Suroco Energy Inc. Announces Agreement to Acquire Interest in the Putumayo 7 Block and Tests Quinde-6 Appraisal Well

May 07 2014 - 9:43AM

Marketwired Canada

(NOT FOR DISSEMINATION IN THE UNITED STATES OF AMERICA)

Suroco Energy Inc. (TSX VENTURE:SRN) ("Suroco" or the "Corporation") is pleased

to announce that its wholly owned subsidiary, Suroco Energy SLU, has entered

into a definitive agreement (the "Agreement") with Petro Caribbean Resources

Ltd. ("PCR") and PetroGranada Colombia Limited ("PGC") to acquire a 50% interest

in the Putumayo-7 Block in Colombia (the "PUT-7 Block") from PCR. Consideration

payable by Suroco under the Agreement is (a) the payment to PCR of US$141,500,

representing a portion of the back costs in the PUT-7 Block, and (b) the

agreement to pay a 10% royalty to PCR on Suroco's share of production in the

PUT-7 Block (as further described below). Pursuant to the Agreement, PCR has

also agreed to sell a 50% interest in the PUT-7 Block to PGC. Under the

Agreement, PGC will provide US$18.6 million of guarantees for the Letters of

Credit required by the Agencia Nacional de Hidrocarburos of Colombia (the "ANH")

to guarantee the first phase of the PUT-7 exploration program.

The transactions contemplated by the Agreement (collectively, the "Transaction")

are subject to a number of conditions. The Transaction is expected to close

within eight (8) business days of the aforementioned conditions being satisfied.

Upon completion of the Transaction, an application will be made to the ANH for

their approval to transfer the operatorship for the PUT-7 Block from PCR to

Suroco.

Upon approval by the ANH, the 50% economic interest in the PUT-7 Block that

Suroco is to acquire pursuant to the Agreement will convert into a full 50%

undivided working interest.

The terms of the royalty payable to PCR pursuant to the Transaction will allow

for transportation costs, marketing and handling fees, government royalties and

the 1% 'X' factor payment to be deducted from production revenue prior to the

royalty being paid. Pursuant to the Agreement, Suroco would be liable for

funding its 50% interest share of the work program on the PUT-7 Block,

effectively on 'ground-floor' terms, with no promote. The work program on the

Block is expected to include a 3D seismic program in late 2014 and the drilling

of two exploration wells in late 2015. In order to fund the majority of its

share of the proposed 2014 seismic program, Suroco has completed a US$5 million

loan from an existing shareholder which the Corporation expects would be repaid

upon completion of its recently announced agreement with Petroamerica Oil Corp.

("Petroamerica") to sell all of the Corporation's issued and outstanding common

shares to Petroamerica (see the Corporation's April 28, 2014 news release).

Drilling Update - Suroriente Block

The Quinde-6 well commenced drilling on March 13, 2014 (see the Corporation's

March 24, 2014 press release). The well was targeting a strong seismic amplitude

anomaly at the Villeta 'N' sand level with a prognosed pre-drill estimate of 30

feet of Villeta 'N' sand. The well successfully encountered 32 feet of net oil

pay and no indication of an oil water contact. The final bottomhole location of

the Quinde-6 well is 1560 meters west of the Quinde-4 well, and it has

established the lowest known oil depth in the Quinde West pool at 67 feet deeper

than in the Quinde-4 discovery well. After being placed on production with a

submersible pump on April 29, the Quinde-6 well has stabilized at over 2,300

barrels of 19.7 API oil per day (335 barrels per day net to the Corporation)

with zero percent watercut. The drilling rig is currently preparing to drill the

Quinde-7 well from the same multi-well pad.

Drilling Update - PUT 2 Block

The Canelo Sur-2 exploration well resumed normal operations in late March of

2014 (refer to the Corporation's press release of March 14, 2014).

Production Update - Suroriente Block

Average production from the Suroriente Block for the first quarter of 2014 was

14,365 barrels of oil per day (2,086 barrels of oil per day net to the

Corporation after royalty), and for the month of April was 15,437 barrels of oil

per day (2,243 barrels of oil per day net to the Corporation after royalty).

Gross production for the recently drilled Quinde-4 well averaged 2,670 barrels

of oil per day (389 barrels per day net to the Corporation). Production rates

from the Suroriente Block have been gradually reduced since May 1, 2014 due to

road blockages imposed across southern Colombia by a farmer's strike. Production

has averaged 7,272 barrels of oil per day (1,059 barrels per day net to the

Corporation) for the first four days of May. The Corporation will continue to

monitor this situation and will provide additional status updates when deemed

appropriate.

General

Suroco is a Calgary-based junior oil and gas company, which explores for,

develops, produces and sells crude oil, natural gas liquids and natural gas in

Colombia. The Corporation's common shares trade on the TSX Venture Exchange

under the symbol SRN. Additional information can be found in an updated

presentation available on the Corporation's website at www.suroco.com.

PGC is a subsidiary of PetroGranada Limited, a UK based, privately held oil and

gas company.

Forward-Looking Statements

Certain statements included in this press release constitute forward-looking

statements under applicable securities legislation. These statements relate to

future events or future performance of Suroco. All statements other than

statements of historical fact are forward-looking statements. In some cases,

forward-looking statements can be identified by terminology such as "may",

"will", "should", "expect", "plan", "anticipate", "believe", "estimate",

"predict", "potential", "continue", or the negative of these terms or other

comparable terminology. Forward-looking statements or information in this press

release include, but are not limited to, the timing and successful completion of

the Transaction, the receipt of necessary consents, including from the ANH, the

successful completion of the transaction with Petroamerica, repayment of the

loan from an existing shareholder upon completion of the transaction with

Petroamerica, business strategy, priorities and plans, expected production, the

evaluation of certain prospects in which Suroco holds an interest, estimated

number of drilling locations, expected capital program (including its

allocation), production growth, reserves growth, the receipt of and the timing

of receipt of environmental licenses, the ability to sell crude volume and other

statements, expectations, beliefs, goals, objectives assumptions and information

about possible future events, conditions, results of operations or performance.

Readers are cautioned not to place undue reliance on forward-looking statements,

as there can be no assurance that the plans, intentions or expectations upon

which they are based will occur. By their nature, forward-looking statements

involve numerous assumptions, known and unknown risks and uncertainties, both

general and specific, that contribute to the possibility that the predictions,

estimates, forecasts, projections and other forward-looking statements will not

occur, which may cause actual performance and results in future periods to

differ materially from any estimates or projections of future performance or

results expressed or implied by such forward-looking statements. Business

priorities disclosed herein are objectives only and their achievement cannot be

guaranteed.

These assumptions, risks and uncertainties include, among other things, the

inability to obtain all necessary approvals for completion of the Transaction;

the inability to obtain all necessary approvals for completion of the

transaction with Petroamerica; assumptions inherent in current guidance;

projected capital investment levels; the state of the economy in general and

capital markets in particular; fluctuations in oil prices; the results of

exploration and development drilling, recompletions and related activities;

changes in environmental and other regulations; risks associated with oil and

gas operations and future exploration activities; the uncertainty of reserves

estimates; the uncertainty of estimates and projections relating to production,

costs and expenses; the need to obtain required approvals from regulatory

authorities; product supply and demand; market competition; risks in conducting

foreign operations (for example, civil, political and fiscal instability and

corruption); and other factors, many of which are beyond the control of Suroco.

You can find an additional discussion of those assumptions, risks and

uncertainties in Suroco's Canadian securities filings.

The forward-looking statements contained in this press release are made as of

the date of this press release. Except as required by law, Suroco disclaims any

intention and assumes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

Additionally, Suroco undertakes no obligation to comment on the expectations of,

or statements made by, third parties in respect of the matters discussed above.

New factors emerge from time to time, and it is not possible for management of

Suroco to predict all of these factors and to assess in advance the impact of

each such factor on Suroco's business or the extent to which any factor, or

combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statement or information. The forward-looking

statements contained herein are expressly qualified by this cautionary

statement. Moreover, neither Suroco nor any other person assumes responsibility

for the accuracy and completeness of the forward-looking statements.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the

proposed Transaction and has neither approved nor disapproved the contents of

this press release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Suroco Energy Inc.

Alastair Hill

President and Chief Executive Officer

(403) 232-6784

(403) 232-6747 (FAX)

Suroco Energy Inc.

Travis Doupe

VP Finance and Chief Financial Officer

(403) 232-6784

(403) 232-6747 (FAX)

www.suroco.com

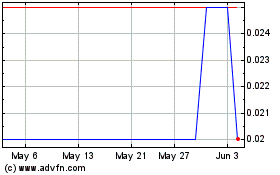

Plato Gold (TSXV:PGC)

Historical Stock Chart

From Oct 2024 to Nov 2024

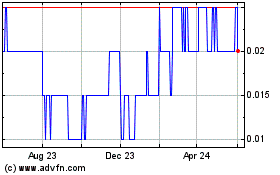

Plato Gold (TSXV:PGC)

Historical Stock Chart

From Nov 2023 to Nov 2024