UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

x

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September

30, 2015

or

¨ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______to______.

3Power Energy Group, Inc.

(Exact name of registrant as specified in

its charter)

| Nevada |

|

333-103647 |

|

98-0393197 |

| (State or other jurisdiction of incorporation or |

|

(Commission File Number) |

|

(I.R.S. Employee Identification No.) |

| organization) |

|

|

|

|

PO Box 50006

Sh. Rashid Building

Sh. Zayed Road

Dubai, United Arab Emirates

(Address of principal executive office,

Zip Code)

011 97 14 3210312

(Registrant’s telephone number, including

area code)

Not Applicable.

(Former name, former address and former

fiscal year, if changed since last report)

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files).

Yes x No

¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the

definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ¨ |

Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company x |

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No

x

Indicate the number of shares outstanding of each of the issuer’s

classes of common equity: As of November 14, 2015, 249,949,923 shares of Common Stock,

par value $0.0001 per share are issued and outstanding.

3POWER ENERGY GROUP, INC.

QUARTERLY REPORT ON FORM 10-Q

September 30, 2015

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

The following cautionary statements identify

important factors that could cause our actual results to differ materially from those projected in forward-looking statements made

in this Quarterly Report on Form 10-Q (this “Report”) and in other reports and documents published by us from time

to time. Any statements about our beliefs, plans, objectives, expectations, assumptions, future events or performance are not historical

facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as

“believes,” “will likely result,” “are expected to,” “will continue,” “is

anticipated,” “estimated,” “intend,” “plan,” “projection,” “outlook”

and the like, constitute “forward-looking statements” . Such forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results, performance or achievements of our Company to be materially

different from any future results, performance or achievements expressed or implied by such forward-looking statements. Given these

uncertainties, readers are cautioned to carefully read all “Risk Factors” set forth under Item 1A under the Company’s

Annual Report on Form 10-K and not to place undue reliance on any forward-looking statements. We disclaim any obligation to update

any such factors or to announce publicly the results of any revisions of the forward-looking statements contained or incorporated

by reference herein to reflect future events or developments, except as required by the Exchange Act. New factors emerge from time

to time, and it is not possible for us to predict which will arise or to assess with any precision the impact of each factor on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statements.

Unless otherwise provided in this Report,

references to the “Company,” the “Registrant,” the “Issuer,” “we,” “us,”

and “our” refer to 3Power Energy Group Inc. and its subsidiaries.

PART I: FINANCIAL INFORMATION

Item 1. Financial

Statements

3POWER ENERGY GROUP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

September 30, | | |

March 31, | |

| | |

2015 | | |

2015 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,779 | | |

$ | 1,585 | |

| Prepaid and other current assets | |

| 42,797 | | |

| 8,172 | |

| Total current assets | |

| 45,576 | | |

| 9,757 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 39,101 | | |

| - | |

| | |

| | | |

| | |

| Total assets | |

$ | 84,677 | | |

$ | 9,757 | |

| | |

| | | |

| | |

| LIABILITIES AND DEFICIT | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 5,391,653 | | |

$ | 5,165,759 | |

| Accrued interest | |

| 683,095 | | |

| 602,747 | |

| Notes payable | |

| 527,152 | | |

| 509,950 | |

| Due to related parties | |

| 559,909 | | |

| 168,404 | |

| Total current liabilities | |

| 7,161,809 | | |

| 6,446,860 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Deficit | |

| | | |

| | |

| Common stock,$0.0001 par value, 300,000,000 shares authorized, 249,949,923 shares issued and outstanding as of September 30, 2015 and March 31, 2015 | |

| 24,995 | | |

| 24,995 | |

| Additional paid in capital | |

| 11,468,714 | | |

| 11,468,714 | |

| Other comprehensive income | |

| 5,656 | | |

| 45,878 | |

| Accumulated deficit | |

| (18,333,451 | ) | |

| (17,774,305 | ) |

| Total deficit attributable to 3Power Energy Group, Inc. | |

| (6,834,086 | ) | |

| (6,234,718 | ) |

| Non-controlling interest | |

| (243,046 | ) | |

| (202,385 | ) |

| Total deficit | |

| (7,077,132 | ) | |

| (6,437,103 | ) |

| | |

| | | |

| | |

| Total liabilities and deficit | |

$ | 84,677 | | |

$ | 9,757 | |

See the accompanying notes to these unaudited condensed consolidated financial statements

3POWER ENERGY GROUP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

| | |

Three months ended September 30, | | |

Six months ended September 30, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

$ | 223,926 | | |

$ | 289,757 | | |

$ | 500,223 | | |

$ | 493,836 | |

| Depreciation | |

| 1,018 | | |

| - | | |

| 1,758 | | |

| - | |

| Total operating expenses | |

| 224,944 | | |

| 289,757 | | |

| 501,981 | | |

| 493,836 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (224,944 | ) | |

| (289,757 | ) | |

| (501,981 | ) | |

| (493,836 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (42,015 | ) | |

| (39,389 | ) | |

| (80,624 | ) | |

| (77,354 | ) |

| Foreign currency transaction loss | |

| (5,734 | ) | |

| - | | |

| (17,202 | ) | |

| - | |

| Total other expenses | |

| (47,749 | ) | |

| (39,389 | ) | |

| (97,826 | ) | |

| (77,354 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before income taxes | |

| (272,693 | ) | |

| (329,146 | ) | |

| (599,807 | ) | |

| (571,190 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (272,693 | ) | |

| (329,146 | ) | |

| (599,807 | ) | |

| (571,190 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to Non-controlling interest | |

| 9,726 | | |

| - | | |

| 40,661 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS ATTRIBUTABLE TO 3POWER ENERGY GROUP, INC. | |

$ | (262,967 | ) | |

$ | (329,146 | ) | |

$ | (559,146 | ) | |

$ | (571,190 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per common share (basic and diluted): | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares outstanding (basic and diluted) | |

| 249,949,923 | | |

| 223,892,947 | | |

| 249,949,923 | | |

| 214,338,490 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss: | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (272,693 | ) | |

$ | (329,146 | ) | |

$ | (599,807 | ) | |

$ | (571,190 | ) |

| Foreign currency translation (loss) income | |

| 67,402 | | |

| 96,167 | | |

| (40,222 | ) | |

| 48,510 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss: | |

| (205,291 | ) | |

| (232,979 | ) | |

| (640,029 | ) | |

| (522,680 | ) |

| Comprehensive loss attributable to non-controlling interest | |

| 9,726 | | |

| - | | |

| 40,661 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss attributable to 3Power Energy Group, Inc. | |

$ | (195,565 | ) | |

$ | (232,979 | ) | |

$ | (599,368 | ) | |

$ | (522,680 | ) |

See the accompanying notes to these unaudited condensed consolidated financial statements

3POWER ENERGY GROUP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| | |

Six months ended September 30, | |

| | |

2015 | | |

2014 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (599,807 | ) | |

$ | (571,190 | ) |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | |

| | | |

| | |

| Depreciation | |

| 1,758 | | |

| - | |

| Foreign currency transaction loss | |

| 17,202 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Advances from related party | |

| 391,505 | | |

| 622,083 | |

| Prepaid and other current assets | |

| (34,625 | ) | |

| 884 | |

| Accounts payable and accrued expenses | |

| 185,672 | | |

| (129,131 | ) |

| Accrued interest | |

| 80,348 | | |

| 77,354 | |

| Net cash provided by operating activities: | |

| 42,053 | | |

| - | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of equipment | |

| (40,859 | ) | |

| - | |

| Net cash used in investing activities | |

| (40,859 | ) | |

| - | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| - | | |

| - | |

| | |

| | | |

| | |

| Effect of foreign currency rate change on cash | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net increase in cash and cash equivalents | |

| 1,194 | | |

| - | |

| | |

| | | |

| | |

| Cash and cash equivalents-beginning of period | |

| 1,585 | | |

| 1,725 | |

| Cash and cash equivalents-end of period | |

$ | 2,779 | | |

$ | 1,725 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information: | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | - | | |

$ | - | |

| Income taxes | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Non cash investing and financing activities: | |

| | | |

| | |

| Common stock issued in settlement of related party payable | |

$ | - | | |

$ | 742,053 | |

See the accompanying notes to these unaudited condensed consolidated financial statements

3POWER ENERGY GROUP, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

NOTE 1 — ORGANIZATION AND BUSINESS

3Power Energy Group, Inc. (the “Company”)

was incorporated in the State of Nevada on December 18, 2002 under the name ATM Financial Corp. On April 1, 2008, the Company changed

its name from ATM Financial Corp. to Prime Sun Power Inc. On March 30, 2011, the Company changed its name from Prime

Sun Power Inc. to 3Power Energy Group, Inc. and increased its authorized share capital to 300,000,000 shares. The Company

is in the business of producing renewable generated electrical power and other alternative energies.

The Company's primary effort is to sell

electricity generated by solar, wind, hydro, biomass and other renewable energy resources and to develop, build and operate power

plants based on these technologies. The core approach of the Company's business is to deliver energy in markets where there is

an inherent energy gap between supply and demand or where there exists long term, stable, government back by financial support

for development of renewable energy.

On May 13, 2011, pursuant to a Stock Purchase

Agreement (the “Stock Purchase Agreement”), the Company consummated a reverse merger (“Merger”) with Seawind

Energy Limited (“Seawind Energy”), Seawind Services Limited (“Seawind Services”, and together with Seawind

Energy, the “Seawind”) and the shareholders of Seawind Energy (the “Seawind Group Shareholders” and together

with the Company, and the Seawind Companies, the “Parties”). The Seawind Companies were formed under the laws of the

United Kingdom.

In connection with the Merger, the Company

issued 40,000,000 restricted shares of the Company’s common stock to the Seawind Group Shareholders (such acquisition

is referred to herein as the “Seawind Acquisition”).

Upon completion of the Stock Purchase Agreement,

Seawind became 3Power Group, Inc.'s wholly-owned subsidiary. For accounting purposes, the acquisition has been treated as a recapitalization

of Seawind with Seawind as the acquirer (reverse acquisition). The historical financial statements prior to May 13, 2011 are those

of Seawind Energy. The Merger was accounted for as a “reverse merger”, since the stockholders of Seawind owned a majority

of the Company’s common stock immediately following the transaction and their management has assumed operational, management

and governance control.

The transaction was accounted for as a

recapitalization of Seawind pursuant to which Seawind was treated as the surviving and continuing entity. The Company

did not recognize goodwill or any intangible assets in connection with this transaction. Accordingly, the Company’s

historical financial statements are those of Seawind immediately following the consummation of the reverse merger. The accompanying

consolidated financial statements give retroactive effect to the recapitalization.

In anticipation of the closing of the Stock

Purchase Agreement, the Company changed its name to 3Power Energy Group Inc. and increased its authorized share capital to 300,000,000

shares.

On July 4, 2011, the Seawind Energy Limited

and Seawind Service Limited changed their name to 3Power Energy Limited and 3Power Project Service Limited, respectively.

Acquisition of Shala Energy sh .p .k:

On June 5, 2012, the Company and Shala

Energy sh.p.k ("Shala") executed a master acquisition agreement (the “Acquisition Agreement”) where Shala

agreed to transfer and the Company agreed to acquire 75% of the equity of Shala. Under the Acquisition Agreement (the “Acquisition”),

the closing of the acquisition was subject to the Company’s completion and satisfaction of the due diligence on Shala and

Shala’s partners with respect to their shares in Shala and upon the Company’s payment of the first year premium for

the insurance bond premium issued in favor of the Ministry of Economy, Trade and Energy of Republic of Albania in replacement of

the then existing bank guarantee issued in favor of Ministry of Economy, Trade and Energy of Republic of Albania for the Shala

River Concession Agreement, in the amount of 7,230,315 Euro (the “Required Insurance Bond Premium”). Shala is a firm

specializing in developing hydro-electric projects, owning and operating sustainable energy projects in the hydro, wind and solar

power sectors in Albania.

3POWER ENERGY GROUP, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

On August 10, 2012, after the conclusion

of the due diligence efforts, the Company made the first year payment of required Insurance Bond Premium in the amount of 164,851

Euro ($211,972), and as such the Acquisition closed. The acquisition resulted in the Company acquiring 75% of the interest in a

hydro-electrical project of a total installed power of 127.6 MW of Shala River in Albania. The Shala River project finalization

is in process with the Ministry of Albania.

In connection the acquisition of Shala,

the Company is obligated for an aggregate of 4% of the total project costs as facilitator fees in either cash or the Company's

common stock to Capital Trust Holding AG, as advisor for the Shala acquisition transaction. During the year ended March 31, 2013,

the Company accrued $600,000 due to the facilitator fees for feasibility studies in process and recorded as expenses. In December

2013, the Company issued to Capital Trust Holding AG and its affiliates, 15,000,000 shares of its common stock, valued at

$0.04 per share in settlement of the facilitator fees for feasibility studies.

During the six months ended September 30,

2015, Shala began operations, acquiring assets and incurring costs. As such, its activity is including in the unaudited condensed

consolidated balance sheet and statement of operations for the current period.

Liquidation/winding up of international

subsidiaries:

On October 8, 2012, the High Court of Justice

in the United Kingdom issued a winding-up order for the liquidation and winding up of the affairs of 3Power Project Services Limited,

a wholly owned subsidiary of the Company’s Subsidiary, 3Power Energy Limited.

By the letter of The Insolvency Service

dated October 12, 2012, the Company was required to provide information relating to 3Power Project Services Limited to the Official

Receiver’s Office (a government body of Plymouth, the United Kingdom) and attend an interview with staff of the Official

Receiver’s Office to review the prospect of recovering the assets of 3Power Project Services Limited for the benefit of creditors.

The Company was also required to deliver

to the Official Receiver’s Office certain assets (cash or cheque) and accounting records that are still in its possession

or control. The Company has attended the interview and delivered all the available accounting records to the Officer Receiver’s

Office. No order confirming a plan of reorganization, arrangement or liquidation has been entered as of this filing.

The major classes of liabilities of 3Power

Project Services Limited as of September 30, 2015 are as follows:

| Current liabilities | |

$ | 1,671,713 | |

On January 17, 2013, the Company filed

a Strike off application with the Registrar of Companies in the United Kingdom to dissolve 3Power Energy Limited, a wholly owned

subsidiary of the Company. Such strike-off application has yet to be approved as of the date of this report. 3Power Energy Limited

had liabilities as of September 30, 2015 as below:

| Current liabilities | |

$ | 176,547 | |

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

Interim Financial Statements

The following (a) condensed consolidated

balance sheet as of March 31, 2015, which has been derived from audited consolidated financial statements, and (b) the unaudited

condensed consolidated interim financial statements of the Company have been prepared in accordance with accounting principles

generally accepted in the United States (“GAAP”) for interim financial information and the instructions to Form 10-Q

and Rule 8-03 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete

financial statements.

3POWER ENERGY GROUP, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

In the opinion of management, all adjustments

(consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for

the three and six months ended September 30, 2015 are not necessarily indicative of results that may be expected for the year ending

March 31, 2016. These unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated

financial statements and notes thereto for the year ended March 31, 2015 included in the Company’s Annual Report on Form

10-K, filed with the Securities and Exchange Commission (“SEC”) on July 14, 2015.

Basis of presentation:

The unaudited condensed consolidated financial

statements include the accounts of the Company and it’s wholly and majority owned subsidiaries. All significant intercompany

balances and transactions have been eliminated in consolidation

Revenue Recognition

The Company recognizes revenue in accordance

with Accounting Standards Codification subtopic 605-10, Revenue Recognition (“ASC 605-10”) which requires that four

basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has

occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria

(3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and

the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other

adjustments are provided for in the same period the related sales are recorded.

ASC 605-10 incorporates Accounting Standards

Codification subtopic 605-25, Multiple-Element Arraignments (“ASC 605-25”). ASC 605-25 addresses accounting for arrangements

that may involve the delivery or performance of multiple products, services and/or rights to use assets. The effect of implementing

605-25 on the Company's financial position and results of operations was not significant.

Use of estimates

The preparation of financial statements

in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of

the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ

from those estimates.

Comprehensive Income (Loss)

The Company applies Statement of Accounting

Standards Codification subtopic 220-10, Comprehensive Income (“ASC 220-10”). ASC 220-10 establishes standards for the

reporting and displaying of comprehensive income and its components. Comprehensive income is defined as the change in equity of

a business during a period from transactions and other events and circumstances from non-owners sources. It includes all changes

in equity during a period except those resulting from investments by owners and distributions to owners. ASC 220-10 requires other

comprehensive income (loss) to include foreign currency translation adjustments and unrealized gains and losses on available for

sale securities.

Cash and Cash Equivalents

For purposes of the Statements of Cash

Flows, the Company considers all highly liquid debt instruments purchased with a maturity date of three months or less to be cash

equivalents.

3POWER ENERGY GROUP, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

Functional currency

The accompanying unaudited condensed consolidated

financial statements are presented in U.S. dollars ("USD"). The Company's functional currencies are British pounds ("GBP")

and Albania Lek (“LEK”). The consolidated financial statements are translated into USD in accordance with Codification

ASC 830, Foreign Currency Matters. All assets and liabilities were translated at the current exchange rate, at respective

balance sheet dates, shareholders' equity is translated at the historical rates and income statement items are translated at the

average exchange rate for the reporting periods. The resulting translation adjustments are reported as other comprehensive income

and accumulated other comprehensive income in the shareholders' equity in accordance with Codification ASC 220, Comprehensive

Income.

Translation gains and losses that arise

from exchange rate fluctuations from transactions denominated in a currency other than the functional currency are translated into

GBP at the rate on the date of the transaction and included in the results of operations as incurred. There were no material transaction

gains or losses in the periods presented.

The exchange rates used to translate amounts

in GBP and LEK into USD for the purposes of preparing the consolidated financial statements were as follows:

Balance sheet:

| | |

September 30, | | |

March 31, | |

| | |

2015 | | |

2015 | |

| Period-end GBP: USD exchange rate | |

$ | 1.5164 | | |

$ | 1.4834 | |

| Period-end LEK: USD exchange rate | |

$ | 0.0079 | | |

$ | NA | |

Income statement:

| | |

September 30, | | |

September 30, | |

| | |

2015 | | |

2014 | |

| Average Six Month GBP: USD exchange rate | |

$ | 1.5407 | | |

$ | 1.6765 | |

| Average Six Month LEK: USD exchange rate | |

$ | 0.0078 | | |

$ | NA | |

Per share data:

The Company accounts for net loss per share

in accordance with Accounting Standards Codification subtopic 260-10, Earnings Per Share (“ASC 260-10”), which requires

presentation of basic and diluted earnings per share (“EPS”) on the face of the statement of operations for all entities

with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to

the numerator and denominator of the diluted EPS.

Basic and diluted net loss per common share

is calculated by dividing net loss, by the weighted average number of outstanding shares of common stock, adjusted to give effect

to the exchange ratio in the Merger in May 2011 (see Note 1), which was accounted for as recapitalization of the Company. The Company

had no common stock equivalents as of September 30, 2015 and 2014.

Income taxes

Deferred income tax assets and liabilities

are determined based on the estimated future tax effects of net operating loss and credit carry forwards and temporary differences

between the tax basis of assets and liabilities and their respective financial reporting amounts measured at the current enacted

tax rates. The Company records an estimated valuation allowance on its deferred income tax assets if it is not more likely than

not that these deferred income tax assets will be realized.

3POWER ENERGY GROUP, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

The Company recognizes a tax benefit from

an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by taxing authorities,

based on the technical merits of the position. The tax benefits recognized in the consolidated financial statements from such a

position are measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement.

As of September 30, 2015 and March 31, 2015, the Company has not recorded any unrecognized tax benefits.

Segment Information

Accounting Standards Codification subtopic

Segment Reporting 280-10 (“ASC 280-10”) establishes standards for reporting information regarding operating segments

in annual financial statements and requires selected information for those segments to be presented in interim financial reports

issued to stockholders. ASC 280-10 also establishes standards for related disclosures about products and services and geographic

areas. Operating segments are identified as components of an enterprise about which separate discrete financial information is

available for evaluation by the chief operating decision maker, or decision-making group, in making decisions how to allocate resources

and assess performance. The information disclosed herein materially represents all of the financial information related to the

Company’s principal operating segment.

Accounting for Stock-Based Compensation

The Company accounts for stock, stock options

and warrants using the fair value method promulgated by Accounting Standards Codification subtopic 480-10, Distinguishing Liabilities

from Equity (“ASC 480-10”) which addresses the accounting for transactions in which an entity exchanges its equity

instruments for goods or services. Therefore, results include non-cash compensation expense as a result of the issuance of stock,

stock options and warrants and we expect to record additional non-cash compensation expense in the future.

The Company follows Accounting Standards

Codification subtopic 718-10, Compensation (“ASC 718-10”) which requires that all share-based payments to both employees

and non-employees be recognized in the income statement based on their fair values.

Recent Accounting Pronouncements

In April 2015, the Financial Accounting

Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2015-03, “Interest -Imputation

of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs” (“ASU 2015-03”). ASU 2015-03

amends the existing guidance to require that debt issuance costs be presented in the balance sheet as a deduction from the carrying

amount of the related debt liability instead of as a deferred charge. ASU 2015-03 is effective on a retrospective basis for annual

and interim reporting periods beginning after December 15, 2015, but early adoption is permitted. The Company does not anticipate

that the adoption of this standard will have a material impact on its condensed consolidated financial statements.

There were other various updates recently

issued by the Financial Accounting Standards Board, most of which represented technical corrections to the accounting literature

or application to specific industries and are not expected to a have a material impact on the Company's consolidated financial

position, results of operations or cash flows.

3POWER ENERGY GROUP, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

NOTE 3 — GOING CONCERN MATTERS

The accompanying unaudited condensed consolidated

financial statements have been prepared on a basis that assumes the Company will continue as a going concern. As of

September 30, 2015, the Company has a deficit of $18,333,451 applicable to controlling interest compared with a deficit of

$17,774,305 applicable to controlling interest as of March 31, 2015, and has incurred significant operating losses and

negative cash flows. For the six months ended September 30, 2015, the Company sustained a net loss of $559,146 compared to a net

loss of $571,190 for the six months ended September 30, 2014. The Company will need additional financing which may take the

form of equity or debt and the Company has converted certain liabilities into equity. In the event the Company are not able to

increase its working capital, the Company will not be able to implement or may be required to delay all or part of its business

plan, and their ability to attain profitable operations, generate positive cash flows from operating and investing activities and

materially expand the business will be materially adversely affected. The accompanying unaudited condensed consolidated financial

statements do not include any adjustments relating to the classification of recorded asset amounts or amounts and classification

of liabilities that might be necessary should the company be unable to continue in existence.

NOTE 4 — PROPERTY AND EQUIPMENT

Property and equipment as of September 30, 2015 and March 31,

2015 summarized as follows:

| | |

September 30, 2015 | | |

March 31, 2015 | |

| Furniture and equipment | |

$ | 14,143 | | |

$ | - | |

| IT and other equipment | |

| 26,716 | | |

| - | |

| | |

| 40,859 | | |

| - | |

| Less accumulated depreciation | |

| (1,758 | ) | |

| - | |

| | |

$ | 39,101 | | |

$ | - | |

Property and equipment are recorded on

the basis of cost. For financial statement purposes, property, plant and equipment are depreciated using the straight-line method

over their estimated useful lives.

Expenditures for repair and maintenance

which do not materially extend the useful lives of property and equipment are charged to operations. When property or equipment

is sold or otherwise disposed of, the cost and related accumulated depreciation are removed from the respective accounts with the

resulting gain or loss reflected in operations. Management periodically reviews the carrying value of its property and equipment

for impairment in accordance with the guidance for impairment of long lived assets.

During the three and six months ended September

30, 2015, the Company charged to operations depreciation expense of $1,018 and $1,758, respectively. During the three and six months

ended September 30, 2014, the Company charged to operations depreciation expense of $-0-.

NOTE 5 — NOTES PAYABLE

On March 2, 2010, the Company issued an

unsecured Senior Promissory Note ("Note") for 470,000 Euros ($527,152 at September 30, 2015) initially due on December

31, 2010 including interest at 7.5% per annum. Upon default by the Company on January 1, 2011, the interest rate of 15% per annum

applies. The Note has not been paid by the Company. As of September 30, 2015, accrued interest on this note was $598,973.

On November 14, 2012, CRG Finance AG (“CRG”)

filed a complaint in the District Court for Southern District of New York for allegedly beaching a promissory note.

On January 17, 2013, the Company filed

a motion to compel arbitration and on May 23, 2013, the Court granted the Company’s Motion to Compel and ordered that CRG

file its claims as an AAA arbitration.

3POWER ENERGY GROUP, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

The Final Hearing in the AAA arbitration

took place on February 27, 2014, wherein the Company was not able to establish its defense due to the lack of evidence from Rudana.

The AAA Arbitrator entered an award of Euro 470,000 plus interest at the annual rate of 7.5% against the Company. As of March

31, 2014, the total award against the Company is Euro 728,241 ($816,795). On or about April 4, 2014, in an effort to perfect this

award against the Company, CRG filed a petition with the Southern District of New York seeking to confirm the award. In addition,

the Company accrued total of $56,835 as reimbursement of attorney fees and cost incurred by CRG and $15,500 as administrative

fees and compensation to the Arbitrator. On July 8, 2014, a judgment has been entered against 3Power in the Southern District

of New York in the amount of $1,086,186. That judgment remains unpaid.

NOTE 6 — COMMON STOCK

The Company is authorized to issue 300,000,000

shares of $0.0001 par value common stock. As of September 30, 2015 and March 31, 2015, 249,949,923 shares were issued and outstanding.

NOTE 7 — RELATED PARTY TRANSACTIONS

The Company’s current and former

officers and stockholders have advanced funds on a non-interest bearing basis to the Company for travel related and working capital

purposes. The Company has not entered into any agreement on the repayment terms for these advances. As of September 30, 2015 and

March 31, 2015, there were $559,909 and $168,404 advances outstanding, respectively.

As of September 30, 2015 and March 31,

2015, the Company owed approximately £117,918 ($178,811) and £117,918 ($174,920), respectively, to Seawind Marine Limited,

a company controlled by the former directors, Mr. T P G Adams and Mr. J R Wilson, included in accounts payable and accrued expenses

in balance sheet.

As of September 30, 2015 and March 31,

2015, the Company owed approximately £177,548 ($269,234) and £177,548 ($263,375), respectively to Seawind International

Limited, a company controlled by the former directors, Mr. T P G Adams and Mr. J R Wilson, included in accounts payable and accrued

expenses in balance sheet.

As of September 30, 2015 and March 31,

2015, the Company owed approximately £88,753 ($134,585) and £88,753 ($131,656), respectively to Power Products Ltd

(Enerserve Limited f/k/a), a company under the control of Mr. T P G Adams and Mr. J R Wilson, former directors of the Company,

included in accounts payable and accrued expenses in balance sheet.

As of September 30, 2015 and March 31,

2015, the company owed Mr. J R Wilson (ex-Director) £1,144 ($1,735) and £1,144 ($1,697), respectively, included in

accounts payable and accrued expenses in balance sheet.

During the six months ended September

30, 2015 and 2014, the Company charged to operation $90,000 and $90,000 as salary to Board members, respectively.

During the three months ended September

30, 2015 and 2014, the Company charged to operation $45,000 and $45,000 as salary to Board members, respectively.

During the six months ended September 30,

2015 and 2014, the Company charged to operation $90,000 and $90,000 as consulting fees to a significant shareholder for services

provided, respectively.

During the three months ended September

30, 2015 and 2014, the Company charged to operation $45,000 and $45,000 as consulting fees to a significant shareholder for services

provided, respectively.

3POWER ENERGY GROUP, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

NOTE 8 — NON CONTROLLING INTEREST

The Company has a 50% interest in American

Seawind Energy LLC, a company registered in the State of Texas, United States of America and as of September 30, 2015, 75% interest

in Shala Energy sh.pk, a Company registered in the Republic of Albania. American Seawind Energy LLC was inactive as of September

30, 2015.

A reconciliation of the non-controlling

loss attributable to the Company:

Net loss Attributable to the Company and

transfers (to) from non-controlling interest for the three months ended September 30, 2015:

| | |

American | | |

Shala | |

| | |

Seawind | | |

Energy | |

| | |

Energy LLC | | |

sh pk | |

| Net loss | |

$ | - | | |

$ | 38,904 | |

| Average Non-controlling interest percentage | |

| 50.0 | % | |

| 25.0 | % |

| Net loss attributable to the non-controlling interest | |

$ | - | | |

$ | 9,726 | |

Net loss Attributable to the Company and

transfers (to) from non-controlling interest for the six months ended September 30, 2015:

| | |

American | | |

Shala | |

| | |

Seawind | | |

Energy | |

| | |

Energy LLC | | |

sh pk | |

| Net loss | |

$ | - | | |

$ | 162,642 | |

| Average Non-controlling interest percentage | |

| 50.0 | % | |

| 25.0 | % |

| Net loss attributable to the non-controlling interest | |

$ | - | | |

$ | 40,661 | |

Net loss Attributable to the Company and

transfers (to) from non-controlling interest for the three and six months ended September 30, 2014:

| | |

American | | |

Shala | |

| | |

Seawind | | |

Energy | |

| | |

Energy LLC | | |

sh pk | |

| Net loss | |

$ | - | | |

$ | - | |

| Average Non-controlling interest percentage | |

| 50.0 | % | |

| 25.0 | % |

| Net loss attributable to the non-controlling interest | |

$ | - | | |

$ | - | |

The following table summarizes the changes

in Non-controlling Interest from April 1, 2014 through September 30, 2015:

| | |

American | | |

| | |

| |

| | |

Seawind | | |

Shala | | |

| |

| | |

Energy LLC | | |

Energy sh pk | | |

Total | |

| Balance, April 1, 2014 | |

$ | 608 | | |

$ | (202,993 | ) | |

$ | (202,385 | ) |

| Net loss attributable to the non-controlling interest | |

| - | | |

| - | | |

| - | |

| Balance, March 31, 2015 | |

| 608 | | |

| (202,993 | ) | |

| (202,385 | ) |

| Net loss attributable to the non-controlling interest | |

| - | | |

| (40,661 | ) | |

| (40,661 | ) |

| Balance, September 30, 2015 | |

$ | 608 | | |

$ | (243,654 | ) | |

$ | (243,046 | ) |

3POWER ENERGY GROUP, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

NOTE 9 — COMMITMENTS AND CONTINGENCIES

Wuersch Settlement

In November 2011, the Company entered into

a Settlement Agreement (the “Wuersch Agreement”) with Wuersch & Gering LLP (“Wuersch”). The Wuersch

Agreement provided that Wuersch will accept a cash payment of $50,000, payable in five equal installments, and 2,000,000 options

to purchase shares of our common stock at $0.54 per share as full satisfaction of debt obligations to Wuersch of $518,359. The

five cash payment installments of $10,000 were due on the 15th calendar day of each month beginning November 15, 2011 and ending

on March 15, 2012. Two installment payments were made to Wuersch. The total outstanding balance as of September 30, 2015 and March

31, 2015 is $504,518, included in accounts payable and accrued expenses in balance sheet.

Hellenic Settlement

On November 15, 2011, the Company entered

into a Settlement Agreement (the “Hellenic Agreement”) with Hellenic Technologies (“Hellenic”). The Hellenic

Agreement provided that Hellenic will accept cash payments of $70,000, payable in five equal installments, and 1,260,000 shares

of common stock as full satisfaction of debt obligations to Hellenic of $700,000. The five cash payment installments of $14,000

were due beginning November 14, 2011 and continuing on the 15th calendar day of each month thereafter until paid in full. Two installments

were paid as of March 31, 2012. The Company has also issued 1,260,000 of Common stock valued at $630,000 during the year ended

March 31, 2012. The outstanding balance as of September 30, 2015 and March 31, 2015 is $28,000, included in accounts payable and

accrued expenses in balance sheet.

Litigation

The Company is subject to certain legal

proceedings and claims, which arise in the ordinary course of its business. Although occasional adverse decisions or settlements

may occur, the Company believes that the final disposition of such matters should not have a material adverse effect on its financial

position, results of operations or liquidity.

NOTE 10 - SUBSEQUENT EVENTS

The Company has evaluated subsequent events

through, the date the unaudited condensed consolidated financial statements are available to be issued. There are no subsequent

events.

Item 2. Management’s

Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion provides information

which management believes is relevant to an assessment and understanding of our results of operations and financial condition.

The discussion should be read along with our financial statements and notes thereto contained elsewhere in this Report. The

following discussion and analysis contains forward-looking statements, which involve risks and uncertainties. Our actual results

may differ significantly from the results, expectations and plans discussed in these forward-looking statements.

Overview

We were incorporated in the State of Nevada

on December 18, 2002, as ATM Financial Corp.

On May 13, 2011 the Company entered into

a Stock Purchase Agreement (the “Stock Purchase Agreement”) with Seawind Energy Limited (“Seawind Energy”)

and its subsidiary Seawind Services Limited (“Seawind services”), pursuant to which the Company acquired 100% of the

issued and outstanding common stock of Seawind Energy, in exchange for the issuance of 40,000,000 restricted shares of the Company’s

common stock (such transaction as “Seawind Acquisition”). The acquisition was accounted for as a reverse

merger and, accordingly, the Company is the legal survivor and Seawind Energy is the accounting survivor.

For accounting purposes, Seawind Energy

was the surviving entity. The transaction was accounted for as a recapitalization of Seawind Energy pursuant to which Seawind Energy

was treated as the surviving and continuing entity. The Company did not recognize goodwill or any intangible assets

in connection with this transaction. Accordingly, the Company’s historical financial statements are those of Seawind

Energy immediately following the consummation of the reverse merger.

In anticipation of the closing of the Stock

Purchase Agreement, on March 30, 2011 the Company changed its name to 3Power Energy Group Inc. and increased its authorized share

capital to 300,000,000 shares. On July 4, 2011, Seawind Energy and Seawind Service changed their name to 3Power Energy

Limited (“3Power Energy”) and 3Power Project Service Limited (“3Power Service”), respectively. Both 3Power

Energy and 3Power Service are inactive as of September 30, 2015.

The Business

The principle planned business of the Company

is to sell electricity generated by solar, wind, hydro, biomass and other renewable energy resources and to develop, build and

operate power plants based on these technologies. The core approach of the Company’s planned business is to deliver

energy in markets where there is an inherent energy gap between supply and demand or where there exists long term, stable, government

backed financial support for the development of renewable energy. The strategic plan of the Company is to develop power plants

and sell electricity in mature and emerging international energy markets at secure rates with the highest potential margins for

return on investment.

Acquisition of Shala Energy sh .p .k:

On June 5, 2012, the Company and Shala

Energy sh.p.k ("Shala") executed a master acquisition agreement (the “Acquisition Agreement”) whereby Shala

agreed to transfer and the Company agreed to acquire 75% of the equity of Shala. Under the Acquisition Agreement (the “Acquisition”),

the closing of the acquisition was subject to the Company’s completion and satisfaction of the due diligence on Shala and

Shala’s partners with respect to their shares in Shala and upon the Company’s payment of the first year premium for

the insurance bond premium issued in favor of the Ministry of Economy, Trade and Energy of Republic of Albania in replacement of

the then existing bank guarantee issued in favor of Ministry of Economy, Trade and Energy of Republic of Albania for the Shala

River Concession Agreement, in the amount of 7,230,315 Euro (the “Required Insurance Bond Premium”). Shala is a firm

specializing in developing hydro-electric projects, owning and operating sustainable energy projects in the hydro, wind and solar

power sectors in Albania.

On August 10, 2012, after the conclusion

of the due diligence efforts, the Company made the first year payment of required Insurance Bond Premium in the amount of 164,851

Euro ($211,972), and as such the Acquisition closed. The Acquisition resulted in the Company acquiring 75% of the interest in a

hydro-electrical project of a total installed power of 127.6 MW of Shala River in Albania. The Shala River project finalization

is in process with the Ministry of Albania.

In connection the acquisition of Shala,

the Company is obligated for an aggregate of 4% of the total project costs as facilitator fees in either cash or the Company's

common stock to Capital Trust Holding AG, as advisor for the Shala acquisition transaction. During the year ended March 31, 2013,

the Company accrued $600,000 due to the facilitator fees for feasibility studies in process and recorded as expenses. In December

2013, the Company issued to Capital Trust Holding AG and its affiliates, 15,000,000 shares of its common stock, valued at

$0.04 per share in settlement of the facilitator fees for feasibility studies.

During the six months ended September 30,

2015, Shala began operations, acquiring assets and incurring costs. As such, this activity is including in our unaudited condensed

consolidated balance sheet and statement of operations for the current period.

Current Focus

We currently have only one project, a hydro-electrical

project of a total installed power of 127.6 MW of Shala River in Albania, and the commercialization of this project is in its infancy.

Our intended markets may not utilize our producible products, and it may not be commercially successful.

We intend to develop additional projects

but to date, none have proven to be commercially viable or successful.

Results of

Operations For The Three Months Ended September 30, 2015 And 2014

We had revenues from operations in the amount of $Nil for

the three months ended September 30, 2015 and 2014.

We incurred operating expenses of $224,944

for the three months ended September 30, 2015 compared to $289,757 for the three months ended September 30, 2014. The decrease

is due to less travel and other cost in the current period as compared to prior year, offset by depreciation expense of $1,018

incurred with our majority owned subsidiary Shala Energy.

Our interest expense was $42,015 for the

three months ended September 30, 2015 as compared to $39,389 for the same period in 2014. The increase of $2,626 or 7% was due

primarily to compounding of interest associated with note obligations. Additionally, we recognized a foreign currency transaction

loss of $5,734 during the three months ended September 30, 2015 as compared to $-0- last year.

Results of

Operations For The Six Months Ended September 30, 2015 And 2014

We had revenues from operations in the amount of $Nil for

the six months ended September 30, 2015 and 2014.

We incurred operating expenses of $501,981

for the six months ended September 30, 2015 compared to $493,836 for the six months ended September 30, 2014. This increase was

primarily attributable to start up and other costs incurred with our majority owned subsidiary, Shala Energy.

Our interest expense was $80,624 for the

six months ended September 30, 2015 as compared to $77,354 for the same period in 2014. The increase of $3,270 or 4% was due primarily

to compounding of interest associated with note obligations. Additionally, we recognized a foreign currency transaction loss of

$17,202 during the six months ended September 30, 2015 as compared to $-0- last year.

Liquidity and Capital Resources

Our total cash and cash equivalents as

of September 30, 2015 was $2,779 compared to the total cash and cash equivalents of $1,585 as of March 31, 2015.

As of September 30, 2015, our total current

assets were $45,576 compared to total current assets $9,757 as of March 31, 2015 and the total current liabilities were $7,161,809

as of September 30, 2015 compared to $6,446,860 as of March 31, 2015. The increase in current liabilities was primarily due increase

in accounts payable and accrued expenses of $225,894 and $391,505 related party debt.

Net cash provided by operating activities

was $42,053 for the six months ended September 30, 2015 compared to net cash used in operating activities of $-0- for the six months

ended September 30, 2014. The cash flow from operating activities consists of $599,807 net loss, with payments on the Company’s

behalf by related party of $391,505 and deprecation of $1,758, foreign currency transaction loss of $17,202, an increase in prepaid

and other assets of $(34,625), increase in accounts payable and accrued expenses of $185,672 and an increase in accrued interest

of $80,348.

Net cash used in investing activities was

$40,859 for the six months ended September 30, 2015 reflecting purchases of equipment by our majority owned subsidiary, Shala Energy;

as compared to $Nil for the same period last year.

Net cash provided by financing activities

was $Nil for the six months ended September 30, 2015 and 2014.

Our pre-operational activities to date

have consumed substantial amounts of cash. Our negative cash flow from operations is expected to continue and accelerate in the

foreseeable future as the Company invests in capital expenditures to commence operations.

We will need to raise additional capital

to implement our business plan and continue operations for any length of time. We are seeking alternative sources of financing,

through private placement of securities and loans from our shareholders in order for us to maintain our operations. We cannot guarantee

that we will be successful in raising additional cash resources for our operations.

The independent registered public accounting

firm’s report on our March 31, 2015 consolidated financial statements included in our Form 10-K states that our difficulty

in generating sufficient cash flow to meet our obligations and sustain operations raise substantial doubts about our ability to

continue as a going concern. The unaudited condensed consolidated financial statements do not include any adjustments that might

result should the Company be unable to continue as a going concern.

Critical Accounting Policies

Our discussion and analysis of our financial

condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting

principles generally accepted in the United States of America. The preparation of these financial statements requires us to make

estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. In consultation with our

Board of Directors, we have identified several accounting principles that we believe are key to the understanding of our financial

statements. These important accounting policies require management’s most difficult, subjective judgments.

Revenue Recognition

The Company recognizes revenue in accordance

with Accounting Standards Codification subtopic 605-10, Revenue Recognition (“ASC 605-10”) which requires that four

basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has

occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Determination of criteria

(3) and (4) are based on management's judgments regarding the fixed nature of the selling prices of the products delivered and

the collectability of those amounts. Provisions for discounts and rebates to customers, estimated returns and allowances, and other

adjustments are provided for in the same period the related sales are recorded.

ASC 605-10 incorporates Accounting Standards

Codification subtopic 605-25, Multiple-Element Arraignments (“ASC 605-25”). ASC 605-25 addresses accounting for arrangements

that may involve the delivery or performance of multiple products, services and/or rights to use assets. The effect of implementing

605-25 on the Company's financial position and results of operations was not significant.

Comprehensive Income (Loss)

The Company applies Statement of Accounting

Standards Codification subtopic 220-10, Comprehensive Income (“ASC 220-10”). ASC 220-10 establishes standards for the

reporting and displaying of comprehensive income and its components. Comprehensive income is defined as the change in equity of

a business during a period from transactions and other events and circumstances from non-owners sources. It includes all changes

in equity during a period except those resulting from investments by owners and distributions to owners. ASC 220-10 requires other

comprehensive income (loss) to include foreign currency translation adjustments and unrealized gains and losses on available for

sale securities.

Foreign Currency Translation and

Transactions

The accompanying unaudited condensed consolidated

financial statements are presented in U.S. dollars (“USD”). The functional currency of our subsidiaries is British

pounds (“GBP”) and Albania Lek (“LEK”). The financial statements of subsidiaries are translated into USD

in accordance with the Codification ASC 830, “Foreign Currency Matters”. All assets and liabilities were

translated at the current exchange rate, at respective balance sheet dates, shareholders’ equity is translated at the

historical rates and income statement items are translated at the average exchange rate for the reporting periods. The

resulting translation adjustments are reported as other comprehensive income and accumulated other comprehensive income in shareholders’

equity in accordance with the Codification ASC 220, “Comprehensive Income.”

Transaction gains and losses that arise

from exchange rate fluctuations from transactions denominated in a currency other than the functional currency are translated into

GBP at the rate on the date of the transaction and included in the results of operations as incurred. There were no

material transaction gains or losses in the periods presented.

Income taxes

Income tax provisions or benefits for interim

periods are computed based on the Company’s estimated annual effective tax rate. Based on the Company's historical losses

and its expectation of continuation of losses for the foreseeable future, the Company has determined that it is not more likely

than not that deferred tax assets will be realized and, accordingly, has provided a full valuation allowance. As the Company anticipates

or anticipated that its net deferred tax assets at September 30, 2015 and March 31, 2015 would be fully offset by a valuation allowance,

there is no federal or state income tax benefit for the six months ended September 30, 2015 and 2014 related to losses incurred

during such periods.

Off Balance Sheet Transactions

We do not have any off-balance sheet transactions.

Recently Issued Accounting Pronouncements

There were various updates recently issued,

most of which represented technical corrections to the accounting literature or application to specific industries and are not

expected to a have a material impact on our consolidated financial position, results of operations or cash flows.

Inflation

We do not believe that inflation has had

a material effect on our business, financial condition or results of operations. If our costs were to become subject to significant

inflationary pressures, we may not be able to fully offset such higher costs through price increases. Our inability or failure

to do so could adversely affect our business, financial condition and results of operations.

Disclosure of Contractual Obligations

The Company does not have any significant

contractual obligations which could negatively impact our results of operations and financial condition.

Item 3. Quantitative

and Qualitative Disclosures About Market Risk.

Smaller reporting companies are not required

to provide the information required by this item.

Item 4. Controls

and Procedures.

Evaluation of Disclosure Controls and

Procedures

As of the end of the period covered by

this Report, an evaluation was carried out under the supervision and with the participation of our management, including our Chief

Executive Officer/Chief Financial Officer, of the effectiveness of our disclosure controls and procedures, as defined in Rule 13a-15(e)

promulgated under the Securities and Exchange Act of 1934 (the “Exchange Act”). In carrying out that evaluation, management

identified a material weakness (as defined in Public Company Accounting Oversight Board Standard No. 2) in our disclosure controls

and procedures regarding a lack of adequate personnel and adequate segregation of duties. Based on management’s

evaluation of our disclosure controls and procedures as of September 30, 2015, our Chief Executive Officer/Chief Financial Officer

has concluded that, as of that date, our disclosure controls and procedures were not effective.

Our size has prevented us from being able

to employ sufficient resources to enable us to have an adequate level of supervision and segregation of duties within our internal

control system. Therefore while there are some compensating controls in place, it is difficult to ensure effective segregation

of accounting and financial reporting duties. Management reported a material weakness resulting from the combination of the following

significant deficiencies:

| |

• |

Lack of segregation of duties in certain accounting and financial reporting processes including the approval and execution of disbursements; |

| |

|

|

| |

• |

The Company’s corporate governance responsibilities are performed by the Board of Directors; we do not have independent Board of Directors, we do not have an audit committee or compensation committee. Because our Board of Directors only meets periodically throughout the year, several of our corporate governance functions are not performed concurrent (or timely) with the underlying transaction, evaluation, or recordation of the transaction. |

While we strive to segregate duties as

much as practicable, there is an insufficient volume of transactions at this point in time to justify additional full time staff.

We may not be able to fully remediate the material weakness until we increase operations at which time we would expect to hire

more staff.

Plan for Remediation of Material Weaknesses

To mitigate the current limited resources

and limited employees, we rely heavily on direct management oversight of transactions, along with the use of legal and accounting

professionals. As we grow, we expect to increase our number of employees and engage outsourced accounting professionals, which

will enable us to implement adequate segregation of duties within the internal control framework. We will continue to monitor and

assess the costs and benefits of additional staffing.

Changes in Internal Control over Financial

Reporting

No changes were made to our internal control

over financial reporting during our most recently completed fiscal quarter that have materially affected, or are reasonably likely

to materially affect, our internal control over financial reporting.

PART II: OTHER INFORMATION

Item 1. Legal Proceedings

On November 14, 2012, CRG Finance AG (“CRG”) filed

a complaint in the District Court for Southern District of New York for allegedly beaching a promissory note (See Note 5 above).

On January 17, 2013, the Company filed

a motion to compel arbitration and on May 23, 2013, the Court granted the Company’s Motion to Compel and ordered that CRG

file its claims as an AAA arbitration.

The Final Hearing in the AAA arbitration

took place on February 27, 2014, wherein the Company was not able to establish its defense due to the lack of evidence from Rudana.

The AAA Arbitrator entered an award of Euro 470,000 plus interest at the annual rate of 7.5% against the Company. As of March 31,

2014, the total award against the Company is Euro 728,241 ($1,012,401). On or about April 4, 2014, in an effort to perfect this

award against the Company, CRG filed a petition with the Southern District of New York seeking to confirm the award. In addition,

the Company accrued total of $56,835 as reimbursement of attorney fees and cost incurred by CRG and $15,500 as administrative fees

and compensation to the Arbitrator.

On July 8, 2014, a judgment has been entered

against 3Power in the Southern District of New York in the amount of $1,086,186. That judgment remains unpaid.

Item 1A. Risk Factors

Smaller reporting companies are not required to provide the

information required by this item.

Item 2. Unregistered Sales of Equity Securities And Use Of

Proceeds

None

Item 3. Defaults Upon Senior Securities

The information regarding CRG Finance contained

under Item 1 of Part II above is incorporated herein by reference in response to this item.

Item 4. Mine Safety Disclosures

Not Applicable.

Item 5. Other Information

None.

Item 6. Exhibits.

(a) Exhibits

Exhibit

Number |

|

Description |

| |

|

|

| 31.1* |

|

Certification of the Principal Executive Officer and Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| 32.1+ |

|

Certification of Principal Executive officer and Principal Financial Officer pursuant to 18 U.S.C Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

| 101.INS |

|

XBRL Instance Document |

| 101.SCH |

|

XBRL Taxonomy Extension Schema Document |

| 101.CAL |

|

XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.LAB |

|

XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE |

|

XBRL Taxonomy Extension Presentation Linkbase Document. |

| 101.DEF |

|

XBRL Taxonomy Extension Definition Linkbase Document. |

* Filed herewith.

+ In accordance with the SEC Release 33-8238, deemed being furnished

and not filed.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

3POWER ENERGY GROUP, INC. |

| |

|

| Dated: November 18, 2015 |

By: |

/s/ Sharif Rahman |

| |

|

Name: |

Sharif Rahman |

| |

|

Title: |

Chief Executive Officer and Chief Financial Officer |

| |

|

|

(Principal Executive Officer, Principal Financial and Chief Accounting Officer) |

Exhibit 31.1

CERTIFICATION

OF PRINCIPAL EXECUTIVE OFFICER,

AND PRINCIPAL FINANCIAL AND CHIEF ACCOUNTING

OFFICER

PURSUANT TO EXCHANGE ACT RULE 13a-14(a)

OR 15d-14(a)

AS ADOPTED PURSUANT TO SECTION 302 OF

THE SARBANES-OXLEY ACT OF 2002

I, Sharif Rahman, certify

that:

1. I have reviewed

this quarterly report on Form 10-Q of 3POWER ENERGY GROUP, INC.;

2. Based on my knowledge,

this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements

made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by

this report;

3. Based on my knowledge,

the financial statements, and other financial information included in this report, fairly present in all material respects the

financial condition, results of operations and cash flows of the registrant as of, and for, the periods present in this report;

4. The registrant’s

other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined

in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules

13-a- 15(f) and 15d-15(f)) for the registrant and have:

(a) Designed such

disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to

ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this report is being prepared;

(b) Designed such

internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision,

to provide reasonable assurance regarding the liability of financial reporting and the preparation of financial statements for

external purposes in accordance with generally accepted accounting principles;

(c) Evaluated the

effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the

effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation;

and

(d) Disclosed in this

report any change in the registrant’s internal control over financing reporting that occurred during the registrant’s

most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal

control over financial reporting; and

5. The registrant’s

other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting,

to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing

the equivalent functions):

(a) All significant

deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably

likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b) Any fraud, whether

or not material, that involves management or other employees who have a significant role in the registrant’s internal control

over financial reporting.

Date: November 18, 2015

| /s/ Sharif Rahman |

|

| Sharif Rahman |

|

| Chief Executive Officer and Chief Financial Officer |

|

| (Principal Executive Officer, Principal Financial and Accounting Officer) |

|

Exhibit 32.1

CERTIFICATION

PRINCIPAL EXECUTIVE OFFICER,

AND PRINCIPAL FINANCIAL AND CHIEF ACCOUNTING OFFICER

PURSUANT TO 18 U.S.C. SECTION 1350

AS ADOPTED PURSUANT TO SECTION 906 OF THE

SARBANES-OXLEY ACT OF 2002

Pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section

906 of the Sarbanes-Oxley Act of 2002, I, Sharif Rahman, Chief Executive Officer and Chief Financial Officer of 3POWER ENERGY GROUP,

INC. (the Company”) hereby certify, that, to my knowledge:

1. The Form 10-Q for the quarter ended September 30, 2015 (the

“Report”) of the Company fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange

Act of 1934; and

2. The information contained in the Report fairly presents,

in all material respects, the financial condition and results of operations of the Company.

Date: November 18, 2015

| /s/ Sharif Rahman |

|

| Sharif Rahman |

|

| Chief Executive Officer and Chief Financial Officer |

|

| (Principal Executive Officer, Principal Financial and Accounting Officer) |

|

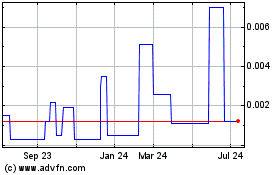

3Power Energy (CE) (USOTC:PSPW)

Historical Stock Chart

From Oct 2024 to Nov 2024

3Power Energy (CE) (USOTC:PSPW)

Historical Stock Chart

From Nov 2023 to Nov 2024