Stroud Appoints Thomas Smeenk, CEO and Dr. Scott Jobin-Bevans to the position of Vice-President Exploration

June 25 2019 - 7:57AM

Stroud Resources Ltd. (TSXV: SDR) (“Stroud” or the “Company”) is

pleased to announce the appointment of Mr. Thomas A. Smeenk, BA, as

President and Chief Executive Officer of the Company, effective

immediately.

Mr. Smeenk is a project finance, mineral exploration and

business development executive with a proven track record of

bringing new discoveries to market. On April 30th, as CEO of

Broadway Gold Mining Ltd, Smeenk closed a $30

million-for-70%-interest earn-in agreement, with option to joint

venture, with Kennecott Exploration Company, part of the Rio Tinto

Group. Investing in the mining industry since 1996, Smeenk

served as President of Tyranex Gold Inc. and as President and CEO

of IBI Corporation, where he financed the discovery of a

world-class vermiculite mine in Uganda, which was subsequently sold

to Rio Tinto.

Additionally, Mr. Smeenk’s background includes extensive

experience in financing and business development as Vice President

and President of e-Manufacturing Networks Inc. He founded,

financed, and spent five years as President and Director of

TheraVitae Inc., a heart disease focused patented autologous stem

cell therapy company; and, he took Astrix Networks Inc. public as

its Vice President, Business Development.

“On behalf of the Board of Directors, I am pleased to welcome

Thomas to the Stroud team. His experience in the mining industry,

finance and business development will be instrumental to unlocking

the value of the Company’s silver-gold project in Mexico,” said

Howard Atkinson, Chairman, Stroud Resources Ltd.

“The Santo Domingo property’s data is very prospective,” said

Thomas Smeenk. “Given its NI 43-101 resource of 39 million

ounces of silver within the first 150 metres of surface which

averages 4 ounces per tonne; vein widths that range from 15 - 85

metres; adit-based mapped depth extensions of existing veins 150 -

500 metres below the deposit; and, five adit-based, mapped,

yet-to-be drilled parallel vein systems that are geologically

similar to the resource; I am honoured to lead the Company through

its capital restructuring and next financings. Silver is trading at

90 ounces to the ounce of gold today. Whereas, historically,

for 5,000 years, it was freely convertible into gold at 11 -

15 ounces. Buying gold as sliver today is buying gold at an 84%

discount to the pre-central banking historic average. That,

plus the 3D mapped down dip and strike length extension merits of

the property, plus the technical factors of the silver market, is

why I’m buying SDR at a $2-$3 million valuation,” Smeenk added.

Building its management team to unlock the value of the Santo

Domingo property, the Board of Directors also appoints Dr. Scott

Jobin-Bevans, PhD, PGeo, PMP, to the position of Vice-President

Exploration. Dr. Derek McBride, PhD, PEng, remains an

integral part of the technical team as an independent consulting

Project Geologist.

About Stroud Resources Ltd.Stroud Resources

Ltd. is focused on the development of its 39-million-ounce

silver-gold epithermal property located 90 kilometres northwest of

Guadalajara, Mexico. The Company owns a 100% interest in the Santo

Domingo Silver-Gold Project, subject to an NSR capped at USD $3.25

million. Discovered and mined by the Spaniards in the 1600’s, the

Santo Domingo deposit is located in a rich mining area that

includes the Cinco Minas and San Pedro de Analco mines.

Neither the TSX Venture Exchange Inc. nor its regulation

services provider (as that term is defined in the policies of The

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For more information: Thomas Smeenk, President &

CEO905-580-4170

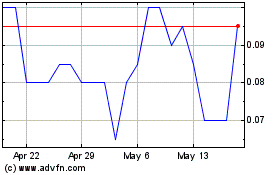

Stroud Resources (TSXV:SDR)

Historical Stock Chart

From Nov 2024 to Dec 2024

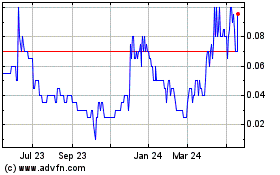

Stroud Resources (TSXV:SDR)

Historical Stock Chart

From Dec 2023 to Dec 2024