Definitive Materials Filed by Investment Companies. (497)

February 14 2014 - 4:27PM

Edgar (US Regulatory)

Filed pursuant to Rule 497(e)

File Nos. 33-36528 and 811-6161

ALLIANZ FUNDS

Supplement

dated February 14, 2014 to the

Statutory Prospectuses for Administrative Class, Institutional Class, Class A, Class B, Class C,

Class D, Class P and

Class R shares of all series of Allianz Funds except for AllianzGI Money Market Fund

Dated August 28, 2013 (as revised December 19, 2013) (as supplemented thereafter)

Disclosure Relating to AllianzGI U.S. Managed Volatility Fund

Within the Fund Summary relating to the AllianzGI U.S. Managed Volatility Fund, the first sentence in the third paragraph in the subsection entitled

“Principal Investment Strategies” is hereby restated in its entirety as follows:

In addition to equity securities (such as

preferred stocks, convertible securities and warrants) and equity-related instruments, the Fund may invest in securities issued in initial public offerings (IPOs) and real estate investment trusts (REITs), and utilize foreign currency exchange

contracts, options, stock index futures contracts, warrants and other derivative instruments.

Corresponding changes are hereby made within the

“Principal Investments and Strategies of Each Fund – AllianzGI U.S. Managed Volatility Fund” section of the Prospectuses.

Within the Fund

Summary relating to the AllianzGI U.S. Managed Volatility Fund, the following is hereby added after “Management Risk” in the subsection entitled “Principal Risks”:

REIT and Real Estate-Related Investment Risk

: Adverse changes in the real estate markets may affect the value of REIT investments or

real estate-linked derivatives.

Within the subsection entitled “Principal Investments and Strategies of Each Fund — Allianz U.S. Managed

Volatility Fund – Principal Risks,” “REIT and Real Estate-Related Investment Risk” is hereby added after “Management Risk” as a principal risk of the AllianzGI U.S. Managed Volatility Fund.

Disclosure Relating to AllianzGI International Managed Volatility Fund

Within the Fund Summary relating to the AllianzGI International Managed Volatility Fund, the first sentence in the third paragraph in the subsection entitled

“Principal Investment Strategies” is hereby restated in its entirety as follows:

In addition to equity securities (such as

preferred stocks, convertible securities and warrants) and equity-related instruments, the Fund may invest in securities issued in initial public offerings (IPOs) and real estate investment trusts (REITs), and utilize foreign currency exchange

contracts, options, stock index futures contracts, warrants and other derivative instruments.

Corresponding changes are hereby made within the

“Principal Investments and Strategies of Each Fund – AllianzGI International Managed Volatility Fund” section of the Prospectuses.

Within

the Fund Summary relating to the AllianzGI International Managed Volatility Fund, the following is hereby added after “Management Risk” in the subsection entitled “Principal Risks”:

REIT and Real Estate-Related Investment Risk

: Adverse changes in the real estate markets may affect the value of REIT investments or

real estate-linked derivatives.

Within the subsection entitled “Principal Investments and Strategies of Each Fund — Allianz International

Managed Volatility Fund – Principal Risks,” “REIT and Real Estate-Related Investment Risk” is hereby added after “Management Risk” as a principal risk of the AllianzGI International Managed Volatility Fund.

Please retain this Supplement for future reference.

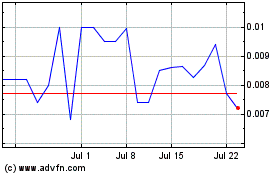

1933 Industries (QB) (USOTC:TGIFF)

Historical Stock Chart

From Jun 2024 to Jul 2024

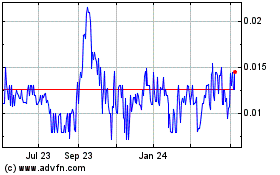

1933 Industries (QB) (USOTC:TGIFF)

Historical Stock Chart

From Jul 2023 to Jul 2024