Revival Gold

Inc. (TSXV: RVG,

OTCQX: RVLGF) (“Revival Gold” or

the “Company”) is pleased to announce the completion of the

previously announced business combination between Revival Gold and

Ensign Minerals Inc. (“Ensign”), by way of a statutory

three-cornered amalgamation (the “Amalgamation”) under the Business

Corporations Act (British Columbia), whereby Ensign and Revival

Gold Amalgamation Corp. (“Revival Subco”), a wholly-owned

subsidiary of Revival Gold, amalgamated to form a newly amalgamated

company, named Ensign Minerals Inc. (“Amalco”).

In addition, the Company is also pleased to

announce that it has satisfied the outstanding conditions for the

release of the escrowed funds from the previously announced

C$7,167,464 brokered private placement of 22,398,325 subscription

receipts of Revival Subco (the “Subscription Receipts”) at a price

of $0.32 per Subscription Receipt, which closed on May 2, 2024 (the

“Offering”).

Hugh Agro, President, CEO and director of

Revival Gold stated, “With the completion of this transaction,

Revival Gold is poised to capitalize on rising gold prices,

boasting one of the largest pure gold development portfolios in the

United States. Our assets in Utah and Idaho comprise approximately

12,000 hectares (almost 30,000 acres) in complementary, proven

mining camps, offering excellent infrastructure, exciting

exploration potential, and local community support. We look forward

to providing further updates as work progresses to transform

Revival Gold into an emerging heap leach gold producer, with

targeted aggregate gold production of 150,000 ounces per year.”

Transaction Details

The Transaction was completed pursuant to a

business combination agreement dated April 9, 2024, between Revival

Gold, Ensign, and Revival Subco, pursuant to which Revival Gold

acquired all the issued and outstanding common shares of Ensign

(the “Ensign Shares”) in consideration for 61,376,098 common shares

of Revival at a deemed price per share of $0.3569 (the

“Consideration Shares”). The Consideration Shares were distributed

to holders of Ensign Shares on a pro rata basis based on a share

exchange ratio of 1.1667 Consideration Shares for each Ensign Share

(the “Exchange Ratio”). Further, under the Transaction, all of

Ensign’s outstanding options (the “Ensign Options”) and warrants

(the “Ensign Warrants”) to acquire Ensign Shares will adjust in

accordance with the terms thereof such that the holders thereof are

entitled to acquire Revival Shares in lieu of Ensign Shares based

on the Exchange Ratio.

Upon completion of the Transaction, Revival Gold

became the parent company and the sole shareholder of Amalco and

will indirectly carry on the current business of Ensign. The

Company expects to pursue engineering and economic studies at the

newly acquired Mercur Gold Project (“Mercur”) located in Utah, USA

while continuing to advance permitting preparations and ongoing

exploration at the Company’s Beartrack-Arnett Gold Project

(“Beartrack-Arnett”) located in Idaho, USA.

Further details of the Transaction can be found

in the Company’s press release dated April 10, 2024 (the

“Announcement Press Release”).

Technical Report

In connection with the Transaction, Revival Gold

has filed a technical report with respect to Mercur titled, “NI

43-101 Technical Report for the Mercur Project, Camp Floyd and

Ophir Mining Districts, Tooele & Utah Counties, Utah, USA”,

prepared by Lions Gate Geological Consulting Inc., RESPEC Company

LLC, and Kappes, Cassidy & Associates, dated May 24, 2024 and

with an effective date of December 5, 2023 (the “Technical

Report”). A summary of the Technical Report was included in the

Announcement Press Release.

Since the date of the Announcement Press

Release, the Technical Report was updated to add Revival Gold as

the addressee of the Technical Report and certain other minor

amendments were made to ensure full compliance with NI 43-101 –

Standards of Disclosure for Mineral Projects and the requirements

of the TSX Venture Exchange. The effective date of the Technical

Report was not changed and amended Technical Report does not change

the mineral resource estimates, conclusions, and recommendations

provided in the original technical report dated February 1, 2024,

for Mercur. The Technical Report supersedes and replaces all prior

technical reports written for Mercur. Readers are encouraged to

read the Technical Report in its entirety, including all

qualifications, assumptions and exclusions that relate to the

mineral resource estimate. The Technical Report may be accessed

under Revival Gold’s SEDAR+ profile (www.sedarplus.ca). The

Technical Report is intended to be read as a whole, and sections

should not be read or relied upon out of context.

Automatic Conversion of Subscription

Receipts

Prior to the Amalgamation taking effect and upon

satisfaction of the escrow release conditions of the Offering, each

Subscription Receipt was converted into one unit comprised of one

common share of Revival Subco (each, a “Revival Subco Share”) and

one-half of one common share purchase warrant of Revival Subco

(each whole warrant, a “Revival Subco Warrant”). Upon completion of

the Amalgamation, each Revival Subco Share was exchanged for one

common share of the Company (a “Revival Share”), and each Revival

Subco Warrant was exchanged for one Revival Share purchase warrant

(a "Revival Warrant"). Each Revival Warrant is exercisable by the

holder thereof for one Revival Share (each, a “Revival Warrant

Share”) at an exercise price of C$0.45 per Revival Warrant Share at

any time on or before May 30, 2027. The Revival Shares and Revival

Warrants are not subject to a hold period under applicable Canadian

securities laws.

The net proceeds of the Offering have been

released from escrow and the Company anticipates using such

proceeds to complete a Preliminary Economic Assessment on Ensign’s

Mercur Project, advance permitting preparations and continue

exploration for high-grade material at Beartrack-Arnett, and for

working capital and general corporate purposes.

Paradigm Capital Inc. and BMO Capital Markets,

acted as co-lead agents, on behalf of a syndicate of agents, which

included Beacon Securities Limited (the “Agents”), in connection

with the Offering. As consideration for their services, the Agents

received: (i) a cash commission of $430,047; and (ii) 1,343,900

non-transferable compensation warrants (the “Compensation

Warrants”). Following completion of the Transaction, each

Compensation Warrant entitles the holder to purchase one Revival

Share at a price of $0.32 at any time on or before May 30, 2026.

The Compensation Warrants and 50% of the Agent’s aggregate cash

commission was issued and paid, respectively, to the Agents upon

closing of the Offering, and the remaining 50% has been released to

the Agent’s in connection with the satisfaction of the escrow

release conditions for the Offering.

Board Reconstitution & Key

Management

As a result of the completion of the

Transaction, Norm Pitcher, a former director of Ensign, has been

appointed to the board of directors of Revival Gold (the “Board”)

and Michael Mansfield has resigned from the Board. Additionally,

Revival Gold has designated independent Director Tim Warman as

Non-Executive Chairman of the Board. Wayne Hubert will continue on

the Board as a non-executive Director.

“Mike Mansfield was a founding investor and

Company director and has been a keen champion for Revival Gold’s

shareholders over the years,” said Hugh Agro. “We are grateful to

have benefited from Mike’s pragmatic advice and keen understanding

of the public markets as we’ve worked to build the business

to-date. On behalf of our entire management team and board, I wish

to thank Mike for his commitment and service to Revival Gold and to

say that we look forward to Mike’s continued involvement as a

senior advisor to the Company going forward,” added Agro.

Key management of Revival Gold is unchanged and

consists of Hugh Agro serving as President & CEO and Director,

John Meyer as Vice President, Engineering & Development, and

Lisa Ross as Vice President & CFO.

Advisors and Counsel

MPA Morrison Park Advisors Inc. (“MPA”) acted as

financial advisor to Revival Gold. Peterson McVicar LLP acted as

Revival Gold’s legal counsel. Osler, Hoskin & Harcourt LLP

acted as Ensign’s legal counsel. Bennett Jones LLP acted as legal

counsel to the Agents.

In connection with the Transaction, MPA provided

financial advisory services including delivery of a fairness

opinion to the Company’s Board of Directors and certain other

ancillary matters (the “Services”). The Company paid MPA a success

fee of $250,000 and issued to MPA 657,895 Revival Shares at a

deemed price of $0.38 per Revival Share.

None of the securities issued pursuant to the

Transaction or the Offering have been, nor will they be, registered

under the U.S. Securities Act and may not be offered or sold in the

United States or to, or for the account or benefit of, U.S. persons

absent registration or an applicable exemption from the

registration requirements. This news release shall not constitute

an offer to sell or the solicitation of an offer to buy nor shall

there be any sale of the securities in any state in which such

offer, solicitation or sale would be unlawful. “United States” and

“U.S. person” are as defined in Regulation S under the U.S.

Securities Act.

Qualified Persons

John P.W. Meyer, Vice President, Engineering and

Development, P.Eng., and Steven T. Priesmeyer, C.P.G., Vice

President Exploration, Revival Gold Inc., are the Company’s

designated Qualified Persons for this news release within the

meaning of National Instrument 43-101 Standards of Disclosure for

Mineral Projects and have reviewed and approved its scientific and

technical content.

About Revival Gold Inc.

Revival Gold is one of the largest, pure gold,

mine developers in the United States. The Company is advancing

engineering and economic studies on the Mercur Gold Project in Utah

and mine permitting preparations and ongoing exploration at the

Beartrack-Arnett Gold Project located in Idaho.

Revival Gold is listed on the TSX Venture

Exchange under the ticker symbol "RVG" and trades on the OTCQX

Market under the ticker symbol "RVLGF". The Company is

headquartered in Toronto, Canada, with its exploration and

development office located in Salmon, Idaho.

Additional disclosure including the Company’s

financial statements, technical reports, news releases and other

information can be obtained at www.revival-gold.com or on SEDAR+ at

www.sedarplus.ca.

For further information, please contact:

Hugh Agro, President and CEO or Lisa Ross, CFOTelephone: (416)

366-4100 or Email: info@revival-gold.com.

Cautionary Statement

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This press release includes certain

"forward-looking information" within the meaning of Canadian

securities legislation and “forward-looking statements” within the

meaning of U.S. securities legislation (collectively

“forward-looking statements”). Forward-looking statements are not

comprised of historical facts. Forward-looking statements include

estimates and statements that describe the Company’s future plans,

objectives or goals, including words to the effect that the Company

or management expects a stated condition or result to occur.

Forward-looking statements may be identified by such terms as

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, or “plan”. Since forward-looking statements are

based on assumptions and address future events and conditions, by

their very nature they involve inherent risks and uncertainties.

Although these statements are based on information currently

available to the Company, the Company provides no assurance that

actual results will meet management’s expectations. Risks,

uncertainties, and other factors involved with forward-looking

statements could cause actual events, results, performance,

prospects, and opportunities to differ materially from those

expressed or implied by such forward-looking statements.

Forward-looking statements in this document

include, but are not limited to, Revival Gold being poised to

capitalize on rising gold prices, Revival Gold’s assets in Utah and

Idaho having exciting exploration potential, progressing work to

transform Revival Gold into an emerging heap leach gold producer

with an expected target of aggregate gold production of at least

150,000 ounces per year, advancement of permitting preparations and

ongoing exploration at Beartrack-Arnett, the inability of the

Company to apply the use of proceeds from the Offering as

anticipated; the resale restrictions of the securities issued

pursuant to the Offering, the Company’s objectives, goals and

future plans, and statements of intent, the implications of

exploration results, mineral resource/reserve estimates and the

economic analysis thereof, exploration and mine development plans,

timing of the commencement of operations, estimates of market

conditions, and statements regarding the results of the

pre-feasibility study, including the anticipated capital and

operating costs, sustaining costs, net present value, internal rate

of return, payback period, process capacity, average annual metal

production, average process recoveries, concession renewal,

permitting of the project, anticipated mining and processing

methods, proposed pre-feasibility study production schedule and

metal production profile, anticipated construction period,

anticipated mine life, expected recoveries and grades, anticipated

production rates, infrastructure, social and environmental impact

studies, availability of labour, tax rates and commodity prices

that would support development of the Project. Factors that could

cause actual results to differ materially from such forward-looking

statements include, but are not limited to failure to identify

mineral resources, failure to convert estimated mineral resources

to reserves, the inability to maintain the modelling and

assumptions upon which the interpretation of results are based

after further testing, the inability to complete a feasibility

study which recommends a production decision, the preliminary

nature of metallurgical test results, delays in obtaining or

failures to obtain required governmental, environmental or other

project approvals, changes in regulatory requirements, political

and social risks, uncertainties relating to the availability and

costs of financing needed in the future, uncertainties or

challenges related to mineral title in the Company’s projects,

changes in equity markets, inflation, changes in exchange rates,

fluctuations in commodity and in particular gold prices, delays in

the development of projects, capital, operating and reclamation

costs varying significantly from estimates, the continued

availability of capital, accidents and labour disputes, and the

other risks involved in the mineral exploration and development

industry, an inability to raise additional funding, the manner the

Company uses its cash or the proceeds of an offering of the

Company’s securities, an inability to predict and counteract the

effects of COVID-19 on the business of the Company, including but

not limited to the effects of COVID-19 on the price of commodities,

capital market conditions, restriction on labour and international

travel and supply chains, future climatic conditions, the discovery

of new, large, low-cost mineral deposits, the general level of

global economic activity, disasters or environmental or climatic

events which affect the infrastructure on which the project is

dependent, and those risks set out in the Company’s public

documents filed on SEDAR+. Although the Company believes that the

assumptions and factors used in preparing the forward-looking

statements in this news release are reasonable, undue reliance

should not be placed on such information, which only applies as of

the date of this news release, and no assurance can be given that

such events will occur in the disclosed time frames or at all.

Specific reference is made to the most recent Annual Information

Form filed on SEDAR+ for a more detailed discussion of some of the

factors underlying forward-looking statements and the risks that

may affect the Company’s ability to achieve the expectations set

forth in the forward-looking statements contained in this

presentation. The Company disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, other than

as required by law.

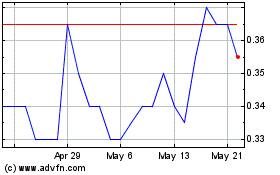

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Revival Gold (TSXV:RVG)

Historical Stock Chart

From Dec 2023 to Dec 2024