NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE

SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

Triumph Gold Corp. ("Triumph Gold" or the “Company”) (TSX Venture

Exchange: TIG) (OTCMKTS: TIGCF) (Frankfurt: 8N61) is pleased

to announce its intention to complete a non-brokered private

placement (the "Offering") of up to 17,000,000 units (the "Units")

at a price of CDN$0.35 per Unit for gross proceeds of up to

CDN$5,950,000. Each Unit will consist of one common share in the

capital of the Company (a “Share”) and one-half of one common share

purchase warrant (each whole common share purchase warrant, a

“Warrant”). Each whole Warrant will be exercisable to acquire one

Share at an exercise price of CDN$0.60 per Share for a period of 24

months from the date of issuance.

The Offering is available to investors in

reliance on certain prospectus exemptions including to existing

shareholders of the Company (the "Existing Security Holder

Exemption") and to investors who have received investment advice

(the "Investment Dealer Exemption"). The Existing Security Holder

Exemption is available in each of the provinces and territories of

Canada to a person or company who became a shareholder of the

Company on or before April 9, 2019 (the “Record Date”). To rely

upon the Existing Security Holder Exemption, the shareholder must:

(a) have been a shareholder of the Company on the Record Date and

continue to hold shares of the Company until the date of closing of

the Offering, (b) be purchasing the Shares as a principal and for

their own account and not for any other party, and (c) not

subscribe for more than CDN$15,000 of securities from the Company

in any 12-month period unless the shareholder has obtained advice

regarding the suitability of the investment from a person

registered as an investment dealer in the shareholder’s

jurisdiction.

The Investment Dealer Exemption is available in

each of Alberta, British Columbia, Saskatchewan, Manitoba and New

Brunswick to a person or company who has obtained advice regarding

the suitability of the investment from a person registered as an

investment dealer in such person’s or company’s jurisdiction. As

required by the Existing Security Holder Exemption and Investment

Dealer Exemption, the Company confirms there is no material fact or

material change relating to the Company that has not been generally

disclosed.

There is no minimum Offering size and the

maximum offering is 17,000,000 Units for gross proceeds of

CDN$5,950,000. Assuming the Offering is fully subscribed, the

Company plans to allocate the gross proceeds of the Offering to:

(i) exploration on its Freegold Mountain project (CDN$5,000,000)

and (ii) general working capital (CDN$1,000,000).

If the Offering is not fully subscribed, the

Company will apply the proceeds to the above uses in priority and

in such proportions as the Board of Directors and management of the

Company determine is in the best interests of the Company. Although

the Company intends to use the proceeds of the Offering as

described above, the actual allocation of proceeds may vary from

the uses set out above depending on future operations, events or

opportunities.

If the Offering is oversubscribed, unless the

Company determines to increase the maximum gross proceeds of the

Offering and receives approval from the TSX Venture Exchange for

such increase, the Company will allocate the Units issued under the

Offering to those subscribers whose subscriptions were first

received by the Company. A subscription will be deemed to be

received when a completed subscription agreement together with

payment of the subscription amount has been received by the

Company.

Certain insiders of the Company may acquire

Units in the Offering. Any participation by insiders in the

Offering would constitute a "related party transaction" as defined

under Multilateral Instrument 61-101 Protection of Minority

Security Holders in Special Transactions (“MI 61-101”). However,

the Company expects such participation would be exempt from the

formal valuation and minority shareholder approval requirements of

MI 61-101 as neither the fair market value of the Units subscribed

for by the insiders, nor the consideration for the Units paid by

such insiders, would exceed 25% of the Company's market

capitalization.

The Company may pay finder’s fees on a portion

of the Offering, subject to compliance with the policies of the TSX

Venture Exchange and applicable securities legislation.

Closing of the Offering is subject to approval

of the TSX Venture Exchange.

The securities issued under the Offering, and

any Shares that may be issuable on exercise of any such securities,

will be subject to a statutory hold period expiring four months and

one day from the date of issuance of such securities. Additional

resale restrictions and legends may apply in the United States and

other jurisdictions.

About Triumph Gold Corp.

Triumph Gold Corp. is a growth oriented

Canadian-based precious metals exploration and development

company. Triumph Gold Corp. is focused on creating value

through the advancement of the district scale Freegold Mountain

project in Yukon. For maps and more information, please visit our

website www.triumphgoldcorp.com.

On behalf of the Board of

Directors

Signed "Paul Reynolds" Paul Reynolds, President &

CEO

| For further

information please contact: John Anderson, Executive

Chairman Triumph Gold Corp. (604) 218-7400

janderson@triumphgoldcorp.com |

Paul Reynolds President

& CEO Triumph Gold Corp.(604)

283-0895preynolds@triumphgoldcorp.com |

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act"), or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

Cautionary Statement Regarding

Forward-Looking Information

Certain information contained in this news

release constitutes “forward-looking information” or

“forward-looking statements” (collectively, “forward-looking

information”). Without limiting the foregoing, such forward-looking

information includes statements regarding the process and

completion of the Offering, the use of proceeds of the Offering and

any statements regarding the Company’s business plans, expectations

and objectives. In this news release, words such as “may”, “would”,

“could”, “will”, “likely”, “believe”, “expect”, “anticipate”,

“intend”, “plan”, “estimate” and similar words and the negative

form thereof are used to identify forward-looking information.

Forward-looking information should not be read as guarantees of

future performance or results, and will not necessarily be accurate

indications of whether, or the times at or by which, such future

performance will be achieved. Forward-looking information is based

on information available at the time and/or the Company

management’s good faith belief with respect to future events and is

subject to known or unknown risks, uncertainties, assumptions and

other unpredictable factors, many of which are beyond the Company’s

control. For additional information with respect to these and other

factors and assumptions underlying the forward-looking information

made in this news release, see the Company’s most recent

Management’s Discussion and Analysis and financial statements and

other documents filed by the Company with the Canadian securities

commissions and the discussion of risk factors set out therein.

Such documents are available at www.sedar.com under the

Company’s profile and on the Company’s website,

www.triumphgoldcorp.com. The forward-looking information set

forth herein reflects the Company’s expectations as at the date of

this news release and is subject to change after such date. The

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise, other than as required by

law.

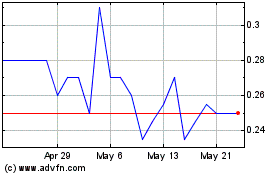

Triumph Gold (TSXV:TIG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Triumph Gold (TSXV:TIG)

Historical Stock Chart

From Dec 2023 to Dec 2024