlord and Tenant agree to work in good faith to decide on a mutually agreed upon value for each item, which may or may not be the FMV assigned by the third-party. In the event the Parties are unable to agree on the FMV on any item, the third-party valuation shall become the value assigned to such item, Tenant agrees to transfer the item to the Landlord, and the Outstanding Balance shall be reduced by said value (“Personal Property Credits”). In the event any Personal Property item becomes part of a superior claim made by another creditor, Tenant agrees to execute an amendment to the Amended and Restated Promissory Note to reflect the value of the Personal Property item (as determined at the time purchased by Landlord) as an addition to the principal amount due under the Amended and Restated Promissory Note.

|

| |

d.

|

Tenant acknowledges and confirms its obligations to Landlord under the terms of a Promissory Note dated September 30, 2023, in the amount of Four Hundred Thousand Dollars ($400,000) (“Existing Promissory Note”). Tenant shall continue to pay to Landlord the amount of Eight Thousand Eight Hundred and Ninety-Seven 78/100 Dollars ($8,897.78) per month on the first day of each month as required by the terms of the Existing Promissory Note, through July, 2024.

|

| |

e.

|

On or about July 31st, 2024, or as soon as the Parties agree on the value of the Personal Property Credits, the Tenant shall execute an Amended and Restated Promissory Note in favor of Landlord with a principal balance equal to the Outstanding Balance plus the balance due on the Existing Promissory Note, reduced by the Personal Property Credits and the License Transfer Credit (the “New Principal Balance”). The Amended and Restated Promissory Note reflecting the New Principal Balance shall be repaid in twenty-four (24) equal monthly payments of principal with no interest.

|

| |

f.

|

Tenant hereby grants to Landlord a Security Interest in certain collateral, as set forth in the financing statement attached hereto as Exhibit B, as continued security for the repayment of the Amended and Restated Promissory Note, and all obligations set forth in this Agreement, and authorizes Landlord to file any financing statement, lien or other documents as Landlord may deem necessary to perfect Landlord’s security interest in the collateral, and Tenant agrees to cooperate to promptly accomplish said filings and to take reasonable steps and execute reasonable documents as may be determined by Landlord to perfect its security interest in the collateral described in the filings.

|

| |

3.

|

Tenant shall vacate and peaceably surrender the Premises on or before August 31, 2024 in an “as is, where is” condition as of the date of this Agreement. Any Personal Property item that is not to be purchased by Landlord shall be removed by Tenant prior to August 31, 2024.

|

| |

4.

|

All payments due hereunder shall be made by Tenant to Landlord by electronic funds transfer or bank check.

|

| |

5.

|

Subject to a cure period of 10 business days, Tenant agrees that its failure to comply with any or all provisions of this Agreement shall constitute an Event of Default and no further notice of default from Landlord under the terms of the Lease or this Agreement will be required, time being of the essence of all terms of this Agreement. Upon an Event of Default, Landlord shall be entitled to exercise any and all rights available to it under the Lease and/or under applicable laws.

|

| |

6.

|

For and in consideration of the full performance by Tenant of all the requirements set forth in this Agreement, the Parties mutually acknowledge and agree that on August 31, 2024 the Lease shall fully terminate, and the following Releases shall become effective:

|

| |

a.

|

Tenant herein, on behalf of itself, its Manager(s), Member(s), officers, transferees, agents, attorneys, successors and/or assigns hereby release Landlord and its respective current and former trustees, beneficiaries, principals, agents, employees, representatives, attorneys, successors and assigns, property management company its officers, directors, shareholders, employees, representatives, attorneys, affiliates, subsidiaries, and successors and assigns of and from any and all claims, demands, obligations, actions, liabilities, defenses, counterclaims or damages of every kind and nature whatsoever, in law or in equity whether known or unknown, from the beginning of time to the date hereof arising out of the Lease.

|

| |

b.

|

Landlord herein, on behalf of itself, its Manager(s), Member(s), officers, transferees, agents, attorneys, successors and/or assigns hereby release Tenant and its respective current and former trustees, beneficiaries, principals, agents, employees, representatives, attorneys, successors and assigns, property management company its officers, directors, shareholders, employees, representatives, attorneys, affiliates, subsidiaries, and successors and assigns of and from any and all claims, demands, obligations, actions, liabilities, defenses, counterclaims or damages of every kind and nature whatsoever, in law or in equity whether known or unknown, from the beginning of time to the date hereof arising out of the Lease.

|

| |

7.

|

Each and every party to this Agreement acknowledges that he or she has had a reasonable opportunity to consult with counsel of his or her choice prior to executing this Agreement and that each such party executes this Agreement voluntarily with full knowledge as to the conditions, terms, reasonableness and effect of this Agreement, and with full authority to execute same on behalf of the entity for which they have executed same.

|

| |

8.

|

Until August 31, 2024, except for the financial terms (Base Rent, Turnover Rent, Impact Fee) which have been superseded by the payments under this Agreement, Tenant and Landlord agree to remain bound by all non-financial terms of the Lease, attached hereto as Exhibit C.

|

| |

9.

|

Landlord and Tenant each warrant to the other that the person or persons executing this Agreement on its behalf has or have authority to do so and that such execution has fully obligated and bound such Party to all terms and provisions of this Agreement. The signatories for the Landlord and the Tenant set forth below represent and warrant, each to the other, that they are the duly elected and appointed representatives of Landlord and Tenant respectively, that they have by trust and corporate procedure and action obtained full power and authority to enter into this Agreement and execute the same on behalf of the respective Parties.

|

| |

10.

|

The Parties agree that, in entering into this Agreement, they are relying upon their own judgment, belief, and knowledge as to all phases of any claims and further acknowledge that no promise, inducement or agreement or any representations and warranties not expressed herein have been made to procure their agreement hereto. The Landlord and Tenant further acknowledge that they have read, understand, and fully agree to the terms of this Agreement.

|

| |

11.

|

This Agreement shall be governed by and construed under the laws of the Commonwealth of Massachusetts without regard to any conflict of law principles that would cause the application of laws of any jurisdiction other than the Commonwealth of Massachusetts. The Landlord and the Tenant, and each officer, director and member of the Landlord and the Tenant hereby submit to personal jurisdiction in the Commonwealth of Massachusetts for the enforcement of this Agreement. The Parties acknowledge that marijuana is illegal under federal law, including consumption, possession, cultivation, distribution, manufacturing and possession with the intent to distribute and federal law supersedes Massachusetts law. The Parties expressly waive any defense to enforcement of the terms or conditions of this Agreement based upon nonconformance with federal law regarding marijuana.

|

| |

12.

|

This Agreement may be executed in two or more counterparts, each of which shall have the same force and effect as the other, and all shall be considered as one and the same instrument. Delivery of an executed counterpart of a signature page to this Agreement by facsimile or portable document format (.pdf) shall be effective as delivery of a manually executed counterpart of this Agreement.

|

| |

13.

|

This Agreement shall inure to the benefit of, and shall be binding upon, the Parties hereto and their respective legal representatives, successors and assigns.

|

| |

14.

|

Landlord and Tenant hereby agree to execute such further documents or instruments as may be necessary or appropriate to carry out the intention of this Agreement.

|

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Landlord and Tenant have caused this Agreement to be signed and made effective as of the Effective Date.

|

AMERICANN, INC.

|

|

BASK, INC.

|

|

| |

|

|

|

| |

|

|

|

|

By:

|

|

|

By:

|

|

|

|

Name: Ben Barton

|

|

Name: Chapman Dickerson

|

|

|

Title: Chief Financial Officer

|

|

Title: Chief Executive Office

|

|

EXHIBIT A

May 3, 2024

Bask, Inc.

Chapman Dickerson, CEO

2 Pequod Road

Fairhaven, MA 02719

Re: Agreement to Pursue Change of Control with Cannabis Control Commission

Dear Mr. Dickerson:

This binding letter of intent (the “LOI”) will serve as a statement of mutual intent between Americann Brands, Inc. (“Buyer”) and Bask, Inc. (“Seller”), to the general terms under which Buyer will acquire ownership of the Seller’s two (2) provisional licenses for the adult-use cultivation and product manufacturing of cannabis and cannabis products (“Business”) located at 7 Campanelli Drive, Freetown, MA (the “Transaction”). This LOI shall be binding upon Buyer and Seller. Buyer and Seller are sometimes called singularly a “Party” and collectively the “Parties.”

1. General Terms. The basic terms of the Transaction are as set forth in Exhibit A attached hereto and incorporated as part of this LOI.

2. Confidentiality. The terms of this LOI and the Transaction and any Confidential Information provided by Buyer or Seller to the other in connection with the contemplation and negotiation of this LOI or the Transaction Documents, shall be kept strictly confidential by the Parties and their Representatives; provided, however, the Parties may make disclosures (i) as required by law, and in connection with any disclosures to regulatory authorities (including but not limited to the Massachusetts Cannabis Control Commission (the “CCC”) or the Town of Freetown (the “Town”), (ii) to employees, officers, members, potential investors, agents, attorneys, accountants and any other of either Party’s advisors, as required in connection with the Transaction and provided that any such Persons are required to keep such information confidential or if such disclosures need to be made, redact the identities of the Parties. The confidentiality provisions contained herein shall remain in full force and effect for twelve (12) months following the end of the Exclusivity Period (as defined below) except as otherwise may be provided for in the Transaction Documents.

For purposes of this LOI, the term (i) “Representative” shall mean a Party’s officers, directors, members, managers, employees, representatives, Affiliates, agents, professional advisors or authorized representatives, (ii) “Person” shall mean any natural person, general or limited partnership, corporation, limited liability company, limited liability partnership, firm, association or organization, trust or other legal entity, (iii) “Affiliate” shall mean, with respect to any specified Person, any other Person that, at the time of determination, directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with such specified Person, and (iv) “Confidential Information” shall mean all financial and business-related information or material, written or oral, whether or not it is marked as such, that is disclosed or made available to the receiving party, directly or indirectly, through any means of communication or observation in connection with this letter of intent or the Transaction; provided, however, that “Confidential Information” shall not include information or material that (A) is publicly available or becomes publicly available through no action or fault of the recipient party, (B) was already in the recipient party’s possession or known to the recipient party prior to being disclosed or provided to the recipient party by or on behalf of the other party, provided, that, the source of such information or material was not bound by a contractual, legal or fiduciary obligation of confidentiality to the non-disclosing party or any other party with respect thereto, (C) was or is obtained by the recipient party from a third party, provided, that, such third party was not bound by a contractual, legal or fiduciary obligation of confidentiality to the non-disclosing party or any other party with respect to such information or material, or (D) is independently developed by the recipient party without reference to the Confidential Information.

3. Expenses. Each Party will pay its own expenses with respect to the negotiation and preparation of this LOI and the negotiation, preparation and consummation of the Transaction Documents.

4. Definitive Agreements. The proposed Transaction Documents will consist of a Mutual Lease Modification Agreement, by and between Americann, Inc. (“Americann Parent”) and Seller (the “Mutual Lease Modification Agreement”), an application to CCC to effectuate the transfer of ownership and control of the Licenses (as that term is defined below), and such other documents as may be agreed upon between Buyer and Seller to effectuate the Transaction. The Mutual Lease Modification Agreement shall contain such representations, warranties and covenants from each Party as are customary in transactions of this nature. The Parties will conduct their due diligence regarding the Transaction prior to the execution of the Transaction Documents.

5. Governing Law; Venue. This LOI shall be deemed to have been made in the Commonwealth of Massachusetts and shall be governed by and interpreted in accordance with the laws of such state. Exclusive venue for any action to enforce the binding provisions of this letter of intent shall be in the Commonwealth of Massachusetts.

6. Exclusivity. From the date hereof for a period of ninety (90) days (the “Exclusivity Period”), Buyer and Seller and their respective Representatives, will not entertain, solicit or engage in any discussions with any third party in connection with the sale of the Licenses or provide any third party with any information relating to the foregoing or take any action leading to such sale; provided, however, that the Exclusivity Period may be extended upon the mutual written consent of the Parties, which consent shall not be unreasonably withheld so long as the Parties are continuing to negotiate the terms and conditions of the Transaction in good faith at the expiration of the Exclusivity Period.

7. Binding Letter of Intent. This LOI is intended to be an expression of the Parties’ respective intentions, interests, and willingness to continue to work together in good faith and to finalize the Transaction Documents consistent with the terms outlined in Exhibit A on or before August 31, 2024.

8. Prior Agreements. The Parties acknowledge that this LOI is designed to replace any prior agreements concerning the Transaction, written or oral, and that upon execution of this letter of intent, such agreements shall be of no further force or effect.

9. Cannabis Laws. The Parties acknowledge that the production, sale, manufacture, possession and use of cannabis is illegal under U.S. federal law, including the investment in a company engaging in such activities, and the Parties expressly waive any defense to the enforcement of the terms and conditions of this LOI based upon non-conformance with federal law relating to cannabis (marijuana) and the cannabis (marijuana) industry.

10 Severability. Each provision of this LOI is distinct and severable. If any provision of this LOI, in whole or in part, is or becomes illegal, invalid or unenforceable in any jurisdiction, the illegality, invalidity or unenforceability of that provision shall not affect the legality, validity or enforceability of the remaining provisions of this LOI in that or any other jurisdiction, or the legality, validity or enforceability of that provision in any other jurisdiction.

11. Counterparts and Electronic Means. This LOI may be executed in one or more counterparts, each of which shall be deemed to be an original and all of which shall together constitute one and the same instrument. Delivery of an executed copy of this LOI by email, DocuSign or other means of electronic communication capable of producing a printed copy shall be deemed to be execution and delivery of this LOI as of the date of successful transmission.

12. Amendment or Assignment. No amendment or assignment of this LOI by either Party shall be permitted without the prior written consent of the other Party.

[Signature Page Follows]

If the foregoing correctly sets forth our understanding, please execute one copy of this letter of intent as indicated below.

| |

Very truly yours, |

| |

|

| |

AMERICANN BRANDS, INC., |

| |

a Massachusetts corporation |

| |

|

| |

|

| |

|

| |

By: |

|

| |

|

Name: Benjamin Barton |

| |

|

Title: CFO |

Accepted and agreed to this 3rd day of May, 2024.

BASK, INC.,

a Massachusetts corporation

EXHIBIT A

Terms

|

BUYER

|

Americann Brands, Inc.

|

|

SELLER

|

Bask, Inc.

|

|

LICENSES

|

Those two (2) Adult-Use Provisional Licenses issued by the CCC, including (i) Provisional Cultivation License No. MCN282211 and (ii) Provisional Product Manufacturing License No. MPN281702 (collectively, the “Licenses”)

|

|

TRANSACTION

|

Buyer will purchase one hundred percent (100%) of the ownership and control the Licenses. In connection with this LOI, Americann Parent and Seller shall execute the Mutual Lease Modification Agreement and Buyer and Seller shall cooperate on the execution and filing of a change of control and ownership application with the CCC to approve the transfer of the Licenses from Seller to Buyer (the “CHOW Application” and together with the Mutual Lease Modification Agreement, the “Transaction Documents”).

|

|

DUE DILIGENCE PERIOD

|

The due diligence period will commence upon the execution of this letter of intent and continue for a period of forty-five (45) calendar days (“Due Diligence Period”).

|

|

DUE DILIGENCE MATERIALS

|

Seller and Buyer agree to provide documents and information requested by the other party as soon as possible after the signing of this letter of intent.

|

|

CLOSING

|

The closing shall occur on the first day of the month following the Commission’s approval of the Buyer’s acquisition of the Seller’s Licenses (“Commission Approval”) and satisfaction of any other closing conditions set forth in the Transaction Documents (“Closing”), unless otherwise agreed to in writing by the parties.

|

|

EXISTING INDEDBTEDNESS

|

Seller acknowledges and agrees that (i) as of March 31, 2024, Seller owes a past due balance in the sum of $623,244.39 to Americann Parent for failure to make certain monetary payments due under that certain Commercial Lease dated as of August 2, 2019, by and between Seller and Americann Parent. In addition, Seller acknowledges and confirms its obligations to Americann Parent under the terms of a Promissory Note dated September 30, 2023 in the amount of $400,000 (collectively, the “Indebtedness”).

|

|

PURCHASE PRICE

|

The purchase price shall be Eighty Thousand Dollars ($80,000.00), of which Forty Thousand Dollars ($40,000.00) shall be allocated to each of the Licenses (the “Purchase Price”).

|

|

CLOSING COVENANTS

|

Each of the Parties shall use commercially reasonable efforts to (i) obtain from any governmental body any consents, licenses, permits, waivers, clearances, approvals, authorizations or orders required to be obtained or made by Buyer or Seller in connection with the authorization, execution and delivery of this LOI and the other Transaction Documents and the consummation of the transactions contemplated herein and therein and (ii) make or cause to be made the applications or filings required to be made by Buyer or Seller or any of their respective Affiliates under or with respect to any applicable laws in connection with the authorization, execution and delivery of this Agreement and the other Transaction Documents and the consummation of the transactions contemplated herein and therein, as promptly as is reasonably practicable, including but not limited to the filings necessary to obtain the Commission Approval. Seller and Buyer shall, and shall cause their respective Affiliates and Representatives to, furnish to the other Party all information necessary for any application or filing to be made in connection with the transactions contemplated herein and therein. Seller and Buyer shall promptly inform the other of any material communication with, and any proposed understanding, undertaking or agreement with, any governmental body regarding any such application or filing.

|

|

PURCHASE PRICE PAYMENT TIMING

|

The Purchase Price shall be paid in the form of a reduction to be applied to the amount of Indebtedness then owed by Seller to Americann Parent as further set forth in the Mutual Lease Modification Agreement.

|

|

CLOSING COSTS

|

Each Party shall be responsible for its own legal and other expenses related to the Transaction.

|

|

CONTINGENCIES

|

The Closing shall be contingent upon the following:

(i) the execution of the Mutual Lease Modification Agreement;

(ii) Commission approval; and

(iii) No material breach of the Transaction Documents by either party prior to the Closing.

|

|

INDEMNIFICATION

|

Seller shall indemnify Buyer against: (i) breaches of representations, warranties and covenants of Seller and (ii) liabilities of the Seller not assumed by the Buyer. The Buyer shall indemnify Seller against breaches of representations, warranties and covenants of the Buyer.

|

|

REPRESENTATIONS, WARRANTIES AND COVENANTS

|

Seller represents, warrants, and agrees to the following in connection with the Transaction:

1. Seller is and has been in compliance in all material respects with each law, License and governmental authorization that is or was applicable to Seller or to the conduct or operation of the Business;

2. The execution, delivery and performance by Seller of this LOI and each of the Transaction Documents to which Seller is or will be a signatory has been or shall be, on or prior to its execution and delivery, duly authorized by all necessary corporate action on the part of Seller. This LOI has been, and each other Transaction Documents to which Seller is to be a party will be, upon its execution and delivery, duly executed and delivered by Seller, this LOI constitutes, and each other Transaction Agreement to which SELLER is to be a party, when so executed and delivered, will constitute legal, valid and binding obligations of Seller, enforceable against Seller in accordance with its terms;

3. To the Knowledge of Seller, no event has occurred, or circumstance exists that (with or without notice or lapse of time) may constitute or result in a material violation by Seller of, or a failure on the part of Seller to comply with, any law, License or any governmental authorization related to the operation of the Business; and

4. Buyer shall not assume any employment-related liabilities of Seller, including but not limited to liabilities for any action resulting from the Seller’s separation of employment, liabilities arising out of or relating to any employment contract, consulting contract, payroll and payroll taxes, misclassification of any Employee, liabilities for vacation, sick leave, parental leave, and other paid-time off accrued by Employees of Seller as a result of Seller entering into this LOI.

|

EXHIBIT B

Debtor's Accounts, Chattel Paper, any and all proceeds and products from Commercial Tort Claims, Deposit Accounts (other than payroll accounts), Documents, Equipment, Fixtures, Payment Intangibles and other General Intangibles, Goods, Inventory, Instruments, Investment Property, Letter of Credit Rights, and Supporting Obligations, and in all other personal property of Debtor, whether now owned or existing or hereafter arising or acquired, together with all policies and certificates of insurance, cash, deposits, imprest accounts, compensating balances, or other property owned by Debtor or in which Debtor has an interest; together with all books, records, and information relating to the foregoing and/or to the operation of Debtor's business, and all property in which such books, records, and information are stored, recorded, and maintained, all insurance proceeds, refunds and premium rebates, including, without limitation, proceeds of fire, casualty and credit insurance, whether any of such proceeds, refunds, and premium rebates arise out of any of the foregoing; any and all additions, substitutions, replacements and accessions of any of the foregoing; and all proceeds and products of any of the foregoing (collectively, the "Collateral"). Collateral shall not include any marijuana or marijuana products.

v3.24.1.u1

Document And Entity Information

|

May 03, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

AMERICANN, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 03, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-54231

|

| Entity, Tax Identification Number |

27-4336843

|

| Entity, Address, Address Line One |

1555 Blake Street, Unit 502

|

| Entity, Address, City or Town |

Denver

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

80216

|

| City Area Code |

303

|

| Local Phone Number |

862-9000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001508348

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

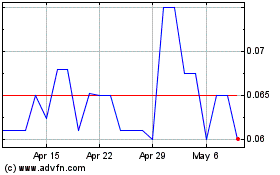

Americann (QB) (USOTC:ACAN)

Historical Stock Chart

From Apr 2024 to May 2024

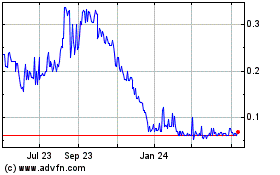

Americann (QB) (USOTC:ACAN)

Historical Stock Chart

From May 2023 to May 2024