Logitech Upgraded to Neutral - Analyst Blog

April 04 2013 - 8:40AM

Zacks

On Apr 4, we upgraded our recommendation on Logitech

International SA (LOGI) to Neutral from Underperform. Our new

investment thesis is supported by a Zacks Rank #3 (Hold) for the

stock. However, we remain disappointed with the company’s weak

third quarter fiscal 2013 results and are also concerned about the

low demand for Logitech products in the EMEA (Europe, Middle East

and Africa) division.

Furthermore, Logitech operates in a highly competitive market,

wherein smaller, mobile computing devices, such as, tablets and

smartphones with touch interfaces are increasingly gaining in

popularity, while demand for desktop PCs is declining. These

factors have been continuously affecting both the top- and

bottom-line of the company over the past four to five quarters.

Why the Upgrade?

Recently, Logitech launched a number of new and innovative

products. The new tablet accessories and gaming accessories are

expected to benefit the company in the long run. Given the current

trend towards smart phones and tablets, Logitech intends to tap

this high potential market through its range of accessories. In the

last reported quarter (3Q13), tablet accessories was also the

best-performing retail product category, with sales increasing a

robust 119.2% year over year to $39.4 million.

In addition, the company’s cost-cutting initiatives are expected

to benefit Logitech, saving approximately $12 million to $14

million in the fourth quarter of fiscal 2013. These savings will be

primarily induced from employee retrenchments of 140 employees, or

5% of its workforce as part of its cost cutting measure.

Moreover, the company is discontinuing with its non-profitable

products and businesses. The company divested its remote control

and digital video security categories with further plans to

discontinue other non-profitable products, such as speaker docks

and console gaming peripherals by the end of 2013.

Stocks That Warrant a Look

While we expect Logitech to perform in line with its peers and

industry levels in the coming months and advice investors to wait

for a better entry point before accumulating shares, we are bullish

for Synaptics Inc. (SYNA) carrying a Zacks Rank #1(Strong Buy).

Other companies like Alps Electric Co. Ltd. (APELY) and Analogic

Corporation (ALOG) also have good buying opportunities. These

computer and peripheral equipment companies with a Zacks Rank #2

(Buy) have the potential to rise significantly from the current

levels.

ANALOGIC CORP (ALOG): Free Stock Analysis Report

ALPS ELECTRIC (APELY): Get Free Report

LOGITECH INTL (LOGI): Free Stock Analysis Report

SYNAPTICS INC (SYNA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

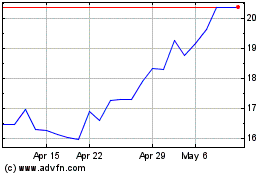

Alps Alpine (PK) (USOTC:APELY)

Historical Stock Chart

From Jun 2024 to Jul 2024

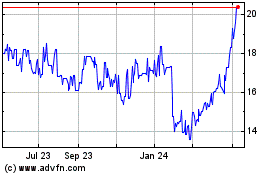

Alps Alpine (PK) (USOTC:APELY)

Historical Stock Chart

From Jul 2023 to Jul 2024