Current Report Filing (8-k)

April 29 2021 - 4:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 23, 2021

Altair International

Corp.

(Exact name of registrant as specified in its charter)

|

Nevada

|

333-190235

|

99-0385465

|

|

(State of other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

322 North Shore Drive

|

|

|

|

Building 1B, Suite 200

|

|

|

|

Pittsburgh, PA

|

|

15212

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (412) 770-3140

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

ATAO

|

|

OTC:Pink

|

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive

Agreement.

On April 23, 2021, the registrant

("Altair International") issued to EROP Enterprises LLC a convertible promissory note (the “Note”) in the principal

amount of $400,000 bearing annual interest at 8% and due in 12 months from the date of the Note. The Company used $304,268 of the Note

to repay the three prior secured promissory notes and accrued interest under those notes issued by Altair International to EROP Enterprises

LLC dated March 8, 2021, February 2, 2021 and December 29, 2020 that were secured by the Walker Ridge claims and project that Altair International

purchased under a Mining Lease dated August 14, 2020 between Altair International and Oliver Geoservices LLC involving Altair International’s

right to mine certain property in Nevada for a period of five years that can be extended for an additional twenty years if a certain extension

payment are made within the term of the lease as more fully described in the Form 8-K filed August 18, 2020 by Altair International. The

conversion price under the Note will be the lesser of $.25 or 80% of the lowest closing bid over the prior five trading days prior to

conversion. The foregoing description of the Note does not purport to be complete and is qualified in its entirety by reference to the

Note which is filed as Exhibits 10.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

Date: April 29, 2021

|

Altair International Corp.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leonard Lovallo

|

|

|

|

Leonard Lovallo

|

|

|

|

President and CEO

|

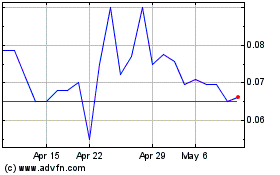

Altair (QB) (USOTC:ATAO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Altair (QB) (USOTC:ATAO)

Historical Stock Chart

From Dec 2023 to Dec 2024