AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $3,934,000 for the first quarter of 2013, a 63% increase

over the $2,404,000 earned in the first quarter of 2012. Earnings

per share (basic) in the first quarter of 2013 increased to $0.89

versus $0.54 in the first quarter of 2012 primarily due to a $0.31

per share increase in realized securities gains.

“The Bank saw an excellent increase in its loan totals during

the first quarter as compared to the same period last year. Also

noteworthy was a nine percent increase in its demand deposits,”

said Wes Schaefer, Vice Chairman and CFO. “Additionally, we took

advantage of some of the recent market gains in our investment

portfolio, selling a modest number of bonds to 'harvest' gains that

added to our earnings, thus increasing the Bank’s Tier 1

Capital.”

Total assets increased 9% or $108 million to $1.308 billion at

March 31, 2013 as compared to $1.200 billion at March 31, 2012. The

loan portfolio (net) increased 27% or $110 million to $516 million

at March 31, 2013 as compared to $406 million at March 31, 2012.

Deposits increased 8% or $90 million to $1.114 billion at March 31,

2013 as compared to $1.024 billion at March 31, 2012.

During the first quarter of 2013, Net Interest Income increased

$861,000 or 10% to $9,559,000 from $8,698,000 during the first

quarter of 2012.

Non-Interest income during the first quarter of 2013 increased

$1,989,000 to $2,710,000 from $721,000 during the first quarter of

2012.

Non-Interest expense during the first quarter of 2013 increased

$358,000 or 6% to $6,065,000 from $5,707,000 during the first

quarter of 2012.

Asset quality at quarter-end remains excellent, with $1,255,000

non-performing loans or 0.2% of total loans; and, no OREO. At the

end of March 2013, the allowance for loan losses stood at

$10,211,000 or 1.94% of loans.

Dividend Announcement

The Bank’s Board of Directors has authorized the payment of a

10% stock dividend to holders of record as of April 30, 2013, to be

paid on May 20, 2013. The Board felt that the Bank’s earnings and

performance over the past two years warranted rewarding our

shareholders with additional shares in the Company.

Management Changes Announcement

At its shareholder meeting today, the Bank announced that Don

Johnson, the Bank’s founding President and CEO, will step down as

CEO and Leon Blankstein, President, will assume the additional CEO

title, effective immediately. Mr. Johnson will become Vice Chairman

and will continue as a member of the Board of Directors. This

succession plan in the Bank’s management team has been in process

since 2011 when Mr. Blankstein was named President. Mr. Blankstein

said, “I am truly honored to be named the CEO of American Business

Bank and I look forward to continuing to add to the Bank’s success.

For me and my fellow Executives, having worked with Don Johnson

over the past fifteen years, we thank him for his tireless

dedication, enthusiasm and discipline.”

AMERICAN BUSINESS BANK headquartered in downtown Los Angeles

with over $1.3 billion in total assets offers a wide range of

financial services to the business marketplace. Clients include

wholesalers, manufacturers, service businesses, professionals and

non-profits. The Bank has opened four Loan Production Offices in

strategic areas including our Orange County Office in Irvine, our

South Bay Office in Torrance, our San Fernando Valley Office in the

Warner Center and our Inland Empire Office in Ontario.

American Business Bank Figures in $000, except per

share amounts

CONSOLIDATED BALANCE SHEET (unaudited)

For the period ended:

March March

Change 2013 2012 %

Assets:

Cash & Equivalents $ 44,290 $ 32,177 37.6 % Fed Funds Sold

1,000 1,000 0.0 % Interest Bearing Balances 28 28 0.0 %

Investment

Securities:

US Agencies 376,454 404,802 -7.0 % Mortgage Backed Securities

170,832 188,340 -9.3 % State & Municipals 157,424 125,886 25.1

% Other 3,124

5,323 -41.3 % Total Investment Securities

707,834 724,351 -2.3 %

Gross

Loans:

Commercial Real Estate 292,808 228,551 28.1 % Commercial &

Industrial 191,709 149,684 28.1 % Other Real Estate 36,864 31,497

17.0 % Other 5,220

5,338 -2.2 % Total Gross Loans 526,601 415,070

26.9 %

Allowance for Loan & Lease Losses

(10,211 )

(9,234 ) 10.6 % Net Loans 516,390 405,836 27.2 % Premises &

Equipment 640 1,002 -36.1 %

Other Assets

37,929

35,822 5.9 %

Total Assets

$ 1,308,111 $

1,200,216 9.0 %

Liabilities:

Demand Deposits $ 515,501 $ 472,975 9.0 % Money Market 517,871

462,837 11.9 % Time Deposits and Savings

80,345 88,370 -9.1

% Total Deposits 1,113,717 1,024,182 8.7 % FHLB Advances / Other

Borrowings 70,500 71,000 -0.7 % Other Liabilities

19,330 15,565

24.2 %

Total Liabilities

$ 1,203,547 $

1,110,747 8.4 %

Shareholders'

Equity:

Common Stock & Retained Earnings $ 94,696 $ 81,576 16.1 %

Accumulated Other Comprehensive Income

9,868 7,893 25.0 %

Total Shareholders' Equity $

104,564 $ 89,469

16.9 %

Total Liabilities & Shareholders' Equity

$ 1,308,111

$ 1,200,216 9.0 %

Capital

Adequacy:

Tangible Common Equity / Tangible Assets 7.99 % 7.45 % -- Tier 1

Leverage Ratio 7.54 % 6.99 % -- Tier 1 Capital Ratio / Risk

Weighted Assets 15.96 % 17.43 % -- Total Risk-Based Ratio 17.22 %

18.69 % --

Per Share

Information:

Common Shares Outstanding 4,433,331 4,427,862 -- Book Value Per

Share $ 23.59 $ 20.21 16.7 % Tangible Book Value Per Share $ 23.59

$ 20.21 16.7 %

American Business Bank

Figures in $000, except per share amounts

CONSOLIDATED

INCOME STATEMENT (unaudited) For the 3-month

period: March March Change

2013 2012 %

Interest

Income:

Loans & Leases $ 5,870 $ 5,450 7.7 % Investment Securities

4,215

4,017 4.9 % Total Interest Income 10,085 9,467 6.5 %

Interest

Expense:

Money Market, NOW Accounts & Savings 368 553 -33.5 % Time

Deposits 104 151 -31.1 % Repurchase Agreements / Other Borrowings

54

65 -16.9 % Total Interest Expense 526 769 -31.6 %

Net Interest Income 9,559 8,698 9.9 % Provision for Loan

Losses (300 )

(300 ) 0.0 % Net Interest Income After Provision 9,259 8,398

10.3 %

Non-Interest

Income:

Deposit Fees 270 270 0.0 % Realized Securities Gains / (Losses)

2,689 612 339.4 % Other (249 )

(161 ) 54.7 % Total Non-Interest Income 2,710

721 275.9 %

Non-Interest

Expense:

Compensation & Benefits 3,691 3,466 6.5 % Occupancy &

Equipment 510 543 -6.1 % Other 1,864

1,698 9.8 % Total

Non-Interest Expense 6,065 5,707 6.3 % Pre-Tax Income

5,904 3,412 73.0 % Provision for Income Tax

(1,970 ) (1,008 ) 95.4 %

Net Income $ 3,934

$ 2,404 63.6 %

Per Share

Information:

Average Shares Outstanding (for the year) 4,433,331 4,427,862 --

Earnings Per Share - Basic $ 0.89 $ 0.54 63.4 %

American Business Bank Figures in $000, except per

share amounts

March March Change

2013 2012 %

Performance

Ratios

Return on Average Assets (ROAA) 1.23 % 0.81 % -- Return on Average

Equity (ROAE) 15.06 % 10.85 % --

Asset Quality

Overview

Non-Performing Loans $ 322 $ 2,239 -85.6 % Loans 90+Days Past Due

933

0 NA Total Non-Performing Loans $ 1,255

$ 2,239 -43.9 % Restructured Loans (TDR's) $ 6,472 $ 134

4729.9 % Other Real Estate Owned 0 0 -- ALLL / Gross

Loans 1.94 % 2.22 % -- ALLL / Non-Performing Loans * 813.63 %

412.42 % -- Non-Performing Loans / Total Loans *

0.24

% 0.54 % -- Non-Performing Assets / Total Assets * 0.10 % 0.19 % --

Net Charge-Offs $ 629 $ - -- Net Charge-Offs / Average Gross Loans

0.12 % 0.00 % --

* Excludes Restructured Loans

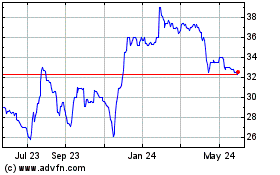

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

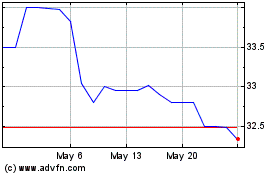

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025