Osisko Metals Incorporated (the "

Company" or

"

Osisko Metals") (TSX-V: OM;

OTCQX: OMZNF; FRANKFURT: 0B51) is pleased to announce an updated

Mineral Resource Estimate (“MRE”) at Copper Mountain as part of the

Gaspé Copper Project, located near Murdochville in the Gaspé

Peninsula of Quebec.

The updated MRE (see Table 1 below) comprises an

open-pit Indicated Resource of 495 million tonnes grading

0.37% CuEq, representing a 30% increase in

copper-equivalent metal content over the previously

reported copper-only Inferred Resource (see April 28, 2022 press

release), as well as greater than 99% conversion

rate from Inferred to Indicated category.

At 3.25 billion pounds (1.47 million

tonnes) of contained copper, not

including significant molybdenum (180 million pounds) and silver

(28 million ounces) resources (see Table 1 below), the Copper

Mountain in-pit Indicated Resource hosts the largest undeveloped

copper asset in Eastern North America.

Other improvements in the updated MRE include

a 38% reduction of the strip ratio (now estimated

at 1.23) from the estimate in the previously reported Inferred

Resource, based on the mineralization geometry that surrounds the

former open pit mine.

Robert Wares, CEO & Chairman of the Board,

commented: “We are extremely pleased with the results of the

updated Mineral Resource Estimate for the Copper Mountain Deposit.

The overall copper resource has increased since we announced the

maiden resource estimate in 2022 with significant molybdenum and

silver credits now included in the estimate. Integrating the

recently-announced positive metallurgical testing results, the

Gaspé Copper Project is showing excellent potential towards

becoming a key Canadian copper-molybdenum producer, located in one

of the world’s safest mining jurisdictions.”

Mr. Wares continued: “This MRE will provide the

basis for a Preliminary Economic Assessment, scheduled to be

released in early Q1 2025 in the context of what we believe is the

start of a strong long-term copper market. Furthermore, we strongly

believe that this important asset could become a core component of

Quebec’s critical mineral development strategy that aims to provide

essential metals for global decarbonization initiatives.”

Table 1: Mineral Resource Estimate (MRE)

Base Case

|

Class |

Tonnes |

Cu Eq |

Cu |

Mo |

Ag |

Cu |

Cu |

Mo |

Mo |

Ag |

|

|

Mt |

% |

% |

% |

g/t |

M lbs |

kt |

M lbs |

kt |

(koz) |

|

Indicated |

495 |

0.37 |

0.30 |

0.016 |

1.75 |

3,248 |

1,473 |

180 |

82 |

27,911 |

|

Inferred |

6.3 |

0.37 |

0.28 |

0.019 |

1.44 |

39 |

18 |

3 |

1 |

291 |

- The independent qualified persons

for the MRE, as defined by National Instrument (“NI”) 43-101

guidelines, is Pierre-Luc Richard, P.Geo., of PLR Resources Inc.

with contributions from Carl Michaud, P.Eng., of G-Mining for

cut-off grade and Pit shell optimization, and Colin Hardie, P.Eng.,

from BBA, for metallurgical parameters. The effective date of the

MRE is April 22, 2024.

- These Mineral Resources are not

mineral reserves as they have no demonstrated economic viability.

No economic evaluation of these Mineral Resources has been

produced. The quantity and grade of reported Inferred Resources in

this MRE are uncertain in nature and there has been insufficient

drilling to define these Inferred Resources as Indicated. However,

it is reasonably expected that the majority of Inferred Mineral

Resources could be upgraded to Indicated category with continued

drilling.

- The Qualified Persons are not aware

of any known environmental, permitting, legal, title-related,

taxation, socio-political, marketing or other relevant issues that

could materially affect the MRE.

- Calculations used metric units

(metres, tonnes). Metal contents in the above table are presented

in percent, pounds or tonnes. Metric tonnages and pounds were

rounded, and any discrepancies in total amounts are due to rounding

errors.

- CIM definitions and guidelines for

Mineral Resource Estimates have been followed. See Cautionary Note

below for copper equivalency (CuEq) values.

Building upon the information released in this

updated MRE, an 8,000 to 10,000 metre drill program is planned to

commence in May that aims to 1) partially define

Measured Resources and improve grades in the higher-grade core of

the Copper Mountain deposit, which could provide approximately 60

Mt of higher grade “starter-pit” material estimated from a 0.40% Cu

lower cut-off grade; and 2) test the potential for

near-surface mineralization around the historical Needle Mountain

mine that was the starter operation for Gaspé Copper in the 1950’s

(A and B Zones).

General parameters of the updated

Mineral Resource Estimate

This resource is pit-constrained to

mineralization surrounding the past-producing Copper Mountain open

pit mine and uses, amongst other parameters, a long-term price of

US$4.00/lb copper (cutoff of 0.12% Cu) for pit shell modelling,

pre-set eastern and southeastern geographical constraints on pit

limits to minimize impacts on the town of Murdochville from future

potential mining operations, and a lower cut-off grade of 0.15%

copper for base case in-pit resource estimation. The resource was

estimated using data from historical drilling completed between the

1950’s and 2019 and 37,390 metres of drilling completed by the

Company in 2022 and 2023. See the Appendix at the end of this news

release for detailed parameters.

Mineral Resource

Sensitivity

The following table shows the resources reported

at various in-pit cut-off grades within a pit shell modelled at a

lower cut off of 0.12% Cu; the base case resource cut-off grade

reported herein is 0.15% copper and is highlighted in bold

text:

Table 2: Indicated Mineral Resource

Estimates at Variable Cut-Off Grades

|

Class |

Copper Cut-off(%) |

Tonnage(Mt) |

StripRatio |

Grade |

Copper Metal Resource |

|

Cu % |

Mo % |

M lbs |

kt |

|

Indicated |

0.12 |

572 |

0.93 |

0.28 |

0.015 |

3,476 |

1,576 |

|

0.15 |

495 |

1.23 |

0.30 |

0.016 |

3,248 |

1,473 |

|

0.20 |

376 |

1.94 |

0.34 |

0.018 |

2,791 |

1,266 |

|

0.25 |

273 |

3.05 |

0.38 |

0.020 |

2,279 |

1,034 |

|

0.30 |

186 |

4.93 |

0.43 |

0.022 |

1,758 |

797 |

|

0.40 |

86 |

11.9 |

0.53 |

0.025 |

1,000 |

454 |

Same footnotes as Table 1 apply to this

table.

Potential for Additional Mineral

Resources at Gaspé Copper

End-of-mine historical mineral resources at

Gaspé Copper that are not NI 43-101 compliant are reported in the

Noranda/Falconbridge Annual Reports 1998-2000, Quebec government

mining assessment reports and in Hussey & Bernard (SME Aug

1998, p. 36-44). The following disclosure describes areas of

remaining mineralization at Gaspé Copper that the Company believes

offer excellent potential for additional mineral resources. Osisko

Metals’ strategy at the present time is to focus on the economic

viability of the currently defined Copper Mountain resource, and if

this can be achieved, evaluation of mineralized zones described

below will follow with additional drill programs.

Larger open pit resource potential at Copper

Mountain

The current modelled Whittle pit shell includes

pre-set eastern and southeastern geographical constraints on pit

limits designed to minimize impacts on the town of Murdochville

from potential future mining operations (Figure 1), namely leaving

the southern portion of Copper Mountain intact. Geological

modelling of stockwork mineralization and residual disseminated

skarn mineralization occurring between the Copper Mountain and

Needle Mountain historical open pits, the latter located 1.6

kilometers south of Copper Mountain, indicates potential for a

significantly larger open pit resource at Gaspé Copper. Further

geological and pit modelling is required to evaluate such potential

and this work is ongoing. In the event that a larger viable

pit-constrained resource can be defined, the Company will evaluate

the possibility of reconfiguring the current layout of the site to

minimize disturbance and ensure the protection and safety of the

residents of Murdochville and the surrounding environment.

Figure 1. Plan view of the footprint of

the currently modelled Whittle pit encompassing the base case

mineral resource.

Open pit resource potential at Needle

Mountain

Modelling of the residual copper mineralization

along the perimeter and below the open pit A Zone and the

underground B Zone at Needle Mountain, including residual pillars

in the B Zone, indicates potential for a higher-grade, secondary

open-pit resource that would be distinct from the Copper Mountain

resource. The modelling is based entirely on 1950’s and 1960’s

historical drill holes, which were only partially assayed for

copper and not for molybdenum nor silver. This area will be tested

with a Phase I, 4,000-metre drill program starting at the end of

May and if successful, will be followed by a Phase II program later

in the season.

High-grade residual mineralization near past

underground operations

Residual underground skarn mineralization still

remains in the form of pillars in the mined portion of the C Zone

(grades of 1% to 2% copper), as well as massive sulfide/skarn

mineralization in the deeper E Zone (grades of 3% to 4% copper)

within the E-38 deposit and up to 800 metres north of this deposit.

The E Zone skarn aureole received little follow-up drilling north

of the E-38 deposit and offers excellent potential for further

resource definition at significantly higher copper and molybdenum

grades. Drilling of the E Zone skarn is planned for 2025.

Appendix - parameters and criteria used

for the Mineral Resource Estimate (MRE)

-

General Whittle pit parameters used for the Mineral Resource

Estimate include:

|

Parameter |

Value |

Unit |

|

Copper Price |

$4.00 |

US$ per pound |

|

CAD:USD exchange rate |

1.33 |

|

|

Discount Rate |

8.0 |

Percent |

|

Royalty Rate |

1.0 |

Percent |

|

Cu concentrate transport + loading costs |

$10.40 |

US$ per wmt |

|

Cu concentrate shipping cost |

$66.25 |

US$ per wmt |

|

Cu concentrate insurance and other costs |

$23.35 |

US$ per wmt |

|

Cu concentrate smelter treatment cost |

$80.00 |

US$ per wmt |

|

Cu concentrate smelter refining cost |

$0.08 |

US$ per pound |

|

Cu concentrate grade |

25.0 |

Percent |

|

Payable Cu |

96.5 |

Percent |

|

In-Pit Mining Cost |

$2.85 |

US$ per tonne mined |

|

Mill Processing Cost |

$3.76 |

US$ per tonne milled |

|

General and Administrative Costs |

$1.57 |

US$ per tonne milled |

|

Overall Pit Slope - Rock |

48 |

Degrees |

|

Copper Recovery |

92 |

Percent (%) |

|

Mining loss / Dilution (open pit) |

0 / 0 |

Percent / Percent |

|

Waste Avg. Specific Gravity |

2.67 |

Tonnes/cubic metre |

|

Mineralization Specific Gravity (variable) |

Avg. 2.73 |

Tonnes/cubic metre |

- Resources are presented as

undiluted and in situ for an open-pit scenario and are considered

to have reasonable prospects for economic extraction. The

constraining pit shell was developed using overall pit slopes of 48

degrees in bedrock and 20 degrees in overburden. The pit

optimization to develop the resource-constraining pit shells was

performed using Geovia Whittle 2022 software.

- The MRE wireframe was prepared

using Leapfrog Edge v.2023.2.1 and is based on 570 drill holes and

41,198 samples. The drill hole database includes recent drilling

totalling 44,407 metres in 83 drill holes (Xstrata 2011-2012,

Glencore Canada 2019 and Osisko Metals 2022-2023) and also

incorporates historical drill holes totalling 126,515 metres in 487

drill holes (Noranda 1998 and earlier). Drill hole data

verification was performed by verifying the coherence of the

information but not its correctness; original logs and laboratory

certificates were only available for 2011, 2012, 2019, 2022 and

2023 drill holes. The cut-off date for the drill hole database was

February 12, 2024.

- Composites of 10-metre lengths were

created inside the mineralization volume. A total of 12,760

composites were generated with an average grade of 0.27 %Cu.

High-grade capping was done on the composited assay data;

composites were capped at 1.50% for Cu, 0.16% for Mo, and 7.5g/t

for Ag.

- Pit constrained Mineral Resources

for the base case are reported at a cut-off grade of 0.15 % Cu in

sulfide within a conceptual pit shell based on a 0.12% Cu lower

cut-off. The cut-off grades will be re-evaluated on an ongoing

basis in light of future prevailing market conditions and

costs.

- Contained copper in the resource

includes sulfide copper only and soluble copper was ignored. It was

assumed for this MRE that only the copper contained in sulfides

could have economical potential. Therefore, the soluble copper that

is present as oxides and carbonates was removed and significant

oxidized zones are all located in the south-west portion of the

deposit. The proportion of the copper contained as soluble copper

relative to sulfides is correlated to the depth of the

mineralization. Therefore, depth from the original topographic

surface was modeled and used to estimate the percentage of copper

that would be contained as soluble copper within the MRE.

- Specific gravity values were

estimated using data available in the historical drill holes.

Values were interpolated for the mineralized solid - the average

value is 2.73 tonnes/cubic metre. Surrounding barren lithologies

were assigned the average specific gravity value from all measured

samples.

- Modelled base case pit shell

measures 2,100 X 1,500 metres and reaches a maximum depth of

approximately 700 metres.

- Grade model resource estimation was

calculated from drill hole data using an ordinary kriging (OK)

interpolation method in a sub-blocked model using blocks measuring

10 m x 10 m x 10 m in size and sub-blocks down to 1.25 m x 1.25m x

1.25 m. Both ordinary kriging and inverse square distance (ID2)

interpolation methods were tested, resulting in no material

difference in the Mineral Resource Estimates.

- The Indicated and Inferred Mineral

Resource categories are constrained to areas where drill spacing is

less than 150m and 300 metres, respectively, and show reasonable

geological and grade continuity.

Cautionary Statement Regarding Copper

Equivalent Grades

Copper Equivalent grades are expressed for

purposes of simplicity and are calculated taking into account 1)

metal grades; 2) estimated long-term prices of metals: US$4.00/lb

copper, $19.00/lb molybdenum and US$22/oz silver; 3) estimated

recoveries of 92%, 70% and 70% for Cu, Mo and Ag respectively and

4) net smelter return value of metals as percentage of the price,

estimated at 86.5%, 90.7% and 75.0% for Cu, Mo and Ag

respectively.

Cautionary Statement Regarding Mineral

Resources

The mineral resources disclosed in this press

release conform to NI43-101 standards and guidelines and were

prepared by independent qualified persons. The above-mentioned

mineral resources are not mineral reserves as they do not have

demonstrated economic viability. The quantity and grade of the

reported Inferred Mineral Resources are conceptual in nature and

are estimated based on limited geological evidence and sampling.

Geological data is sufficient to imply but not verify geological

grade and/or quality of continuity. An Inferred Mineral Resource

has a lower level of confidence relative to a Measured or Indicated

Mineral Resource and constitutes an insufficient level of

confidence to allow conversion to a Mineral Reserve. It is

reasonably expected, but not guaranteed, that the majority of

Inferred Mineral Resources could be upgraded to Measured or

Indicated Mineral Resources with additional drilling. The National

Instrument 43-101 Technical Report, including the mineral resources

for the Gaspé Copper Project contained in this news release, will

be delivered and filed on SEDAR by Osisko Metals within 45 days of

the date of this news release.

Qualified Persons

The Mineral Resource Estimate and technical

information in this news release has been prepared and approved by

independent qualified persons, as defined by National Instrument

(“NI”) 43-101 guidelines: Pierre-Luc Richard, P.Geo., of PLR

Resources Inc. with contributions from Carl Michaud, P.Eng., of

G-Mining for cut-off grade and Pit Shell optimization, and Colin

Hardie, P.Eng., from BBA, for metallurgical parameters. Technical

information relating to historical copper deposits at Gaspé Copper

has been reviewed by Jeff Hussey, P. Geo., a non-independent

Qualified Person in accordance with National Instrument 43-101

standards.

About Osisko Metals

Osisko Metals Incorporated is a Canadian

exploration and development company creating value in the critical

metals space, more specifically copper and zinc. The Company is a

joint venture partner with Appian Capital Advisory LLP for the

advancement of one of Canada’s premier past-producing zinc mining

camps, the Pine Point Project, located in the Northwest

Territories, for which the 2022 PEA (as defined herein) has

indicated an after-tax NPV of C$602 million and an IRR of 25%,

based on long-term zinc price of US$1.37/lb and the current mineral

resource estimates that are amenable to open pit and shallow

underground mining. The current mineral resource estimate in the

2022 PEA consists of 15.7 Mt grading 5.55% ZnEq of

Indicated Mineral Resources and 47.2 Mt grading 5.94% ZnEq

of Inferred Mineral Resources. Please refer to the

technical report entitled “Preliminary Economic Assessment,

Pine Point Project, Hay River, Northwest Territories,

Canada” dated August 26, 2022 (with an effective date of July

30, 2022), which was prepared for Osisko Metals and PPML by

representatives of BBA Engineering Inc., HydroRessources Inc., PLR

Resources Inc. and WSP Canada Inc. (the “2022 PEA”). Please refer

to the full text of the 2022 PEA, a copy of which is available on

SEDAR (www.sedar.com) under the Osisko Metals’ issuer profile, for

the assumptions, methodologies, qualifications and limitations

described therein. The Pine Point Project is located on the south

shore of Great Slave Lake in the Northwest Territories, near

infrastructure, with paved highway access, an electrical

substation, as well as 100 kilometres of viable haulage roads.

In addition, the Company acquired in July 2023,

from Glencore Canada Corporation, a 100% interest in the

past-producing Gaspé Copper Project, located near Murdochville in

the Gaspé peninsula of Québec. The Company is currently focused on

resource evaluation of the Copper Mountain Deposit that hosts the

updated Mineral Resource Estimate described herein. Gaspé Copper

hosts the largest undeveloped copper resource in Eastern North

America, strategically located near existing infrastructure in the

mining-friendly province of Québec.

| For further

information on this news release,

visit www.osiskometals.com or contact:Robert Wares,

Chairman & CEO of Osisko Metals Incorporated |

|

Email: |

info@osiskometals.com |

| |

www.osiskometals.com |

Follow Osisko Metals on Facebook at

https://www.facebook.com/osiskometals/,on LinkedIn at

https://www.linkedin.com/company/osiskometals/,and on

X at https://twitter.com/osiskometals.

Cautionary Statement on Forward-Looking

Information

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation based on expectations, estimates and projections as at

the date of this news release. Any statement that involves

predictions, expectations, interpretations, beliefs, plans,

projections, objectives, assumptions, future events or performance

are not statements of historical fact and constitute

forward-looking information. This news release may contain

forward-looking information pertaining to the Pine Point and Gaspé

Copper Projects, including, among other things, the results of the

2022 PEA on Pine Point and the IRR, NPV and estimated costs,

production, production rate and mine life; the ability to identify

additional resources and reserves (if any) and exploit such

resources and reserves on an economic basis; the expected high

quality of the metal concentrates; the potential economic impact of

the projects on local communities, including but not limited to the

potential generation of tax revenues and contribution of jobs; the

timing and ability for Projects to reach construction decision (if

at all); the estimated costs to take the Projects to construction

decision (if at all) and the impact to the Company of the

disposition of ownership interest and control in the Pine Point

Project, which is a material property of the Company; Gaspé Copper

hosting the largest undeveloped copper resource in Eastern North

America and Glencore becoming a Control Person of the Company.

Forward-looking information is not a guarantee

of future performance and is based upon a number of estimates and

assumptions of management, in light of management’s experience and

perception of trends, current conditions and expected developments,

as well as other factors that management believes to be relevant

and reasonable in the circumstances, including, without limitation,

assumptions about: favourable equity and debt capital markets; the

ability and timing for the Pine Point joint-venture parties to fund

cash calls to advance the development of the Pine Point Project and

pursue planned exploration and development; future spot prices of

copper, zinc, lead and molybdenum; the timing and results of

exploration and drilling programs; the accuracy of mineral resource

estimates; production costs; political and regulatory stability;

the receipt of governmental and third party approvals; licenses and

permits being received on favourable terms; sustained labour

stability; stability in financial and capital markets; availability

of mining equipment and positive relations with local communities

and groups. Forward-looking information involves risks,

uncertainties and other factors that could cause actual events,

results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. Factors that could cause actual results to differ

materially from such forward-looking information are set out in the

Company’s public disclosure record on SEDAR (www.sedar.com) under

Osisko Metals’ issuer profile. Although the Company believes that

the assumptions and factors used in preparing the forward-looking

information in this news release are reasonable, undue reliance

should not be placed on such information, which only applies as of

the date of this news release, and no assurance can be given that

such events will occur in the disclosed time frames or at all. The

Company disclaims any intention or obligation to update or revise

any forward- looking information, whether as a result of new

information, future events or otherwise, other than as required by

law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accept responsibility for the

adequacy or accuracy of this news release. No stock exchange,

securities commission or other regulatory authority has approved or

disapproved the information contained herein.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/81834f9f-fc34-4cab-a569-166f8f53236c

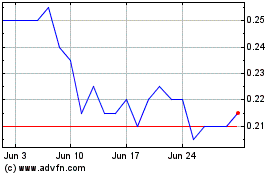

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Dec 2023 to Dec 2024