AMERICAN BUSINESS BANK Announces Its Results for the Second Quarter Ended June 30th 2012, Including 7% Loan Growth, 14% Depos...

July 16 2012 - 4:57PM

Business Wire

AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $2,663,000 for the second quarter of 2012, a 5.8%

increase over the $2,516,000 earned in the second quarter of 2011.

Earnings per share (EPS) in the second quarter of 2012 increased to

$0.60 versus $0.57 in the second quarter of 2011. Shares

outstanding as of June 30, 2012 totaled 4,430,302.

“Our marketing effort continues to be robust and we have been

able to add several new relationship managers to our team, which

will insure our forward momentum,” said Leon Blankstein,

President.

“We continue to produce double-digit returns on equity, which is

exceptional considering both this low interest rate environment and

slow economy,” said Bob Schack, Chairman of the Bank.

"The Bank’s deposit growth has been outstanding," added Wes

Schaefer, Vice Chairman. “Our deposits are driven through the

excellent efforts put forth by our Relationship Manager staff with

the support of a knowledgeable cadre of customer service

specialists.”

Assets and Liabilities

Total assets increased 11% or $128 million to $1.236 billion at

June 30, 2012 as compared to $1.108 billion at June 30, 2011. Loans

increased 7% or $28 million to $426 million at June 30, 2012 as

compared to $398 million at June 30, 2011 while investments and

federal funds sold increased $87 million. Funding the asset growth

was a 14% or $130 million increase in deposits.

Interest Income

During the second quarter of 2012, Net Interest Income rose

$288,000 or 3% to $8,999,000 from $8,771,000 during the same period

in 2011.

Non-Interest Income

Non-Interest Income for the second quarter in 2012 rose $61,000

or 6% to $1,083,000 from $1,022,000 during the second quarter of

2011.

Credit Quality

Asset quality at quarter-end remains excellent, with nominal

past dues and no OREO loans. At the end of June of 2012, the

allowance for loan losses stood at $9,542,000 or 2.19% of

loans.

AMERICAN BUSINESS BANK headquartered in downtown Los Angeles

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

AMERICAN BUSINESS BANK

BALANCE SHEET ( Unaudited - 000's omitted)

June

2012 2011 Assets

Investment Securities $ 719,889 $ 636,881 Federal Funds Sold 4,000

- Loans and Leases (net) 425,694 397,567

Cash, Checks in process of collection, Due

From Banks

47,356 37,529 Premises, Equipment and Other Assets 39,670

36,352

Total Assets $ 1,236,609

$ 1,108,329 Liabilities and Shareholders'

Equity Demand Deposits 494,870 387,674 Money Market and

NOW Deposits 488,136 453,884 Savings and Time Deposits

87,259 98,500 Total Deposits 1,070,265 940,058 FHLB

Advances/ Borrowings 52,000 80,200 Other Liabilities 18,333 11,350

Shareholders' Equity 96,011 76,721

Total Liabilities and Shareholders'

Equity

$ 1,236,609 $ 1,108,329

AMERICAN BUSINESS BANK INCOME STATEMENT (

Unaudited - 000's omitted) Three months ended

June 2012

2011 Interest Income Loans and Leases $ 5,474

$ 5,554 Investment Securities 4,251 4,061

Total Interest Income 9,725 9,615

Interest

Expense Money Market and NOW Accounts 510 624 Savings and Time

Deposits 141 193 Repurchase Agreements/ Other Borrowings 75

87 Total Interest Expense 726 904 Net

Interest Income 8,999 8,711 Provision for Loan Losses

(300 ) (582 )

Net Interest Income After Provision for

Loan Losses

8,699 8,129

Other Income 1,083 1,022

Operating Expenses 5,714 5,727

Operating Income 4,068 3,424

Income

Taxes (1,405 ) (908 )

Net Earnings

$ 2,663 $ 2,516 Selected

Ratios: Earnings per Share $ 0.60 $ 0.57 Tier 1 Capital Ratio

7.11 % 6.95 % Net Interest Margin (Prior to tax effects) 3.15 %

3.46 % Return on Beginning Equity 11.72 % 13.41 % Return on Average

Assets 0.85 % 0.90 % Efficiency Ratio 56.0 % 59.5 %

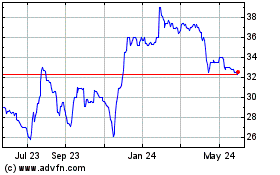

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

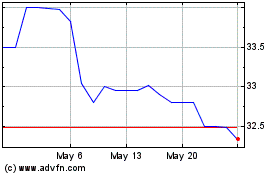

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025