Pulse Oil Corp., (“Pulse” or the "Company”) (TSXV: PUL) is off to a

strong start in 2022 and is happy to provide a production and

operations update, along with progress related to the Company’s

100% owned Bigoray area Enhanced Oil Recovery (“EOR”) project.

Production:

Pulse’s oil and gas production over the past 30

days has averaged approximately 355 BOE/D (64% oil) and over the

past week has reached 425 BOE/D (68% oil) following recently

completed operations in both the Company’s core areas of Bigoray

and Queenstown. The Company reports that lingering industry

downturns in Alberta has provided the opportunity to complete all

work quickly and on budget.

Pulse CEO Garth Johnson added; “The combination

of Pulse’s strong team, surplus equipment in our areas and a

readily available service workforce has allowed us to not only add

additional oil production, but do so without drilling new wells or

incurring any additional reclamation liabilities. That’s a bonus in

our industry these days. Going forward we forecast strong oil

prices will continue to ramp up activity, we will be focussed on

planning and safely executing our plan to continue growing our

production and cash-flow.”

Queenstown Update:

In December 2021, Pulse cleaned out a horizontal

well drilled by Pulse in 2018 (capital cost $185,000), moving the

well from shut-in / non-producing status to production rates of

approximately 75 BOE/D (71% oil). Pulse is in the process of a

second 100% interest horizontal well clean-out from the same

surface pad and expects similar results. Robust commodity prices

and a better understanding of the required operation and potential

clean out results supported this work as we continue to strengthen

Pulse cashflow moving forward.

Bigoray Reactivation

Update:

Pulse’s team has re-activated a number of

historical producing wells in the Bigoray area, while continuing to

acquire core assets. Many of our acquisitions are via abandoned or

suspended pipelines and production facilities (at little to no

cost) from the AER’s Orphaned Well Association, or from third

parties looking to divest of liabilities associated with excess

infrastructure.

Pulse’s newly acquired infrastructure, combined

with the Company’s existing Bigoray production facilities, is

providing immediate monetisation opportunities for shut-in oil and

gas wells. Importantly the longer term goal of this acquisition

work is to provide key components necessary to advance the

Company’s EOR mandate.

Bigoray EOR:

Pulse has made several investments at much lower

cost than initially estimated to progress the EOR, including the

completion of the Bigoray production facility and critical pipeline

acquisitions.

Company President Drew Cadenhead noted; “Our

management and operations team remains focused on all aspects of

the Company’s operations such as risk, cost, cashflow, production,

reserves and much more, but we know our prime goal is the

initiation of the miscible flood in our two Bigoray oil pools. With

all wells in that plan already drilled, we’re fortunate the

drilling risk has been taken out of the equation, meaning we can

see the goal-line, and by employing proven EOR technology, we can

start focusing on monetisation without any further drilling or

associated reclamation liabilities. Our newly re-activated

production has coincided with strong oil price increases to

accelerate our entire EOR timeline.” Cadenhead also noted, “Pulse

has existed in survival mode for the past two years as global

circumstances stalled oil and gas investment momentum. We’ve made

it through now, and it is clear there is an increasing energy

supply shortage that continues to increase oil and gas prices as

the reality of the push towards de-carbonization conflicts with the

reality of near-term fossil fuel demands. It’s a good time to own

assets like our Bigoray oil pools, it’s time to get busy.”

About Pulse

Pulse is a Canadian company incorporated under

the Business Corporations Act (Alberta) that is primarily focused

on a 100% Working Interest Enhanced Oil Project Located in West

Central Alberta, Canada. The project includes two established Nisku

pinnacle reef reservoirs that have been producing sweet light crude

oil for over 40 years. The Company plans to institute a proven

recovery methodology (NGL solvent injection) to further enhance the

ultimate oil recovery from these two proven pools. With under 10

million barrels of oil recovered to date, and representing just 35%

recovery factor from the pools, Pulse is moving forward to execute

the EOR project and unlock significant value for shareholders.

Pulse’s total reclamation liabilities are just $2.23 Million,

which, when compared to many peers in the industry in Western

Canada, are very low.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information contact:

Pulse Oil Corp.

Garth

JohnsonCEO604-306-4421garth@pulseoilcorp.com

Drew CadenheadPresident and

COO604-909-1152drew@pulseoilcorp.com

Barrels of oil equivalent (boe) is calculated

using the conversion factor of 6 mcf (thousand cubic feet) of

natural gas being equivalent to one barrel of oil. Boe’s may

be misleading, particularly if used in isolation. A boe

conversion ratio of 6 mcf:1 bbl (barrel) is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the

wellhead. Given that the value ratio based on the current

price of crude oil as compared to natural gas is significantly

different from the energy equivalency of 6:1, utilizing a

conversion on a 6:1 basis.

Forward Looking Statements:

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. All statements, other than statements of historical

fact, included herein are forward-looking information. In

particular, this news release contains forward-looking information

regarding: production rates, reactivation operations, oil and gas

prices, EOR projects and the potential timing of operations. There

can be no assurance that such forward-looking information will

prove to be accurate, and actual results and future events could

differ materially from those anticipated in such forward-looking

information. This forward-looking information reflects Pulse’s

current beliefs and is based on information currently available to

Pulse and on assumptions Pulse believes are reasonable. These

assumptions include, but are not limited to: oil and gas prices,

timing and success of operations, weather, well productivity and

Pulse finances. Forward-looking information is subject to known

and unknown risks, uncertainties and other factors that may cause

the actual results, level of activity, performance or achievements

of Pulse to be materially different from those expressed or

implied by such forward-looking information. Such risks and other

factors may include, but are not limited to: general business,

economic, competitive, political and social uncertainties; general

capital market conditions and market prices for securities; the

actual results of future operations; competition; changes in

legislation, including environmental legislation, affecting Pulse;

the timing and availability of external financing on acceptable

terms; and loss of key individuals. A description of additional

risk factors that may cause actual results to differ materially

from forward-looking information can be found in Pulse’s

disclosure documents on the SEDAR website at www.sedar.com.

Although Pulse has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. Readers are cautioned that the foregoing list of factors

is not exhaustive. Readers are further cautioned not to place

undue reliance on forward-looking information as there can be no

assurance that the plans, intentions or expectations upon which

they are placed will occur. Forward-looking information contained

in this news release is expressly qualified by this cautionary

statement. The forward-looking information contained in this news

release represents the expectations of Pulse as of the date of

this news release and, accordingly, is subject to change after such

date. However, Pulse expressly disclaims any intention or

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or

otherwise, except as expressly required by applicable securities

law.

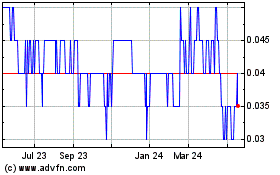

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Nov 2024 to Dec 2024

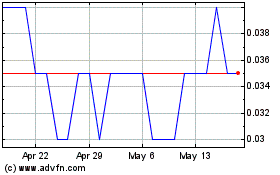

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Dec 2023 to Dec 2024