Omni-Lite Industries Canada, Inc (“Omni-Lite” or the “Company”)

(TSXV: OML OTCQX: OLNCF) is pleased to announce that it has

completed a series of strategic transactions including the

acquisition of Brampton, Ontario-based Designed Precision Castings

Inc. (“DP Cast”), a leading investment castings manufacturer and

marketer of highly engineered, high-performance, hardware and

structural components for aerospace, defense, industrial and energy

applications (the "Acquisition"), and a sale and leaseback of the

Company’s California manufacturing facility and real estate.

DP Cast was acquired in a share and cash

transaction valued at approximately US$5.7 million.1 In connection

with the Acquisition, Jan Holland, former Chairman, CEO and

shareholder of DP Cast, has been appointed to the Company’s Board

of Directors. In further alignment and validation of the strategic

rationale of the business combination, an affiliate of DP Cast,

whose shareholders are the vendors of DP Cast, has irrevocably

committed to purchasing common shares of the Company ("Common

Shares") at a price of C$1.25 per Common Share for aggregate gross

proceeds of C$1.25 million (the "Private Placement"). See "Designed

Precision Castings Transaction Terms" and "Private Placement"

below.

Following the Company’s announcement on December

17, 2021, the Company completed the sale of its California

manufacturing facility and associated real estate for aggregate

gross proceeds of approximately US$6.8 million, representing a

substantial premium over the Company’s carrying value of the asset.

See " Sale Leaseback and Financing Overview" below.

The Acquisition, which was unanimously approved

by the Boards of Directors of both companies, will diversify

Omni-Lite’s aerospace and industrial portfolio, and create a

platform with enhanced scale and scope, and a competitive moat that

will lead to producing highly engineered, high-performance

components, ranging from fasteners to large, complex, hardware and

structural investment castings for the aerospace, defense,

industrial and energy markets.

The Company intends to integrate its

complementary operations with DP Cast. Omni-Lite believes that it

will be capable of delivering strong margins and returns from its

suite of product offerings that will serve attractive markets with

positive long-term outlooks, including the early-stage recovery of

the commercial aerospace sector, following the COVID-19

pandemic.

Omni-Lite’s Chief Executive Officer, Dave

Robbins, commented “I am very excited about adding investment

(metal) casting manufacturing technology, and Designed Precision

Castings’ reputation as a critical supplier to large aerospace and

industrial customer’s high-value platforms, into Omni-Lite’s

portfolio of highly engineered components. This acquisition will

expand our technology directionally towards the goal of a platform

capable of delivering high-performance, precision-rugged,

mechanical and electromechanical components, sensors and subsystems

for aerospace, defense, and industrial markets. DP Cast’s

competitive positioning and pipeline of new products in the early

stage of production gives me great confidence in their contribution

toward fueling our collective growth.”

"We are very excited about this business

combination, and what it will mean for DP Cast’s next phase of

growth, as we continue to find ways to provide additional value-add

services across a complementary platform and customer base,” said

Jan Holland, Chairman and Chief Executive Officer of DP Cast.

“Working with Omni-Lite – a world-class supplier of precision

forgings to Fortune 500 OEM manufacturers – will allow us to

accelerate the R&D, intellectual capital, techniques,

structures, capabilities and operational excellence we’ve focused

on for the past decade. The enhanced scope this transaction

represents an important step in achieving our companies’ shared

vision – and in DP Cast’s ability to provide an enhanced suite of

mission critical components, with an ongoing focus on our three

tenets: optimal quality, service excellence and on-time

delivery.”

Designed Precision Castings Highlights

and Rationale

Founded in 1958, DP Cast (www.dpcast.com) has

spent the last decade transforming the business, from producing

small form factor aerospace and industrial hardware components, to

larger, more complex, structural investment castings, and serving

trusted, long-tenured customers, including, among others, Pratt

& Whitney Canada, L3Harris Technologies, J/E Bearings to

General Dynamics Land Systems, Boart Longyear, S&C Electric, Q2

Artifical Lift, EMBRAER, Forrest Machine, Arkwin Industries and

Viking Air. DP Cast is accredited under ISO 9001:2015 and AS 9100D

by the Bureau Veritas for the manufacture of custom, ferrous,

non-ferrous and light-alloy investment castings for aerospace,

nuclear, and industrial applications. DP Cast’s’ state-of-the-art,

vertically integrated manufacturing capabilities, combined with

critical regulatory compliance and customer performance

requirements, have resulted in high barriers to entry and superior

differentiation, versus its competitors. DP Cast generated

approximately US$3.7 million2 in revenues for the trailing 12-month

period ended September 30, 2021, and operates from its Brampton,

Ontario facility, employing approximately 50 people. DP Cast has an

excellent foundation built on the elimination of oxide bi-films,

proprietary fill systems and adoption of robotics and automation

that is poised for substantial sales growth.

The combination of Omni-Lite and DP Cast brings

together the natural marriage of high-performance manufacturing of

ferrous, non-ferrous and light-alloy components, utilizing a

spectrum of technologies ranging from cold/hot forging, to

investment castings, which demand the production of complex, net

form products operating in critical and harsh environments.

The two companies will be able to leverage their

combined management expertise, current customer relationships,

market knowledge, R&D, and broader manufacturing processes to

strengthen their shipset content and presence across a diverse

range of markets.

The combined company’s revenues and earnings

profile are expected to be more diverse, both on geographic and

market bases, resilient, and potentially achieving margin expansion

through increased revenues and operating efficiencies.

Designed Precision Castings Transaction

Terms

Under the terms of the Acquisition, Omni-Lite,

through a wholly owned and newly formed subsidiary, acquired 100%

of the issued and outstanding shares of DP Cast pursuant to a share

purchase agreement. As consideration for the Acquisition, the

Company:

- Issued 3,078,710 Common Shares to

the vendors, subject to certain provisions, valued at US$2.3

million based on the closing price and currency exchange rate on

December 17, 2021.

- Paid US$0.3 million in cash on

closing to the vendors.

- Assumed and/or repaid approximately

US$3.0 million of DP Cast’s outstanding net debt.

Following the issuance of the Common Shares in

connection with the Acquisition and the Private Placement, assuming

the Private Placement is completed on the terms described herein,

the vendors and their affiliates will hold, in the aggregate,

approximately 26.4% of issued and outstanding Common Shares, with

each of the vendors holding approximately 4.0% of the issued and

outstanding Common Shares directly and the Investor (as defined

below) holding approximately 6.5% of the issued and outstanding

Common Shares.

Sale Leaseback and Financing

Overview

The Company completed the sale of its California

manufacturing facility and associated real estate for aggregate

gross proceeds of approximately US$6.8 million, representing a

substantial premium over the Company’s carrying value of the asset.

After taking into account capital gain taxes and transaction

expenses, the Company expects to yield net proceeds of

approximately US$5.6 million, or approximately US$0.50 per Common

Share (excluding Common Shares issued in the DP Cast and Private

Placement transactions). Approximately US$1.5 million of the

proceeds will be used to repay the borrowings under the Company's

revolving credit facility.

Upon the closing of both transactions, the net

proceeds, including the proceeds expected from Private Placement,

combined with cash on-hand and cash equivalents, will fund the

repayment of DP Cast’s outstanding debt, the Company's expected

growth opportunities and operating needs, and, importantly,

position the Company as a debt-free entity following completion of

the Acquisition.

In connection with the real estate sale

transaction, the Company entered into a 10-year lease agreement

with an option to extend the term up to another 10 years, ensuring

long-term continuity and growth capacity for the Company.

Private Placement

In connection with the Acquisition, an affiliate

of DP Cast (the “Investor”) entered into a subscription agreement,

whereby the Investor has irrevocably subscribed for and agreed to

purchase 1,000,000 Common Shares at a price of C$1.25 per Common

Share for aggregate proceeds of C$1.25 million. The completion of

the Private Placement is subject to final approval from the TSXV

and is expected to occur prior to December 31, 2021, subject to

certain conditions.

The Common Shares issued pursuant to the Private

Placement will be subject to a statutory four month hold period in

accordance with the applicable securities legislation.

Investor Conference Call

Omni-Lite Industries Canada, Inc will host a

conference call for investors on Wednesday, January 5, 2022,

beginning at 12 P.M. Eastern Time to discuss the DP Cast and Sale

Leaseback transactions and review of its strategy and operations.

To join the conference call, (888) 437-3179 in the USA and Canada,

or (862) 298-0702 for all other countries. Please call five to ten

minutes prior to the scheduled start time. A replay of the

conference call will be available 48 hours after the call and

archived on the Company’s investors page of the Company’s website

at www.omni-lite.com for 12 months.

The Company has agreed to compensate an advisor

on the Acquisition, Cypress Partners LLC, in the form of cash

compensation and 200,000 Common Share purchase warrants with each

warrant exercisable for one Common Share at a price of C$0.95 per

Common Share for a period of five years following the completion of

the Acquisition ("Advisor Compensation"). The warrants and any

securities issuable upon exercise thereof are subject to a

statutory four month hold period in accordance with the applicable

securities legislation.

A director of the Company is also a managing

director of Cypress Partners LLC. As such, the Advisor Compensation

constitutes a “related party transaction” subject to Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions (“MI 61-101”). Such Advisor Compensation was

exempt from the formal valuation and minority shareholder approval

requirements provided under sections 5.5(a) and 5.7(a) of MI 61-101

as the fair market value of the Advisor Compensation did not exceed

25% of the Company's market capitalization. None of the Company's

directors expressed any contrary views or disagreements with

respect to the foregoing. The Company did not file a material

change report 21 days prior to the payment of the Advisor

Compensation as the details of the participation of the insider of

the Company had not been confirmed at that time.

Cypress Partners LLC and Fogler, Rubinoff LLP

served as financial advisor and legal counsel, respectively, to

Omni-Lite Industries Canada, Inc. Aird & Berlis LLP served as

legal counsel to Designed Precision Castings, Inc. and the

Investor.

……………………………………………………………About Omni-Lite

Industries Canada, Inc

Omni-Lite Industries Canada, Inc. is

incorporated under the laws of Ontario and its head office is

located at 18 King Street East, Toronto, Ontario, M5C 1C4. The

principal business of Omni-Lite Industries Canada, Inc is the

manufacturing of specialized components for the aerospace, defense,

automotive, and industrial sectors.

Omni-Lite Industries Canada, Inc is a rapidly

growing, high-technology company that develops and manufactures

mission-critical, precision components that are utilized by Fortune

500 companies, including Boeing, Airbus, Raytheon Technologies,

Lockheed Martin, Howmet, Ford, Borg Warner, the U.S. Military and

Nike.

For further information, please

contact:

Mr. David Robbins, CEOTel. No. (562)404-8510 or

(800)577-6664Email: d.robbins@omni-lite.comWebsite:

www.omni-lite.com

Reader Advisory

The securities disclosed herein have not

been, and will not be, registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”) or

any U.S. state securities laws, and may not be offered or sold in

the United States or to, or for the account or benefit of, U.S.

persons absent registration or an applicable exemption from the

registration requirements of the U.S. Securities Act and applicable

U.S. state securities laws.

Except for statements of historical

fact, this news release contains certain "forward-looking

information" within the meaning of applicable securities law.

Forward-looking information is frequently characterized by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate" and other similar words, or statements

that certain events or conditions "may" or "will" occur. In

particular, forward-looking information in this press release

includes, but is not limited to the expected future performance of

the Company, the expected returns of DP Cast, the completion of the

Private Placement and the use of proceeds of the Private Placement

and the sale and leaseback financing. Although we believe that the

expectations reflected in the forward-looking information are

reasonable, there can be no assurance that such expectations will

prove to be correct. We cannot guarantee future results,

performance or achievements. Consequently, there is no

representation that the actual results achieved will be the same,

in whole or in part, as those set out in the forward-looking

information. Forward-looking information is based on the opinions

and estimates of management at the date the statements are made and

are subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

information. Some of the risks and other factors that could cause

the results to differ materially from those expressed in the

forward-looking information include, but are not limited to: the

ability to successfully integrate the DP Cast acquisition; general

economic conditions in Canada, the United States and globally;

industry conditions, governmental regulation, including

environmental regulation; unanticipated operating events or

performance; the effects of COVID-19 and governmental restrictions

related thereto on the Company's business and operations; to obtain

industry partner and other third-party consents and approvals, if

and when required; the availability of capital on acceptable terms;

the need to obtain required approvals from regulatory authorities;

stock market volatility; competition for, among other things,

capital, skilled personnel and supplies; changes in tax laws; and

the other risk factors disclosed under our profile on SEDAR at

www.sedar.com. Readers are cautioned that this list of risk factors

should not be construed as exhaustive. The forward-looking

information contained in this news release is expressly qualified

by this cautionary statement. We undertake no duty to update any of

the forward-looking information to conform such information to

actual results or to changes in our expectations except as

otherwise required by applicable securities legislation. Readers

are cautioned not to place undue reliance on forward-looking

information.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

(1) Based on the closing price

and foreign exchange rate on December 17,

2021(2) Based on the average foreign exchange rate

for the twelve-month period ended September 30, 2021

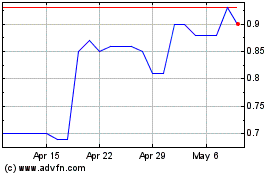

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Oct 2024 to Nov 2024

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Nov 2023 to Nov 2024