Canadian Spirit Resources Inc. (“CSRI” or the

“Corporation”) (TSXV:SPI) (OTCBB:CSPUF) announces the

reactivation of natural gas production at Farrell Creek, Northeast

British Columbia and the release of its unaudited interim financial

statements (the “

Financial Statements”) and

management discussion and analysis (“

MD&A”),

each for the three month period ended September 30, 2023.

Reactivation Of Joint Venture Production

At Farrell Creek

In June 2023, the Corporation and its joint

venture partner opted to shut-in its Farrell Creek natural gas

processing facility and associated Montney wells as a result of

negative netback caused by low natural gas prices at Station 2. The

Corporation’s joint venture Montney wells were returned to

production on November 17, 2023. Based on the Corporation's net

average production over 60 days prior to the suspension of its

joint venture operations, a production rate of approximately 2.5

Mmcf/d is anticipated, with CSRI’s 35% share being approximately

0.87 Mmcf/d.

First Quarter Financial

Results

This news release summarizes information

contained in the Financial Statements and MD&A and should not

be considered a substitute for reading these full disclosure

documents which are available on the Corporation's profile on

SEDAR+ at www.sedarplus.ca.

In accordance with the Corporation's change of

year-end from December 31 to June 30 that was approved by the board

of directors of the Corporation (the “Board”) on

August 25, 2023, the Financial Statements and MD&A provide a

comparison of the financial performance of the Corporation for the

three-month period ended September 30, 2023 to the three-month

period ended September 30, 2022. The Corporation has requested

approval of the change of year-end from the Canada Revenue Agency,

however such approval is still pending.

Selected Financial Data

The following summarizes certain selected

financial data from the Financial Statements for the three months

ended September 30, 2023:

(all amounts are presented in Canadian

dollars, unless otherwise indicated)

|

|

|

Three months endedSeptember

30, |

|

|

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

Natural gas sales (net) |

|

|

$ |

- |

|

$ |

25,267 |

|

|

Operating costs |

|

|

|

(40,932 |

) |

|

(83,777 |

) |

|

|

|

|

|

|

|

Operating netback |

|

|

$ |

(40,932 |

) |

$ |

(58,510 |

) |

|

Other income and gains |

|

|

|

3,187 |

|

|

8,119 |

|

|

Other Expenses |

|

|

|

(385,219 |

) |

|

(339,491 |

) |

|

|

|

|

|

|

|

Net comprehensive loss for the period |

|

|

$ |

(422,964 |

) |

$ |

(389,882 |

) |

The Corporation’s loss and comprehensive loss

for the three months ended September 30, 2023 was $422,964 (2022 -

$389,882) resulting in an increased loss of $33,082 for the three

months, partly due to the shut-in of production experienced during

the three months ended September 30, 2023.

The Corporation had a working capital deficit as

at September 30 2023 of $62,628 (June 30, 2023 - working capital of

$123,980). The Corporation’s shareholders equity is $36,194,481 at

September 30, 2023 (June 30, 2023 - $36,429,424).

|

|

|

|

|

September 30,2023 |

|

|

June 30,2023 |

|

|

|

|

|

|

|

|

Working capital: |

|

|

|

|

|

Current assets |

|

|

$ |

824,660 |

|

$ |

1,209,720 |

|

|

Current liabilities |

|

|

|

(887,288 |

) |

|

(1,085,740 |

) |

|

|

|

|

|

(62,628 |

) |

|

123,980 |

|

|

Shareholders’ Equity |

|

|

|

36,194,481 |

|

|

36,429,424 |

|

|

|

|

|

|

|

|

|

|

|

$ |

36,131,853 |

|

$ |

36,553,404 |

|

The Corporation will continue to pursue

financing alternatives to maintain the Corporation as a going

concern as it seeks and evaluates strategic alternatives.

Additional necessary financing may be secured through either the

issue of new equity or debt instruments or entering into new joint

venture or farm-in arrangements.

Review of Strategic

Alternatives

The Corporation also announces that it has

initiated a process to review strategic alternatives with a view to

maximizing the value of the Corporation's Montney resource base at

Farrell Creek and Altares. This may include, among other

alternatives, the addition of capital to further develop the

potential of the assets, the sale of the Corporation or a portion

of the Corporation's assets, a merger, farm-in or joint venture, or

other such options as may be determined by the Board to be in the

best interests of the Corporation and its shareholders. CSRI has

engaged Sayers Energy Advisors to serve as financial advisor in the

strategic alternatives review process.

The Corporation has not set a definitive

schedule to complete its strategic alternatives review evaluation

and no decision on any particular alternative has been reached at

this time. CSRI does not intend to disclose developments with

respect to this process unless and until the Board has approved a

definitive transaction agreement or other course of action or

otherwise deems disclosure of developments is appropriate or

otherwise required by applicable securities laws or the

requirements of the TSX Venture Exchange. There are no guarantees

that the process will result in a transaction of any form or, if a

transaction is entered into, as to its terms or timing.

Information regarding CSRI is available on

SEDAR+ at www.sedarplus.ca or the Corporation’s website at

www.csri.ca.

On behalf of the Board of Directors

CANADIAN SPIRIT RESOURCES INC.

"Louisa DeCarlo" President and Chief Executive Officer

For further information, please contact:

Canadian Spirit Resources Inc. Attention:

Louisa

DeCarloTelephone: (403) 618-2113Email:

louisa.decarlo@csri.ca

Forward-looking

Information Cautionary

Statement

This press release contains forward-looking

statements. More particularly, this press release contains

statements concerning: the re-starting of the Farrell Creek

facility and associated Montney wells; reactivation operations; the

potential production from reactivation operations; oil and gas

prices; the approval of the Corporations change in year-end by the

Canadian Revenue Agency; and the strategic alternatives review

process. The forward-looking statements in this press release are

based on certain expectations and assumptions made by the

Corporation. These assumptions include, but are not limited to, the

performance of activities by third parties, oil and gas prices,

timing and success of operations, weather, well productivity, the

Corporation's finances, and changes in the Corporation's business

plans. Although the Corporation believes that the expectations and

assumptions on which the forward-looking statements are based are

reasonable, undue reliance should not be placed on the

forward-looking statements because the Corporation can give no

assurance that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, general business, economic, competitive, political and

social uncertainties, general capital market conditions and market

prices for securities, the actual results of future operations,

competition, changes in legislation, including environmental

legislation affecting the Corporation, the timing and availability

of external financing on acceptable terms or at all, and loss of

key individuals. Forward-looking statements are based on estimates

and opinions of management of the Corporation at the time the

statements are presented. The Corporation may, as considered

necessary in the circumstances, update or revise such forward-

looking statements, whether as a result of new information, future

events or otherwise, but the Corporation undertakes no obligation

to update or revise any forward-looking statements, except as

required by applicable securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE

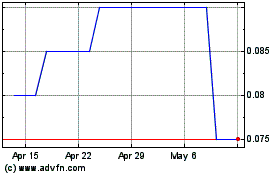

Canadian Spirit Resources (TSXV:SPI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Canadian Spirit Resources (TSXV:SPI)

Historical Stock Chart

From Feb 2024 to Feb 2025