Triumph Gold Corp., (TSX-V: TIG) (OTCMKTS: TIGCF) (“

Triumph

Gold” or the “

Company”) is pleased to

release updated mineral resource estimates for the three deposits

(Nucleus, Revenue and Tinta) on the Company’s 100% owned, 200 km2,

road accessible Freegold Mountain Property in the Yukon Territory.

The new mineral resource estimates were

generated by Robert Sim (P.Geo.) of SIM Geological Inc., an

independent qualified person and resource expert with over thirty

five years of experience. A new NI43-101 technical report will be

available on SEDAR within 45 days. The new mineral resource

estimates are effective as of February 11, 2020 and supersede the

previous mineral resource estimate (Campbell et. al, 2015.

Technical report on the Freegold Mountain Project, Yukon Canada

Resource Estimates), which is available on SEDAR.

Triumph Gold President, Tony Barresi (Ph.D.,

P.Geo.), comments: “We are pleased to present three pit-constrained

resources, two of which also have high-grade underground resources.

The new pit constraint, and other stringent economic parameters

applied to the three resource estimates demonstrate that the

mineral deposits exhibit reasonable prospects for eventual economic

extraction as required under NI 43-101. Since 2016 Triumph has been

dedicated to bringing shareholder value by first focusing on

grassroots exploration with resource definition to follow. This

effort resulted in a number of new discoveries, including the

high-grade Blue Sky Porphyry Breccia, and the WAu Breccia, both

located within the Revenue deposit. While our attention will remain

on discovery-focused exploration in the near term, we are pleased

to provide updated mineral resource estimates that we believe

accurately assess the resources identified to date, which are

contained on our 100% owned Freegold Mountain Property.”

Technical Highlights of Freegold

Mountain Property Mineral Deposits:

- Three deposits (Figure 1) host

open-pit constrained mineral resources, two of which also include

deeper, high-grade, additional mineral resources that are

considered amenable to underground extraction methods.

- Combined Indicated Mineral

Resources from Revenue and Nucleus deposits total 42.4 million

tonnes at 0.58 grams per tonne (g/t) gold (Au), 0.08% copper (Cu)

and 1.2 g/t silver (Ag) for a total of 1 million contained gold

equivalent (AuEq) ounces (oz). Combined Inferred Mineral Resources

at Revenue, Nucleus and Tinta total 39 million tonnes at 0.56 g/t

gold, 0.10% copper and 4.5 g/t silver for a total of 1.1 million

contained gold equivalent ounces (see Tables 1,2, and 3 for

details).

- Higher grade (>1.4 g/t AuEq)

mineralization from the newly discovered Blue Sky Porphyry Breccia

is now included in an underground portion of the Revenue

resource.

- Inclusion of tungsten (W) in the

estimate of mineral resources at the Revenue deposit.

Triumph Gold’s Freegold Mountain Property hosts

three road-accessible mineral deposits (Figure 1). Changes from the

2015 mineral resource estimates, which were unconstrained, are the

result of a combination of new drilling and the application of

updated technical and economic parameters. The new estimates are

either constrained within pit shells or, in the case of underground

mineral resources, show favourable geometry and continuity of grade

and thickness so as to exhibit reasonable prospects for eventual

economic extraction.

TABLE 1: ESTIMATE OF MINERAL RESOURCE FOR THE NUCLEUS

DEPOSIT

|

Class |

Tonnes (million) |

Average Grade |

Contained Metal |

|

AuEq(g/t) |

Au

(g/t) |

Cu (%) |

Ag (g/t) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

|

Indicated |

31.0 |

0.75 |

0.65 |

0.07 |

0.70 |

748 |

651 |

44 |

698 |

|

Inferred |

9.4 |

0.63 |

0.56 |

0.04 |

0.72 |

189 |

169 |

9 |

217 |

Note: 0.30 g/t AuEq cut-off grade for

pit constrained resources. Koz = thousands of ounces; Mlbs –

millions of pounds

TABLE 2: ESTIMATE OF MINERAL RESOURCES FOR THE REVENUE

DEPOSIT

|

Type |

Tonnes (million) |

Average Grade |

Contained Metal |

|

AuEq(g/t) |

Au

(g/t) |

Cu

(%) |

Ag (g/t) |

Mo(%) |

W(%) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

Moklbs |

Wklbs |

|

Indicated |

|

Pit Constrained |

11.4 |

0.69 |

0.38 |

0.12 |

2.4 |

0.016 |

0.008 |

252 |

140 |

30 |

895 |

4089 |

2082 |

|

Inferred |

|

Pit Constrained |

25.0 |

0.70 |

0.46 |

0.11 |

2.2 |

0.009 |

0.005 |

565 |

367 |

61 |

1786 |

4954 |

2807 |

|

Underground |

2.5 |

1.40 |

0.99 |

0.22 |

5.2 |

0.010 |

0.001 |

112 |

79 |

12 |

417 |

525 |

60 |

|

Combined Inferred |

27.5 |

0.77 |

0.51 |

0.12 |

2.5 |

0.009 |

0.005 |

677 |

446 |

73 |

2203 |

5478 |

2867 |

Note: 0.30 g/t AuEq cut-off grade for pit constrained

resources and 1.0g/tAuEq cut-off grade for underground resources.

Mo = Molybdenum

TABLE 3: ESTIMATE OF INFERRED MINERAL

RESOURCE AT THE TINTA DEPOSIT

|

Type |

Tonnes (000) |

Average grade: |

Contained Metal: |

|

AuEq(g/t) |

Au(g/t) |

Cu(%) |

Ag (g/t) |

Pb(%) |

Zn(%) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

Pb Mlbs |

ZnMlbs |

|

Pit Constrained |

908 |

3.01 |

1.09 |

0.18 |

42.5 |

0.72 |

1.47 |

88 |

32 |

4 |

1240 |

14 |

29 |

|

Underground |

1313 |

3.13 |

1.43 |

0.16 |

46.3 |

0.56 |

1.17 |

132 |

60 |

5 |

1955 |

16 |

34 |

|

Combined |

2221 |

3.08 |

1.29 |

0.17 |

44.7 |

0.63 |

1.29 |

220 |

92 |

8 |

3195 |

31 |

63 |

Note: 0.35 g/t AuEq cut-off grade for pit constrained

resources and 1.8 g/t AuEq cut-off for underground

resources.

TABLE 4: COMBINED ESTIMATE OF MINERAL

RESOURCES ON THE FREEGOLD MOUNTAIN PROPERTY

|

Deposit |

Tonnes(million) |

Average Grade |

Contained Metal |

Comments |

|

AuEq (g/t) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

Mo (%) |

W (%) |

Pb (%) |

Zn (%) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

Mo(klbs) |

W(klbs) |

Pb Mlbs |

ZnMlbs |

|

Indicated |

|

Nucleus |

31.0 |

0.75 |

0.65 |

0.07 |

0.7 |

n/a |

n/a |

n/a |

n/a |

748 |

651 |

44 |

698 |

n/a |

n/a |

n/a |

n/a |

Pit resources 0.3 g/tAuEq cut-off grade |

|

Revenue |

11.4 |

0.69 |

0.38 |

0.12 |

2.4 |

0.016 |

0.008 |

n/a |

n/a |

252 |

140 |

30 |

895 |

4089 |

2082 |

n/a |

n/a |

Pit resources 0.3 g/tAuEq cut-off grade |

|

Total Indicated |

42.4 |

0.73 |

0.58 |

0.08 |

1.2 |

|

|

|

|

1000 |

791 |

74 |

1593 |

4089 |

2082 |

|

|

|

|

Inferred |

|

Nucleus |

9.4 |

0.63 |

0.56 |

0.04 |

0.7 |

n/a |

n/a |

n/a |

n/a |

189 |

169 |

9 |

217 |

n/a |

n/a |

n/a |

n/a |

Pit resources 0.3 g/tAuEq cut-off grade |

|

Revenue |

27.5 |

0.77 |

0.51 |

0.12 |

2.5 |

0.009 |

0.005 |

n/a |

n/a |

677 |

446 |

73 |

2203 |

5478 |

2867 |

n/a |

n/a |

Pit resources 0.3 g/tAuEq cut-off grade and U/G resources at 1.0

g/tAuEq cut-off grade. |

|

Tinta |

2.2 |

3.08 |

1.29 |

0.17 |

44.7 |

n/a |

n/a |

0.63 |

1.29 |

220 |

92 |

8 |

3195 |

n/a |

n/a |

31 |

63 |

Pit resources 0.35 g/tAuEq cut-off grade and U/G resources at 1.8

g/tAuEq cut-off grade. |

|

Total Inferred |

39.0 |

0.86 |

0.56 |

0.10 |

4.5 |

|

|

|

|

1085 |

707 |

90 |

5614 |

5499 |

3094 |

31 |

63 |

|

Note: U/G = underground; n/a = non applicable

Nucleus

The Nucleus deposit is an epithermal style

gold-silver-copper deposit. Indicated mineral resources at Nucleus

include 31 M tonnes at 0.65 g/t Au, 0.7 g/t Ag and 0.07% Cu using a

0.3 g/t AuEq cut-off grade. Inferred mineral resources at Nucleus

include 9.4 M tonnes at 0.56 g/t Au, 0.7 g/t Ag and 0.04% Cu. The

Nucleus deposit is open to the south and at depth.

The Nucleus deposit has been tested with a total

of 359 drill holes with a cumulative length of 60,061m. The mineral

resource estimate was generated using drill hole sample assay

results and the interpretation of a geological model which relates

to the spatial distribution of gold, copper and silver.

Interpolation characteristics are defined based on the geology,

drill hole spacing, and geostatistical analysis of the data. The

effects of potentially anomalous high-grade sample data, composited

to 1.5 metre intervals, are controlled using both traditional

top-cutting as well as limiting the distance of influence during

block grade interpolation. Block grades are estimated into a

three-dimensional block model with nominal block size measuring

10x10x5m (LengthxWidthxHeight), using ordinary kriging and have

been validated using a combination of visual and statistical

methods. Resources in the indicated category are delineated by

drilling spaced at maximum 50 metre intervals. Resources in the

inferred mineral category are within a maximum distance of 150

metres from a drill hole. The estimate of the indicated and

inferred mineral resources is constrained within a limiting

pit-shell derived using projected technical and economic

parameters*. The cut-off grade of the base case estimate of mineral

resource is projected to be 0.30 g/t AuEq, calculated using the

formula AuEq=Au g/t + (Ag g/t x 0.012) + (Cu% x 1.371). The

sensitivity of the Nucleus mineral resource to cut-off grade,

constrained by the $1500/oz gold pit shell, is shown in Tables 5

and 6.

TABLE 5: SENSITIVITY OF INDICATED MINERAL RESOURCE TO

CUT-OFF GRADE FOR THE NUCLEUS DEPOSIT

|

Cut-off Grade AuEq

(g/t) |

Tonnes (million) |

Average Grade |

Contained Metal |

|

AuEq(g/t) |

Au

(g/t) |

Cu (%) |

Ag (g/t) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

|

0.2 |

39.5 |

0.64 |

0.55 |

0.06 |

0.64 |

815 |

701 |

52 |

812 |

|

0.3 base case |

31.0 |

0.75 |

0.65 |

0.07 |

0.70 |

748 |

651 |

44 |

698 |

|

0.4 |

23.2 |

0.88 |

0.78 |

0.07 |

0.75 |

661 |

583 |

35 |

560 |

|

0.5 |

17.0 |

1.04 |

0.93 |

0.07 |

0.82 |

571 |

510 |

28 |

448 |

Notes: Resources constrained within $1500/ozAu

pit shell. Base case cut-off grade is 0.30 g/t AuEq for

pit constrained resources.

TABLE 6: SENSITIVITY OF INFERRED MINERAL RESOURCE TO

CUT-OFF GRADE FOR THE NUCLEUS DEPOSIT

|

Cut-off Grade AuEq

(g/t) |

Tonnes (million) |

Average Grade |

Contained Metal |

|

AuEq(g/t) |

Au

(g/t) |

Cu (%) |

Ag (g/t) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

|

0.2 |

11.5 |

0.56 |

0.50 |

0.04 |

0.66 |

206 |

183 |

10 |

243 |

|

0.3 base case |

9.4 |

0.63 |

0.56 |

0.04 |

0.72 |

189 |

169 |

9 |

217 |

|

0.4 |

6.5 |

0.75 |

0.67 |

0.05 |

0.82 |

156 |

141 |

7 |

171 |

|

0.5 |

4.4 |

0.89 |

0.81 |

0.05 |

0.91 |

126 |

115 |

5 |

128 |

Note: Resources constrained within $1500/ozAu

pit shell. Base case cut-off grade is 0.30 g/t AuEq for

pit constrained resources. Revenue

Revenue is a

gold-silver-copper-molybdenum-tungsten deposit located

approximately 4 km to the southeast of the Nucleus deposit. The new

mineral resource estimate for Revenue improves upon the previous

(2015) estimate with:

1) New drilling that

has better delineated the higher grade WAu Breccia domain2)

Expansion of the resource to the northeast to include higher grade

mineralization at the newly discovered Blue Sky Porphyry Breccia3)

Inclusion of a >300 metre deep high grade (e.g. 1.4 g/t AuEq)

portion of the Blue Sky Porphyry Breccia in an underground

resource4) Upgrading a portion of the resource into an indicated

category5) Inclusion of tungsten in the resource estimate

Indicated mineral resources at Revenue include

11.4 M tonnes at 0.38 g/t Au, 2.4 g/t Ag, 0.12% Cu, 0.016% Mo and

0.008% W. Combined open-pit constrained and underground inferred

resources at Revenue include 27.5 M tonnes at 0.51 g/t Au, 2.5 g/t

Ag, 0.12% Cu, 0.009% Mo, and 0.005% W. Some of the known zones of

mineralization at Revenue remain open in multiple directions and to

depth; for example, the Blue Sky Porphyry Breccia is open to the

east, west and to depth, and the WAu breccia is open to depth.

Triumph Gold believes there is significant potential in the

immediate vicinity of Revenue for new discoveries.

The Revenue deposit has been tested with a total

of 324 drill holes with a cumulative length of 55,100m. The mineral

resource estimate was generated using drill hole sample assay

results and the interpretation of a geological model which relates

to the spatial distribution of gold, copper, silver, molybdenum and

tungsten. Interpolation characteristics are defined based on the

geology, drill hole spacing, and geostatistical analysis of the

data. The effects of potentially anomalous high-grade sample data,

composited to 1.5 metre intervals, are controlled using both

traditional top-cutting as well as limiting the distance of

influence during block grade interpolation. Block grades are

estimated into the three-dimensional block model with nominal block

size measuring 10x10x5m (LengthxWidthxHeight), using ordinary

kriging and have been validated using a combination of visual and

statistical methods. Resources in the indicated category are

delineated by drilling spaced at maximum 50 metre intervals.

Resources in the inferred mineral category are within a maximum

distance of 150 metres from a drill hole. The estimate of the

indicated and inferred mineral resources is constrained within a

limiting pit shell derived using projected technical and economic

parameters*. The base case cut-off grade of the estimate of open

pit constrained mineral resources is projected to be 0.30 g/t AuEq

calculated using the formula AuEq = Au g/t + (Ag g/t

x 0.012) + (Cu% x 1.371) + (Mo% x 4.114) + (W% x 5.942). Resources

below the pit shell that are considered potentially amenable to

bulk underground extraction methods are estimated at a cut-off

grade of 1g/t AuEq. The sensitivity of the Revenue mineral

resources to cut-off grade is shown in Tables 7, 8 and 9.

TABLE 7: SENSITIVITY OF PIT CONSTRAINED INDICATED

MINERAL RESOURCES TO CUT-OFF GRADE FOR THE REVENUE

DEPOSIT

|

Cut-Off Grade AuEq

(g/t) |

Tonnes (million) |

Average Grade |

Contained Metal |

|

AuEq(g/t) |

Au

(g/t) |

Cu

(%) |

Ag (g/t) |

Mo(%) |

W(%) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

Moklbs |

Wklbs |

|

0.2 |

12.6 |

0.65 |

0.36 |

0.11 |

2.3 |

0.015 |

0.008 |

262 |

145 |

31 |

928 |

4197 |

2196 |

|

0.3 base case |

11.4 |

0.69 |

0.38 |

0.12 |

2.4 |

0.016 |

0.008 |

252 |

140 |

30 |

895 |

4089 |

2082 |

|

0.4 |

9.2 |

0.77 |

0.43 |

0.13 |

2.7 |

0.019 |

0.009 |

228 |

127 |

26 |

809 |

3754 |

1907 |

|

0.5 |

7.1 |

0.87 |

0.48 |

0.14 |

3.1 |

0.021 |

0.011 |

197 |

110 |

22 |

701 |

3282 |

1704 |

Notes: Resources constrained within $1500/ozAu

pit shell. Base case cut-off grade is 0.30 g/t AuEq for

pit constrained resources.

TABLE 8: SENSITIVITY OF PIT CONSTRAINED INFERRED MINERAL

RESOURCES TO CUT-OFF GRADE FOR THE REVENUE DEPOSIT

|

Cut-Off Grade AuEq

(g/t) |

Tonnes (million) |

Average Grade |

Contained Metal |

|

AuEq(g/t) |

Au

(g/t) |

Cu

(%) |

Ag (g/t) |

Mo(%) |

W(%) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

MoMlbs |

WMlbs |

|

0.2 |

36.1 |

0.56 |

0.36 |

0.09 |

1.8 |

0.007 |

0.004 |

653 |

419 |

72.4 |

2049 |

5807 |

3420 |

|

0.3 base case |

25.0 |

0.70 |

0.46 |

0.11 |

2.2 |

0.009 |

0.005 |

565 |

367 |

61.1 |

1786 |

4954 |

2807 |

|

0.4 |

17.2 |

0.86 |

0.57 |

0.13 |

2.7 |

0.010 |

0.006 |

479 |

318 |

50.1 |

1516 |

3836 |

2203 |

|

0.5 |

13.2 |

0.99 |

0.67 |

0.15 |

3.1 |

0.011 |

0.006 |

422 |

285 |

43.4 |

1314 |

3176 |

1807 |

Notes: Resources constrained within $1500/ozAu

pit shell. Base case cut-off grade is 0.30 g/t AuEq for

pit constrained resources.

TABLE 9: SENSITIVITY OF UNDERGROUND INFERRED MINERAL

RESOURCES TO CUT-OFF GRADE FOR THE REVENUE DEPOSIT

|

Cut-Off Grade AuEq

(g/t) |

Tonnes (million) |

Average Grade |

Contained Metal |

|

AuEq(g/t) |

Au

(g/t) |

Cu

(%) |

Ag (g/t) |

Mo(%) |

W(%) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

Moklbs |

Wklbs |

|

0.8 |

3.0 |

1.32 |

0.92 |

0.22 |

5.0 |

0.010 |

0.001 |

126 |

88 |

14 |

479 |

626 |

72 |

|

1.0 base case |

2.5 |

1.40 |

0.99 |

0.22 |

5.2 |

0.010 |

0.001 |

112 |

79 |

12 |

417 |

525 |

60 |

|

1.2 |

1.8 |

1.53 |

1.09 |

0.24 |

5.6 |

0.010 |

0.001 |

86 |

61 |

9 |

313 |

367 |

43 |

|

1.4 |

1.1 |

1.66 |

1.20 |

0.25 |

6.0 |

0.009 |

0.001 |

60 |

43 |

6 |

215 |

225 |

27 |

|

1.6 |

0.6 |

1.81 |

1.34 |

0.26 |

6.4 |

0.009 |

0.001 |

34 |

25 |

3 |

118 |

108 |

14 |

|

1.8 |

0.2 |

1.99 |

1.51 |

0.27 |

7.2 |

0.007 |

0.001 |

15 |

12 |

1.4 |

56 |

36 |

6 |

Tinta

Tinta is a vein-hosted

gold-silver-copper-lead-zinc deposit located on the southern

portion of Triumph Gold’s Freegold Mountain property that extends

to depths approaching 400m below surface. Combined open-pit

constrained and underground inferred resources at Tinta include 2.2

M tonnes at 1.29 g/t Au, 44.7 g/t Ag, 0.17% Cu, 0.63% Pb and 1.29%

Zn. The Tinta deposit remains open at depth where a number of

gold-rich drill intersections have not yet been followed up on with

additional drilling. Grassroots exploration along strike to the

northwest of the Tinta vein identified a 1.8 km long coincident

soil geochemistry and geophysical anomaly. Seven trenches across

the anomaly exposed quartz veins with precious and base metal

mineralization similar to the Tinta vein.

The Tinta deposit has been tested with a total

of 74 drill holes with a cumulative length of 10,063m plus a total

of 450m of underground drifting in two locations. The mineral

resource estimate was generated using drill hole and drift channel

sample assay results and the interpretation of a geological model

which relates to the spatial distribution of gold, copper, silver,

lead and zinc. Interpolation characteristics are defined based on

the geology, drill hole spacing, and geostatistical analysis of the

data. The effects of potentially anomalous high-grade sample data,

composited to 1 metre intervals, are controlled by limiting the

distance of influence during block grade interpolation. Block

grades are estimated into the three-dimensional block model with

nominal block size measuring 2x5x5m. The block model is rotated so

the short axis (2m blocks) are perpendicular to the strike of the

deposit at an azimuth of 305 degrees and the larger block

dimensions are oriented along strike and in the vertical dimension.

Grade estimates are made using ordinary kriging and have been

validated using a combination of visual and statistical methods.

Resources in the inferred category are within a maximum distance of

50m from drilling or underground channel samples. The base case

cut-off grade of the open pit constrained mineral resource is

projected to be 0.35 g/t AuEq calculated using the formula

AuEq = Au g/t + (Ag g/t x 0.012) + (Cu% x 1.371) +

(Pb% x 0.457) + (Zn% x 0.571). Resources below the pit shell that

are considered potentially amenable to underground extraction

methods are estimated at a cut-off grade of 1.8 g/t AuEq. The

sensitivity of the Tinta mineral resources to cut-off grade is

shown in Tables 10 and 11.

TABLE 10: SENSITIVITY OF PIT CONSTRAINED INFERRED

MINERAL RESOURCES TO CUT-OFF GRADE AT THE TINTA

DEPOSIT

|

Cut-Off Grade AuEq

(g/t) |

Tonnes (000) |

Average grade: |

Contained Metal: |

|

AuEq(g/t) |

Au(g/t) |

Cu(%) |

Ag (g/t) |

Pb(%) |

Zn(%) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

Pb Mlbs |

ZnMlbs |

|

0.25 |

919 |

2.98 |

1.07 |

0.18 |

42.0 |

0.71 |

1.45 |

88 |

32 |

3.6 |

1241 |

14 |

29 |

|

0.3 |

913 |

2.99 |

1.08 |

0.18 |

42.2 |

0.72 |

1.46 |

88 |

32 |

3.6 |

1240 |

14 |

29 |

|

0.35 Base Case |

908 |

3.01 |

1.09 |

0.18 |

42.5 |

0.72 |

1.47 |

88 |

32 |

3.6 |

1240 |

14 |

29 |

|

0.4 |

906 |

3.01 |

1.09 |

0.18 |

42.6 |

0.72 |

1.47 |

88 |

32 |

3.6 |

1240 |

14 |

29 |

|

0.45 |

901 |

3.03 |

1.09 |

0.18 |

42.8 |

0.73 |

1.48 |

88 |

32 |

3.6 |

1239 |

14 |

29 |

|

0.5 |

893 |

3.05 |

1.10 |

0.18 |

43.1 |

0.73 |

1.49 |

88 |

32 |

3.5 |

1238 |

14 |

29 |

Note: Resources constrained within $1500/ozAu

pit shell.

TABLE 11: SENSITIVITY OF UNDERGROUND INFERRED MINERAL

RESOURCES TO CUT-OFF GRADE AT THE TINTA DEPOSIT

|

Cut-Off Grade AuEq

(g/t) |

Tonnes (000) |

Average grade: |

Contained Metal: |

|

AuEq(g/t) |

Au(g/t) |

Cu(%) |

Ag (g/t) |

Pb(%) |

Zn(%) |

AuEq koz |

Au koz |

Cu Mlbs |

Ag koz |

Pb Mlbs |

ZnMlbs |

|

1.4 |

1,646 |

2.82 |

1.26 |

0.15 |

41.7 |

0.53 |

1.07 |

149 |

67 |

5.4 |

2204 |

19 |

39 |

|

1.6 |

1,466 |

2.98 |

1.35 |

0.16 |

44.1 |

0.55 |

1.12 |

140 |

64 |

5.0 |

2080 |

18 |

36 |

|

1.8 Base Case |

1,313 |

3.13 |

1.43 |

0.16 |

46.3 |

0.56 |

1.17 |

132 |

60 |

4.7 |

1955 |

16 |

34 |

|

2 |

1,177 |

3.27 |

1.49 |

0.17 |

48.5 |

0.58 |

1.23 |

124 |

57 |

4.3 |

1836 |

15 |

32 |

|

2.2 |

1,048 |

3.42 |

1.56 |

0.17 |

50.7 |

0.61 |

1.30 |

115 |

52 |

3.9 |

1709 |

14 |

30 |

|

2.4 |

905 |

3.59 |

1.63 |

0.18 |

53.8 |

0.64 |

1.37 |

104 |

47 |

3.5 |

1564 |

13 |

27 |

Note: Resources constrained below the $1500/ozAu

pit shell.

Notes* The economic viability

of the mineral resources at the Freegold property were tested by

constraining them within a floating cone pit shells, or evaluating

the viability of possible underground extraction using the

following technical and economic parameters:

|

• |

Mining Cost (open pit) |

$2.50/t |

|

• |

Mining Cost (underground) |

$25/t at Revenue, $60/t at Tinta |

|

• |

Process |

$11/t at Nucleus and Revenue, $12/t at Tinta |

|

• |

G&A |

$1.50/t at Nucleus and Revenue, $2.50/t at Tinta |

|

• |

Gold Price |

$1,500/oz |

|

• |

Silver Price |

$18/oz |

|

• |

Copper Price |

$3.00/lb |

|

• |

Lead Price |

$1.00/lb |

|

• |

Zinc Price |

$1.25/lb |

|

• |

Molybdenum price |

$9.00/lb |

|

• |

Tungsten price |

$13.00/lb |

|

• |

Gold Process Recovery |

85% |

|

• |

Silver Process Recovery |

60% |

|

• |

Copper Process Recovery |

75% (80% at Tinta) |

|

• |

Lead Process Recovery |

75% (Tinta only) |

|

• |

Zinc Process Recovery |

75% (Tinta Only) |

|

• |

Mo Process Recovery |

50% (Revenue Only) |

|

• |

Tungsten Process Recovery |

50% (Revenue Only) |

|

• |

Pit Slope |

45 degrees |

There are no adjustments for mining recoveries

or dilution. The open pit testing indicates that some of the deeper

mineralization may not be economic due to the increased waste

stripping requirements. Underground mineral resources exhibit

continuity of thickness and grade and are considered to exhibit

reasonable prospects for eventual economic extraction using

underground extraction methods at the projected cut-off grades. It

is important to recognize that these discussions of surface and

underground mining parameters are used solely to test the

“reasonable prospects for eventual economic extraction,” and that

they do not represent an attempt to estimate mineral reserves.

There are no mineral reserves calculated for this Project. These

preliminary evaluations are used to prepare the mineral resource

estimates and to select appropriate reporting assumptions.

Quality Assurance

All Triumph’s sample assay results have been

independently monitored through a quality control / quality

assurance (“QA/QC”) program that includes the insertion of blind

standards, blanks and pulp and reject duplicate samples. Logging

and sampling are completed at Triumph’s secure facility located at

the Freegold project. Predominately NTW and HTW sized drill core is

sawn in half on site and half drill-core samples are securely

transported to prep laboratories in Whitehorse for crushing and

pulverizing and then to geochemical laboratories located in

Vancouver, Canada for analysis. Gold content is determined by fire

assay of a 30 gram charge and the additional elements are

determined by four-acid, or historically aqua regia, digestion with

ICP finish. ALS and SGS Labs have been used and both are

independent from Triumph.

Triumph is not aware of any drilling, sampling, recovery or

other factors that could materially affect the accuracy or

reliability of the data referred to herein.

Qualified Persons

Robert Sim, P.Geo., a Qualified Person as

defined by NI 43-101, is responsible for the estimate of mineral

resources presented in this news release and has reviewed, verified

and approved the contents of this news release as they relate to

the mineral resource estimate, including the sampling, analytical,

and test data underlying the mineral resource estimate. Mr. Sim is

independent from Triumph and confirms there were no limitations

from the company in verifying the drilling and sample data with

site visit observations and monitoring of the QAQC program.

Tony Barresi, Ph.D., P.Geo., President of the

Company, and qualified person as defined by NI 43-101 for the

Freegold Mountain project has reviewed, verified and approved the

contents of this news release as they relate to the ongoing

exploration and development program at the Freegold Mountain

project.

About Triumph Gold Corp.Triumph

Gold Corp. is a growth oriented Canadian-based precious metals

exploration and development company. Triumph Gold Corp. is focused

on creating value through the advancement of the district scale

Freegold Mountain Project in Yukon. For maps and more information,

please visit our website www.triumphgoldcorp.com

On behalf of the Board of

Directors Signed "Tony Barresi" Tony Barresi,

President

| For further information

please contact: John Anderson, Executive ChairmanTriumph

Gold Corp. (604) 218-7400 janderson@triumphgoldcorp.com |

Nancy Massicotte IR Pro

Communications Inc. (604)-507-3377

nancy@irprocommunications.com |

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

This news release contains forward-looking

information, which involves known and unknown risks, uncertainties

and other factors that may cause actual events to differ materially

from current expectations. Important factors - including the

availability of funds, the results of financing efforts, the

completion of due diligence and the results of exploration

activities - that could cause actual results to differ materially

from the Company's expectations are disclosed in the Company's

documents filed from time to time on SEDAR (see www.sedar.com).

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company disclaims any intention or obligation,

except to the extent required by law, to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

A photo accompanying this announcement is available

at: https://www.globenewswire.com/NewsRoom/AttachmentNg/09f34c67-f8c9-419c-9478-d89d003cce5e

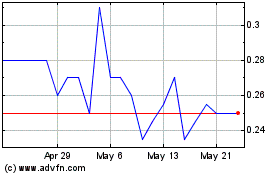

Triumph Gold (TSXV:TIG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Triumph Gold (TSXV:TIG)

Historical Stock Chart

From Dec 2023 to Dec 2024