Sparta Capital Ltd. Releases Second Quarter Financial Statements

May 29 2009 - 1:51PM

Marketwired Canada

Sparta Capital Ltd. ("Sparta") (TSX VENTURE:SAY) released today its unaudited

financial statements for its three month and six month periods ended March 31,

2009.

The net comprehensive loss for the three month and six month periods ended March

31, 2009 was $107,435 and 184,086 respectively.

SUMMARY OF INCOME STATEMENT INFORMATION

----------------------------------------------------------------------------

January 1 to October 1 to

Income Statement March 31, 2009 March 31, 2009

----------------------------------------------------------------------------

Sales $ - $ -

Cost of sales $ - $ -

Net comprehensive loss for period $ 107,435 $ 184,086

Loss Per share - basic and diluted $ 0.003 $ 0.005

Weighted average shares outstanding - basic 35,247,631 35,247,631

----------------------------------------------------------------------------

SUMMARY OF CASH FLOW INFORMATION

----------------------------------------------------------------------------

January 1 to October 1 to

Cash Flow March 31, 2009 March 31, 2009

----------------------------------------------------------------------------

Cash from operating activities $ (124,746) $ (193,938)

Cash from financing activities $ - $ -

Cash from investing activities $ (6,095) $ 432,232

Increase (decrease) in cash and cash equivalents $ (130,841) $ 238,294

Cash and cash equivalents - beginning of period $ 770,510 $ 401,375

Cash and cash equivalents - end of period $ 639,669 $ 639,669

----------------------------------------------------------------------------

SUMMARY OF BALANCE SHEET INFORMATION

----------------------------------------------------------------------------

March 31, September 30,

Balance Sheet 2009 2008

----------------------------------------------------------------------------

Cash and cash equivalents $ 639,669 $ 401,375

Total Assets $ 1,232,575 $ 1,436,489

Total Liabilities $ 9,983 $ 29,811

Share capital $ 5,221,199 $ 5,221,199

Total Shareholders' Equity $ 1,222,592 $ 1,406,678

Total Liabilities & Shareholders' Equity $ 1,232,575 $ 1,437,489

----------------------------------------------------------------------------

RESULTS OF OPERTIONS

For the six month period ended March 31, 2009 the Corporation had a net

comprehensive loss of $184,086 as compared to the March 31, 2008 net

comprehensive loss of $159,418. For the three month period ended March 31, 2009

the Corporation had a net comprehensive loss of $107,435 as compared to the

March 31, 2008 loss of $103,254.

Advertising & Promotion increased slightly from $10,464 to $10,619 during the

six month period and from $5,746 to $7,507 in the three month period due to an

increase in promotional expense related to the evaluation of business growth

opportunities.

Consulting fees increased from $114,169 to $123,900 during the six month period

due to increased consulting fees related to evaluation of business growth

opportunities and remained relatively constant over the three month period

increasing from $63,800 to $64,800.

Licenses and fees increased from $9,671 to $13,725 during the six month period

and from $9,671 to $11,111 during the three month period resulting from

regulatory and exchange filing fees incurred during the period.

Office rent decreased from $12,486 to $7,518 during the six month period and

from $6,306 to $3,860 during the three month period due to office relocation

with decreased lease costs and subletting a part of the office space to a third

party.

Travel decreased from $6,657 to $3,644 during the six month period and $6,353 to

$1,931 during the three month period due to a decrease in travel related to

review of business growth opportunities.

The Corporation's March 31, 2009 financial statements and management discussion

and analysis may be viewed on SEDAR at www.sedar.com

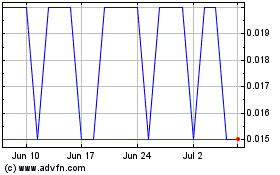

Sparta Capital (TSXV:SAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

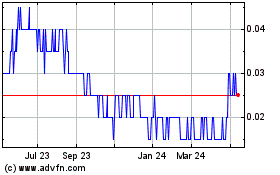

Sparta Capital (TSXV:SAY)

Historical Stock Chart

From Jul 2023 to Jul 2024