0001442999

false

0001442999

2023-09-08

2023-09-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September

8, 2023

Alterola Biotech, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

333-156091 |

82-1317032 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

47 Hamilton Square Birkenhead Merseyside United

Kingdom |

CH41 5AR |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: +44 151 601

9477

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 1 - REGISTRANT'S BUSINESS AND OPERATIONS

ITEM 1.01 - ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

As previously reported, on December 2, 2021,

Alterola Biotech Inc. (the “Company”), closed an Asset Purchase Agreement (the “Purchase Agreement”) with C2 Wellness

Corp., a Wyoming corporation, and Dr. G. Sridhar Prasad (together, the “Seller”).

On the Closing Date, pursuant to the Purchase

Agreement, the Company acquired certain IP assets (the “Assets”) from Seller, which include:

|

• |

Novel cannabinoid molecules and their associated intellectual property; |

| |

• |

Novel cannabinoid pro-drugs, and their associated intellectual property; |

| |

• |

Novel proprietary cannabinoid formulations, designed to target lymphatic delivery, and their associated intellectual property; |

| |

• |

Novel proprietary nano-encapsulated cannabinoid formulations, in self dissolving polymers, and their associated intellectual property; and |

| |

• |

Cannabinoids and cannabinoid pro-drug formulations for topical ocular delivery, and their associated intellectual property. |

In exchange for the Assets, the Company issued to Seller twenty

four million (24,000,000) shares of common stock.

On September 8, 2023, the Company and Seller entered into an Agreement

to Return Assets and Shares, such that the Company transferred the Assets back to the Seller and the Seller paid 30,019,493 shares of

ABTI common stock to the Company.

The foregoing description of the Agreement

to Return Assets and Shares does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full

text of the Agreement to Return Assets and Shares, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

SECTION 9 – Financial

Statements and Exhibits

Item 9.01 Financial

Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Alterola Biotech, Inc.

/s/ David Hitchcock

David Hitchcock

Chief Executive Officer

Date: September 19, 2023

AGREEMENT TO RETURN ASSETS AND SHARES

THIS AGREEMENT

is made and entered into on this 8th day of September 2023.

BETWEEN:

1.

Alterola Biotech, Inc. (hereinafter

referred to as "Alterola"), a Nevada corporation, with its principal place of business located at 47 Hamilton Square, Birkenhead,

Merseyside, United Kingdom, CH41 SAR.

AND

2.

C2 Wellness Corporation, a

Wyoming registered company (hereinafter referred to as "C2"), with

its registered office at an address to be supplied.

RECITALS:

WHEREAS, in November

2021, Alterola and C2 entered into an Asset Purchase Agreement whereby Alterola acquired certain assets from C2;

WHEREAS the Parties now wish to return the

assets and shares as outlined in this Agreement;

WHEREAS, both Parties are optimistic

about the potential for future collaboration and express a mutual desire to maintain a cooperative relationship moving forward;

NOW, THEREFORE,

in consideration of the mutual covenants and promises contained herein and other good and valuable consideration, the receipt and sufficiency

of which is hereby acknowledged, the Parties hereto agree as follows:

1.

Return of Shares: C2 agrees to ensure the return of shares as outlined

in Exhibit A attached hereto within 21 days from the date of this Agreement.

2.

Return of Assets: Alterola agrees to transfer the assets to C2 as outlined in Exhibit B of this Agreement

within 21 days from the date of this Agreement. Alterola acknowledges and agrees that it shall not infringe upon the proprietary ownership

rights of C2 in respect of these specific assets.

3.

Governing Law: This Agreement shall be governed by and construed in accordance

with the laws of the State of New York.

4.

Dispute Resolution: The Parties agree to first attempt to resolve any disputes through mediation.

If mediation is unsuccessful, the Parties agree to refer the dispute to the American Arbitration Association ("AAA") for resolution.

5. Costs:

Each Party shall bear its own costs associated with the implementation of this Agreement.

6.

No Waiver: The failure of either Party to exercise any of its rights under this Agreement for a breach

thereof shall not be deemed to be a waiver of such rights, and no waiver by either Party, whether written or oral, express or implied,

of any rights under or arising from this Agreement shall be binding on any subsequent occasion; and no concession by either Party shall

be treated as an implied modification of the Agreement unless specifically agreed in writing.

7.

Acknowledgment: The Parties acknowledge that they do not foresee any issues arising from this Agreement

and express their gratitude to each other for the amicable resolution. They further express hopefulness for the potential of beneficial

cooperation in the future.

| 8. | Entire Agreement: This Agreement contains the entire agreement between

the Parties and supersedes all prior negotiations, understandings, and agreements between the Parties. |

| 9. | Amendments: No amendment or modification of this Agreement shall be valid

unless in writing and signed by both Parties. |

IN WITNESS

WHEREOF, the Parties hereto have executed this Agreement as of the date first above written.

ALTEROLA BIOTECH, INC.

By:

/s/ Timothy Rogers

Name:

Timothy Rogers

Title: Executive

Chairman

Date: September 8, 2023

C2 WELLNESS CORPORATION

By: /s/

Philip R.H. Connor III

Name: Philip R.H.

Connor Ill

Title: Executive Vice President

Date: September 8, 2023

EXHIBIT

A

Shares to be Returned to Alterola Biotech, Inc.:

| # |

NAME OF HOLDER |

ISSUANCE

DATE |

CERTIFICATE

NUMBER |

NUMBER OF

SHARES |

| |

C2 HOLDINGS LLC |

7/11/2022 |

CERTIFICATE 700166 |

1,903,003 |

| |

(ROGER BENDELAC) |

|

|

|

| 2 |

THOMAS CAPELLINI |

5/25/2022 |

CERTIFICATE 700127 |

1,530,000 |

| 3 |

HEMLOCK HOLDINGS LLC |

5/24/2022 |

CERTIFICATE 500221 |

2,331,490 |

| |

(PHILIP R.H. CONNOR) |

|

|

|

| 4 |

G. SRIDHAR PRASAD |

5/22/2022 |

CERTIFICATE 700142 |

12,000,000 |

| 5 |

REB CONSULTANCY LLC |

5/24/2022 |

CERTIFICATE 700122 |

12,000,000 |

| |

(ROGER BENDELAC) |

|

|

|

| 6 |

WHITNEY CONNOR |

5/22/2022 |

CERTIFICATE 700151 |

127,500 |

| 7 |

WHITNEY CONNOR |

7/5/2022 |

CERTIFICATE 700132 |

127,500 |

| TOTAL NUMBER OF SHARES RETURNING TO TREASURY |

30,019,493 |

EXHIBIT

B

Assets to be Returned to C2:

| 1. | Novel cannabinoid molecules and their associated intellectual property; |

| 2. | Novel cannabinoid pro-drugs, and their associated intellectual property; |

| 3. | Novel proprietary cannabinoid formulations, designed to target lymphatic

delivery, and their associated intellectual property; |

| 4. | Novel proprietary nano-formulations and their associated intellectual property. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

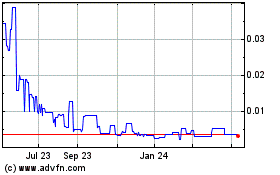

Alterola Biotech (PK) (USOTC:ABTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

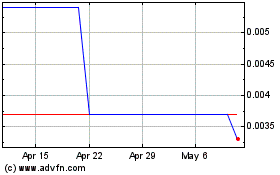

Alterola Biotech (PK) (USOTC:ABTI)

Historical Stock Chart

From Dec 2023 to Dec 2024