Skyharbour Resources

Ltd. (TSX-V: SYH

)

(OTCQX: SYHBF

) (Frankfurt:

SC1P

) (“Skyharbour” or the “Company”) is pleased

to announce that, in connection with its previously announced

private placement, it has entered into an amended agreement with

Haywood Securities Inc. and Red Cloud Securities Inc. as co-lead

agents and co-bookrunners (collectively, the “Agents”) to increase

the aggregate size of the financing for gross proceeds to the

Company of up to C$9,500,000.

The private placement will now include the sale

of (i) up to 5,000,000 hard dollar units of the Company (the

“Units”) at a price of C$0.40 per Unit for gross proceeds of up to

C$2,000,000 (the “Unit Offering”), plus (ii) any combination of the

following for total gross proceeds of up to C$7,500,000:

- Charity flow-through shares (the

“Charity FT Shares”) at a price per Charity FT Share of C$0.59;

and

- Traditional flow-through shares

(the “Traditional FT Shares”) at a price per Traditional FT Share

of C$0.46 (collectively, the “Flow-Through Offering”, and together

with the Unit Offering, the “Offering”).

Each Unit will consist of one common share of

the Company (a “Share”) plus one-half of one common share purchase

warrant (each whole such warrant, a “Warrant”). Each Warrant will

entitle the holder thereof to purchase one Share (a “Warrant

Share”) at an exercise price of C$0.55 for 30 months following the

completion of the Offering.

The gross proceeds from the sale of the Charity

FT Shares and the Traditional FT Shares will be used by the Company

to incur eligible “Canadian exploration expenses” that qualify as

“flow-through critical mineral mining expenditures” as both terms

are defined in the Income Tax Act (Canada), and will also be used

to incur “eligible flow-through mining expenditures” as defined in

The Mineral Exploration Tax Credit Regulations, 2014 (Saskatchewan)

(collectively, the “Qualifying Expenditures”) related to the

Company’s projects in Saskatchewan, on or before December 31, 2025,

and to renounce all Qualifying Expenditures in favour of such

subscribers effective December 31, 2024. The net proceeds from the

sale of Units will be used for the 2025 exploration and drilling

programs at the Company’s uranium projects in Saskatchewan, as well

as for general working capital purposes.

The Offering will be conducted in accordance

with available prospectus exemptions pursuant to applicable

Canadian securities laws, with the securities issuable under the

Offering subject to the statutory hold period of four months and

one day from the date of issuance.

The Offering is scheduled to close on or about

December 20, 2024, subject to customary closing conditions

including receipt of all necessary approvals including the approval

of the TSX Venture Exchange (“TSX-V”). The Company has agreed to

pay the Agents a cash commission of 6.5% of the gross proceeds

raised under the Offering, and issue to the Agents compensation

options equal to 6.5% of the total number of securities sold under

the Offering (the “Compensation Options”), other than with respect

to president’s list orders for which a 3.25% cash fee shall be

payable and 3.25% Compensation Options shall be issuable. Each

Compensation Option shall be exercisable at C$0.50 for a period of

30 months from the closing date.

The purchase of securities under the Offering by

related parties are expected to constitute “related party

transactions” of the Company under Multilateral Instrument 61-101

- Protection of Minority Security Holders in Special

Transactions (“MI 61-101”). It is expected pursuant to

sections 5.5(b) and 5.7(1)(a) of MI 61-101, the Company will be

exempt from obtaining formal valuation and minority approval of the

Company’s shareholders respecting the purchase of securities under

the Offering by related parties as the fair market value of

securities to be purchased under the Offering is expected to be

below 25% of the Company's market capitalization as determined in

accordance with MI 61-101.

The securities offered have not been, nor will

they be, registered under the U.S. Securities Act, as amended, or

any state securities law, and may not be offered, sold or

delivered, directly or indirectly, within the United States, or to

or for the account or benefit of U.S. persons, absent registration

or an exemption from such registration requirements. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy nor shall there be any sale of securities in any

state in the United States in which such offer, solicitation or

sale would be unlawful.

About Skyharbour Resources

Ltd.:

Skyharbour holds an extensive portfolio of

uranium exploration projects in Canada's Athabasca Basin and is

well positioned to benefit from improving uranium market

fundamentals with interest in twenty-nine projects, ten of which

are drill-ready, covering over 580,000 hectares (over 1.4 million

acres) of land. Skyharbour has acquired from Denison Mines, a large

strategic shareholder of the Company, a 100% interest in the Moore

Uranium Project, which is located 15 kilometres east of Denison's

Wheeler River project and 39 kilometres south of Cameco's McArthur

River uranium mine. Moore is an advanced-stage uranium exploration

property with high-grade uranium mineralization at the Maverick

Zone that returned drill results of up to 6.0% U3O8 over 5.9

metres, including 20.8% U3O8 over 1.5 metres at a vertical

depth of 265 metres. Adjacent to the Moore Project is the Russell

Lake Uranium Project, in which Skyharbour is an operator with

joint-venture partner Rio Tinto. The project hosts several

high-grade uranium drill intercepts over a large property area with

robust exploration upside potential. The Company is actively

advancing these projects through exploration and drill

programs.

Skyharbour also has joint ventures with industry

leader Orano Canada Inc., Azincourt Energy, and Thunderbird

Resources at the Preston, East Preston, and Hook Lake Projects

respectively. The Company also has several active earn-in option

partners, including CSE-listed Basin Uranium Corp. at the Mann Lake

Uranium Project; CSE-listed Medaro Mining Corp. at the Yurchison

Project; TSX-V listed North Shore Uranium at the Falcon Project;

UraEx Resources at the South Dufferin and Bolt Projects; Hatchet

Uranium at the Highway Project; Mustang Energy at the 914W Project;

and TSX-V listed Terra Clean Energy at the South Falcon East

Project which hosts the Fraser Lakes Zone B uranium and thorium

deposit. In aggregate, Skyharbour has now signed earn-in option

agreements with partners that total over $41 million in

partner-funded exploration expenditures, over $30 million worth of

shares being issued, and over $22 million in cash payments coming

into Skyharbour, assuming that these partner companies complete

their entire earn-ins at the respective projects.

Skyharbour's goal is to maximize shareholder

value through new mineral discoveries, committed long-term

partnerships, and the advancement of exploration projects in

geopolitically favourable jurisdictions.

Skyharbour’s Uranium Project Map in the

Athabasca

Basin:https://www.skyharbourltd.com/_resources/images/SKY_SaskProject_Locator_2024-02-14_V2.jpg

To find out more about Skyharbour Resources Ltd.

(TSX-V: SYH) visit the Company’s website

at www.skyharbourltd.com.

SKYHARBOUR RESOURCES LTD.

“Jordan

Trimble”_____________________________

Jordan TrimblePresident and CEO

For further information contact myself or:Nicholas

ColturaInvestor Relations Manager Skyharbour Resources Ltd.

Telephone: 604-558-5847Toll Free: 800-567-8181Facsimile:

604-687-3119Email: info@skyharbourltd.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE

ADEQUACY OR ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

Forward-Looking Information

This news release contains “forward‐looking

information or statements” within the meaning of applicable

securities laws, which may include, without limitation, the size of

the Offering, the use of proceeds from the Offering, the ability of

the Company to renounce Qualifying Expenditures in favour of the

subscribers, tax treatment of the Charity FT Shares and the

Traditional FT Shares, the anticipated closing date, the receipt of

regulatory approvals for the Offering, the exercise of the option

granted to the Agents, future results of operations, performance

and achievements of the Company, completing ongoing and planned

work on its projects including drilling and the expected timing of

such work programs, and other statements relating to the technical,

financial and business prospects of the Company, its projects and

other matters. All statements in this news release, other than

statements of historical facts, that address events or developments

that the Company expects to occur, are forward-looking statements.

Although the Company believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance and actual

results may differ materially from those in the forward-looking

statements. Such statements and information are based on numerous

assumptions regarding present and future business strategies and

the environment in which the Company will operate in the future,

including the price of uranium, the ability to achieve its goals,

that general business and economic conditions will not change in a

material adverse manner, that financing will be available if and

when needed and on reasonable terms. Such forward-looking

information reflects the Company’s views with respect to future

events and is subject to risks, uncertainties and assumptions,

including the risks and uncertainties relating to the

interpretation of exploration results, risks related to the

inherent uncertainty of exploration and cost estimates and the

potential for unexpected costs and expenses, and those filed under

the Company’s profile on SEDAR+ at www.sedarplus.ca. Factors that

could cause actual results to differ materially from those in

forward looking statements include, but are not limited to,

continued availability of capital and financing and general

economic, market or business conditions, adverse weather or climate

conditions, failure to obtain or maintain all necessary government

permits, approvals and authorizations, failure to obtain or

maintain community acceptance (including First Nations), decrease

in the price of uranium and other metals, increase in costs,

litigation, and failure of counterparties to perform their

contractual obligations. The Company does not undertake to update

forward‐looking statements or forward‐looking information, except

as required by law.

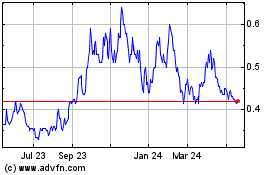

Skyharbour Resources (TSXV:SYH)

Historical Stock Chart

From Dec 2024 to Jan 2025

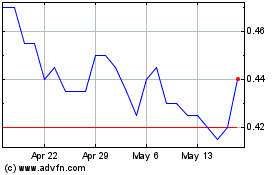

Skyharbour Resources (TSXV:SYH)

Historical Stock Chart

From Jan 2024 to Jan 2025