Pulse Oil Announces Closing of Rights Offering

January 23 2024 - 8:00AM

Pulse Oil Corp. (the “

Company” or

“

Pulse”) (TSXV: PUL) reports the completion of the

rights offering (the “

Rights Offering”) to

eligible holders of its common shares (the “

Common

Shares”), announced in its news release of December 7,

2023.

Pursuant to the Rights Offering, the Company

issued a total of 103,910,942 Common Shares, the full amount of the

Rights Offering, at a price of $0.04 per Common Share for aggregate

gross proceeds of $4,156,437.68. A total of 49,074,871 Common

Shares were issued under the basic subscription privilege,

including 39,889,286 Common Shares to insiders of the Company, as a

group, and 6,786,000 Common Shares to all other persons

(“Non-Insiders”), as a group. In addition, a total

of 2,399,585 Common Shares were issued under the additional

subscription privilege, all to Non-Insiders. To the knowledge of

the Company after reasonable inquiry, no person became an insider

of Pulse as a result of the Rights Offering.

As of the closing of the Rights Offering, Pulse

has 623,465,656 Common Shares issued and outstanding. The Rights

Offering remains subject to receipt of final acceptance of the TSX

Venture Exchange.

In connection with the Rights Offering and as

previously announced, Pulse entered into a standby commitment

agreement with each of CDN Trustee Limited TR CDN Trust and Andrew

Ritchie TR AJ Trust No 2 (collectively, the “Standby

Purchasers”), each dated December 7, 2023 (the

“Standby Commitment Agreements”). Pursuant to the

Standby Commitment Agreements, (i) the Standby Purchasers exercised

their basic subscription privileges and, in addition thereto,

purchased, in aggregate, 54,836,071 Common Shares available as a

result of unexercised rights under the Rights Offering; and (ii)

the Company issued, in aggregate 17,050,000 non-transferable Common

Share purchase warrants (the “Bonus Warrants”) to

the Standby Purchasers. Each Bonus Warrant is exercisable for 60

months from the date of issuance into one Common Share at a price

of $0.05 per Common Share. No other fees or commissions were paid

by the Company in connection with the Rights Offering.

Pulse Oil Corp. CEO, Garth Johnson, commented:

“We are looking forward to a busy schedule of operations in 2024

using the proceeds from this financing. We’ve already begun the

stimulation of one well in our Nisku E pool with a goal to add new

oil production in February, followed by the drilling of a new well

in the Nisku D pool with a short-term goal to add new production

from drilling in Q1 of 2024 and longer term this well will provide

Pulse with an ideally located enhanced oil recovery

(“EOR”) production well when the EOR program

injection solvent migrates toward this well, further increasing oil

production. Finally, we are also pleased to announce that we have

finalized all pipeline plans, costs and timing and Pulse will be

completing this work in Q1/Q2 of 2024 while also converting another

of our existing wells in our D pool to a water flood well in order

to further increase ultimate oil recoveries within our D pool

asset."

About Pulse:

Pulse is a Canadian company incorporated under

the Business Corporations Act (Alberta) that is primarily focused

on a 100% Working Interest Enhanced Oil Project Located in West

Central Alberta, Canada. The project includes two established Nisku

pinnacle reef reservoirs that have been producing sweet light crude

oil for over 40 years.

The Company has instituted a proven recovery

methodology (NGL solvent injection) to further enhance the ultimate

oil recovery from these two proven pools. With under 10 million

barrels of oil recovered to date, and representing approximately

30% recovery factor from the pools, Pulse is moving forward to

execute the EOR project and unlock significant value for

shareholders. Pulse’s total reclamation liabilities are just $2.96

million which, when compared to many peers in the industry in

Western Canada, are very low.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information contact:

Pulse Oil Corp.

Garth

JohnsonCEO604-306-4421garth@pulseoilcorp.com

Forward Looking

Statements:

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. All statements, other than statements of historical

fact, included herein are forward-looking information. In

particular, this news release contains forward-looking information

regarding the planned use of proceeds from the Rights Offering and

the anticipated benefit from the same. There can be no assurance

that such forward-looking information will prove to be accurate,

and actual results and future events could differ materially from

those anticipated in such forward-looking information. This

forward-looking information reflects Pulse’s current beliefs and

is based on information currently available to Pulse and on

assumptions Pulse believes are reasonable. These assumptions

include, but are not limited to receipt of TSX Venture Exchange

final approval of the Rights Offering, the conditions facing Pulse

at the time of planned expenditure of proceeds from the Rights

Offering, and operational timing and results. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of Pulse to be materially

different from those expressed or implied by such forward-looking

information. Such risks and other factors may include, but are not

limited to general business, economic, competitive, political and

social uncertainties, delay or failure to receive board or

regulatory approvals, the actual results of future drilling and

workover operations, production growth anticipated from drilling

operations, EOR operational results, changes in legislation,

including environmental legislation, affecting Pulse, and loss of

key individuals. A description of additional risk factors that

may cause actual results to differ materially from forward-looking

information can be found in Pulse’s disclosure documents on the

SEDAR+ website at www.sedarplus.ca. Although Pulse has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. Readers are cautioned

that the foregoing list of factors is not exhaustive. Readers are

further cautioned not to place undue reliance on forward-looking

information as there can be no assurance that the plans,

intentions or expectations upon which they are placed will occur.

Pulse expressly disclaims any intention or obligation to update or

revise any forward-looking information except as expressly required

by applicable securities law.

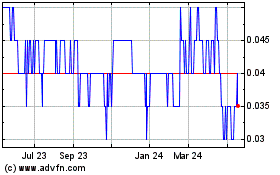

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Nov 2024 to Dec 2024

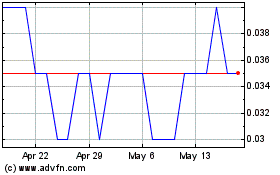

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Dec 2023 to Dec 2024