TrueContext Corporation (“

TrueContext” or the

“

Company”) (TSXV:TCXT), a global leader in field

intelligence, is pleased to announce that the Company and an entity

(the “

Buyer”) controlled by

Battery

Ventures (

“Battery”) have entered into an

arrangement agreement (the “

Arrangement

Agreement”) whereby the Buyer will acquire all of the

issued and outstanding common shares of the Company (the

“

Shares”) for $1.07 per share in cash (the

“

Consideration”) by way of a statutory plan of

arrangement under the Business Corporations Act (Ontario) (the

“

Transaction”). Upon completion of the

Transaction, TrueContext will become a privately held company.

The Transaction values the Company’s total

equity at approximately $150 million on a fully diluted basis. The

Consideration represents a 39.9% premium to the closing price of

the Shares on the TSX Venture Exchange (the

“TSXV”) prior to the Company’s announcement of the

Transaction and a premium of approximately 40.1% to the 20-day, and

52.1% to the 60-day volume-weighted average trading prices of the

Shares.

TrueContext, formerly ProntoForms, is a trusted

and indispensable partner for field intelligence. The Company helps

asset-centric organizations rise to the complexity of field service

with adaptive mobile workflows built for the realities of their

environment and around their technician experience. The Company’s

no-code platform enables rapid workflow automation and data-driven

transformation focused on delivering productivity, efficiency, and

actionable real-time intelligence.

“The Transaction is a result of a thorough

strategic review process conducted by a Special Committee of the

Board of TrueContext with its financial advisors, with a view to

maximizing value for shareholders. We are very pleased with the

outcome of the process and expect that the Transaction will be well

received by shareholders, as evidenced by the strong initial

support from our major shareholders,” said Catherine Sigmar, Chair

of the committee of independent directors of the Company (the

“Special Committee”) responsible for overseeing

the Company's strategic review process.

“TrueContext welcomes our new partner Battery

Ventures as we continue our journey of delivering best-in-class

workflows to field technicians,” said Alvaro Pombo, Co-CEO and

Founder. “We are excited to work with Battery to accelerate the

next chapter of our continued growth in the Field Intelligence

space.”

“We are pleased to announce a transaction that

maximizes value for shareholders and offers the Company a strong

partner to continue its growth,” said Philip Deck, Co-CEO, “A

majority of our shareholders have already expressed their

enthusiastic support.”

Transaction Highlights

- The Transaction

provides attractive value for each shareholder of the Company (the

“Shareholders”), representing a premium of

approximately 39.9% to the closing price of the Shares on the TSXV

prior to the announcement of the Transaction and a premium of

approximately 40.1% to the 20-day, and 52.1% to the 60-day

volume-weighted average trading prices of the Shares.

- The Transaction

provides immediate liquidity and certainty of value to TrueContext

shareholders.

- The Special

Committee comprised of independent directors of the Company

unanimously recommended that the board of directors of the Company

(the “Board”) approve the Transaction. The Board

unanimously approved the Transaction and unanimously determined to

recommend that the Shareholders vote in favour of the

Transaction.

- Battery has

entered into voting support agreements with certain Shareholders

(collectively, the “Supporting Shareholders”) and

all of the directors and officers of the Company holding an

aggregate of 76.4% of the outstanding Shares.

- Canaccord

Genuity Corp. (“Canaccord Genuity”) has provided a

verbal fairness opinion to the Special Committee, stating that, as

at March 12, 2024, subject to certain assumptions and limitations,

the Consideration to be received by Shareholders pursuant to the

Arrangement is fair, from a financial point of view, to such

Shareholders.

Transaction Details

Under the Arrangement Agreement, the Buyer will

acquire the outstanding Shares of the Company, and each Shareholder

will receive $1.07 per Share. The Consideration represents a total

equity value of approximately $150 million on a fully diluted

basis.

The Transaction will be implemented by way of a

statutory plan of arrangement under the Business Corporations Act

(Ontario) and will require the approval of 66 2/3% of the votes

cast by Shareholders, as well as the approval by a simple majority

of votes cast by Shareholders, excluding certain Shareholders

required to be excluded under Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”) at a special meeting of Shareholders

to be called to approve the Transaction (the “Special

Meeting”). It is anticipated that the Special Meeting will

be held in early May 2024. Following closing of the Transaction,

the Shares will be delisted from the TSXV. The Transaction is

expected to close in the second quarter of 2024.

The completion of the Transaction is subject to

obtaining required court approval and satisfaction of closing

conditions customary for a transaction of this nature. The

Arrangement Agreement includes customary deal-protection provisions

with customary “fiduciary out” provisions. The Company is subject

to non-solicitation provisions which, in certain circumstances,

allow the Board to terminate the Arrangement Agreement in favour of

a superior proposal, subject to the payment of a termination fee of

approximately $6.3 million, in certain circumstances, and a right

of the Buyer to match such superior proposal.

The foregoing summary is qualified in its

entirety by the provisions of the Arrangement Agreement, a copy of

which will be filed with the Canadian securities regulators and

made available under the Company’s profile on SEDAR+ at

www.sedarplus.ca.

Special Committee and Board

Recommendations

The Board formed the Special Committee to, among

other things, review and evaluate potential strategic alternatives

for the Company, including among other potential alternatives, a

sale of the Company. The Special Committee was responsible for

reviewing, evaluating and negotiating the terms of proposals

received from Battery and other parties, making recommendations to

the Board in respect of such proposals, and negotiating the terms

of the Transaction.

The Board, based on the unanimous recommendation

of the Special Committee, has determined that the Transaction is

fair to Shareholders and that the Transaction is in the best

interests of the Company. The Board has also determined to

recommend that Shareholders vote in favour of the Transaction at

the Special Meeting. The Special Committee has obtained a verbal

fairness opinion from Canaccord Genuity, financial advisor to the

Special Committee, that, as at March 12, 2024, subject to certain

assumptions and limitations, the Consideration to be received by

Shareholders pursuant to the Arrangement is fair, from a financial

point of view, to such Shareholders.

Copies of the written fairness opinion of

Canaccord Genuity, the rationale for the recommendations made by

the Special Committee and the Board, and other relevant background

information will be included in the management information circular

(the “Circular”) of the Company to be prepared in

connection with the Special Meeting. The Company will send the

Circular and certain related documents to Shareholders and copies

of the Circular and certain related documents will be filed with

the Canadian securities regulators and will be made available under

the Company’s profile on SEDAR+ at www.sedarplus.ca and on the

Company’s website at http://www.truecontext.com. Until the Circular

is mailed, Shareholders are not required to take any action in

respect of the Transaction. Unless otherwise noted, all references

to “$” in this press release are to Canadian dollars.

Voting Agreements

The Buyer has entered into voting support

agreements with the directors and officers of the Company and each

of the Supporting Shareholders for, among other things, the

agreement of each of the directors, officers and Supporting

Shareholders to vote their Shares at the Special Meeting in favour

of the Transaction. Collectively, the directors, officers and

Supporting Shareholders hold approximately 76.4% of the outstanding

Shares.

Advisors and Counsel

Canaccord Genuity is acting as financial advisor

to the Special Committee. Blake, Cassels & Graydon LLP and

LaBarge Weinstein LLP are acting as counsel to the Special

Committee and the Company, respectively.

CIBC Capital Markets is acting as financial

advisor to Battery. Osler, Hoskin & Harcourt LLP and Cooley LLP

are acting as counsel to Battery.

About TrueContext

TrueContext is a global leader in field

intelligence. The product’s field workflows and data collection

capabilities enable enterprise field teams to optimize

decision-making, decrease organizational risk, maximize the uptime

of valuable assets, and deliver exceptional service experiences.

Over 100,000 subscribers use the Company’s product across multiple

use cases, including asset inspection, compliance, installation,

repair, maintenance, and environmental, health & safety with

quantifiable business impacts.

The Company is based in Ottawa, Canada, and

currently trades on the TSXV under the symbol TCXT. “ProntoForms”

and “TrueContext” are registered trademarks of TrueContext Inc., a

wholly-owned subsidiary of the Company.

For further information, please visit

www.TrueContext.com or please contact:

|

Alvaro Pomboco-Chief Executive OfficerTrueContext

Corporation613.599.8288 ext. 1111apombo@truecontext.com |

Philip Deckco-Chief Executive OfficerTrueContext

Corporation416.702.3974pdeck@truecontext.com |

Dave CroucherChief Financial OfficerTrueContext Corporation

613-286-9212dcroucher@truecontext.com |

|

|

|

|

About Battery Ventures

Battery partners with exceptional founders and

management teams developing category-defining businesses in markets

including software and services, enterprise infrastructure, online

marketplaces, healthcare IT and industrial technology. Founded in

1983, the firm backs companies at all stages, ranging from seed and

early to growth and buyout, and invests globally from six strategic

locations: Boston; San Francisco and Menlo Park, Calif.; Tel Aviv;

London; and New York. Follow the firm on X @BatteryVentures, visit

our website at www.battery.com and find a

full list of Battery's portfolio companies.

Battery Contact:

Rebecca BuckmanMarketing PartnerBattery

Ventures650-292-2077becky@battery.com

The TSXV has neither approved nor disapproved

the contents of this press release. The TSXV does not accept

responsibility for the adequacy or accuracy of this press

release.

Forward-Looking Statements

Certain statements in this news release

constitute forward-looking statements within the meaning of

applicable securities laws. Forward-looking statements generally

can be identified by the use of terms and phrases such as “will”,

“may”, “subject to”, “expected”, “if”, “option”, and similar terms

and phrases, including references to assumptions and limitations.

Some of the specific forward-looking statements in this news

release include, but are not limited to, statements with respect

to: the Transaction and the terms thereof; the anticipated date of

the Special Meeting; the expected timing for completion of the

Transaction; regulatory, court and Shareholder approvals; the

delisting of the Shares from the TSXV; and the anticipated benefits

of the Transaction to the Shareholders. There can be no assurance

that the proposed Transaction will be completed or that it will be

completed on the terms and conditions contemplated in this news

release. The proposed Transaction could be modified, restructured

or terminated in accordance with its terms.

Forward-looking statements are based on

information available at the time they are made, underlying

estimates and assumptions made by management and management’s good

faith belief with respect to future events, performance and

results. Such assumptions include, without limitation, expectations

and assumptions concerning the anticipating timing of the

Transaction and the Special Meeting, the anticipated benefits of

the Transaction to the Shareholders, the delisting of the Shares

from the TSXV and the receipt in a timely manner of regulatory,

court and Shareholder approvals for the Transaction.

Forward-looking statements involve known and

unknown risks, uncertainties and other factors, some of which are

beyond the Company’s control, which may cause actual events,

results or performance to be materially different from the events,

results, or performance expressed in such forward-looking

statements. Such risks and uncertainties include, but are not

limited to, the inherent risks and uncertainties surrounding future

expectations of the Company, general economic, market and business

conditions in Canada and globally, governmental and regulatory

requirements and actions by governmental authorities, changes and

competition in the technology industry, financing and refinancing

risks, changes in economic conditions, changes in interest rates,

changes in taxation rules, reliance on key personnel and potential

diversion of management time on the Transaction, environmental

matters and fluctuations in commodity prices. This information is

based on current expectations that are subject to significant risks

and uncertainties that are difficult to predict. Actual results

might differ materially from results suggested in any

forward-looking statements. The Company assumes no obligation to

update the forward-looking statements, or to update the reasons why

actual results could differ from those reflected in the

forward-looking statements unless and until required by securities

laws applicable to the Company. There are a number of risk factors

that could cause future results to differ materially from those

described herein. Please see “Risk Factors Affecting Future

Results” in the Company’s annual management discussion and analysis

dated March 8, 2023 found at www.sedarplus.ca. The anticipated

timeline for completion of the Transaction may change for a number

of reasons, including the inability to secure necessary regulatory,

court, Shareholder or other approvals in the time assumed, third

party litigation or the need for additional time to satisfy the

conditions to the completion of the Transaction. Additional risks

and uncertainties not presently known to the Company or that the

Company currently believes to be less significant may also

adversely affect the Company.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended. Forward-looking statements contained herein

are made as of the date of this news release and the Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, results or otherwise, except as may be required

under applicable securities laws. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements.

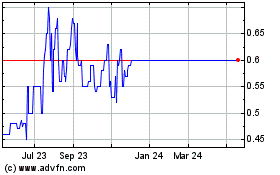

ProntoForms (TSXV:PFM)

Historical Stock Chart

From Feb 2025 to Mar 2025

ProntoForms (TSXV:PFM)

Historical Stock Chart

From Mar 2024 to Mar 2025