- First Quarter Fiscal 2022 Revenue of US$2.4 million, compared

to US$1.3 million in the First Quarter Fiscal Year 2021; Organic

Growth Rate of approximately 8%

- Adjusted EBITDA(1) Improvement of 17%, on a Quarterly

Sequential Basis

- Backlog at US$2.5 million, an Increase of 7% from December 31,

2021

- Issued 1 million Common Shares in a Private Placement

Generating Proceeds of US$986,000

- Cash balance of US$3.2 million and Debt-Free Balance Sheet

TSXV: OMLOTCQX: OLNCF

Omni-Lite Industries Canada Inc. (the "Company"

or “Omni-Lite”; TSXV: OML) today reported results for the fiscal

first quarter ending March 31, 2022. Full financial results are

available at sedar.com.

First Quarter Fiscal

2022 Results

Revenue for the first quarter of fiscal 2022 was

approximately US$2.4 million, an improvement of 43% on a quarterly

sequential basis and an increase of approximately 87% as compared

to the first quarter of fiscal 2021. The increase in revenue was

due principally to the acquisition of Designed Precision Castings

Inc. (“DP Cast”) in December 2021. Excluding the acquisition of DP

Cast, revenue increased approximately 8% as compared to the first

quarter of fiscal 2021 principally due to increased demand for

commercial aerospace fasteners and electronic components. Adjusted

EBITDA(1) was approximately US$(374,000) an improvement of 17% on a

quarterly sequential basis, and a decline of 173% as compared to

the first quarter of fiscal 2021. The year-over-year decline in

Adjusted EBITDA(1) was a result of the acquisition of DP Cast and

additional rent expense associated with the sale and leaseback of

the Company’s Cerritos facility. On a proforma basis, first quarter

of fiscal 2022 (assuming the inclusion of DP Cast and

sale/leaseback transaction as of January 1, 2021) Adjusted

EBITDA(1) modestly declined compared to the year ago period, which

was mainly attributed to sales mix and additional tooling. Free

Cash Flow(1) was approximately US$(183,000) in the fiscal first

quarter, as compared to US$(130,000) in the first quarter of fiscal

2021 and break-even in the fourth quarter of fiscal 2021. The

decrease in free cash flow in the first quarter of fiscal 2022 as

compared to year ago period was due, principally, to capital

expenditures related to manufacturing process improvements.

Fiscal first quarter 2022 bookings were US$2.5

million, comparable bookings without DP Cast was an increase of 89%

over fourth quarter of fiscal 2021. Omni-Lite ended the fiscal

first quarter with a backlog of US$2.5 million, an increase of 7%

from fiscal fourth quarter 2021. The Company expects the majority

of this backlog to ship within the remainder of the fiscal

year.

The Company’s liquidity position remains strong

in part by our disciplined approach to management of our cost

structure and working capital and capital spending needs resulting

in the Company ending the first quarter of fiscal 2022 with

approximately US$3.2 million in cash and no indebtedness

outstanding.

Management Comments

David Robbins, Omni-Lite’s CEO, stated “the

first quarter sequential and year-over-year revenue jump is a

result of the inclusion of newly-acquired DP Cast’s business and

increased demand for aerospace fasteners and defense electronics.

We have made significant progress integrating business systems and

implementing manufacturing automation initiatives at DP Cast as we

anticipate conversion of some new bookings in the coming quarters.

Also, in the quarter we completed a private placement investment of

US$986,000 which contributed to our increase in cash levels.”

California Nanotechnologies

Update

Our affiliate, California Nanotechnologies Inc.

(“CalNano”), has been making progress in recent years, in terms of

strategic and operational performance. Most recently, in March

2022, CalNano pre-announced record revenue of approximately

US$470,000 for its fourth quarter ended February 28, 2022, and its

expectation of record EBITDA performance for that quarter.

Omni-Lite, the founding shareholder of CalNano,

maintains an equity ownership position in the company of

approximately 19%. In addition, Omni-Lite has made two loans to

CalNano totaling approximately US$1. 5 million. The larger of the

two loans of approximately US$1.2 million (including accrued

interest) has not paid cash interest and was fully reserved in

Fiscal 2019. CalNano also has a senior secured term loan

outstanding with Manufacturers Bank, which has been reduced in

quarterly installments and is expected to be fully repaid in

February 2023.

Omni-Lite is pleased to announce that, in light

of CalNano’s improved performance, Omni-Lite and CalNano have

agreed to a repricing of its US$1.2 million loan agreement. The

interest rate has been amended to 7.5% (versus 2.9% under the prior

agreement) with a loan maturity of May 30, 2025. Additionally,

CalNano will commence interest payments in June 2022 with principal

repayments commencing with the retirement of the Manufacturers Bank

term loan early next year.

Financial SummaryAll figures in

(US$000) unless noted.

|

For the Three Months Ended March 31, |

|

|

|

2022 |

|

|

2021 |

|

% Increase/(Decrease) |

|

Revenue |

|

$2,380 |

|

|

$1,270 |

|

87 |

% |

|

Adjusted EBITDA(1) |

|

(374 |

) |

|

(137 |

) |

(173 |

)% |

|

Adjusted Free Cash Flow(1) |

|

(154 |

) |

|

(127 |

) |

N/A |

|

Acquisition Costs |

|

(29 |

) |

|

- |

|

N/A |

|

Free Cash Flow(1) |

|

(183 |

) |

|

(127 |

) |

N/A |

|

Net Income/(Loss) |

|

(703 |

) |

|

(354 |

) |

N/A |

|

Diluted EPS |

|

($0.05 |

) |

|

($0.03 |

) |

(60 |

)% |

Please see First Quarter 2022 Management Discussion and Analysis

for additional notes and definitions.

Investor Conference Call

Omni-Lite will host a conference call for

investors on Thursday May

26,

2022, beginning at 1 P.M. Eastern

Time to discuss the first quarter of fiscal 2022 results and review

of its business and operations. To join the conference call, (888)

428-7458 in the USA and Canada, or (862) 298-0702 for all other

countries. Please call five to ten minutes prior to the scheduled

start time. A replay of the conference call will be available 48

hours after the call and archived on the Company’s investors page

of the Company’s website at www.omni-lite.com for 12 months.

(1) Adjusted EBITDA is a non-IFRS financial

measure defined as earnings before interest, taxes, depreciation,

amortization, stock-based compensation provision, gains (losses) on

sale of assets, and non-recurring items, if any. Free Cash Flow is

a non-IFRS financial measure defined as cash flow from operations

minus capital expenditures. Adjusted Free Cash Flow is a non-IFRS

financial measure defined as Free Cash Flow excluding, if any,

gains (losses) on sale of assets and non-recurring items. These are

non-IFRS financial measures, as defined herein, and should be read

in conjunction with IFRS financial measures and they are not

intended to be considered in isolation or as a substitute for, or

superior to, financial information prepared and presented in

accordance with IFRS. The non-IFRS financial measures as used

herein may not be comparable to similarly titled measures reported

by other companies. We believe the use of Adjusted EBITDA, Free

Cash Flow and Adjusted Free Cash Flow along with IFRS financial

measures enhances the understanding of our operating results and

may be useful to investors in comparing our operating performance

with that of other companies and estimating our enterprise value.

Adjusted EBITDA, Free Cash Flow and Adjusted Free Cash Flow are

also useful tools in evaluating the operating results of the

Company given the significant variation that can result from, for

example, the timing of capital expenditures and the amount of

working capital in support of our customer programs and contracts.

We also use Adjusted EBITDA, Free Cash Flow and Adjusted Free Cash

Flow internally to evaluate the operating performance of the

Company, to allocate resources and capital, and to evaluate future

growth opportunities.

About Omni-Lite Industries Canada Inc.

Omni-Lite Industries Canada Inc. is an

innovative company that develops and manufactures mission critical,

precision components utilized by Fortune 100 companies in the

aerospace and defense industries.

For further information, please contact:

Mr. David RobbinsChief Executive OfficerTel. No. (562) 404-8510

or (800) 577-6664Email: d.robbins@omni-lite.comWebsite:

www.omni-lite.com Forward Looking

Statements

Except for statements of historical fact, this

news release contains certain “forward-looking information” within

the meaning of applicable securities law. Forward-looking

information is frequently characterized by words such as “plan”,

“expect”, “project”, “intent”, “believe”, “anticipate”, “estimate”

and other similar words, or statements that certain events or

conditions “may” or “will” occur. Forward-looking information in

this press release includes, but is not limited to, the expect

future performance of the Company. Although we believe that the

expectations reflected in the forward-looking information are

reasonable, there can be no assurance that such expectations will

prove to be correct. We cannot guarantee future results,

performance or achievements. Consequently, there is no

representation that the actual results achieved will be the same,

in whole or in part, as those set out in the forward-looking

information. Forward-looking information is based on the opinions

and estimates of management at the date the statements are made,

and are subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

information. Some of the risks and other factors that could cause

the results to differ materially from those expressed in the

forward-looking information include, but are not limited to:

general economic conditions in Canada, the United States and

globally; industry conditions, governmental regulation, including

environmental consents and approvals, if and when required; stock

market volatility; competition for, among other things, capital,

skilled personnel and supplies; changes in tax laws; and the other

risk factors disclosed under our profile on SEDAR at www.sedar.com.

Readers are cautioned that this list of risk factors should not be

construed as exhaustive.

The forward-looking information contained in

this news release is expressly qualified by this cautionary

statement. We undertake no duty to update any of the

forward-looking information to conform such information to actual

results or to changes in our expectations except as otherwise

required by applicable securities legislation. Readers are

cautioned not to place undue reliance on forward-looking

information.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

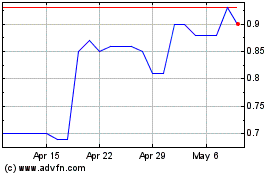

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Dec 2024 to Jan 2025

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Jan 2024 to Jan 2025