Vior Acquires Gold and Base Metal Property in the Chibougamau-Chapais Area

February 28 2008 - 10:04AM

Marketwired

QUEBEC CITY, QUEBEC (TSX VENTURE: VIO)(FRANKFURT: VL5) announces

the signature of an agreement with Mr. Robert Gagnon ("the vendor")

by which it can acquired a 100% interest in the Barlow gold and

base metal property located 20 kilometres northwest of Chapais in

the Chibougamau area, Province of Quebec.

The Property

The Barlow property comprises 58 claims covering a surface area

of approximately 2171 hectares (21.72 square kilometres) in the

northeast section of the Abitibi Greenstone Belt. The property is

easily accessed by forest roads.

The Chapais area hosted several major former producing mines

including the Springer Mine - 12.5 million tonnes at 2.56% Cu and

1.23 g/t Au, the Perry Mine - 9 million tonnes at 3.06% Cu, 0.48

g/t Au and 21.94 g/t Ag and the Robitaille Mine - 196,000 tonnes at

2.04% Cu and 0.53 g/t Au.

The Barlow property covers the Blondeau formation and the

Cummings complex within the Gilman formation. Several fault systems

running in east-west and northeast-southwest directions can also be

observed on the property.

Four VMS showings containing pyrite, pyrrhotite, chalcopyrite

and sphalerite have been recognized on the property which has

remained relatively unexplored until now. Drilling in 1953 returned

values of 1.4% Cu over 6 feet (1.85 metres) without gold assays

having been performed (GM 4430-B). Values also obtained by

Falconbridge, (6.8% Zn over 0.6 metre, 3.3% Cu over 0.3 metre, 2

g/t Au over 0.5 metre and 4 g/t Ag over 1.6 metres (GM

27518,29157,30626) tend to confirm the VMS potential of this

area.

The Barlow property is also adjacent and within the possible

extension of the Cuvier deposit, (non-compliant Ni 43-101 resources

of 370,000 tonnes at 4 g/t Au). Closely associated with a shear

zone, this small deposit is located within the basalt/gabbros of

the Gilman formation. This northwest-southeast structure appears to

continue on the Barlow property.

The property is also adjacent to the East and West Barlow

properties recently purchased by MDN Inc. from Diagnos Inc. These

properties were identified by Diagnos using its CARDS

(computer-aided resources detection software) technology, which

helps define targets based on an analysis of all mining data bases

available for a given area.

The Agreement

Under the terms of the agreement, Vior has the option to acquire

a 100% interest in the Barlow property upon fulfilling the

following conditions:

- A cash payment of $10,000 upon signing of the agreement and

further optional payments of $10,000 on the 12th and 24th month

following the signature of the agreement.

- The issuance of 50,000 common shares of Vior in favour of the

Vendor at the signature of the agreement; the optional issuance of

50,000 additional shares on the 12th month of the agreement and

100,000 additional shares on the 24th and 36th month following the

signature of the agreement for a total of 300,000 common

shares.

- Exploration expenditures of $40,000 during the first 12 months

of the agreement; additional expenditures of $40,000 during the

following 24 months and $10,000 during the following 36 months for

a total amount of $90,000.

- A 1% NSR royalty if the property is brought into commercial

production. One half of this royalty can be repurchased at any time

for $1 million.

This agreement is subject to the approval of the regulatory

authorities. The common shares issued under the terms of this

agreement are subject to a four-month hold period after the

signature of the agreement.

This press release was prepared by Denis Chenard, Eng. a

Qualified Person as defined by National Instrument 43-101.

Sale of Uranium South Properties

Vior also announces that in partnership with Virginia Mines Inc.

("Virginia"), it has entered into an agreement with Northfield

Metals Inc. ("Northfield"), pursuant to which Northfield acquired

100 per cent interest in 297 claims jointly owned by Vior and

Virginia in exchange for 500,000 common shares of Northfield

(250,000 to Vior and 250,000 to Virginia). The agreement is also

subject to a 2 per cent net smelter return (NSR) royalty of which 1

per cent is in favour of Vior. Northfield may buy back 0.5 per cent

of this 1 per cent NSR royalty for $500,000.

Profile

Vior is a growing mining company focused on acquiring and

developing high quality, low risk gold and base metal resource

prospects in accessible mining areas of Quebec. The Company wholly

owns the Douay gold project on which an NI 43-101 compliant

independent resource evaluation was recently completed (See press

release dated November 7, 2007). Vior is aggressively pursuing

opportunities to develop working interests in mineral properties

that offer significant upside exploration potential. Vale Inco

Limited is the largest shareholder of Vior with an 11%

interest.

Sedar: Societe d'exploration miniere Vior inc.

The TSX Venture Exchange (TSX Venture) does not accept

responsibility for the adequacy or accuracy of this Press

Release.

Contacts: Vior Inc. Patrick Bradley President 514-235-1409

pbradley@vior.ca Vior Inc. Denis Chenard, P. Eng. Director,

Exploration 819-856-9743 datac.geo@tlb.sympatico.ca

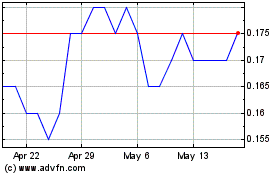

Vior (TSXV:VIO)

Historical Stock Chart

From Jun 2024 to Jul 2024

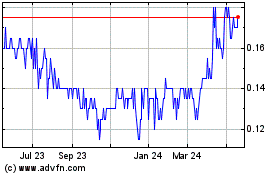

Vior (TSXV:VIO)

Historical Stock Chart

From Jul 2023 to Jul 2024