Pulse Oil Corp., (“Pulse” or the "Company”) (TSXV: PUL) is pleased

to announce that the Company has recently completed a number of

critical steps to move forward with the Company’s Enhanced Oil

Recovery (“EOR”) project in the Bigoray area of Alberta, Canada.

The Company has agreed to terms and secured a solvent supply, one

of the last remaining commercial project paths before actual

injection can begin. Pulse has also secured an agreement for oil

and gas sales for the EOR project with more details of these

advancements provided below.

EOR Operational

Advancements:

- Pulse

has secured a solvent supply to begin injecting into the first of

two reservoirs (Nisku D) estimated to start in November 2022 with a

large mid-stream company (the “Solvent Supplier”). The contracted

amount of solvent is for the period December 2022 through to March

31, 2023 for up to 6,000 m3 per month of solvent (approximately

38,000 barrels). Going forward after March 31, 2023, Pulse has the

option to lock-in a minimum of 6,000m3/d of solvent supply on an

annual basis or increase the overall volumes to initiate injection

into Pulse’s second reservoir (Nisku E) at that time.

- Pulse

has secured an agreement with a second large mid-stream company to

construct and operate a Lease Automatic Custody Unit (“LACT”) on

Pulse’s behalf. This facility expansion will tie-in the

mid-streamers facilities with Pulse’s existing pipelines to measure

all oil and gas volumes produced from Pulse’s properties at

Bigoray. The project will provide the mechanisms to transfer

custody to the buyer of Pulse’s oil and gas from the Bigoray EOR

project.

- Pulse

has filed the necessary applications with the Alberta Energy

Regulator (AER) to approve of the Bigoray EOR project and injection

well. It is anticipated that approval will be granted in November

2022.

- Pulse

has completed consultation with affected First Nations as part of

the approval to expand our operational area to safely and

efficiently accommodate the extra facility and trucking

requirements associated with the EOR project. The project has

recently been completed and the site is ready for installation of

the remaining facility infrastructure.

- Pulse

has commissioned a third party pump manufacturer to build a fit for

purpose injection skid to satisfy the company’s requirements to

complete the injection of solvent for the EOR project. The pump is

to be delivered in October with an estimated in service date of

November 2022.

Pulse’s CEO Garth Johnson commented; “Our team

is excited to dig into the final phases of initiating this EOR

solvent flood. Pulse was originally created to initiate this

project, and after surviving the past 3 years of global

uncertainty, we managed to clean up our own balance sheet, acquire

facility assets for the EOR at discounted prices, and remained debt

free. We’re now ready to kick this well-proven process off, with

injection scheduled to commence in December 2022.”

EOR Technical Updates

In May of 2019, Pulse released the results of a three-phase

independent viability analysis by one of the world leading

providers of technology for reservoir characterization, drilling,

production and processing to the oil and gas industry.

The purpose of the study was to seek third-party confirmation

that Pulse’s two 100% operated Nisku Pinnacle Reef reservoirs were

viable candidates to initiate a solvent flood EOR scheme, similar

to the fifty surrounding pools where successful solvent floods have

already been initiated. A summary of the results follows:

- The three geo-technical phases of

the EOR study, were the first ever utilising 3-dimensional seismic

data on the Nisku D & E pinnacle reefs.

- The reservoir simulation conducted

as part of the EOR study included over 200 separate computer

iterations of historical production, adjusting the geo-model after

every iteration to ensure the model was as accurate as possible

based on historical production and modern 3-D interpretations,

before beginning the solvent flood forecast.

- The detailed simulation allowed the

team to model the most effective positioning of solvent injectors,

optimum compositions, pressures and rates of injected fluids and

optimum production take-points to maximise ultimate recovery from

these established pools.

- The go-forward simulation under the

EOR program resulted in a peak estimated Nisku D-Pool production

rate of approximately 2,000 barrels of oil/day, with peak

production, including Nisku E production increasing to

approximately 3,000 barrels of oil/d. Although the independent

study was commissioned by Pulse to focus only on the feasibility

and forecast of oil production within Pulse’s Nisku D & E

pinnacle reefs, Pulse’s management team also expects to see similar

amounts of gas production on a BOE basis from gas breakout as oil

flows to the surface. Given recent increases in natural gas prices

in Alberta, the gas could become as important commercially as the

oil recovered at Bigoray.

- This production simulation was

prepared, at Pulse’s request, to assume initiation of the solvent

injection into the two reservoirs was staggered by 12-18 months.

Beginning with the Nisku D Pool, and then following with the Nisku

E Pool allows the Company to preserve working capital and begin

generating cash flow during the initial years of the program.

- Pulse, subject to having sufficient

working capital, can accelerate this schedule to initiate the E

Pool EOR program at any time in conjunction with the D pool. The

simultaneous implementation of both pools results in peak forecast

rates of approximately 5,000 barrels/day.

- Importantly, the estimate for

Discovered Petroleum Initially-In-Place (“DPIIP”) as part of the

newly interpreted geo-model was calculated at 33.5 million barrels

of oil, which is 26% higher than the DPIIP volume calculated by the

Alberta Energy Regulator (“AER”) of 26.5 MM barrels. (1)

- The estimated total oil recovery

factor can be doubled from the currently recovered approximately

35% to at least 70% of PIIP. (1)

- The estimated incremental oil

reserves from the Nisku D and E EOR program could range from 9.28

million barrels to as high as 11.73 million barrels.(2)

(1) The Resource Assessment was prepared in accordance with

National Instrument 51-101 – Standards of Disclosure for Oil and

Gas Activities of the Canadian Securities Administrators ("NI

51-101") and the Canadian Oil and Gas Evaluation Handbook ("COGE

Handbook").

(2) All disclosure of reserves in the statement has been

prepared in accordance with the COGE Handbook.

About Pulse

Pulse is a Canadian company incorporated under

the Business Corporations Act (Alberta) that is primarily focused

on a 100% Working Interest Enhanced Oil Project Located in West

Central Alberta, Canada. The project includes two established Nisku

pinnacle reef reservoirs that have been producing sweet light crude

oil for over 40 years. The Company plans to institute a proven

recovery methodology (NGL solvent injection) to further enhance the

ultimate oil recovery from these two proven pools. With under 10

million barrels of oil recovered to date, and representing

approximately 30% recovery factor from the pools, Pulse is moving

forward to execute the EOR project and unlock significant value for

shareholders. Pulse’s total reclamation liabilities are just $2.46

million which, when compared to many peers in the industry in

Western Canada, are very low.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information contact:

Pulse Oil Corp.

Garth

JohnsonCEO604-306-4421garth@pulseoilcorp.com

Drew

CadenheadPresident604-909-1152drew@pulseoilcorp.com

Barrels of oil equivalent (boe) is calculated

using the conversion factor of 6 mcf (thousand cubic feet) of

natural gas being equivalent to one barrel of oil. Boes may be

misleading, particularly if used in isolation. A boe

conversion ratio of 6 mcf:1 bbl (barrel) is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the

wellhead. Given that the value ratio based on the current

price of crude oil as compared to natural gas is significantly

different from the energy equivalency of 6:1, utilizing a

conversion on a 6:1 basis.

Forward Looking Statements:

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. All statements, other than statements of historical

fact, included herein are forward-looking information. In this

news release, such statements include but are not limited to

Pulse’s operations and oil and gas resources. There can be no

assurance that such forward-looking information will prove to be

accurate, and actual results and future events could differ

materially from those anticipated in such forward-looking

information.

This forward-looking information reflects

Pulse’s current beliefs and is based on information currently

available to Pulse and on assumptions Pulse believes are

reasonable. These assumptions include, but are not limited to,

conditions facing Pulse at the time of the planned expenditure in

advancing the Bigoray EOR project, conducting operations on time

and on budget and the anticipated reserves, resources, production,

revenue and cash flow anticipated from these operations.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of Pulse to be

materially different from those expressed or implied by such

forward-looking information. Such risks and other factors may

include, but are not limited to: general business, commodity

prices, economic, competitive, political and social uncertainties;

general capital market conditions and market prices for

securities; consistent production and cash flow from current

operations, the actual results of future operations; competition;

changes in legislation, including environmental legislation,

affecting Pulse; the timing and availability of external financing

on acceptable terms; and loss of key individuals. A description of

additional risk factors that may cause actual results to differ

materially from forward-looking information can be found in

Pulse’s disclosure documents on the SEDAR website at www.sedar.com.

Although Pulse has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. Readers are cautioned that the foregoing list of factors

is not exhaustive. Readers are further cautioned not to place

undue reliance on forward-looking information as there can be no

assurance that the plans, intentions or expectations upon which

they are placed will occur. Forward-looking information contained

in this news release is expressly qualified by this cautionary

statement. The forward-looking information contained in this news

release represents the expectations of Pulse as of the date of

this news release and, accordingly, is subject to change after such

date. However, Pulse expressly disclaims any intention or

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or

otherwise, except as expressly required by applicable securities

law.

Reserves

All production and reserves quantities included

in Pulse’s public filings have been prepared in accordance with

Canadian practices and specifically in accordance with National

Instrument 51-101 Standards of Disclosure for Oil and Gas

Activities. These practices are different from the practices used

to report production and to estimate reserves in reports and other

materials filed with the SEC by United States companies.

Accordingly, information concerning resources, deposits,

production, reserves and any similar information of the Company may

not be comparable with information made public by companies that

report in accordance with United States standards.

Resource Definitions

Resources encompasses all petroleum quantities

that originally existed on or within the earth's crust in naturally

occurring accumulations, including Discovered and Undiscovered

(recoverable and unrecoverable) plus quantities already produced.

"Total Resources" is equivalent to "Total Petroleum Initially

In-Place". Resources are classified in the following

categories:

Total Petroleum Initially In-Place ("TPIIP") is

that quantity of petroleum that is estimated to exist originally in

naturally occurring accumulations. It includes that quantity of

petroleum that is estimated, as of a given date, to be contained in

known accumulations, prior to production, plus those estimated

quantities in accumulations yet to be discovered.

Discovered Petroleum Initially In-Place

("DPIIP") is that quantity of petroleum that is estimated, as of a

given date, to be contained in known accumulations prior to

production. The recoverable portion of DPIIP includes production,

reserves, and Contingent Resources; the remainder is

unrecoverable.

Contingent Resources are those quantities of

petroleum estimated, as of a given date, to be potentially

recoverable from known accumulations using established technology

or technology under development but which are not currently

considered to be commercially recoverable due to one or more

contingencies. Economic Contingent Resources (ECR) are those

contingent resources that are currently economically

recoverable.

Undiscovered Petroleum Initially In Place

("UPIIP") is that quantity of petroleum that is estimated, on a

given date, to be contained in accumulations yet to be discovered.

The recoverable portion of UPIIP is referred to as Prospective

Resources and the remainder is unrecoverable.

Prospective Resources are those quantities of

petroleum estimated, as of a given date, to be potentially

recoverable from undiscovered accumulations by application of

future development projects. Prospective Resources have both an

associated chance of discovery and a chance of development.

Unrecoverable is that portion of DPIIP and UPIIP

quantities which is estimated, as of a given date, not to be

recoverable by future development projects. A portion of these

quantities may become recoverable in the future as commercial

circumstances change or technological developments occur; the

remaining portion may never be recovered due to the

physical/chemical constraints represented by subsurface interaction

of fluids and reservoir rocks. Uncertainty Ranges are described by

the Canadian Oil and Gas Evaluation Handbook as low, best, and high

estimates for reserves and resources as follows:

Low Estimate: This is considered to be a

conservative estimate of the quantity that will actually be

recovered. It is likely that the actual remaining quantities

recovered will exceed the low estimate. If probabilistic methods

are used, there should be at least a 90 percent probability (P90)

that the quantities actually recovered will equal or exceed the low

estimate.

Best Estimate: This is considered to be the best

estimate of the quantity that will actually be recovered. It is

equally likely that the actual remaining quantities recovered will

be greater or less than the best estimate. If probabilistic methods

are used, there should be at least a 50 percent probability (P50)

that the quantities actually recovered will equal or exceed the

best estimate.

High Estimate: This is considered to be an

optimistic estimate of the quantity that will actually be

recovered. It is unlikely that the actual remaining quantities

recovered will exceed the high estimate. If probabilistic methods

are used, there should be at least a 10 percent probability (P10)

that the quantities actually recovered will equal or exceed the

high estimate.

Development Unclarified is a project maturity

sub-class of contingent resources that refers to the development

plan evaluation is not complete and there is ongoing activity to

resolve any risks or uncertainties.

Certain resource estimate volumes disclosed

herein are arithmetic sums of multiple estimates of DPIIP or UPIIP,

which statistical principles indicate may be misleading as to

volumes that may actually be recovered. Readers should give

attention to the estimates of individual classes of resources and

appreciate the differing probabilities of recovery associated with

each class as explained under this Resource Definitions

section.

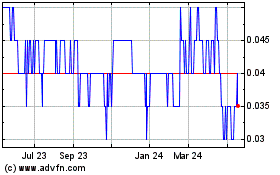

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Nov 2024 to Dec 2024

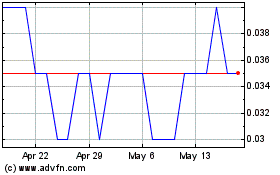

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Dec 2023 to Dec 2024