American Bus. Bank Announces Its Results for the Third Quarter Ended September 30th 2011, Including 7% Loan Growth, 13% Depos...

October 17 2011 - 7:46PM

Business Wire

AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $3,246,000 for the third quarter of 2011, a 39% increase

over the $2,320,000 earned in the third quarter of 2010. Earnings

per share (EPS) in the third quarter of 2011 increased to $0.73

versus $0.53 in the third quarter of 2010. Shares outstanding at

the end of the quarter totaled 4,427,620.

“The Bank had a very successful third quarter this year. We

continued to add new clients and we kept our costs in line. The

result was an outstanding increase in earnings over 2010 levels,”

said Wes Schaefer, Vice Chairman of the Bank.

“We have had great momentum this year and we look forward to

finishing the year with a solid balance sheet, a growing list of

quality customers that are in our niche market and an excellent

staff that continues to service our customer base in the

outstanding fashion that they are used to,” said Don Johnson, CEO

of the Bank.

Additionally, the Board of Directors announced that Leon

Blankstein, 52, Executive Vice President of the Bank, was appointed

to the position of President of American Business Bank. Mr.

Blankstein, one of the five founding Executive Officers, will also

join the Board of Directors. Don Johnson continues as Chief

Executive Officer of the Bank.

Assets and Liabilities

Total assets increased 16% or $153 million to $1.140 billion at

September 30, 2011 as compared to $987 million at September 30,

2010. Loans increased 7% or $26 million to $398 million at

September 30, 2011 as compared to $372 million at September 30,

2010 while investments and federal funds sold increased $121

million. Funding the asset growth was a 13% or $119 million

increase in deposits.

Interest Income

During the third quarter, Net Interest Income rose by $922,000

or 12% over the same period in 2010.

Non-interest Income

Non-interest income in the third quarter of 2011 increased to

$2,049,000 from $759,000 in the third quarter of 2010.

Credit Quality

Asset quality at quarter-end remains excellent, with nominal

past dues and no OREO loans. At the end of September of 2011, the

allowance for loan losses stood at $8.4 million or 2.06% of

loans.

AMERICAN BUSINESS BANK headquartered in downtown Los Angeles

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

AMERICAN BUSINESS BANK

BALANCE SHEET

(Unaudited - 000's omitted)

September

2011 2010

Assets Investment Securities $ 669,943 $ 548,278 Federal

Funds Sold - 1,000 Loans and Leases (net) 397,869 372,391

Cash, Checks in process of collection,

Due From Banks

37,507 32,719 Premises, Equipment and Other Assets 34,925

33,199

Total Assets $ 1,140,244

$ 987,587 Liabilities and Shareholders'

Equity Demand Deposits 427,856 333,319 Money Market and NOW

Deposits 479,488 459,684 Savings and Time Deposits 102,215

97,937 Total Deposits 1,009,559 890,940

FHLB Advances/Borrowings

33,300 15,800 Other Liabilities 14,141 11,132 Shareholders' Equity

83,244 69,715

Total Liabilities and

Shareholders' Equity $ 1,140,244 $

987,587 AMERICAN BUSINESS BANK INCOME

STATEMENT

(Unaudited - 000's omitted)

Three months ended September

2011

2010 Interest Income Loans and Leases $ 5,496

$ 5,382 Investment Securities 4,048 3,444 Federal Funds Sold

- 9 Total Interest Income 9,544 8,835

Interest Expense Money Market and NOW Accounts 613 739

Savings and Time Deposits 222 259 Repurchase Agreements/ Other

Borrowings 67 117 Total Interest

Expense 902 1,115 Net Interest Income 8,642 7,720 Provision

for Loan Losses (375 ) (490 ) Net Interest Income

After Provision for Loan Losses 8,267 7,230

Other

Income 2,049 759

Other Expense 5,685

5,173

Operating Income 4,631

2,816

Income Taxes (1,385 ) (496 )

Net Earnings $ 3,246 $

2,320 Selected Ratios: Earnings per Share $

0.73 $ 0.53 Tier 1 Capital Ratio 7.03 % 6.71 %

Net Interest Margin

(Prior to tax effects)

3.45 % 3.51 % Return on Beginning Equity 16.25 % 13.74 % Return on

Average Assets 1.01 % 0.91 % Efficiency Ratio 55.0 % 62.7 %

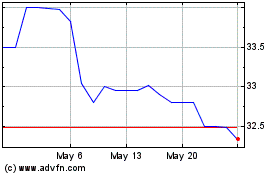

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025