Pulse Oil Corp. Proposes Extension of Warrants and Updates Operations

May 01 2023 - 7:30AM

Pulse Oil Corp., (“Pulse” or the "Company”) (TSX-V: PUL) is pleased

to announce that, subject to TSX Venture Exchange (“TSXV”)

approval, the Company intends to extend the expiry dates of

211,870,000 outstanding share purchase warrants, (the “Warrants”)

by 6 months, to November 16, 2023 (the “

Warrant

Extension”). The Warrants were issued pursuant to a

private placement announced on February 17, 2022 and accepted for

filing by the TSXV on May 16, 2022. Each Warrant is exercisable to

purchase one common share of Pulse at $0.065 per share and are

currently set to expire on May 16, 2023. All other terms of the

Warrants, including the exercise price, will remain unchanged. Upon

receipt of the approval of the TSXV of the Warrant Extension, a

material change report in respect of the Warrant Extension will be

filed by the Company. As the Warrants currently expire on May 16,

2023 and the date of receipt of TSXV approval (if granted) is

unknown, the material change report may be filed less than 21 days

before the Warrant Extension occurs.

A total of 149,000,000 of the affected Warrants

are held by parties considered to be “related parties” of the

Company under Multilateral Instrument 61-101 Protection of Minority

Shareholders in Special Transactions (“MI 61-101”). Therefore, the

amendment of Warrants constitutes a “related party transaction” as

contemplated by MI 61-101 and TSXV Policy 5.9 – Protection of

Minority Shareholders in Special Transactions. However, the

exemptions from formal valuation and minority approval requirements

provided for by these guidelines can be relied upon by the Company

in respect of this matter as the fair market value of the Warrants

held by “interested parties" (as defined in MI 61-101) does not

exceed 25% of the market capitalization of the Company as

determined under MI 61-101.

EOR Operational

Advancements:

Pulse has injected approximately 5550 m3 of

solvent into the first of its two pinnacle reef reservoirs (Nisku

D) as of April 25, 2023 and will continue to inject solvent on a go

forward basis as planned in order to increase recovery rates and

oil and gas production within Pulse’s 100% owned Bigoray field.

- Pulse’s

solvent contract with a large mid-stream company (the “Solvent

Supplier”) expired on March 31, 2023 and Pulse has secured a

continued supply of solvent with the same Solvent Supplier from

April 1, 2023 to March 31, 2024 with savings of approximately 15%

per m3 of solvent purchased going forward.

- Pulse is

now taking a number of steps to optimize the forecasted timing for

increased oil production, resulting from a successful solvent

flooding process. Currently, Pulse plans to implement the following

operations:

- Convert

an existing shut-in well to a producing well in order to enhance

the growth of oil and gas production over time as Pulse’s solvent

injection continues, increasing the solvent bank and sweeping it

through the Nisku D pinnacle reef.

- Workover

a current producer within the Nisku D pool in order to test its

potential as a second injection well and determine its potential to

increase the current rate of solvent injection into the Nisku D

pool.

- If the

solvent injection test noted above returns positive results, Pulse

will convert this well into a full-time solvent injector in the

Nisku D pool.

- Pulse is

in the process of acquiring an existing water disposal well from an

arms-length party at no cost that will be able to dispose of

additional produced water. Oil and water will be produced

simultaneously during the solvent flood and additional water

disposal capacity equates to additional oil production

capacity.

- Pulse

will continue to identify other opportunities to further optimize

the Bigoray EOR project and will constantly monitor the operations

to determine if any additional operations will cost-effectively

enhance the timing of production growth and overall recovery of the

Bigoray EOR project.

About Pulse

Pulse is a Canadian company incorporated under

the Business Corporations Act (Alberta) that is primarily focused

on a 100% Working Interest Enhanced Oil Project Located in West

Central Alberta, Canada. The project includes two established Nisku

pinnacle reef reservoirs that have been producing sweet light crude

oil for over 40 years. The Company plans to institute a proven

recovery methodology (NGL solvent injection) to further enhance the

ultimate oil recovery from these two proven pools. With under 10

million barrels of oil recovered to date, and representing

approximately 30% recovery factor from the pools, Pulse is moving

forward to execute the EOR project and unlock significant value for

shareholders. Pulse’s total reclamation liabilities are less than

$3 million which, when compared to many peers in the industry in

Western Canada, are very low.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information contact:

Pulse Oil Corp.

Garth

JohnsonCEO604-306-4421garth@pulseoilcorp.com

Drew

CadenheadDirectordrew@pulseoilcorp.com

Forward Looking Statements:

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. All statements, other than statements of historical

fact, included herein are forward-looking information. In this

news release, such statements include but are not limited to

Pulse’s proved and probable reserves, Pulse’s operations and its

oil and gas resources. There can be no assurance that such

forward-looking information will prove to be accurate, and actual

results and future events could differ materially from those

anticipated in such forward-looking information.

This forward-looking information reflects

Pulse’s current beliefs and is based on information currently

available to Pulse and on assumptions Pulse believes are

reasonable. These assumptions include, but are not limited to, the

independent reserves estimates, conditions facing Pulse at the time

of planned expenditure included in the reserve evaluation and in

advancing and optimizing the Bigoray EOR project, conducting

operations on time and on budget and growing reserves, resources,

production, revenue and cash flow anticipated from these

operations. Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

Pulse to be materially different from those expressed or implied

by such forward-looking information. Such risks and other factors

may include, but are not limited to: general business, commodity

prices, economic, competitive, political and social uncertainties;

general capital market conditions and market prices for

securities; consistent production and cash flow from current

operations, the actual results of future operations; competition;

changes in legislation, including environmental legislation,

affecting Pulse; the timing and availability of external financing

on acceptable terms; and loss of key individuals. A description of

additional risk factors that may cause actual results to differ

materially from forward-looking information can be found in

Pulse’s disclosure documents on the SEDAR website at www.sedar.com.

Although Pulse has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. Readers are cautioned that the foregoing list of factors

is not exhaustive. Readers are further cautioned not to place

undue reliance on forward-looking information as there can be no

assurance that the plans, intentions or expectations upon which

they are placed will occur. Forward-looking information contained

in this news release is expressly qualified by this cautionary

statement. The forward-looking information contained in this news

release represents the expectations of Pulse as of the date of

this news release and, accordingly, is subject to change after such

date. However, Pulse expressly disclaims any intention or

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or

otherwise, except as expressly required by applicable securities

law.

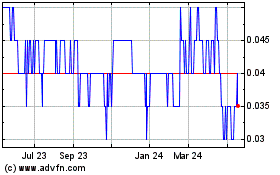

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Nov 2024 to Dec 2024

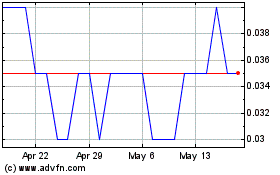

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Dec 2023 to Dec 2024