Omni-Lite Industries Canada Inc. (the “Company”) (TSXV: OML; OTCQX:

OLNCF) reported financial and operating results for its fiscal

third quarter ended September 30, 2020. Full financial statements

can be found on sedar.com or on our website at www.Omni-Lite.com.

Third Quarter

Fiscal 2020 Results

Omni-Lite today reported third quarter fiscal

2020 results, with revenues of US$1.6 million, representing a

decline of 23% compared to the year ago period, due to disruptions

in the commercial aerospace market, primarily driven by the

COVID-19 pandemic. The third quarter fiscal 2020 net loss was

US$(410,266), or US$(0.04) per diluted share, as compared to the

third quarter fiscal 2019 net loss of US$1.5 million, or US$(0.13)

per diluted common share.

Third quarter fiscal 2020 Adjusted

EBITDA(1) was US$(271,870), as compared to US$(29,435) in the

comparable year ago period. Fiscal third quarter results included a

severance charge of US$55,000. Also, the Company had to cease

manufacturing operations at its California facility for 2 weeks due

to a COVID-19 incident which resulted in an adverse impact on

Adjusted EBITDA of approximately US$225,000.

Free cash flow(1), defined as cash flows from

operating activities less capital expenditures for property and

equipment, was US$(0.2) million for the third quarter of fiscal

2020, as compared to US$5,507 for the third quarter of fiscal 2019.

Net debt outstanding, excluding the Paycheck Protection Program

Loan that is subject to pending forgiveness, at the end of the

third quarter of fiscal 2020 was US$.8 million; and the Company’s

liquidity was US$2.9 million(2), which includes US$1.5 million of

undrawn revolving credit facility borrowing capacity. Net working

capital as of September 30, 2020 was US$5.8 million, representing a

current ratio of 11.5, as compared to a current ratio of 4.7 at

September 30, 2019.

Year-to-Date

September 30, 2020 Fiscal

Results

Year-to-date fiscal 2020 revenue was US$5.4

million, a 24% decrease as compared to US$7.1 million in the first

nine months of fiscal 2019, due to disruptions in the commercial

aerospace market, primarily driven by the COVID-19 pandemic that

began late in the Company’s fiscal first quarter of 2020.

Year-to-date fiscal 2020 Adjusted EBITDA(1) was

US$(217,807), as compared to US$1.1 million in the comparable year

ago period. The year-to-date fiscal 2020 net loss was US$760,756 or

US$(0.07) per diluted share as compared to a net loss of US$1.1

million, or US($0.10) in the first nine months of fiscal 2019.

Free cash flow(1) was US$(0.2) million for the

nine-months ended September 30, 2020, as compared to US$(0.6)

million for the comparable year ago period.

Omni-Lite’s Chief Executive Officer David

Robbins stated, “The third quarter 2020 financial performance was

affected by low demand for commercial aircraft fastener components

due to effects of COVID-19 on commercial aerospace market. During

the quarter the Company implemented a repositioning and alignment

plan in the metal forming operations that will result in

approximately $680,000 in annual cost reductions at the facility.

Had these cost savings been implemented at the beginning of the

third fiscal quarter of 2020, EBITDA would have been enhanced by

approximately $55,000. Moving forward, we are prioritizing our

efforts on maximizing the efficiency of our operations, converting

inventory to cash and growing our product portfolio in the defense

aerospace market.”

“2020 has been a difficult year, generally, and,

in particular, for the commercial aerospace business. While our

results this fiscal year are not what we would like them to be, the

Company is well positioned for the future when the market recovers.

We have a substantial asset base, including our Company-owned

California manufacturing facility that is invested with

state-of-the-art cold and hot forging systems, which we believe is

worth well in excess of its book value. We are also encouraged by

the ongoing gradual improvement in the prospects for our

minority-owned affiliate, California Nanotechnologies Corp.,” said

David Robbins.

Financial SummaryAll figures in US dollars

unless noted

|

For the three months ended September 30 |

|

Revenue |

$1,630,536 |

$2,213,087 |

|

Adjusted EBITDA(1) |

(271,870) |

(29,435) |

|

Free Cash Flow(1) |

(216,730) |

5,507 |

|

Net income |

(410,265) |

119,320 |

|

Diluted EPS |

($0.04) |

$0.01 |

|

For the nine months ended September 30 |

|

|

2020 |

2019 |

|

Revenue |

$5,399,056 |

$7,141,121 |

|

Adjusted EBITDA(1) |

(217,807) |

1,081,965 |

|

Free Cash Flow(1) |

(242,473) |

(555,068) |

|

Net loss |

(760,756) |

(1,113,433) |

|

Diluted EPS |

$(0.07) |

$(0.10) |

(1) Adjusted EBITDA is a non-IFRS financial

measure defined as earnings before interest income, interest

expense, taxes, depreciation, amortization, stock-based

compensation, and non-recurring items, if any. Free Cash Flow is a

non-IFRS financial measure defined as cash flow from operations

minus capital expenditures.

(2) Excludes US$819,700 Paycheck Protection

Program Loan pursuant to the CARES Act, subject to pending

application and approval for forgiveness in its entirety.

Investor Conference Call

Omni-Lite will host a conference call for

investors on Monday, November 30th, beginning at 4:30 PM Eastern

Time to discuss our third quarter and year to date September 2020

results. To join the conference call, dial (888) 645-4404 in the

USA and Canada, or (404) 267-0372 for all other countries. Please

call five to ten minutes prior to the scheduled start time. A

replay of the conference call will be available 48 hours after the

call and archived on the Company’s investors page of the Company’s

website at www.omni-lite.com for 12 months.

About Omni-Lite Industries Canada Inc.

Omni-Lite Industries Canada Inc. is an

innovative company that develops and manufactures mission critical,

precision components utilized by Fortune 100 companies in the

aerospace and defense industries.

For further information, please contact:

Mr. David RobbinsPresident and Chief Executive OfficerTel. No.

(562) 404-8510 or (800) 577-6664Email:

d.robbins@omni-lite.comWebsite: www.omni-lite.com

Forward Looking Statements

Except for statements of historical fact, this

news release contains certain “forward-looking information” within

the meaning of applicable securities law. Forward-looking

information is frequently characterized by words such as “plan”,

“expect”, “project”, “intent”, “believe”, “anticipate”, “estimate”

and other similar words, or statements that certain events or

conditions “may” or “will” occur. Forward-looking information in

this press release includes, but is not limited to, the expect

future performance of the Company. Although we believe that the

expectations reflected in the forward-looking information are

reasonable, there can be no assurance that such expectations will

prove to be correct. We cannot guarantee future results,

performance or achievements. Consequently, there is no

representation that the actual results achieved will be the same,

in whole or in part, as those set out in the forward-looking

information. Forward-looking information is based on the opinions

and estimates of management at the date the statements are made,

and are subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

information. Some of the risks and other factors that could cause

the results to differ materially from those expressed in the

forward-looking information include, but are not limited to:

general economic conditions in Canada, the United States and

globally; industry conditions, governmental regulation, including

environmental consents and approvals, if and when required; stock

market volatility; competition for, among other things, capital,

skilled personnel and supplies; changes in tax laws; and the other

risk factors disclosed under our profile on SEDAR at www.sedar.com.

Readers are cautioned that this list of risk factors should not be

construed as exhaustive.

The forward-looking information contained in

this news release is expressly qualified by this cautionary

statement. We undertake no duty to update any of the

forward-looking information to conform such information to actual

results or to changes in our expectations except as otherwise

required by applicable securities legislation. Readers are

cautioned not to place undue reliance on forward-looking

information.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

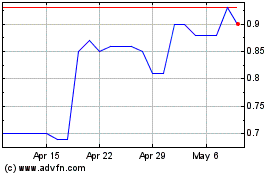

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Oct 2024 to Nov 2024

Omni Lite Industries Can... (TSXV:OML)

Historical Stock Chart

From Nov 2023 to Nov 2024