Oroco Resource Corporation. (“

Oroco” or the

“

Company”) (TSXV: OCO; OTCQB: ORRCF, BF: OR6) is

pleased to announce a Preliminary Economic Assessment

(“

PEA”) and updated Mineral Resource Estimate

(“

MRE”) for the North Zone and South Zone of its

Santo Tomas Porphyry Copper Project (“

Santo Tomas”

or the “

Project”) in Sinaloa State, Mexico. The

PEA results support a staged open pit mine and processing plant

starting at 60,000 tonnes per day (“

t/d”) in year

1 of production, expanding to 120,000 t/d in year 2 over a

20.1-year Life of Mine (“

LOM”). Production is

preceded by two years of construction and pre-stripping. The PEA

has been prepared by Ausenco Engineering USA South Inc.

(“

Ausenco”). The updated MRE and geologic model

were prepared by SRK Consulting (US), Inc. of Denver, Colorado and

SRK Consulting (Canada), Vancouver, BC (“

SRK”).

SRK (Canada) was responsible for geotechnical modeling. The mine

planning and mine costs components of the PEA were prepared by

Mining Plus Canada Consulting Ltd. (“

Mining

Plus”).

Highlights of the Santo Tomas PEA

include:

- US$2.33 billion pre-tax NPV (8%) and US$1.24 billion after-tax

NPV (8%)

- 23.0% pre-tax IRR; 17.3% after-tax IRR.

- Total LOM payable copper production of 4,749 M lb.

- Pre-tax payback of 4.1 years; after-tax payback of 5.0 years

from first concentrate production.

- Initial capital costs estimated at US$1,339.9 million;

sustaining and expansion capital costs estimated at US$1,134.5

million.

- Average annual LOM C1 Cash Cost of US$1.66/lb Cu on by-product

basis.

- An ultimate pit design constrained resource of 388 Mt of

Indicated and 460 Mt of Inferred material.

Commenting on the PEA, Richard Lock stated:

“This is a significant start to the process of evaluating Santo

Tomas. The PEA firmly demonstrates the economic viability of the

Santo Tomas Project and justifies its continued development. The

combination of excellent infrastructure, simple metallurgy, a

cohesive and consistent grade distribution, and a low strip ratio,

along with the identification of several existing opportunities for

resource expansion, provide additional strength and certainty to

the Project. We have also identified a high probability of

additional upside in Project economics through the future

application of mine and process design improvements, all of which

confirm that we have a substantial resource at Santo Tomas. In

summary, the Santo Tomas Project clearly has robust potential for

the development of a large, low-cost open-pit, copper mining

operation.”

Santo Tomas Project PEA

OverviewThe Santo Tomas property comprises 9,034

ha of mineral concessions encompassing significant porphyry copper

mineralization in northern Sinaloa and southwest Chihuahua, Mexico.

The Project is located in the Santo Tomas Porphyry District, which

extends from Santo Tomas northward to the Jinchuan Group’s

Bahuerachi Project located approximately 14 km to the

north-northeast. The PEA was conducted using data (including 27,382

Cu assays) from 68 diamond drill holes (43,063 m) drilled by the

Company and 90 legacy reverse circulation and diamond drill holes

(21,075 m, for a total of 64,138 m in 158 drill holes) in the

Project’s North Zone and South Zone. The data from the seven

exploration diamond drill holes in Brasiles Zone and the single

geotechnical hole (GT001) drilled by the Company were excluded from

consideration in the MRE and PEA. Oroco’s entire updated drill hole

database (including PEA excluded holes) contains 166 new and legacy

drill holes totaling 69,556 m with lithological logging data and

29,992 Cu assays.

The commodity price assumptions for the

Discounted Cash Flow (“DCF”) analysis are

presented in Table 1. Key results are presented in Tables 2 &

3.

Table

1: PEA

DCF Price Assumptions

|

Commodity |

Unit |

Price* |

|

Cu |

US $ / lb |

3.85 |

|

Mo |

US $ / lb |

13.50 |

|

Au |

US $ / t.oz |

1,700 |

|

Ag |

US $ / t.oz |

22.50 |

*Cash flow model assumptions only

Table

2: Mining and Production –

Key Results

|

Key Assumptions |

Unit |

LOM |

|

Exchange Rate |

MXN / US$ |

19.76 |

|

Fuel Price |

MXN / L |

20.41 (US$1.03) |

|

Production Profile |

Unit |

LOM |

|

Total Open Pit Tonnage |

Mt |

1,831 |

|

Total Open Pit Mineralized Material Mined |

Mt |

848 |

|

Open Pit Strip Ratio |

Waste : mill feed |

1.16 |

|

Daily Throughput (Year 1 // Year 2 on) |

kt/d |

60 // 120 |

|

LOM concentrate production) |

Years |

20.1 |

|

Copper in Mill Feed |

M lb |

5,920 |

|

Molybdenum in Mill Feed |

M lb |

141.7 |

|

Gold in Mill Feed |

koz Au |

747.3 |

|

Silver in Mill Feed |

koz Ag |

54,998 |

|

LOM mill feed (Indicated // Inferred) |

Mt |

388 // 460 |

|

Average Cu payable / year – LOM |

M lb |

236 |

|

Average Cu payable / year – First 5 Years (1) |

M lb |

281 |

|

Payable (2) Copper LOM (in concentrate) |

M lb |

4,749 |

|

Payable Molybdenum LOM (in concentrate) |

M lb |

82.6 |

|

Payable Silver LOM (min 30 g/t payable in Cu Concentrate) |

koz |

26,330 |

|

Payable Gold LOM (min 1 g/t payable in Cu Concentrate) |

koz |

331.9 |

|

Operating Costs

(US$/lb.) |

Unit |

LOM |

|

C1 Cash Costs Copper (By-Product Basis) (3) |

US$/lb |

1.66 |

|

C3 Cash Costs Copper (By-Product Basis) (4) |

US$/lb |

2.00 |

|

Capital Expenditures

(5) |

Unit |

LOM |

|

Initial Capital (6) |

US$M |

1,339.9 |

|

Sustaining and Development Capital (6) |

US$M |

1,134.5 |

|

Closure Costs (5 years, year 20 - 24) |

US$M |

209.2 |

|

Estimated Salvage Value |

US$M |

0 |

| Notes: |

|

|

(1) |

|

First 5 Years at full production, starting year 2. |

| |

(2) |

|

Payable metals consider mining

dilution, concentrator recoveries and Treatment Charges/Refining

Charges (TC/RC). |

| |

(3) |

|

C1 Cash Costs consist of mining

costs, processing costs, mine-level G&A and transportation

costs net of by-product credits. |

| |

(4) |

|

C3 Cash Costs includes C1 Cash

Costs plus sustaining and expansion capital, royalties, and closure

costs and excludes expansion capital. |

| |

(5) |

|

All capital expenditures are

inclusive of contingency provisions to allow for uncertain cost

elements, which are predicted to occur but are not included in the

cost estimate. |

| |

(6) |

|

Net of leasing capital deferment

and leasing costs. |

| |

|

|

|

Table

3: Key Financial Results and

Costs

|

Economics |

Unit |

LOM |

|

NPV at 8% (pre-tax // post-tax) |

US$M |

2,328.9 // 1,237.6 |

|

IRR (pre-tax // post-tax) |

% |

23.0 // 17.3 |

|

Payback (pre-tax // post-tax) |

Years |

4.1 // 5.0 |

|

Revenue over LOM |

US$M |

20,553 |

|

Initial Capital |

|

Mining Pre-Stripping (Capitalized Opex) |

US$M |

183.5 |

|

Mining Capital Equipment (1) |

US$M |

328.9 |

|

Total Mining (1) |

US$M |

512.4 |

|

Processing |

US$M |

976.1 |

|

Total Initial Capital (1) |

US$M |

1,488.5 |

|

Total Initial Capital Net of Leasing

(2) |

US$M |

1,339.9 |

|

Sustaining Capital |

|

Mining Equipment (3) |

US$M |

203.5 |

|

Processing |

US$M |

72.9 |

|

Total Sustaining Capital

(3) |

US$M |

276.4 |

|

Total Sustaining Capital Net of Leasing

(2) |

US$M |

467.5 |

|

Expansion Capital – Processing (year 2) |

US$M |

667.0 |

|

Operating Costs |

|

Mining Cost per tonne mined (4) |

US$ / t |

2.30 |

|

Mining Cost per tonne milled (4) |

US$ / t |

4.77 |

|

Processing Cost per tonne milled |

US$ / t |

4.25 |

|

G&A Cost per tonne milled |

US$ / t |

0.67 |

|

Total Operating Cost (3) |

US$ / t |

9.68 |

| Notes: |

|

|

(1) |

|

Includes the full mining capital cost without deferral of capital

attributable to leasing in the amount of M$191.1 from initial

capital to sustaining capital. Excludes leasing costs in the amount

of M$42.4 incurred prior to production. |

| |

(2) |

|

Supplier-sourced leasing terms

from October 2023 are used in the DCF model mine fleet cost

calculations that include a 5-year lease period with 10.3%

interest, 0.5% upfront fee, and no residual payment. |

| |

(3) |

|

Includes sustaining capital

mining equipment without inclusion of costs attributable to the

deferral of initial mining equipment in the amount of M$191.1. |

| |

(4) |

|

Excludes leasing costs. |

PEA Economic

SensitivitiesProject economics and cash flows are most

sensitive to changes in the price of copper (Figure 1). Mined grade

and recovery sensitivity is high and future studies will seek to

optimize these parameters. However, the highest potential for

change in economics is anticipated to result from future changes in

copper pricing.

Figure

1: Post-Tax NPV and

IRR Sensitivity Plots

PEA Mineral ResourcesThe PEA

MRE prepared by SRK Consulting (U.S.), Inc. in accordance with the

Canadian Institute of Mining, Metallurgy, and Petroleum

(“CIM”) Definition Standards (the “CIM

Standards”) incorporated by reference in National

Instrument 43-101 (“NI 43-101”), with an effective

date of October 11, 2023. The technical report will be prepared and

released by the Company and will be available at

www.orocoresourcecorp.com and on SEDAR (www.sedarplus.ca) under the

Company’s profile, within 45 days of this news release.

The mineral resource estimation process includes

updated structural, lithologic, and mineralization models, though

the PEA MRE has not materially changed from the previous study,

effective April 27, 2023, due to the inclusion of two additional

drill holes in the North Zone and updated economic assumptions

based on the PEA study. The Company provided SRK with an updated

exploration database including drill hole collar and downhole

survey data, geological logging, assay, specific gravity,

geotechnical classification, and associated information.

The resource estimation methodology involved the

following procedures:

- Database compilation and verification,

- Construction of wireframe models for the major structures,

lithotypes, and controls on mineralization,

- Definition of resource domains using a combination of

lithotypes, structure, and mineralization grade shells,

- Data conditioning (compositing and capping) for statistical and

geostatistical analyses,

- Determination of spatial continuity through variography within

the estimation domains,

- Block modeling and grade interpolation for all key economic

variables (Cu, Mo, Ag, Au, and Sulfur [S]) and secondary variables

(arsenic [As], calcium [Ca], potassium [K], lead [Pb], and zinc

[Zn]),

- Block model validation,

- Resource classification,

- Assessment of “reasonable prospects for eventual economic

extraction” (“RPEEE”) using a constraining

economic pit shell and selection of an effective cut-off grade

(“CoG”), and

- Preparation of the updated mineral resource statement.

SRK undertook the geological modeling and

mineral resource estimate using Seequent Leapfrog Geo and Leapfrog

Edge, respectively. The procedure involved construction of

wireframe models for structural geology controls, key geological

and mineralization domains, data conditioning (compositing and

capping) for statistical analysis, variography, block modeling and

grade interpolation followed by block model validation. Grade was

estimated using a combination of ordinary kriging and inverse

distance weighting cubed estimates for copper, molybdenum, gold,

and silver. Sulfur grades are estimated using inverse distance

weighting squared (“IDW2”) and bulk density is

estimated using a combination of simple kriging and IDW2. Grade

estimation was based on block dimensions of 50 m x 50 m x 10 m for

the PEA model (unchanged from the previous 2023 study). The block

size reflects current data spacing across the Project while

considering a likely open pit mining method. Classification of

mineral resources considers the geological complexity (structure,

lithology, alteration, and mineralization), spatial continuity of

mineralization, data quality, and spatial distribution of drilling

conducted at the Project.

The PEA MRE is supported by 64,138 m of drilling

in 158 holes. The drilling data represents a combination of holes

completed by Oroco from 2021 to 2023 and historical drill holes but

excludes drilling at Brasiles Zone and one geotechnical hole.

The PEA MRE includes the two primary

mineralization zones identified at Santo Tomas: North Zone and

South Zone. These zones display similar mineralization styles but

are physically separated by localized post-mineralization faults

and material currently defined as waste due to a lack of drilling.

Consistent with the previous study, the MRE is not constrained by

the location of the Huites Reservoir. Mineral resources are

reported above an effective cut-off grade (CoG) of 0.15% Cu and

constrained by an economic pit shell (see Table 4).

Table

4: Mineral Resource

Statement for the Santo Tomas Project, effective October 11,

2023

|

Category |

Zone |

TonnesMt |

Average Grade |

In-situ Metal |

|

CuEq% |

Cu% |

Mo% |

Aug/t |

Agg/t |

CuEq M lb |

Cu M lb |

Mo M lb |

Au koz |

Ag koz |

|

Indicated |

North Zone |

561.0 |

0.37 |

0.33 |

0.008 |

0.027 |

2.1 |

4,579 |

4,077 |

98.4 |

487.4 |

37,762 |

|

Total Indicated |

561.0 |

0.37 |

0.33 |

0.008 |

0.027 |

2.1 |

4,579 |

4,077 |

98.4 |

487.4 |

37,762 |

|

Inferred |

North Zone |

118.3 |

0.33 |

0.30 |

0.006 |

0.018 |

1.7 |

848 |

771 |

14.9 |

66.8 |

6,556 |

|

South Zone |

430.8 |

0.35 |

0.31 |

0.008 |

0.022 |

2.0 |

3,317 |

2,958 |

73.9 |

309.0 |

27,902 |

|

Total Inferred |

549.1 |

0.34 |

0.31 |

0.007 |

0.021 |

2.0 |

4,166 |

3,729 |

88.8 |

375.8 |

34,458 |

| Notes: |

|

|

(1) |

|

Mineral resources are not mineral reserves and do not have

demonstrated economic viability. |

| |

(2) |

|

Table abbreviations include: % =

percent, g/t = grams per metric tonne, Mlb = million pounds, Koz =

thousand troy ounces. |

| |

(3) |

|

The mineral resources are

reported at an effective cut-off grade (CoG) of 0.15% Cu. |

| |

(4) |

|

All figures are rounded to reflect

the relative accuracy of the estimates. Totals in the above table

may not sum or recalculate from related values in the table due to

rounding of values in the table, reflecting fewer significant

digits than were carried in the original calculations. |

| |

(5) |

|

The mineral resources exclude

identified oxide mineralization due to a lack of confidence in

recovery assumptions of oxidized tonnages at this phase of the

Project. |

| |

(6) |

|

Metal assays are capped where

appropriate. At the PEA level of the Project, it is the Company’s

opinion that all the elements included in the copper equivalent

calculation have a reasonable potential to be recovered and

sold. |

| |

(7) |

|

All dollar amounts are presented

in U.S. dollars. |

| |

(8) |

|

Bulk density is estimated on a

block basis using specific gravity data collected on diamond drill

core. |

| |

(9) |

|

Reasonable prospects of eventual

economic extraction (RPEEE) are demonstrated through use of an

economic pit shell based on long-term copper price of $4.00/lb,

molybdenum price of $13.50/lb, a gold price of $1,700/oz, and a

silver price of $22.50/oz. Metal recovery factors used in the

determination of CoG and economic pit shell for Cu, Mo, Au, and Ag

have been applied based on metallurgical recovery calculations

based on average feed grade. A 45-degree slope angle was

applied. |

| |

(10) |

|

The Huites Reservoir boundary was

ignored for the purposes of mineral resource determination. This is

consistent with the previous study. |

| |

(11) |

|

The economic CoG was calculated

to be 0.11% Cu but for consistency with the previous study, Oroco

has elected to use an effective CoG at 0.15% Cu. CoG assumptions

include a copper price of $4.00/lb., mining cost of $2.27/t,

processing costs of $4.23/t, G&A costs at $0.65/t, mine

recovery at 98%, mean Cu recovery at 83.7%, and royalties at 1.5%,

have been applied in consideration of the RPEEE. |

| |

(12) |

|

Equivalent Copper (CuEq) percent

is calculated with the formula CuEq% = ((Cu grade * Cu recovery

[83.7%] * Cu price) + (Mo grade * Mo recovery [59.1%] * Mo price) +

(Au grade * Au recovery [58.6%] * Au price) + (Ag grade * Ag

recovery [54.2%] * Ag price)) / (Cu price * Cu recovery [83.7%]).

It assumed that the Santo Tomas Project would produce a

conventional (flotation) copper concentrate product based on metal

recoveries indicated by PEA metallurgical test work and mean

Indicated Resource feed grades. |

| |

(13) |

|

Reported contained individual

metals in the table above represent in-situ metal, calculated on a

100% recovery basis, except for CuEq% which applies mean recovery

assumptions (see Note 12). |

Mineralization has been identified

outside the current economic pit shell. The PEA highlights

the potential to define additional mineral resources on the

property. There is identified exploration potential for additional

mineralization in the southeastern and southwestern portions of the

South Zone based on observations from drilling and surface outcrops

in the area.

PEA Mine Design The PEA Mine

Design, prepared by Mining Plus, contemplates open pit development

that ensures no incursion upon the Huites Reservoir, maintaining a

100 m berm between the reservoir high water mark and the pit limit

thereby remaining outside of CONAGUA’s (Mexican water authority)

jurisdiction boundary (the “CONAGUA limit”). These

constraints were selected by the Company. Avoiding the CONAGUA

limit and applying a series of pit slope constraints derived from

preliminary geotechnical domains defined by SRK from Phase 1

drilling on the Project, a Mineral Resource within the ultimate pit

design (by classification and grades) for this PEA has been defined

as shown in Table 5.

Table

5: Pit Constrained Resource:

Mining-Plus

|

|

Indicated |

Inferred |

|

In-pit Resource(1) Mt |

387.98 |

459.70 |

|

Copper % |

0.340 |

0.297 |

|

Molybdenum % |

0.008 |

0.008 |

|

Gold g/t |

0.033 |

0.023 |

|

Silver g/t |

2.101 |

1.948 |

| Notes: |

| |

(1) |

|

The Mill Feed Tonnes and Grade are Mineral Resources, not Mineral

Reserves, but form part of the potential economic viability

analysis. |

| |

(2) |

|

All dollar amounts are presented

in U.S. dollars (Note 3, below). |

| |

(3) |

|

The marginal CoG was calculated

to be 0.14% CuEq (Cut off NSR = 7 $/t). CoG parameters include a

copper price of $3.80/lb., molybdenum price of $12.00/lb., gold

price of $1650/oz., silver price of $22.0/oz., processing costs of

$6.00/t, G&A costs at $1.00/t, mine recovery at 98%, developed

metallurgical recovery formulas, and royalties at 1.5%. CuEq is

calculated the formula CuEq% = [Cu grade * Cu recovery * (Cu price

– Selling cost Cu) + Mo grade * Mo recovery *(Mo Price - selling

cost Mo) + Au grade * Au recovery * (Au Price - selling cost Au) +

Ag grade * Ag recovery* (Ag Price - selling cost Ag)] / [(Cu Price

- selling cost) * Cu recovery]. |

| |

(4) |

|

Metallurgical recovery formulas

were obtained from Ausenco’s “Oroco Resource Corp. Santo Tomas

Project Metallurgical Testwork Review June 9, 2023” report. |

The Mine Design proposes a standard open-pit,

truck and shovel operation with 10-meter bench intervals. Haul

trucks with a capacity of 194 tonnes will be used for hauling

mineralized material to the mineral processing plant, stockpile

facilities and the waste rock storage facility

(“WRSF”). Mining operations will use large-scale

mining equipment including 20 cm diameter blast hole drills, 29 m3

hydraulic shovel, 22 m3 front end loader, and 194 tonne capacity

haul trucks. Supplier-sourced capital costs from October 2023 are

used in the mine fleet cost calculations.

The mine is divided into two zones, the

higher-grade North Zone, which is the initial focus of mine

development, and the lower-grade South Zone, which requires

pre-stripping ahead of mine development. The North Zone pit is

approximately 1,850 m long (N-S) and 1,000 m wide (E-W) with a

depth of 680 m and the South Zone pit is 2,050 m long and 1,080 m

wide with a depth of 780 m.

The mining sequence consists of four phases. The

first and second phases define the North Pit, and the successive

two phases define the South Pit.

The Project has an operational LOM of 22.1

years, which includes two years of pre-stripping. The pit

constrained resource contains 388 million tonnes of indicated and

460 million tonnes of inferred resource and 983.6 million tonnes of

waste is removed, resulting in a strip ratio of 1.16 over the life

of the mine.

Mining operations will be carried out on a

24-hour per day, 365 days per year schedule. Milling will start at

60 kt/d in the first year of production, expanding to 120 kt/d in

the second year.

Mill feed tonnages and corresponding resource

classification are shown in Figures 2 and 3.

Figure

2: Preliminary Economic Assessment Mine

Plan and Schedule

Figure

3: Classification of

Material for Processing

Process Design & Plant

InfrastructureThe Q2 2022 metallurgical test work program

demonstrated the ability to produce a marketable copper concentrate

using a conventional flotation process flowsheet. Levels of

molybdenum in bulk concentrates were sufficient to produce a

marketable molybdenum concentrate using conventional Cu-Mo

separation flotation techniques. For purposes of the PEA,

logarithmic regression analysis was performed on the flotation test

work results to develop metallurgical process recoveries as a

function of head grade. Based on these formulas, Ausenco forecasts

the following mean recoveries for copper, molybdenum, silver, and

gold at 83.3%, 59.2%, 53.9%, and 53.2%, respectively. Results from

comminution test work on nine variability samples returned elevated

hardness properties for some of the mineralized materials (e.g. Axb

& ball mill work index of 30 and 18.3 kWh/tonne, respectively).

Given these measurements and high throughputs, High Pressure

Grinding Rolls (“HPGR”) crushing was considered

over conventional SAG milling. Figure 4 illustrates the simplified

overall process flowsheet developed for the Project.

Figure 4: Simplified

Process Flowsheet

The primary crusher is located at the north-east

end of the South Pit (see Figure 5). Coarse crushed material is

transported to a stockpile facility to the west of the process

plant via an overland conveyor. An alternative to this design would

involve the construction of conveyance tunnels and in-pit crushers

in both the North and South pits feeding the stockpile. Material

from the primary crusher is further reduced in size via secondary

crushing and HPGR before feeding into twin ball mills. Ground

material at a sizing of 80% passing 150 µm then advances to the

flotation circuit to produce a bulk rougher product that is

subsequently reground to 23 µm P80 prior to cleaner circuit

upgrading. The bulk cleaner concentrate advances to

copper-molybdenum separation to recover a molybdenum concentrate.

Gold and silver report to the copper concentrate. The tailings are

thickened and pumped to the tailings storage facility

(“TSF”). Copper and molybdenum concentrates are

dewatered prior to shipment.

Concentrates are trucked using the sealed

containerized method to the Port of Topolobampo situated on the

Gulf of California for transport to overseas smelters. The

containerized method removes the capital expense of a concentrate

storage facility at the port and loss of concentrate to the

environment. The proximity of rail infrastructure to the Project

could offer an alternative mode of concentrate transport.

Some infrastructure design includes expansion

capacity design features (e.g. overland conveyor, powerline and

water supply) during the initial phase so as to not interfere with

production during the expansion phase.

Figure 5: Mine

Infrastructure, Pits, Process Plant Layout, Tailings and Waste Rock

Storage Facilities

Tailings and Waste Rock Storage

FacilitiesBoth the waste-rock storage facility

(“WRSF”) and the TSF are designed in accordance

with national and international standards and constructed in

valleys west and east of the resource, respectively (see Figure 5).

The TSF has a rock fill with upstream composite liner system for a

starter embankment that transitions to a cycloned sand centerline

dam for the LOM with a seepage collection system in the downstream

foundation. Ditches and berms have been designed to capture

non-contact water above the facility and divert it around to reduce

water management in the TSF. The WRSF will be constructed from the

bottom up in thick lifts and contact water from the facility will

be captured with a water treatment facility at the toe of the

facility prior to release. Ditches and berms direct non-contact

water above the facility and divert it around.

Power Infrastructure and Water

SupplyElectrical supply is either from the Huites

hydroelectric plant down-stream from the Project or via built for

purpose combined cycle gas turbine plant tentatively located close

to the Huites power station and the Texas-Sinaloa natural gas

pipeline. Both options represent low carbon footprint power sources

for the estimated power requirements at similar costs. A 230-kVA

power line trace from Huites Station to the Project has been laid

out and costed, as has the main mine access route.

A make-up process water supply source is from

wells located within 25 km of the Project and follow a gravel

valley well source configuration similar to that employed during

mine operations at the El Sauzal Mine site located 45km upstream of

the Project and the historic Reforma Mine located 7 km to the

north.

Geology and

MineralizationPorphyry Cu (Mo‐Au‐Ag) mineralization on the

Santo Tomas property is closely associated with intrusives linked

to the Late Cretaceous to Paleocene (90 to 40 Ma) Laramide orogeny.

Santo Tomas and most of the known porphyry copper deposits in

Mexico lie along a 1,500 km‐long, NNW trending belt sub-parallel to

the west coast, extending from the southwestern United States

through to the state of Guerrero in Mexico.

In the Santo Tomas area, Mesozoic‐aged country

rocks comprising limestone, minor sandstones, conglomerates,

shales, and a thick succession of andesitic volcanics were intruded

by a range of Laramide age intrusions related to the Late

Cretaceous Sinaloa‐Sonora Batholith. Multiple phases are recognized

ranging from dioritic to monzonitic in composition.

Mineralization is strongly structurally

controlled by the Santo Tomas fault and fracture zone by the

pathway to quartz monzonite dikes, associated hydrothermal

alteration, hydrothermal breccias, and sulfide mineralization.

Sulfide minerals are dominated by chalcopyrite, pyrite and

molybdenite with minor bornite, covellite, and chalcocite. Sulfides

occur as fracture fillings, veinlets, and fine disseminations

together with potassium feldspar, quartz, calcite, chlorite, and

locally, tourmaline. Chalcopyrite is the main copper mineral with

minor copper oxides near surface.

Community and EnvironmentOroco

maintains an environmental and social plan for the Project

which provides a framework for its community outreach efforts

focused on education, ongoing employment, indigenous engagement and

community mapping. Oroco strives to maintain the support of the

community, local municipal leaders and state regulators and

governments in Sinaloa and Chihuahua. Oroco maintains its

exploration permits and approvals in good standing.

Additional baseline studies and initiatives in

key subject areas related to environmental, socio-economic,

cultural, and community engagement are planned. These studies and

activities will be necessary to advance the project and

provide a strong basis for the preparation of future

environmental studies and permitting.

Project Enhancement

OpportunitiesSeveral further opportunities to improve the

Project have been identified during the PEA Study. These include

but are not limited to:

- The application of sulfide leaching on lower grade chalcopyrite

resources currently assigned to waste. Preliminary studies have

commenced, and results are expected in Q4 2023. CAPEX/OPEX costs

for an SX/EW facility are developed but are not considered in this

PEA.

- Fully evaluate oxide copper resources that are currently

carried as waste in combination with sulfide leaching using

available data from surface sampling and drilling.

- Optimize mine plan around larger loading and haulage

equipment.

- Optimize mobile mining fleet considering mixed fuel and or

electrified options.

- Infill resource drilling in the area between North and South

zones: additional resource in that area would improve optimized pit

development and reduce mining costs.

- Additional comminution studies and variability testing to

better constrain recoveries across the full range of expected mill

feed grades based on rock and alteration types.

- Consider relocation of the primary crushing facility closer to

the pit(s) via in-pit crushing stations and conveyance via tunnels

from both North and South pits to the mill feed stockpile.

- Investigate coarse particle flotation to reduce comminution

costs and improve factors of safety on TSF design.

- Drill hydrogeological test wells at the north end of the North

Pit to better define pit inflow and pit dewatering costs.

- Drill selected geotechnical holes to optimize pit slope angles

and reduce mining of waste.

- Optimize heavy equipment leasing terms.

A geological-geochemical conceptual model will

inform the ongoing development and refinement of geochemical and

mine rock management plan for the site. The predicted occurrence of

large volumes of net neutralizing mine waste materials to be mined

in early years will be confirmed, as the buffering characteristics

of these waste materials can be effectively utilized as part of the

overall waste rock management strategy. Additional geochemical

assessment of the acid rock drainage / metal leaching risk for the

Project will be implemented to provide additional test work and

sampling coverage, and to confirm preliminary study findings.

Cautionary Notes to Investors

PEAThe reader is cautioned that the PEA is

preliminary in nature, and that it includes inferred mineral

resources that are considered too speculative geologically to have

the economic considerations applied to them that would enable them

to be categorized as mineral reserves, and there is no certainty

that the preliminary economic assessment will be realized.

Mineral Resource and Reserve

EstimatesIn accordance with applicable Canadian securities

laws, all Mineral Resource estimates of the Company disclosed or

referenced in this news release have been prepared in accordance

with the disclosure standards of NI 43-101 and have been classified

in accordance with the CIM Standards. Mineral Resources

that are not Mineral Reserves do not have demonstrated economic

viability. The estimate of mineral resources may be

materially affected by environmental, permitting, legal, title,

socio-political, marketing, or other relevant issues. In

particular, the quantity and grade of reported inferred mineral

resources are uncertain in nature and there has been insufficient

exploration to define these inferred mineral resources as an

indicated or measured mineral resource. It is uncertain in all

cases whether further exploration will result in upgrading the

inferred mineral resources to an indicated or measured mineral

resource category.

Qualified PersonsThe PEA for

the Project summarized in this news release was prepared by Ausenco

with input from SRK and Mining Plus, and will be incorporated in a

technical report prepared in accordance with NI 43-101 which will

be available under the Company’s SEDAR profile at www.sedarplus.ca

and on the Company’s website within 45 days of this news release.

The affiliation and areas of responsibility for each of the

Qualified Persons involved in preparing the PEA, upon which the

technical report will be based, are as follows:

Table

6: Qualified

Persons for

PEA

|

Qualified Persons |

Qualification |

Company (location) |

Position / Oversight |

|

James Norine |

P.E. |

Ausenco Engineering USA South Inc. (Tucson) |

Vice President, Southwest USA / PEA |

|

Shaida Miranda |

MSc, MAusIMM (CP), Mining Engineer |

Mining Plus SAC (Lima) |

Senior Mining Consultant / Mine Plan, Mining CAPEX + OPEX |

|

Ron Uken |

PhD, PrSciNat |

SRK Consulting (Canada), Inc. (Vancouver) |

Principal Structural Geologist / Geology |

|

Scott Burkett |

RM-SME |

SRK Consulting (U.S.), Inc.(Denver) |

Principal Consultant / Resource Geology |

|

Andy Thomas |

MEng, BE, P.Eng., EGBC |

SRK Consulting (Canada), Inc. (Vancouver) |

Principal Rock Mechanics Engineer / Geotechnical (Preliminary) |

|

Peter Mehrfert |

P. Eng. |

Ausenco Engineering Canada Inc. (Vancouver) |

Principal Process Engineer / Metallurgy |

|

James Millard |

M. Sc, P. Geo. |

Ausenco Sustainability Inc. (Victoria) |

Director, Strategic Projects / Environmental, Social,

Permitting |

|

Scott Elfen |

P.E. |

Ausenco Engineering Canada Inc. (Vancouver) |

Global Lead Geotechnical Services / TSF & WRSF design +

geotechnical |

Each QP has reviewed and verified the content of

this news release.

About OROCO The Company holds a

net 85.5% interest in those central concessions that comprise 1,173

hectares “the Core Concessions” of The Santo Tomas Project, located

in northwestern Mexico. The Company also holds an 80% interest in

an additional 7,861 hectares of mineral concessions surrounding and

adjacent to the Core Concessions (for a total Project area of 9,034

hectares, or 22,324 acres). The Project is situated within the

Santo Tomas District, which extends up to the Jinchuan Group’s

Bahuerachi Project, approximately 14 km to the northeast. The

Project hosts significant copper porphyry mineralization defined by

prior exploration spanning the period from 1968 to 1994. During

that time, the Project area was tested by over 100 diamond and

reverse circulation drill holes, totalling approximately 30,000

meters. Commencing in 2021, Oroco conducted a drill program (Phase

1) at Santo Tomas, with a resulting total of 48,481 meters drilled

in 76 diamond drill holes. In May of 2023, the Company completed a

Mineral Resource Estimate for the Core Concessions that identified

Indicated and Inferred resources of 487 Mt @ 0.36% CuEq and 600 Mt

@ 0.36% CuEq respectively. This news release updates that resource

identifying Indicated and Inferred resources of 561 Mt @ 0.37% CuEq

and 549 Mt @ 0.34% CuEq respectively.

The Project is located within 160 km of the

Pacific deep-water port at Topolobampo and is serviced via highway

and proximal rail (and parallel corridors of trunk grid power lines

and natural gas) through the city of Los Mochis to the northern

city of Choix. The property is reached, in part, by a 32 km access

road originally built to service Goldcorp’s El Sauzal Mine in

Chihuahua State.

Additional information about Oroco can be found

on its website at www.orocoresourcecorp.com and by reviewing its

profile on SEDAR at www.sedarplus.ca.

For further information, please contact:

Richard Lock, CEOOroco Resource Corp. Tel:

604-688-6200 Email: info@orocoresourcecorp.com

www.orocoresourcecorp.com

Cautionary Note Regarding

Forward-Looking Information

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation based on expectations, estimates and projections as at

the date of this news release. Forward-looking information involves

risks, uncertainties and other factors that could cause actual

events, results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

information. All statements other than statements of fact included

in this document constitute forward-looking information, including,

but not limited to, objectives, goals or future plans, statements

regarding anticipated exploration results and exploration plans,

Oroco’s expectations regarding the future potential of the Santo

Tomas deposits, its plans for additional drilling and other

exploration work on the Santo Tomas deposits and the potential to

advance or improve the PEA study.

Forward-looking information is not, and cannot

be, a guarantee of future results or events. Forward-looking

information is based on, among other things, opinions, assumptions,

estimates and analyses that, while considered reasonable by the

Corporation at the date the forward-looking information is

provided, inherently are subject to significant risks,

uncertainties, contingencies and other factors that may cause

actual results and events to be materially different from those

expressed or implied by the forward-looking information.

Factors that could cause actual results to

differ materially from such forward-looking information include,

but are not limited to, capital and operating costs varying

significantly from estimates; the preliminary nature of

metallurgical test results; delays in obtaining or failures to

obtain and comply with required governmental, environmental or

other Project approvals; uncertainties relating to the availability

and costs of financing needed in the future; changes in equity

markets; inflation; fluctuations in commodity prices; delays in the

development of the Project; COVID-19 and other pandemic risks;

those other risks involved in the mineral exploration and

development industry; and those risks set out in the Company’s

public documents filed on SEDAR at www.sedarplus.ca.

Should one or more risk, uncertainty,

contingency or other factor materialize or should any factor or

assumption prove incorrect, actual results could vary materially

from those expressed or implied in the forward-looking information.

Accordingly, you should not place undue reliance on forward-looking

information. Oroco does not assume any obligation to update or

revise any forward-looking information after the date of this news

release or to explain any material difference between subsequent

actual events and any forward-looking information, except as

required by applicable law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release. No stock exchange,

securities commission or other regulatory authority has approved or

disapproved the information contained herein.

All figures in this announcement are available at : Oroco

Resource October 17, 2023 PEA Figures

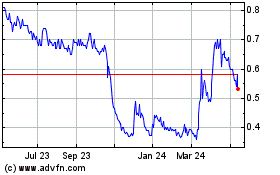

Oroco Resource (TSXV:OCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

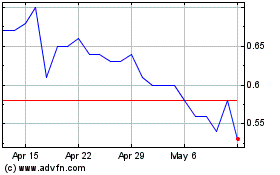

Oroco Resource (TSXV:OCO)

Historical Stock Chart

From Dec 2023 to Dec 2024