Prospera Energy Inc. (TSX.V: PEI, OTC: GXRFF)

("

Prospera", “

PEI” or the

"

Corporation")

Prospera Energy Inc. (TSXV: PEI, OTC: GXRFF)

("Prospera," "PEI," or the "Corporation") is pleased to announce

its 2024 year-end reserves, highlighting significant growth in

Proven Developed Producing (“PDP”) and Total Proved plus Probable

(“2P”) reserves. The reserves and future net revenue of the

Corporation were prepared by InSite Petroleum Consultants Ltd.

(“InSite”), an independent qualified reserves evaluator, in

accordance with the Canadian Oil and Gas Evaluation Handbook

(“COGEH”) standards. InSite prepared a report dated February 21,

2025 (the “InSite Report”), in which it has evaluated, as of

December 31, 2024, the oil and gas reserves attributable to the

principal properties of the Corporation. The evaluation assumes

that each property included in the estimate will be developed,

without considering the Corporation’s ability to secure the

necessary funding for that development. The oil and gas annual

disclosure can be found on SEDAR+ (www.sedarplus.ca).

Corporate Overview:

The Corporation’s core strategy is focused on

proven developed non-producing (“PDNP”) and proven undeveloped

(“PUD”) to PDP conversions through a series of low-risk,

low-decline workovers, recompletions and reactivations in our core

Cuthbert, Luseland, and Hearts Hill properties. To increase gross

production above 1,000 barrels per day, the Corporation will bring

online incremental wells with capital intensity of less than $8,000

per flowing barrel to ensure efficient usage of capital. Progress

related to these programs will be provided in the Corporation’s

future monthly operational updates.

Notably, the Corporation has successfully

converted wells with no reserves assigned (“NRA”) into PDNP and PUD

reserves, further increasing proven reserves and positioning for

additional capital deployment in 2025. Furthermore, the

acceleration of well reactivations has deferred asset retirement

obligations (“ARO”) by extending the economic life and productivity

of these assets. By reactivating wells instead of abandoning them,

the Corporation is transforming liabilities into revenue-generating

assets, in turn, increasing cash flow rather than incurring

abandonment costs. By prioritizing conversion of PDNP and PUD wells

into PDP assets, the Corporation will further bolster its

production, cash flow, and ability to attract additional growth

capital to support its long-term reserves development vision.

Key Highlights:

- NPV before tax for PDP reserves increased 3% from $27.1MM to

$28.0MM at a 10% discount rate

- NPV before tax for PDNP reserves doubled from $8.5MM to $18.9MM

at a 10% discount rate

- NPV before tax for 1P reserves increased 24% from $89.9MM to

$111.4MM at a 10% discount rate.

- NPV before tax for 2P reserves increased 20% from $133.3MM to

$159.3MM at a 10% discount rate

- Gross 2P reserves increased by 26% from 5,403 to 6,793 Mboe

(98% liquids)

- Total Proved (“1P”) reserve life index (“RLI”) increased by 8%

from 24.8 to 26.7 years

- 2P RLI increased by 5% from 30.1 to 31.7 years

- 2P Finding and Development (“F&D”) costs of $10.59/boe

- Net asset value per share: 1P at $0.17 and 2P at $0.28 at a 10%

discount rate

Net present value (“NPV”) is estimated

using forecast prices and costs

Net Present Value Growth and Market

Capitalization Trends (2020-2024)

NI 51-101 Table 2.1.1 The

following table discloses, in the aggregate, the Corporation’s

gross and net proved and probable reserves, estimated using

forecast prices and costs, by product type. “Forecast prices and

costs” means future prices and costs in the InSite Report that are

generally accepted as being a reasonable outlook of the future or

fixed or currently determinable future prices or costs to which the

Corporation is bound.

|

Prospera Energy Inc. |

|

Summary of Oil and Gas Reserves as of December 31, 2024 |

|

Forecast Prices and Costs |

|

Reserves Category |

Light and Medium Oil (Mbbl) |

Heavy Oil (Mbbl) |

Solution Gas (MMcf) |

Sales Gas (MMcf) |

|

Gross |

Net |

Gross |

Net |

Gross |

Net |

Gross |

Net |

|

Proved Developed Producing |

232 |

196 |

1,136 |

1,070 |

24 |

-34 |

- |

- |

|

Proved Developed Non-Producing |

112 |

92 |

587 |

573 |

9 |

2 |

269 |

226 |

|

Proved Undeveloped |

96 |

77 |

2,576 |

2,460 |

11 |

11 |

- |

- |

|

Total Proved |

440 |

365 |

4,299 |

4,103 |

44 |

-22 |

269 |

226 |

|

Total Probable |

153 |

126 |

1,769 |

1,595 |

13 |

-8 |

464 |

421 |

|

Total Proved + Probable |

593 |

491 |

6,068 |

5,698 |

57 |

-29 |

733 |

647 |

Gross reserves are the working interest

share only. Net reserves are the working interest gross reserves

plus all royalty interest reserves receivable less all royalty

burdens payable. Conventional natural gas (solution) includes all

gas produced in association with light, medium and heavy crude

oil.

After Tax Results As mandated

by NI 51-101, after tax results are shown in the various tables of

the InSite Report. After-tax calculations at the company level

incorporated tax legislation and tax pool details for the

Corporation, complying with the guidelines and philosophy of NI

51-101 in all material aspects. All future capital cost estimates

herein have been categorized by tax pool definitions and used to

supplement the year-end tax pool information provided by the

Corporation. The year-end tax pool, as provided by the Corporation,

is summarized below:

- Canadian Oil and Gas Property Expense (COGPE) $19,242,826

- Canadian Development Expense (CDE) $17,217,048

- Non-Capital Losses (100%) $28,436,034

Remaining Reserves Remaining

reserves of oil and gas have been determined as of December 31,

2024. A summary of property gross and total company reserves

follows:

|

Prospera Energy Inc. |

|

Summary of Reserves as of December 31, 2024 |

|

|

Proved Developed Producing |

|

Total Proved Plus Probable |

|

|

Oil – Mbbl |

|

|

|

|

|

Property Gross |

1,425 |

|

7,113 |

|

|

Company WI |

1,369 |

|

6,661 |

|

|

Company Net |

1,267 |

|

6,189 |

|

|

|

|

|

|

|

|

Gas – MMcf |

|

|

|

|

|

Property Gross |

24 |

|

790 |

|

|

Company WI |

24 |

|

790 |

|

|

Company Net |

-34 |

|

618 |

|

|

|

|

|

|

|

|

BOEs – MBOE |

|

|

|

|

|

Property Gross |

1,429 |

|

7,245 |

|

|

Company WI |

1,373 |

|

6,793 |

|

|

Company Net |

1,261 |

|

6,292 |

|

Product Prices The InSite base

product price forecast, effective January 1, 2025, was used for

this evaluation. A copy of which is included in the InSite Report.

To estimate actual received prices, adjustments were made to crude

oil and by-products prices for quality and transportation tariffs.

Similarly, adjustments were made to gas prices for heating value

and transportation. It is assumed that the adjustment factors and

increments will remain constant throughout the forecasts. Revenue

data provided by the Corporation was used to quantify price

adjustments. If such data was unavailable, typical values for the

area were used to estimate price adjustments. Risks of political

and economic uncertainties could affect future results and could

cause results to differ materially from those expressed in this

evaluation.

Qualification To prepare their

evaluation, a technical presentation of properties was made by the

Corporation to InSite. Data required by them was sourced from the

Corporation, industry references and regulatory bodies. Neither

field inspection nor environmental review of these properties were

conducted by InSite, nor deemed necessary. Generally accepted

engineering methods were employed to estimate reserves and forecast

production. The InSite Report follows the Practice Standards and

Guidelines of the Association of Professional Engineers and

Geoscientists of Alberta (“APEGA”) and adheres in all material

aspects to the business practices, evaluation procedures, and

reserve definitions contained within NI 51-101 and the COGEH.

NI 51-101 Table 2.1.2 The

following table discloses, in the aggregate, the NPV of the

Corporation’s future net revenue attributable to the reserves

categories previously tabulated, estimated using forecast prices

and costs, before and after deducting future income tax expenses,

and calculated without discount and using discount rates of 5%,

10%, 15% and 20%. Future net revenue includes all resource income

and is after capital investments, operating expenses, and

royalties.

|

Prospera Energy Inc. |

|

Summary of Net Present Values of Future Net Revenue as of December

31, 20232024 |

|

Forecast Prices and Costs |

|

Reserves Category |

Before Income Tax (MM$) |

After Income Tax (MM$) |

Before Tax Net value ($/BOE) |

|

Discounted at (%/year) |

Discounted at (%/year) |

(%/year) |

|

0 |

5 |

10 |

15 |

20 |

0 |

5 |

10 |

15 |

20 |

10 |

|

Proved Developed Producing |

3032.91 |

2931.3 |

28.10 |

25.0 |

22.26 |

2832.81 |

2831.03 |

2528.40 |

2225.90 |

2022.86 |

520.4 |

|

Proved Developed Non-Producing |

1025.90 |

921.67 |

818.59 |

716.55 |

614.75 |

723.74 |

620.96 |

618.11 |

15.49 |

414.80 |

1925.13 |

|

Proved Undeveloped |

89122.53 |

6887.60 |

5464.46 |

4449.25 |

3638.79 |

6691.30 |

5064.11 |

3947.11 |

3135.38 |

2528.60 |

2024.61 |

|

Total Proved |

131179.33 |

108140.10 |

89111.94 |

7690.19 |

6575.96 |

102146.85 |

85116.0 |

7093.62 |

5976.67 |

5164.26 |

1623.13 |

|

Total Probable |

7898.30 |

5666.85 |

4347.49 |

3436.51 |

2828.2 |

5772.72 |

4148.77 |

3135.70 |

2526.3 |

2020.45 |

1923.19 |

|

Total Proved + Probable |

209277.53 |

164206.95 |

144159.73 |

110127.70 |

93104.1 |

160218.7 |

126164.77 |

102128.31 |

84103.70 |

7185.60 |

1623.85 |

Future operating costs are based on historical

data. Wherever unavailable, they were estimated from analogous

operations in the vicinity of the properties. The inflation of

capital and operating costs is assumed to be 2.0% per annum after

2025. InSite has included cost estimates of well abandonment and

reclamation for all existing wells, regardless of reserves

assignment, and undeveloped locations assigned reserves. Estimates

have been prepared based on historical costs and published guidance

from provincial liability management or rating. It is understood

that all abandonment and reclamation costs of wells and facilities

have been accounted for by the Corporation.

About Prospera

Prospera Energy Inc. is a publicly traded

Canadian energy company specializing in the exploration,

development, and production of crude oil and natural gas.

Headquartered in Calgary, Alberta, Prospera is dedicated to

optimizing recovery from legacy fields using environmentally safe

and efficient reservoir development methods and production

practices. The company’s core properties are strategically located

in Saskatchewan and Alberta, including Cuthbert, Luseland, Hearts

Hill, and Brooks. Prospera Energy Inc. is listed on the TSX Venture

Exchange under the symbol PEI and the U.S. OTC Market under

GXRFF.

For Further Information:

Shawn Mehler, PR Email:

investors@prosperaenergy.com

Chris Ludtke, CFO Email:

cludtke@prosperaenergy.com

Shubham Garg, Chairman of the Board Email:

sgarg@prosperaenergy.com

FORWARD-LOOKING STATEMENTS This

news release contains forward-looking statements relating to the

future operations of the Corporation and other statements that are

not historical facts. Forward-looking statements are often

identified by terms such as “will,” “may,” “should,” “anticipate,”

“expects” and similar expressions. All statements other than

statements of historical fact included in this release, including,

without limitation, statements regarding future plans and

objectives of the Corporation, are forward-looking statements that

involve risks and uncertainties. There can be no assurance that

such statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in

such statements.

Although Prospera believes that the expectations

and assumptions on which the forward-looking statements are based

are reasonable, undue reliance should not be placed on the

forward-looking statements because Prospera can give no assurance

that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, risks associated with the oil and gas industry in

general (e.g., operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses, and health, safety and

environmental risks), commodity price and exchange rate

fluctuations and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures.

The reader is cautioned that assumptions used in

the preparation of any forward-looking information may prove to be

incorrect. Events or circumstances may cause actual results to

differ materially from those predicted, as a result of numerous

known and unknown risks, uncertainties, and other factors, many of

which are beyond the control of Prospera. As a result, Prospera

cannot guarantee that any forward-looking statement will

materialize, and the reader is cautioned not to place undue

reliance on any forward- looking information. Such information,

although considered reasonable by management at the time of

preparation, may prove to be incorrect and actual results may

differ materially from those anticipated. Forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement. The forward-looking statements

contained in this news release are made as of the date of this news

release, and Prospera does not undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as expressly required by Canadian securities

law.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

A photo accompanying this announcement is

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a2427c7d-19dd-4737-9dbc-7ded2930b4a4

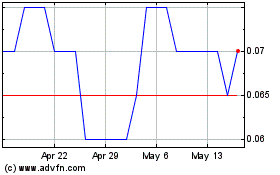

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Mar 2024 to Mar 2025