West Red Lake Gold Mines Ltd. (“West Red

Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG)

(OTCQB: WRLGF) is pleased to announce positive

results from the 2024 regional surface mapping and geochemical

sampling program (the “

Program”) across its 100%

owned Madsen Property located in the Red Lake Gold District of

Northwestern Ontario, Canada.

HIGHLIGHTS:

- The Program at Madsen was focused

on the Confederation Assemblage of rocks, which has remained mostly

unexplored until WRLG completed this first phase of work. The

Confederation rocks are known to host significant gold

mineralization in the Red Lake district, including Kinross Gold’s

Great Bear Project, located approximately 24km southeast of

Madsen.

- The Program consisted of 1,460 till

samples and 42 channel samples, as well as 69 representative

lithologic samples collected to support the geological mapping

program.

- Six (6) anomalous areas were

defined with a geochemical signature of Au-W-As-Ag-Bi (Figure 1),

which is analogous to the geochemical signature of Madsen-style

alteration and mineralization. The most compelling of these targets

is the North Shore anomaly which has already demonstrated high

prospectivity from limited drilling completed in 2024, as well as

its spatial association to the Russet Lake Ultramafic

(“RLUMAF”). The area beneath the strongest part of

the anomaly has never been drilled and will be a top target for

2025.

- Geologic resolution and

understanding within the Confederation Assemblage was greatly

enhanced through the detailed mapping program and will be a

valuable dataset for advancing targets within this package of

rocks.

Will Robinson, Vice President of Exploration,

stated, "We are quite pleased with the results of our first ever

regional surface exploration program across the Madsen property.

The program was focused on the underexplored Confederation

Assemblage and was successful in delineating a number of

high-caliber geochemical anomalies that will warrant follow-up

exploration work and possibly drilling in 2025. The grade and tenor

of the surface anomalies defined within the Confederation rocks and

their spatial association with the underlying geology is very

encouraging and further reinforces our thesis that this mostly

overlooked part of the property still presents excellent potential

for discovery. Additionally, the till anomaly defined at the North

Shore target within Balmer Assemblage rocks along the eastern

margin of the Russet Lake Ultramafic fits our exploration model for

this highly prospective corridor resulting in an exciting

drill-ready target for 2025.”

Figure 1. Map showing anomalous areas

defined through 2024 surface till sampling and characterized by

Au-W-As-Ag-Bi geochemical signature. This geochemical signature is

synonymous with Madsen-style gold mineralization and representative

of gold mineralization elsewhere in the Red Lake

district.

DISCUSSION

The North Shore target returned

the strongest and best constrained till anomaly during the 2024

surface sampling program. The anomaly is defined by a robust

Au-W-As-Ag-Bi signature, which is very encouraging as this is the

primary geochemical signature associated with gold mineralization

at Madsen and elsewhere within the Red Lake district. The majority

of the highest values are concentrated on the hanging wall, or

eastern contact margin of the RLUMAF. This spatial association fits

well with other known deposits and occurrences along the RLUMAF

including Wedge-MJ, Fork and the newly discovered Upper 8 Zone.

Limited drilling at North Shore in 2024 intercepted broad zones of

Madsen-style alteration and polyphase veining with low gold values

along the eastern hanging wall margin of the Venus ultramafic,

which also lines up with the eastern edge of the 2024 North Shore

sampling grid. The new till data suggests that the gold-rich

portion of the system could be positioned further east and closer

to the RLUMAF. This will be a top drilling target for regional

exploration at Madsen in 2025.

The Faulkenham Southwest and

Southeast targets are located south of the

Faulkenham Stock in an area with almost no previous exploration

work, aside from the exploratory Faulkenham Shaft. Prospecting in

this area during 2024 did not identify any high priority targets,

but till samples returned some of the highest Au-W anomalies on the

property from the southwest area and strongly elevated

Au-W-As-Ag-Bi levels in the southeast area – overall the anomalous

area defined extends approximately 4km in an east-west direction.

Outcrop exposure over this part of the property is good, but 2024

mapping was focused on rock classification as opposed to detailed

prospecting. Follow-up detailed work searching for vein exposures

is warranted, especially in the southwest where strong Au-W in till

values persist immediately down-ice from the Faulkenham Shaft. This

work will be completed in 2025, along with infill till sampling to

tighten up the spacing on the existing grid.

The Killoran target represents

a newly defined area of interest in the Confederation Assemblage

along the western shore of Killoran Lake. The target is well

defined with a strong Au-W-As-Ag-Bi till anomaly. Bedrock exposure

is generally good in this area so follow-up high resolution mapping

and prospecting with potential channel sampling and stripping will

be completed in 2025.

The High Lake and

Faulkenham North anomalies are both well defined

with strong Au-W-As-Ag-Bi in till signatures. Much of the High Lake

till anomaly is down-ice from the #1 Vein which likely explains the

anomalous geochemical response in this area. The till geochemical

anomaly also extends up-ice from the #1 Vein exposure which

suggests a continuation of the vein system to the northeast. The #1

Vein, located within the Confederation Assemblage, was the original

area being mined at Madsen (#1 Shaft) before the discovery of the

surface expression of the Austin Zone. The Faulkenham North anomaly

is similar in character to the High Lake anomaly but lacks a

bedrock source to explain the anomalous till geochemistry. It is

possible that the anomalous till geochemistry at Faulkenham North

is indicating additional #1 Vein style mineralization along strike

and under cover to the northeast.

QUALITY ASSURANCE/QUALITY

CONTROL

A total of 1,460 till samples (inclusive of

duplicates) were taken by contracted field personnel between both

phases of surficial sampling on the Madsen property in 2024. The

average sample weight received at the lab was 1.72 kg, with a

following average weight of 114 g of sample material passing the

-64μm fraction screen during preparation. Of the 1460 field

samples, 45 returned with insufficient material for analysis. These

NSS samples had an average receival weight of 1.68 kg, but a post

screen average weight of 19.37 g. A review of sample commentary and

field data shows that most of these 45 samples were recorded as

having a high sand content. With a required nominal weight of 50 g

required for the AuME-ST44™ analysis method, field sampling

protocols are deemed adequate to ensure the required volume of

material has been collected. At a failure rate of 3.1%, this is

deemed to be within acceptable tolerance for sample collection.

Protocols for sampling within sand and coarser grained till

material should still be reviewed with field crew, as a nominal

field weight of 2.5-3.5 kg may be the required minimum for such

coarser grained material.

In total, 1,977 proposed samples sites across

both phases of work were generated during sampling program design.

Of these, 517 sites were not sampled. A review of dropped sample

sites against site comments, aerial imagery, and LIDAR surveys

indicated that the deselection of sites for sampling by field

personnel is considered appropriate. The majority of deselected

sites either occur over areas of locally boggy, low-lying ground

with thick organic soil, or atop outcrop/subcrop with limited to no

till deposition. No trends are evident that would indicate

consistent individual sampler error in assessing a site for sample

suitability.

The performance of the OREAS 46 CRM is shown in

Figure 2. The majority of CRMs samples returned within +/- 2 SD for

both Au and pathfinders, and all returned within +/- 3 SD, except

for a singular sample in its Au result; J086980. With a Z-score of

8.99, and associated assay result of 0.0106 Au ppm (10.6 Au ppb),

this CRM sample return is outside of QAQC expectations as recorded

on the OREAS certificate for this material of 1.6 Au ppb. In

pathfinder elements, however, the assay results for this sample are

all within acceptable tolerances. A review of the assay certificate

for samples immediately preceding and succeeding this elevated Au

result did not indicate inter-sample contamination occurred during

laboratory sample preparation or analysis. Contrarily, samples

immediately succeeding this result are below the anomalous

threshold for Au. Consequently, the elevation in this CRM sample

has been attributed to heterogeneity within the CRM material

itself, and a batch re-run was not required

Figure 2. Shewhart Performance Chart for

OREAS 46, in elements Au, As, Cu, Mo, and W.

The technical information presented in this news

release has been reviewed and approved by Will Robinson, P.Geo.,

Vice President of Exploration for West Red Lake Gold and the

Qualified Person for exploration at the West Red Lake Project, as

defined by NI 43-101 “Standards of Disclosure for Mineral

Projects”.

GRANT OF COMPENSATION SECURITIES

The Company further announces the grant of stock options,

restricted share units (“RSUs”) and deferred share units (“DSUs”)

in accordance with the Company’s stock option plan, and its RSU,

PSU and DSU Compensation Plan.

Directors and Officers of the Company were granted an aggregate

of 2,971,500 stock options vesting over a three year period with

25% vesting in 3 months from the grant date and 25% vesting on the

first, second and third anniversary of the grant date at an

exercise price of $0.63 and will be exercisable for a 5 year period

from the date of grant.

In addition, 3,692,000 RSUs were granted to Officers of the

Company and 1,197,000 DSUs were granted to non-executive Directors.

The RSUs will vest over three years in three equal tranches on the

first, second and third anniversary of the grant date and DSUs will

vest on the first anniversary of the grant date.

The grant of Stock Options, RSUs and DSUs is subject to

regulatory acceptance of the TSX Venture Exchange.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral

exploration company that is publicly traded and focused on

advancing and developing its flagship Madsen Gold Mine and the

associated 47 km2 highly prospective land package in the Red Lake

district of Ontario. The highly productive Red Lake Gold District

of Northwest Ontario, Canada has yielded over 30 million ounces of

gold from high-grade zones and hosts some of the world's richest

gold deposits. WRLG also holds the wholly owned Rowan Property in

Red Lake, with an expansive property position covering 31 km2

including three past producing gold mines - Rowan, Mount Jamie, and

Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES

LTD.

“Shane Williams”

Shane WilliamsPresident & Chief Executive

Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen Preston

Vice President Communications

Tel: (604) 609-6132

Email: investors@wrgold.com or visit the Company’s website at

https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

CAUTIONARY STATEMENT AND FORWARD-LOOKING

INFORMATION

Certain statements contained in this news

release may constitute “forward-looking information” within the

meaning of applicable securities laws. Forward-looking information

generally can be identified by words such as “anticipate”,

“expect”, “estimate”, “forecast”, “planned”, and similar

expressions suggesting future outcomes or events. Forward-looking

information is based on current expectations of management;

however, it is subject to known and unknown risks, uncertainties

and other factors that may cause actual results to differ

materially from the forward-looking information in this news

release and include without limitation, statements relating to

the potential for mineralization in the Red Lake district, the

anticipated value of the dataset for advancing targets from the

Confederation Assemblage, the possibility of drilling in 2025, the

actual potential for discovery within the Confederation rocks, the

anticipated timing for completion of the follow-up detailed work at

the Faulkenham region and Killoran target, and all other plans for

the potential restart of mining operations at the Madsen

Mine, the potential of the Madsen Mine; any untapped growth

potential in the Madsen deposit or Rowan deposit; and the Company’s

future objectives and plans. Readers are cautioned not to place

undue reliance on forward-looking information.

Forward-looking information involve numerous

risks and uncertainties and actual results might differ materially

from results suggested in any forward-looking information. These

risks and uncertainties include, among other things, risks

associated with mineral exploration and development activities,

environmental risks, market volatility; the state of the financial

markets for the Company’s securities; fluctuations in commodity

prices; timing and results of the cleanup and recovery at the

Madsen Mine; and changes in the Company’s business plans.

Forward-looking information is based on a number of key

expectations and assumptions, including without limitation, that

the Company will continue with its stated business objectives and

its ability to raise additional capital to proceed. Although

management of the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such forward-looking

information will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

forward-looking information. Accordingly, readers should not place

undue reliance on forward-looking information. Readers are

cautioned that reliance on such information may not be appropriate

for other purposes. Additional information about risks and

uncertainties is contained in the Company’s management’s discussion

and analysis for the year ended November 30, 2023, and the

Company’s annual information form for the year ended November 30,

2023, copies of which are available on SEDAR+ at

www.sedarplus.ca.

The forward-looking information contained herein

is expressly qualified in its entirety by this cautionary

statement. Forward-looking information reflects management’s

current beliefs and is based on information currently available to

the Company. The forward-looking information is made as of the date

of this news release and the Company assumes no obligation to

update or revise such information to reflect new events or

circumstances, except as may be required by applicable law.

For more information on the Company, investors

should review the Company’s continuous disclosure filings that are

available on SEDAR+ at www.sedarplus.ca.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9790333f-5c2a-40b2-904f-5e81ecd885de

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ef6c97a1-06c8-4ef2-a8bb-b4496dac2eb9

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/04c1ec68-a1b5-43f3-a309-cdf2088b6479

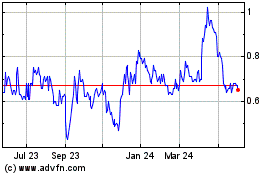

West Red Lake Gold Mines (TSXV:WRLG)

Historical Stock Chart

From Jan 2025 to Feb 2025

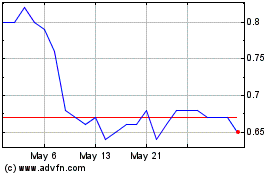

West Red Lake Gold Mines (TSXV:WRLG)

Historical Stock Chart

From Feb 2024 to Feb 2025