CTS Upgraded to Strong Buy - Analyst Blog

October 09 2013 - 4:05PM

Zacks

On Oct 8, Zacks Investment Research upgraded CTS

Corporation (CTS) to a Zacks Rank #1 (Strong Buy).

Why the Upgrade?

The upgrade was primarily based on CTS’s recent restructuring

process combined with the company’s strategy to dissolve its

non-performing entities like the Electronics Manufacturing

Solutions (EMS) business. CTS’s shares reached a new 52-week high

of $15.74 on Sep 27, reflecting a 53.82% increase in a year. The

company delivered positive earnings surprises in two of the last 4

quarters with an average beat of 4.79%.

In Jun 2013, CTS had announced its restructuring plan to

consolidate its manufacturing facilities to fewer locations with an

aim to improve company’s cost structure and capacity utilization.

This will help the company easily manage and better concentrate on

its manufacturing facilities while allowing for sufficient growth

capacity.

In the second quarter of fiscal 2013, the company saved about $2

million pretax through these actions. The company expects to save

about $10 million annually after the complete implementation of the

plan in 2014.

CTS reported fiscal second-quarter 2013 results on Jul 22.

Revenues were up 1% sequentially. Though the weak performance of

the EMS business led to reduced 2013 sales guidance of 6%-8%, the

company’s earning guidance remained unchanged.

CTS’s announcement on Oct 3 to sell its EMS business is a

positive and is expected to increase the company’s financial

flexibility leading to increased growth opportunities for the

company.

The Zacks Consensus Estimate for fiscal 2013 has increased 2.9%

to 79 cents per share as some estimates were revised higher over

the last 90 days. The current estimate is within the guidance range

provided by CTS Corporation.

Other Stocks to Consider

Investors can also consider other stocks that are doing well

right now. These include Fabrinet (FN),

Nidec Corp. (NJ) and AAC Technologies

Holdings Inc. (AACAY). While Fabrinet and Nidec

Corporation carry a Zacks Rank #1 (Strong Buy), AAC Technologies

has a Zacks Rank #2 (Buy).

AAC TECH HLDGS (AACAY): Get Free Report

CTS CORP (CTS): Get Free Report

FABRINET (FN): Free Stock Analysis Report

NIDEC CORP-ADR (NJ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

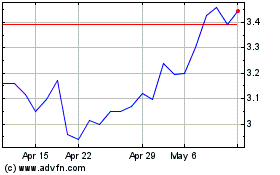

AAC Technologies (PK) (USOTC:AACAY)

Historical Stock Chart

From Feb 2025 to Mar 2025

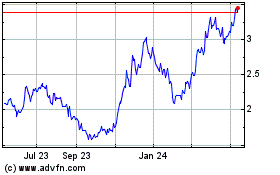

AAC Technologies (PK) (USOTC:AACAY)

Historical Stock Chart

From Mar 2024 to Mar 2025