YANGAROO Inc. (TSX-V: YOO, OTCBB: YOOIF), the

leading secure digital media management and distribution company,

today announced its results for the third quarter ended September

30, 2018.

Revenue for Q3 was $1,735,291, 12% lower than

the same period in 2017 and 3% lower than Q2 2018, with net income

of $84,846 and normalized EBITDA of $204,301. Revenue for the first

9 months of 2018 was $5,482,305, 5% lower than the first 9 months

of 2017, with net income of $150,989 and normalized EBITDA of

$432,232. The decreases from the prior year, both quarterly and

year-to-date, were due to reduced campaign spending by clients and

in some cases loss of business by advertising clients.

Advertising revenue of $1,036,861 in Q3 has

dropped 19% over the same period in 2017 and increased 1% over the

previous quarter. The year-to-date revenue for the first 9 months

was $3,291,408, which has dropped 7% over the same period in 2017,

for reasons discussed above. The slight increase from the prior

period was due to sales starting to rise in the quarter primarily

due to seasonal increases in order flow.

Entertainment Division’s Q3 revenue was

$698,430, up 0.5% over 2017 and down 10% over the previous quarter.

The revenue for the first 9 months of 2018 was $2,190,897, 1% lower

than the same period in 2017. The increase from Q3 2017 was mainly

due to increase of licensing revenue and music audio delivery

revenue; net of a decrease in the awards management revenue as a

result of the change in revenue recognition standards in the

current period. The decrease in revenue from Q2 2018 was mainly due

to seasonal changes in the volume of video deliveries and timing of

revenue recognition from individual awards shows. This decrease was

net of an increase in membership subscription fees. The slight

decrease of revenue for the first 9 months of 2018 was mainly a

result of a decline in the volume of membership subscription and

music video deliveries, offset by increases in music audio delivery

and licensing revenue.

“As stated last quarter, despite lower revenue

year to date, business development efforts are progressing well,”

said Gary Moss, President & CEO of YANGAROO. “I am pleased to

report that the Company expects that new customers signed in the

second half of this year and who are coming on-line in the fourth

quarter, will contribute annual run-rate revenue growth in the

Advertising division, of at least 15% in 2019. The Company also

expects Advertising division revenue to increase sequentially in Q4

from Q3 due to the seasonal strengthening of order flow and

business from new customers. Business development efforts continue

aggressively, and we anticipate adding to this new business over

the coming months. The Company continues to carefully control costs

in line with revenue.”

Total operating expense was $1,600,203 for the

quarter ended September 30, 2018, 23% lower than the previous year

and 13% lower than the previous quarter. The year-to-date operating

expenses was $5,347,539, 4% lower than the same period in 2017. The

decreases for all the periods were primarily due to one-time

restructuring costs incurred in Q3 2017 and the adjustment to the

bonus accrual in Q3 2018. The decreases were offset by higher value

of stock options granted and salary adjustments in the current

year. The Company has retained a net income of $84,846 in the

current quarter, compared to a net loss of $215,711 in the same

quarter of last year; and retained a net income of $150,989 in the

first 9 months of 2018, compared to a net loss of $11,265 in the

same period of last year. Excluding the impact of non-cash and

non-operating costs, the normalized EBITDA was $204,301 in Q3 2018

and $432,232 for the first 9 months of 2018.

Summary of operating results for the periods

ended September 30th:

|

$CDN |

Nine Months |

Third Quarter |

|

|

2018 |

2017 |

|

2018 |

2017 |

|

|

Revenue |

5,482,305 |

5,745,192 |

|

1,735,291 |

1,978,395 |

|

|

EBITDA (loss) |

282,078 |

128,277 |

|

125,979 |

(164,077 |

) |

|

Normalized EBITDA |

432,232 |

801,392 |

|

204,301 |

378,927 |

|

|

Net Income (loss) for the period |

150,989 |

(11,265 |

) |

84,846 |

(215,711 |

) |

|

Basic income (loss) per share |

0.00 |

(0.00 |

) |

0.00 |

(0.00 |

) |

|

Diluted income (loss) per share |

0.00 |

(0.00 |

) |

0.00 |

(0.00 |

) |

Please note that all currency in this press

release is denoted in Canadian dollars.

The full text of the financial statements and

Management Discussion & Analysis is available at

www.yangaroo.com and at www.sedar.com.

About YANGAROO:YANGAROO is a

company dedicated to digital media management. YANGAROO’s patented

Digital Media Distribution System (DMDS) is a leading secure B2B

digital cloud-based solution focused on the music and advertising

industries. The DMDS solution provides more accountable, effective,

and far less costly digital management of broadcast quality media

via the Internet. It replaces the physical, satellite and closed

network distribution and management of audio and video content, for

music, music videos, and advertising to television, radio, media,

retailers, and other authorized recipients. The YANGAROO Awards

platform is now the industry standard and powers most of North

America’s major awards shows.

YANGAROO has offices in Toronto, New York, and

Los Angeles. YANGAROO trades on the TSX Venture Exchange (TSX-V)

under the symbol YOO and in the U.S. under OTCBB: YOOIF. For

further information, please contact Gary Moss at 416-534-0607

ext.111 or visit www.yangaroo.com.

THE TSX VENTURE EXCHANGE HAS NOT

REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

Cautionary Note Regarding

Forward-looking Statements

This news release contains certain

forward-looking statements and forward-looking information

(collectively referred to herein as "forward-looking statements")

within the meaning of applicable Canadian securities laws. All

statements other than statements of present or historical fact are

forward-looking statements. Forward-looking statements are often,

but not always, identified by the use of words such as

"anticipate", "achieve", "could", "believe", "plan", "intend",

"objective", "continuous", "ongoing", "estimate", "outlook",

"expect", "may", "will", "project", "should" or similar words,

including negatives thereof, suggesting future outcomes.

Forward looking statements are subject to both

known and unknown risks, uncertainties and other factors, many of

which are beyond the control of YANGAROO, that may cause the actual

results, level of activity, performance or achievements of YANGAROO

to be materially different from those expressed or implied by such

forward looking statements, including but not limited to: the use

of proceeds of the offering, receipt of all necessary approvals of

the offering, general business, economic, competitive, political

and social uncertainties; negotiation uncertainties and other risks

of the technology industry. Although YANGAROO has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended.

Forward-looking statements are not a guarantee

of future performance and involve a number of risks and

uncertainties, some of which are described herein. Such

forward-looking statements necessarily involve known and unknown

risks and uncertainties, which may cause YANGAROO’s actual

performance and results to differ materially from any projections

of future performance or results expressed or implied by such

forward-looking statements. Any forward-looking statements are made

as of the date hereof and, except as required by law, neither

YANGAROO assumes no obligation to publicly update or revise such

statements to reflect new information, subsequent or otherwise.

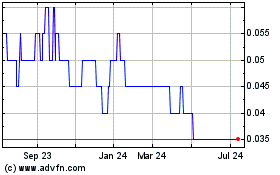

Yangaroo (TSXV:YOO)

Historical Stock Chart

From Dec 2024 to Jan 2025

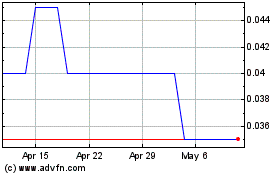

Yangaroo (TSXV:YOO)

Historical Stock Chart

From Jan 2024 to Jan 2025