Relentless Resources Ltd. (TSX VENTURE:RRL) ("Relentless" or the "Company")

announced today that the Company has entered into an asset exchange agreement

(the "Agreement") with an arm's length Calgary-based private oil and gas company

("Privateco") to assign all of the Company's petroleum and natural gas interests

in south-western Saskatchewan in exchange for Privateco's interests in producing

and undeveloped petroleum and natural gas properties located in various areas

throughout Alberta and a cash payment of $200,000.00 (the "Transaction"). The

Transaction is expected to close on or about June 20, 2013, with an effective

date of May 1, 2013, and is subject to regulatory and shareholder approvals.

The petroleum and natural gas assets contemplated for exchange under the

Agreement are all of Relentless' net interests in 3,002 net acres of petroleum

and natural gas rights located in the Loverna area of south-western Saskatchewan

(the "Relentless Assets"), and (i) all of Privateco's interests in 10,842 net

acres of petroleum and natural gas interests located in the Willesden Green area

of Alberta, (ii) all of Privateco's interests in 26,363 net acres of undeveloped

petroleum and natural gas interests located in the Gilby area of Alberta, (iii)

all of Privateco's interests in 4,798 net acres of undeveloped petroleum and

natural gas interests located in the Killam area of Alberta, (iv) all of

Privateco's interests in 4,000 net acres of undeveloped petroleum and natural

gas interests located in the Pine Creek area of Alberta, (v) all of Privateco's

interests in 3,200 net acres of undeveloped petroleum and natural gas interests

located in the Wembly area of Alberta, and (vi) all of Privateco's interests in

4,520, net acres of undeveloped petroleum and natural gas interests located in

various other areas of Alberta (collectively, the petroleum and natural gas

interests of Privateco are referred to as the "Privateco Assets"). The

Relentless Assets include 4 (3.02 net) producing oil and natural gas wells,

representing an average net April 2013 production rate of approximately 25

boes/d, while the Privateco Assets include 5.0 (3.91 net) producing oil and

natural gas wells and 8 suspended wells, representing an average net April 2013

production rate of approximately 50 boes/d, which includes 30 bbls/d of crude

oil production. All Privateco's oil and natural gas production comes from the

Willesden Green area of Alberta (the "Willesden Green Area").

The independent engineering firm of Insite Petroleum Consultants Ltd. ("Insite")

prepared a report (the "InSite Report") evaluating the crude oil, natural gas

and natural gas liquids ("NGLs") interests of Privateco in the Willesden Green

Area, with an effective date of December 31, 2012 and a preparation date of

March 8, 2013. The tables below summarize Privateco's crude oil, natural gas and

NGLs reserves in the Willesden Green Area and the net present value of future

net revenue attributable to such reserves, as evaluated by InSite, based on

forecast prices and costs assumptions. The information set forth below is

prepared in accordance with standards contained in the Canadian Oil and Gas

Evaluation Handbook prepared jointly by the Society of Petroleum Evaluation

Engineers (Calgary Chapter) and the Canadian Institute of Mining, Metallurgy &

Petroleum (the "COGE Handbook") and the reserve definitions contained in

National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities

("NI 51-101") adopted by the Canadian Securities Administrators and the COGE

Handbook.

The net present value of future net revenue attributable to Insite's reserves is

stated without provision for interest costs and general and administrative

costs, but after providing for estimated royalties, production costs,

development costs, other income, future capital expenditures, and well

abandonment costs for only those wells assigned reserves by InSite. It should

not be assumed that the undiscounted or discounted net present value of future

net revenue attributable to Insite's reserves estimated by InSite represent the

fair market value of those reserves. Other assumptions and qualifications

relating to costs, prices for future production and other matters are summarized

herein. Actual reserves may be greater than or less than the estimates provided

herein.

The following tables summarize the data contained in the InSite Report and as a

result may contain slightly different numbers than such report due to rounding.

Also due to rounding, certain columns may not add exactly. The InSite Report is

based on certain factual data supplied by Insite and InSite's opinion of

reasonable practice in the industry. InSite accepted this data as presented and

neither title searches nor field inspections were conducted by InSite.

Summary of Oil And Gas Reserves Based on Forecast Prices and Costs

As At December 31, 2012

Company Reserves

----------------------------------------------------

Light and Natural Gas

Medium Oil Heavy Oil Natural Gas Liquids

----------------------------------------------------

Gross Net Gross Net Gross Net Gross Net

Reserves Category Mbbl Mbbl Mbbl Mbbl MMcf MMcf Mbbl Mbbl

----------------------------------------------------------------------------

Proved

Developed Producing 31.8 28.7 0 0 60.3 50.6 2.4 1.6

Developed Non-

Producing 0 0 0 0 0 0 0 0

Undeveloped 0 0 0 0 0 0 0 0

----------------------------------------------------

Total Proved 31.8 28.7 0 0 60.3 50.6 2.4 1.6

Total Probable 13.7 12.1 0 0 29.9 24.5 1.2 0.7

----------------------------------------------------

Total Proved + Probable 45.5 40.8 0 0 90.2 75.1 3.6 2.3

----------------------------------------------------

----------------------------------------------------

Summary of Net Present Values Based on Forecast Prices and Costs

As At December 31, 2012

Net Present Values of Future Net Revenue

--------------------------------------------------

Before Income Tax

Discounted at

--------------------------------------------------

0%/yr 5%/yr. 10%/yr. 15%/yr. 20%/yr.

Reserves Category $M $M $M $M $M

--------------------------------------------------

Proved

Developed Producing 1,497.6 1,345.0 1,223.6 1,125.2 1,044.2

Developed Non-Producing 0 0 0 0 0

Undeveloped(2)(8) 0 0 0 0 0

--------------------------------------------------

Total Proved 1,497.6 1,345.0 1,223.6 1,125.2 1,044.2

Total Probable 751.7 616.5 517.9 444.0 387.0

--------------------------------------------------

Total Proved + Probable 2,249.3 1,961.5 1,741.5 1,569.2 1,431.2

--------------------------------------------------

--------------------------------------------------

InSite's escalated price forecast assumptions as of December 31, 2012 used in

the InSite Report are as follows:

----------------------------------------------------------------------------

WTI Cushing Edmonton Par Natural Gas NGLs Edmonton

Oklahoma Price 40 API AECO-C Price Propanes

Year (US$/bbl) (C$/bbl) (C$/mmbtu) (C$/bbl)

----------------------------------------------------------------------------

2013 92.00 90.00 3.34 36.00

----------------------------------------------------------------------------

2014 94.00 91.96 3.83 45.98

----------------------------------------------------------------------------

2015 96.00 93.92 4.33 56.35

----------------------------------------------------------------------------

2016 98.00 95.88 4.77 57.53

----------------------------------------------------------------------------

2017 100.00 97.84 5.11 58.70

----------------------------------------------------------------------------

2018 102.00 99.79 5.40 59.88

----------------------------------------------------------------------------

2019 104.04 101.79 5.64 61.07

----------------------------------------------------------------------------

2020 106.12 103.82 5.83 62.29

----------------------------------------------------------------------------

2021 108.24 105.90 5.95 63.54

----------------------------------------------------------------------------

2022 110.41 108.02 6.07 64.81

----------------------------------------------------------------------------

2023 112.62 110.18 6.19 66.11

----------------------------------------------------------------------------

2024 114.87 112.38 6.31 67.43

----------------------------------------------------------------------------

2025 117.17 114.63 6.44 68.78

----------------------------------------------------------------------------

2026 119.51 116.92 6.57 70.15

----------------------------------------------------------------------------

2027 121.90 119.26 6.70 71.56

----------------------------------------------------------------------------

2028 124.34 121.65 6.83 72.99

----------------------------------------------------------------------------

2029 126.82 124.08 6.97 74.45

----------------------------------------------------------------------------

2030 129.36 126.56 7.11 75.94

----------------------------------------------------------------------------

Thereafter Escalation rate of 2.0

----------------------------------------------------------------------------

----------------------------------------------------------------------------

NGLs Edmonton NGLs Edmonton

Butanes Condensate Inflation Exchange

Year (C$/bbl) (C$/bbl) Rate ( %) Rate (US$/C$)

----------------------------------------------------------------------------

2013 76.50 97.20 2.0 1.000

----------------------------------------------------------------------------

2014 78.17 97.48 2.0 1.000

----------------------------------------------------------------------------

2015 79.83 99.55 2.0 1.000

----------------------------------------------------------------------------

2016 81.50 101.63 2.0 1.000

----------------------------------------------------------------------------

2017 83.16 103.71 2.0 1.000

----------------------------------------------------------------------------

2018 84.82 105.78 2.0 1.000

----------------------------------------------------------------------------

2019 86.52 107.89 2.0 1.000

----------------------------------------------------------------------------

2020 88.25 110.05 2.0 1.000

----------------------------------------------------------------------------

2021 90.01 112.25 2.0 1.000

----------------------------------------------------------------------------

2022 91.82 114.50 2.0 1.000

----------------------------------------------------------------------------

2023 93.65 116.79 2.0 1.000

----------------------------------------------------------------------------

2024 95.52 119.12 2.0 1.000

----------------------------------------------------------------------------

2025 97.44 121.51 2.0 1.000

----------------------------------------------------------------------------

2026 99.38 123.94 2.0 1.000

----------------------------------------------------------------------------

2027 101.37 126.42 2.0 1.000

----------------------------------------------------------------------------

2028 103.40 128.94 2.0 1.000

----------------------------------------------------------------------------

2029 105.47 131.52 2.0 1.000

----------------------------------------------------------------------------

2030 107.58 134.15 2.0 1.000

----------------------------------------------------------------------------

Thereafter Escalation rate of 2.0%

----------------------------------------------------------------------------

Sproule Associates Limited, independent petroleum consultants, Calgary, Alberta

("Sproule"), evaluated the Relentless Assets in a report as at December 31,

2012, with a preparation date of March 28, 2013 (the "Sproule Report"). The

tables below summarize the crude oil, NGLs and natural gas reserves of the

Relentless Assets and the net present values of future net revenue for these

reserves using forecast prices and costs. The Sproule Report has been prepared

in accordance with the standards contained in the COGE Handbook and the reserve

definitions contained in NI 51-101 and the COGE Handbook. The net present value

of future net revenue attributable to the Company's reserves is stated without

provision for interest costs and general and administrative costs, but after

providing for estimated royalties, production costs, development costs, other

income, future capital expenditures, and well abandonment costs for only those

wells assigned reserves by Sproule. It should not be assumed that the estimates

of future net revenues presented in the tables below represent the fair market

value of the reserves. There is no assurance that the forecast prices and costs

assumptions will be attained and variances could be material. The recovery and

reserve estimates of the Company's crude oil, NGLs and natural gas reserves

provided herein are estimates only and there is no guarantee that the estimated

reserves will be recovered. Actual crude oil, natural gas and NGLs reserves may

be greater than or less than the estimates provided herein. Readers should note

that the totals in the following tables may not add due to rounding.

Summary of Oil And Gas Reserves Based on Forecast Prices and Costs

As At December 31, 2012

Natural Gas

(non-associated,

Light and associated & Natural Gas

Medium Oil Heavy Oil solution gas) Liquids

---------------------------------------------------------------

Company Company Company Company Company Company Company Company

Reserve Gross Net Gross Net Gross Net Gross Net

Category (Mbbl) (Mbbl) (Mbbl) (Mbbl) (MMcf) (MMcf) (Mbbl) (Mbbl)

----------------------------------------------------------------------------

PROVED

Developed

Producing 41.4 38.8 0.0 0.0 0 0 0 0

Developed

Non-

producing 0.4 0.4 0.0 0.0 57 54 0 0

Undeveloped 0.0 0.0 0.0 0.0 0 0 0 0

TOTAL PROVED 41.8 39.2 0.0 0.0 57 54 0 0

Total

Probable 16.0 15.0 0.0 0.0 21 20 0 0

Total Proved

Plus

Probable 57.8 54.2 0.0 0.0 78 74 0 0

Net Present Values Of Future Net

Revenue as at December 31, 2012

Before Incomes Taxes Discounted At

(%/Year)

(Forecast Costs And Prices)

------------------------------------

Reserves 0% 5% 10% 15% 20%

Category M$ M$ M$ M$ M$

----------------------------------------------------------------------------

PROVED

----------------------------------------------------------------------------

Developed

Producing 1,989 1,730 1,534 1,381 1,259

Developed Non-

producing 48 16 (5) (19) (29)

Undeveloped 0 0 0 0 0

Total Proved 2,037 1,746 1,528 1,362 1,230

Total Probable 968 692 522 412 337

Total Proved

Plus Probable 3,005 2,438 2,051 1,774 1,567

The escalated price forecast assumptions as of December 31, 2012 used in the

Sproule Report are as follows:

Light Crude Oil Heavy & Medium Oil

------------------------------------------- ---------------------

------------------------------------------- ---------------------

- Prices in Canadian Dollars -

1 Synthetic

WTI Edmonton Crude Oil Cromer Hardisty Hardisty

Cushing Par Price Edmonton LSB Heavy Lloydblend

Oklahoma 40 API 34 API 35 API 12 API 20.5 API

Year $US/Bbl $/Bbl $/Bbl $/Bbl $/Bbl $/Bbl

----- -------- -------- -------- -------- -------- --------

2013 89.63 84.55 90.55 81.55 61.72 69.33

2014 89.93 89.84 95.84 86.84 66.48 74.57

2015 88.29 88.21 94.21 85.21 65.27 73.21

2016 95.52 95.43 101.43 92.43 72.53 80.17

2017 96.96 96.87 102.87 93.87 73.62 81.37

2018 98.41 98.32 104.32 95.32 74.72 82.59

2019 99.89 99.79 105.79 96.79 75.84 83.83

2020 101.38 101.29 107.29 98.29 76.98 85.08

2021 102.91 102.81 108.81 99.81 78.14 86.36

2022 104.45 104.35 110.35 101.35 79.31 87.66

2023 106.02 105.92 111.92 102.92 80.50 88.97

-------------------------------

-------------------------------

Western 2

Canada Hardisty Energy

Select Cromer Bow Cost Cost

(WCS) Medium River Cold Lake InflationInflation Exchange

20.5 API 29.3 API 24.9 API Blend 22.6 Rate Rate Rate

Year $/Bbl $/Bbl $/Bbl API $/Bbl %/Yr %/Yr $US/$Cdn

----- -------- -------- -------- -------- -------- -------- --------

2013 69.33 77.79 70.18 68.49 -1.8% 1.5 1.001

2014 74.57 82.66 75.47 73.67 0.3% 1.5 1.001

2015 73.21 81.15 74.09 72.33 -1.8% 1.5 1.001

2016 80.17 88.75 81.12 79.21 8.2% 1.5 1.001

2017 81.37 90.09 82.34 80.40 1.5% 1.5 1.001

2018 82.59 91.44 83.57 81.60 1.5% 1.5 1.001

2019 83.83 92.81 84.82 82.83 1.5% 1.5 1.001

2020 85.08 94.20 86.10 84.07 1.5% 1.5 1.001

2021 86.36 95.61 87.39 85.33 1.5% 1.5 1.001

2022 87.66 97.05 88.70 86.61 1.5% 1.5 1.001

2023 88.97 98.50 90.03 87.91 1.5% 1.5 1.001

Escalation Rate of 1.5% Thereafter

1. 40 Deg API, 0.4% sulphur

2. Based on WTI

Escalation Rate of 1.5% Thereafter

1.

2.

The Transaction will enhance the Company's presence in Alberta area by

increasing the number of producing wells to 42 gross (7.45 net) wells and expand

its land base to 54,878 net acres.

No finder's fee is payable in connection with the Transaction. The Transaction

is subject to industry standard closing conditions, including regulatory

approval. In addition, the disposition of the Relentless Assets to Privateco is

considered a "reviewable disposition" under the policies of the TSX Venture

Exchange (the "TSXV"), requiring the approval of a majority of the

"disinterested" shareholders of Relentless. Unless such requirement is waived by

the TSXV, the divestment of the Relentless Assets pursuant to the Agreement is

subject to the approval of the shareholders of Relentless. Accordingly, the

consent of a majority of Relentless' shareholders in respect of the Agreement,

and specifically, the divestment of the Relentless Assets, is required as a

condition of the acceptance of such transactions by the TSXV. Relentless intends

to seek the written consent of its shareholders on or before June 20, 2013,

failing which Relentless intends to convene a special meeting of shareholders,

at which shareholder approval will be sought for the Agreement and the

divestment of the Relentless Assets thereunder. The board of directors of

Relentless has determined that the Transactions contemplated under the Agreement

are in the best interest of its shareholders, has unanimously approved the

Agreement and Transactions, and recommends that the shareholders execute the

written consents approving such matters. Any shareholder of Relentless wishing

to obtain and execute the written consent should contact Relentless as set out

below.

About Relentless Resources Ltd.

Relentless is a Calgary based emerging oil and natural gas company, engaged in

the exploration, development, acquisition and production of natural gas and

light gravity crude oil reserves in Alberta and Saskatchewan. Relentless' common

shares trade on the TSX Venture Exchange under the symbol RRL.

Relentless' primary corporate objective is to achieve non-dilutive growth and

enhance shareholder value through internal prospect development, strategic

production acquisitions and prudent financial management.

For further information regarding this Press Release, or if you are a

shareholder of Relentless, and you desire to obtain and execute the written

consent in connection with the Transaction, please contact:

www.relentless-resources.com.

Reader Advisory

Certain information in this Press Release is forward-looking within the meaning

of certain securities laws, and is subject to important risks, uncertainties and

assumptions. This forward-looking information includes, among other things,

information with respect to Relentless' beliefs, plans, expectations,

anticipations, estimates and intentions, including the completion of Relentless'

exchange of certain petroleum and natural gas interests, the success of future

drilling and development activities, the performance of existing wells, the

performance of new wells, general economic conditions, availability of required

equipment and services and prevailing commodity prices. The words "may",

"could", "should", "would", "suspect", "outlook", "believe", "anticipate",

"estimate", "expect", "intend", "plan", "target" and similar words and

expressions are used to identify forward-looking information. The

forward-looking information in this Press Release describes Relentless'

expectations as of the date of this Press Release.

Material factors which could cause actual results or events to differ materially

from such forward-looking information include, among others, the failure to

obtain shareholder or regulatory approvals, risks arising from general economic

conditions and adverse industry events, risks arising from operations generally,

changes in plans with respect to exploration or development projects or capital

expenditures; the uncertainty of reserve estimates; the uncertainty of estimates

and projections relating to production, costs and expenses, and health, safety

and environmental risks), commodity price and exchange rate fluctuations;

reliance on contractual rights such as licenses and leases in the conduct of its

business, reliance on third parties, reliance on key personnel, possible failure

of the business model or business plan or the inability to implement the

business model or business plan as planned, competition, environmental matters,

and insurance or lack thereof.

Relentless cautions that the foregoing list of material factors is not

exhaustive, is subject to change and there can be no assurance that such

assumptions will reflect the actual outcome of such items or factors. When

relying on Relentless forward-looking information to make decisions, investors

and others should carefully consider the foregoing factors and other

uncertainties and potential events. Relentless has assumed a certain

progression, which may not be realized. It has also assumed that the material

factors referred to in the previous paragraph will not cause such

forward-looking information to differ materially from actual results or events.

The forward-looking statements contained in this press release are made as of

the date hereof and the Company undertakes no obligation to update publicly or

revise any forward-looking statements or information, whether as a result of new

information, future events or otherwise, unless so required by applicable

securities laws.

Barrels of oil equivalent (boe) is calculated using the conversion factor of 6

mcf (thousand cubic feet) of natural gas being equivalent to one barrel of oil.

Boes may be misleading, particularly if used in isolation. A boe conversion

ratio of 6 mcf:1 bbl (barrel) is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead. Given that the value ratio based on the current

price of crude oil as compared to natural gas is significantly different from

the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be

misleading as an indication of value.

FOR FURTHER INFORMATION PLEASE CONTACT:

Relentless Resources Ltd.

Dan Wilson

President & CEO

(403) 532 - 4466 ext. 227 or Mobile: (403) 874 - 9862

(403) 303 - 2503 (FAX)

dwilson@relentless-resources.com

www.relentless-resources.com

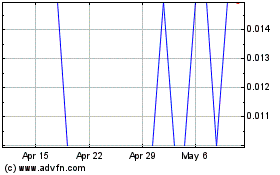

Resolute Resources (TSXV:RRL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Resolute Resources (TSXV:RRL)

Historical Stock Chart

From Dec 2023 to Dec 2024