BioSyent Inc. ("BioSyent") (TSX VENTURE:RX) released today a summary of its

second quarter (Q2) and first half (H1) 2013 financial results for the three and

six months ending June 30, 2013.

-- Q2 2013 Sales of $1,786,685 increased by 47% versus Q2 2012

-- First six months (H1) 2013 Sales of $3,328,528 increased by 57% versus

H1 2012

-- Q2 2013 Pharmaceutical Sales of $1,683,793 were up by 60% versus Q2

2012, and 29% versus Q1 2013

-- H1 Pharmaceutical Sales of $2,991,303 increased by 65% versus H1 2012

-- Fifteen consecutive quarters of continued pharmaceutical sales growth

-- Q2 2013 Income Before Tax of $542,964 increased by 61% versus Q2 2012

-- Q2 2013 Tax Expense was $124,639 versus nil in Q2 2012

-- Q2 Net Income After Tax of $418,325 increased by 24% versus Q2 2012

-- H1 2013 Income Before Tax of $1,024,927 increased by 68% versus H1 2012

-- H1 2013 Tax was $262,192 versus nil in H1 2012 (H1 2013 Tax equivalent

to $0.02/share)

-- H1 2013 Net Income After Tax of $762,735 increased by 25% compared to H1

2012

-- H1 2013 basic earnings per share of $0.06 versus $0.05 in H1 2012

-- H1 2013 Cash Generation of $313,595 represents a 396% increase over the

prior year period

-- FeraMAX(R) Powder, an innovative new product, was launched in June 2013

-- Selected as a TSX Venture 50 Top Performer for two consecutive years -

2012 and 2013

-- Named as one of Canada's fastest growing companies in the Profit 500

rankings for 2013

-- 2 New Products submitted to Health Canada for marketing approval

Total sales for Q2 2013 of $1,786,685, were 47% higher compared to $1,216,115 in

the corresponding prior year period. Total sales for H1 2013 of $3,328,528, were

57% higher than H1 2012.

Income Before Tax for Q2 2013 was $542,964, which is 61% higher than $337,437 in

Q2 2012. Income Before Tax for H1 2013 was 1,024,927, an increase of 68% over

the corresponding prior year period.

H1 2013 has a tax provision of $262,192 whereas there was no tax provision in H1

2012 due to available carry forward losses from previous years. In spite of this

difference in tax expense, Net Income After Tax increased by 25% from $610,620

in H1 2012 to $762,735 in H1 2013.

Working capital, which is the difference between current assets and current

liabilities, has increased by 33% from $2,509,278 as at December 31, 2012 to

$3,336,433 as at June 30, 2013. Cash accounted for 79% of working capital as at

June 30, 2013. Total Cash on June 30 2013 was $2,629,650. Total Shareholder's

Equity increased by 29% from $2,839,409 at December 31, 2012 to $3,663,185 at

June 30, 2013. This is mainly due to an increase in retained earnings for H1

2013.

The Financial Statements and Management's Discussion & Analysis will be posted

on www.sedar.com on August 22, 2013.

For a direct market quote (15 minutes delay) for the TSX Venture Exchange and

other Company financial information please visit www.tmxmoney.com.

BioSyent will also release a CEO presentation on the Second Quarter Financial

Results at the following link: www.biosyent.com/q2/.

About BioSyent Inc.

Listed on the Toronto Venture Exchange under the trading symbol "RX", BioSyent

is a profitable growth oriented specialty pharmaceutical company which searches

the globe to in-license or acquire innovative pharmaceutical products that have

been successfully developed, are safe and effective, and have a proven track

record of improving the lives of patients and supporting the healthcare

professionals that treat them.

Once a product of interest has been found, BioSyent then acquires the exclusive

rights to the product and manages it through the Canadian governmental

regulatory approval process. Once approved, BioSyent markets the product

throughout Canada.

At the date of this press release the Company had 13,571,195 shares issued and

outstanding.

BioSyent Inc.

Interim Consolidated Statement of Comprehensive Income

(Unaudited - Abbreviated)

----------------------------------------------------------------------------

In Canadian Q2 Q2 % H1 H1 %

Dollars 2013 2012 Change 2013 2012 Change

----------------------------------------------------------------------------

Revenues 1,786,685 1,216,115 47% 3,328,528 2,120,603 57%

Cost Of Goods

Sold 387,337 250,065 55% 695,806 438,661 59%

Gross Profit 1,399,348 966,050 45% 2,632,722 1,681,942 57%

Total Operating

Expense 856,384 628,613 36% 1,607,795 1,071,322 50%

Profit Before

Tax 542,964 337,437 61% 1,024,927 610,620 68%

Tax (including

Deferred Tax) 124,639 - NA 262,192 - NA

Profit After Tax 418,325 337,437 24% 762,735 610,620 25%

Profit After Tax

% to Sales 23% 28% 23% 29%

----------------------------------------------------------------------------

BIOSYENT INC.

INTERIM UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT

(Unaudited - Abbreviated)

-------------------------------------

AS AT June 30, December 31, %

2013 2012 Change

-------------------------------------

ASSETS

Receivables 1,074,972 589,697 82%

Inventory 796,908 345,630 131%

Prepaid expenses & deposits 162,463 71,257 128%

Cash & Cash Equivalents 2,629,650 2,316,055 14%

-------------------------------------

Current Assets 4,663,993 3,322,639 40%

Equipment 122,379 97,932 25%

Deferred Tax 204,373 232,199 -12%

-------------------------------------

TOTAL ASSETS 4,990,745 3,652,770 37%

-------------------------------------

-------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current Liabilities 1,327,560 813,361 63%

Total Equity 3,663,185 2,839,409 29%

-------------------------------------

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY 4,990,745 3,652,770 37%

-------------------------------------

This press release may contain information or statements that are

forward-looking. The contents herein represent our judgment, as at the release

date, and are subject to risks and uncertainties that may cause actual results

or outcomes to be materially different from the forward-looking information or

statements. Potential risks may include, but are not limited to, those

associated with clinical trials, product development, future revenue,

operations, profitability and obtaining regulatory approvals.

The TSX Venture Exchange assumes no responsibility for the accuracy of this

release and neither approves nor disapproves of the same.

FOR FURTHER INFORMATION PLEASE CONTACT:

BioSyent Inc.

Mr. Rene C. Goehrum

President and CEO

(905) 206-0013

investors@biosyent.com

www.biosyent.com

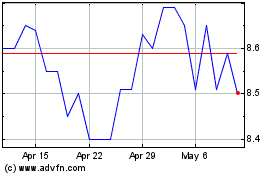

Biosyent (TSXV:RX)

Historical Stock Chart

From Sep 2024 to Oct 2024

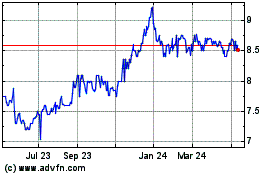

Biosyent (TSXV:RX)

Historical Stock Chart

From Oct 2023 to Oct 2024