Till Capital Receives $96,000 CDN From Sale of Golden Predator Mining Shares

November 11 2015 - 9:00AM

Till Capital

Ltd. (Nasdaq:TIL) (TSX-V:TIL) (the

"

Company" or "

Till"), a Bermuda

domiciled company reports that William Sheriff has exercised his

option to purchase 800,000 shares of Golden Predator Mining Corp.

(TSX-V:GPY) ("

Golden Predator") held by the

Company at an exercise price of $0.12 CDN per share.

Under the terms of the separation agreement announced on

September 2, 2015, Mr. Sheriff was granted two assignable options,

each with a term of 18 months, to purchase the balance of the

Company's 11,812,154 Golden Predator shares. The first option

is to purchase up to 5,500,000 of the Company's Golden Predator

shares according to a staggered schedule priced as follows: a) if

exercised by September 30, 2015, at $0.11 CDN per share b) if

exercised by October 31, 2015 at $0.12 CDN per share, c) if

exercised by November 30, 2015, at $0.13 CDN per share, d) if

exercised by December 23, 2015, at $0.14 CDN per share, e) if

exercised after December 23, 2015, at $0.15 CDN per share.

The second option is the purchase of up to 6,312,154 of the

Company's Golden Predator shares at $0.15 CDN per share.

Following this transaction, Mr. Sheriff has purchased a total of

1,300,000 Golden Predator shares from Till. The first

transaction was completed on September 30, 2015 for 500,000 shares

at an exercise price of $0.11 CDN per share.

Reported by:

John T. Rickard Director

(208) 635-5415

Till Capital Ltd.

Till Capital Ltd. is a Bermuda-domiciled company with two

wholly-owned subsidiaries, Omega Insurance Holdings Inc. and

Resource Re Ltd. Omega Insurance Holdings Inc. owns Omega

General Insurance Company, a Canadian insurance company offering

innovative and customized insurance industry solutions, including

fronting and run-off services for insurers/reinsurers, within the

Canadian marketplace. Omega Insurance Holdings Inc. also

operates Focus Group Inc., a consulting and project management

company servicing the local and international needs of its Property

Casualty Insurance clients. Resource Re Ltd. is a Bermuda-domiciled

reinsurance company regulated by the Bermuda Monetary Authority

with a Class 3A insurance license directed to underwrite

reinsurance policies within a long term investment strategy.

Through its regulated subsidiaries, the Company has been structured

to produce underwriting profits as well as above average returns on

assets under management.

For additional information:

Till Capital Ltd. Monique

Hayes (208) 699-6097 info@tillcap.com

www.tillcap.com

Cautionary Note

At this time, the Company has no current plans to provide

earnings guidance due to the volatility of investment returns.

The Till Capital shares are restricted voting shares, whereby no

single shareholder of Till Capital is able to exercise voting

rights for more than 9.9% of the voting rights of the total issued

and outstanding Till Capital shares (the "9.9%

Restriction"). However, if any one shareholder of Till

Capital beneficially owns, or exercises control or direction over,

more than 50% of the issued and outstanding Till Capital shares,

the 9.9% Restriction will cease to apply to the Till Capital

shares.

This news release shall not constitute an offer to sell or a

solicitation of an offer to buy any securities of Till Capital or

any other securities, and shall not constitute an offer,

solicitation or sale in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful. Trading in the

securities of Till Capital should be considered speculative.

Neither the TSX Venture Exchange nor its Regulatory Service

Provider (as that term is defined in the policies of the TSX

Venture Exchange) nor the Bermuda Monetary Authority accepts

responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward Looking

Information

Except for statements of historical fact, this news release

contains certain "forward-looking information" within the meaning

of applicable securities laws. These forward-looking statements are

intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995, and

generally can be identified by phrases such as "plan", "except",

"project", "intend", "believe", "anticipate", "estimate", "will",

"could" and other similar words, or statements that certain events

or conditions "may" occur. Such forward-looking

statements are subject to risks and uncertainties that may cause

actual results, performance or developments to differ materially

from those contained in the statements. These and all subsequent

written and oral forward-looking information are based on estimates

and opinions of management on the dates they are made and are

expressly qualified in their entirety by this notice. Except as

required by law, Till Capital assumes no obligation to update

forward-looking information should circumstances or management's

estimates or opinions change.

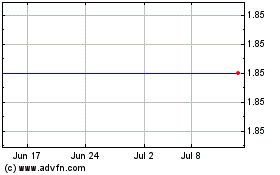

Till Capital (TSXV:TIL)

Historical Stock Chart

From Feb 2025 to Mar 2025

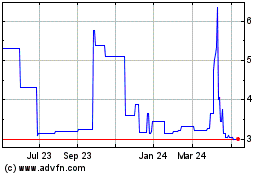

Till Capital (TSXV:TIL)

Historical Stock Chart

From Mar 2024 to Mar 2025