New Zealand Energy Announces 2013 Year-End and Fourth Quarter

Results and Operational Update

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 1, 2014) - New

Zealand Energy Corp. ("NZEC" or the "Company")

(TSX-VENTURE:NZ)(OTCQX:NZERF) has released the results of its

fourth quarter and fiscal year ended December 31, 2013. Details of

the Company's financial results are described in the Audited

Consolidated Financial Statements and Management's Discussion and

Analysis which, together with further details on the Company's

operational activities, are available on the Company's website at

www.newzealandenergy.com and on SEDAR at www.sedar.com. All amounts

are in Canadian dollars unless otherwise stated.

| NZEC

will host a conference call May 1, 2014 |

| 1-2pm PST

(4-5pm EST) |

| North

American toll-free: 1-800-319-4610 |

|

International / Vancouver callers: 604-638-5340 |

HIGHLIGHTS

- Ten wells in production at year-end 2013 (2012: four

wells)

- 77,484 barrels of oil produced and 77,820 barrels of oil sold

during 2013 (2012: 162,444 and 162,077)

- Total recorded revenue of $10,662,879 (2012: $16,475,971)

- Significantly improved average field netback during second half

of 2013 to $60.34 per barrel (compared to $35.10 per barrel in

first six months of 2013)

- Invested $37.7 million in resource properties, plant and

equipment during 2013

- Completed acquisition of strategic midstream and exploration

assets in the Taranaki Basin, recognizing a Gain on Acquisition of

$1.4 million

- Increased 2P Reserves by 145% compared to year-end 2012, with

an after tax net present value (10% discount) of $57.9 million

- Cumulative third-party revenue earned to date through Waihapa

Production Station of $687,000 (net to NZEC)

- New arrangement with gas marketing counterparty is expected to

commence May 5, 2014 and generate between NZ$250,000 and NZ$1

million revenue per year (net to NZEC)

- NZEC retracts its year-end 2014 production guidance

Message from the Chief Executive Officer

As the CEO of NZEC, I am focused on the milestones we need to

achieve in the days, weeks and months ahead to ensure that our

business can continue to grow. Reviewing the year-end financial

statements, however, has provided the opportunity for me to reflect

on the events that occurred during what was certainly a

transformative year for NZEC.

NZEC started 2012 with four producing oil wells and an active

exploration program on its Eltham Permit, and the expectation of

imminently closing the acquisition of the TWN assets from Origin.

The acquisition took much longer than expected, but the

opportunities and benefits this acquisition brought to the Company

far outweigh the challenges. NZEC ended 2013 with ten producing

wells, a 145% increase to its 2P reserves, and a 50% interest in

strategic midstream infrastructure in the heart of the Taranaki

Basin. In the first few months of 2014, NZEC has also brought two

more wells online and anticipates near-term production increases

from additional wells.

Since closing the acquisition at the end of October 2013, NZEC

moved quickly to deliver on a number of milestones. The Company

successfully reactivated oil production from seven existing wells

and confirmed that production can be achieved from an uphole

reservoir, following a successful uphole completion. In addition,

the Company delivered on its promise of realizing new business

opportunities through the Waihapa Production Station, which is now

generating revenue from third-party business opportunities.

I am pleased with our success and proud of the team's ability to

be innovative and nimble. I tasked the team with reviewing these

new assets from every angle and identifying opportunities to use

the existing wells and infrastructure to increase production. The

team identified numerous production opportunities in the due

diligence period before NZEC closed the acquisition, and each of

the development activities to date has yielded oil production. The

technical and operations teams continue to review well logs,

historical drilling records and seismic data across the TWN

Licenses and have identified additional opportunities to advance

existing wells to production.

The Company's primary challenge, however, has been timing.

Continued delays in closing the acquisition resulted in delays to

realizing production and cash flow from the new assets. Likewise,

the sequential development activities that NZEC had planned for the

assets were also pushed back. While NZEC was initially optimistic

that it could make up the time, the recent decision to defer

drilling of a new Tikorangi well made it clear that the Company's

year-end production guidance is no longer attainable, and the

Company retracts its previously stated production guidance. NZEC

still expects to achieve that production target. NZEC has great

confidence in the assets and in the production potential from the

multiple drill-proven formations that underlie the Company's

Taranaki permits. All that's changed is the timing. NZEC is focused

on responsible development of its assets, looking for optimal

production from each well and ensuring that we fully understand

both the assets and the impact of each development activity before

we move ahead to the next task.

For the remainder of 2014, NZEC will prioritize low-cost,

low-risk opportunities that are expected to bring near-term

production and cash flow. Concurrently, the Company continues to

take significant steps to reduce overhead, consolidating its three

New Plymouth premises into one office and eliminating a number of

consulting and employment positions. NZEC's objective is to

organically build up working capital through internally-generated

cash flow. Once the Company has established a strong production and

cash flow base, the Company can again look to advancing

higher-impact operations, such as drilling new wells.

To ensure that NZEC can continue to advance its non-core assets,

the Company is actively seeking farm-in partners for its Eltham and

Alton exploration permits in the Taranaki Basin and also for its

East Coast permits. Securing a farm-in partner would allow the

Company to expedite exploration of priority drill targets,

including the deeper high-impact Tikorangi and Kapuni targets,

while reducing NZEC's financial and technical risk. Establishing

strong partnerships has been one of the cornerstones of NZEC's

success to date. The Company has established strategic partnerships

with L&M Energy and Westech Energy New Zealand, and built a

strong relationship with New Zealand Oil & Gas and also its iwi

partners in both the Taranaki and East Coast basins.

NZEC's reputation as a responsible and entrepreneurial oil and

gas developer has allowed the Company to attract industry experts.

I am very excited that David Robinson will join the team on May

19th to assume the new position of Chief Executive Officer of the

Company's New Zealand business and also join NZEC's Board of

Directors. David brings considerable oil and gas insight to the

Company from a corporate, industry and regulatory perspective. His

expertise and enthusiasm will be invaluable as NZEC continues to

execute its business and development plans.

I believe NZEC has both the assets and the business plan

required to build a substantial oil and gas company. Progress has

been slower than expected, but we are indeed making progress, and I

see many opportunities ahead. We have a core team of highly

qualified and experienced individuals who are focused and committed

to the success of this Company. I look forward to sharing the

Company's successes with our shareholders and community partners as

our development plans unfold in 2014.

FINANCIAL SNAPSHOT

|

|

For the quarter ended December 31, 2013 |

|

|

For the year ended December 31, 2013 |

|

For the year ended December 31, 2012 |

|

For the year ended December 31, 2011 |

|

|

Production |

16,790 bbl |

|

|

77,484 bbl |

|

162,444 bbl |

|

11,623 bbl |

|

|

Sales |

13,968 bbl |

|

|

77,820 bbl |

|

162,077 bbl |

|

9,567 bbl |

|

|

Price |

115.77 $/bbl |

|

|

109.09 $/bbl |

|

106.71 $/bbl |

|

106.83 $/bbl |

|

|

Production costs |

43.39 $/bbl |

|

|

58.73 $/bbl |

|

31.57 $/bbl |

|

23.44 $/bbl |

|

|

Royalties |

10.53 $/bbl |

|

|

5.98 $/bbl |

|

5.06 $/bbl |

|

4.96 $/bbl |

|

|

Field netback |

61.84 $/bbl |

|

|

44.38 $/bbl |

|

70.08 $/bbl |

|

78.43 $/bbl |

|

|

Revenue |

4,108,911 |

|

|

10,662,879 |

|

16,475,971 |

|

974,517 |

|

|

Pre-production recoveries |

- |

|

|

- |

|

2,449,231 |

|

950,440 |

|

|

Total comprehensive loss |

(5,963,723 |

) |

|

(9,303,312 |

) |

(1,235,492 |

) |

(6,655,829 |

) |

|

Finance income (expense) |

(30,804 |

) |

|

(97,598 |

) |

211,511 |

|

119,583 |

|

|

Loss per share - basic and diluted |

(0.06 |

) |

|

(0.12 |

) |

(0.03 |

) |

(0.08 |

) |

|

Current assets |

15,147,197 |

|

|

15,147,197 |

|

49,137,637 |

|

19,293,345 |

|

|

Total assets |

116,782,687 |

|

|

116,782,687 |

|

116,059,939 |

|

31,152,804 |

|

|

Total long-term liabilities |

7,068,585 |

|

|

7,068,585 |

|

2,598,840 |

|

120,429 |

|

|

Total liabilities |

15,337,630 |

|

|

15,337,630 |

|

23,442,632 |

|

1,383,376 |

|

|

Shareholders' equity |

101,445,057 |

|

|

101,445,057 |

|

92,617,307 |

|

29,769,428 |

|

Note: The abbreviation bbl means barrel or barrels of oil.

As at April 30, 2014, the Company had an estimated $2.7 million

in working capital.

SIGNIFICANT DEVELOPMENTS

In the fourth quarter of 2013, NZEC completed the TWN

Acquisition, assumed joint control of the acquired assets and

reactivated oil production in six wells drilled by previous

operators; booked additional reserves and resources related to the

TWN Acquisition; closed an oversubscribed private placement for

gross proceeds of $16.1 million; completed its acquisition of an

80% interest in the Wairoa Permit; extended the exploration period

for the Alton Permit and the Eltham Permit by five years to

September 2018; and relinquished the Ranui Permit.

Subsequent to year-end, NZEC advanced three additional wells to

production on the TWN Licenses and recommenced production from one

well on the Eltham Permit. The Company has also made a number of

changes to its New Zealand senior management team, released an

updated reserve estimate and relinquished its interest in the

Manaia Permit.

Initial development plans for the TWN Licenses included drilling

a crestal well to access oil reserves attributed to the Tikorangi

Formation. The TWN JA has determined that the crestal well will not

be drilled in 2014. Drilling the Tikorangi crestal well was

integral to NZEC achieving its year-end 2014 production guidance.

With the Tikorangi well deferred, NZEC has made the decision to

retract is year-end 2014 production guidance, as previously

announced on August 6, 2013.

PROPERTY REVIEW

Taranaki Basin

The Taranaki Basin is situated on the west coast of New

Zealand's North Island and is currently the country's only oil and

gas producing basin, with total production of approximately 130,000

barrels of oil equivalent per day ("boe/d") from 18 fields. Within

the Taranaki Basin, NZEC holds a 100% interest in the Eltham

Permit, a 65% interest in the Alton Permit with L&M, and a 50%

interest in the TWN Licenses and the TWN Assets with L&M. The

Eltham Permit currently covers 47,387 acres (191.8 km2), of which

approximately 2,029 acres (24.4 km2) is offshore. The Company has

lodged an application with NZPAM to convert 939 acres (3.8 km2) of

the Eltham Permit into a PMP. When approved, the Eltham Permit

acreage will be reduced by the size of the PMP. The Alton Permit

covers approximately 59,565 onshore acres (241 km2). The TWN

Licenses cover approximately 23,049 onshore acres (93 km2).

NZEC is actively seeking farm-in partners for its Eltham and

Alton permits, with the intention that the farm-in partner would

fund the drilling of high-priority targets on the properties in

return for an interest in the permits.

The Taranaki Basin offers production potential from multiple

prospective formations, ranging from the Kapuni sandstones at a

depth of approximately 4,000 metres, the Tikorangi limestones at

approximately 3,000 metres, the Moki sandstones at approximately

2,500 metres, and the shallower Mt. Messenger and Urenui sandstones

at approximately 2,000 metres. All of NZEC's production to date is

from the Tikorangi and Mt. Messenger formations.

Production and

Processing Revenue

At the date of this MD&A, the Company had advanced 12 wells

to production: four wells on the Eltham Permit and eight wells on

the TWN Licenses. The Company's oil production during March 2014

averaged 233 bbl/d net to NZEC (not including production from the

Waihapa-8 well). On March 29, 2014 the Waihapa-8 well commenced

production, on April 12, 2014 the Toko-2B well recommenced

production following installation of high-volume lift, and on April

17, 2014 the Waihapa-2 well commenced production following a

successful uphole completion. Production during April 2014 averaged

228 bbl/d net to NZEC. Production from Toko-2B, Ngaere-2 and

Ngaere-3 is combined into one single pipe that goes through the

B-train separator at the Waihapa Production Station. Ngaere-2 and

Ngaere-3 were taken offline on April 12, 2014 to allow for full

evaluation of Toko-2B. In addition, the Copper Moki-3 well remains

shut-in awaiting installation of a new pump later in Q2-2014.

Details regarding the Company's efforts to increase production from

existing wells and bring new wells into production are available in

the Outlook section below.

TWN Licenses

The TWN JA has identified two opportunities for low-cost,

near-term production on the TWN Licenses: reactivating oil

production from the Tikorangi and Mt. Messenger formations in

existing wells that were produced historically, and recompleting

existing wells uphole in shallower formations that have not been

produced. At the date of this MD&A, the TWN JA had advanced

eight wells to production for a total of 43,594 bbl produced since

closing of the TWN Acquisition (21,797 bbl net to NZEC), with

cumulative pre-tax oil sales net to NZEC of approximately

$2,330,664 (net results of operations are discussed under

Results of Operations). The wells produce light ~41° API

oil that is delivered by pipeline to the Waihapa Production Station

and then piped to the Shell-operated Omata tank farm, where it is

sold at Brent pricing less standard Shell costs.

Following closing of the TWN Acquisition, the TWN JA immediately

proceeded with the work required to reactivate oil production from

the Tikorangi Formation in six wells drilled by previous operators.

On December 2, 2013, NZEC announced that all six wells had been

reactivated and were flowing into the Waihapa Production Station.

In March 2014, the TWN JA also reactivated oil production from the

Mt. Messenger Formation in a well that had been drilled and

produced from the Mt. Messenger Formation by a previous operator

(Waihapa-8).

The TWN JA continues to evaluate and optimize production from

the reactivated wells. As part of the optimization process, in

April 2014, the TWN JA installed high-volume lift ("ESP") on one of

the reactivated wells (Toko-2B). The ESP was operated initially

using a portable generator, which limited the pumping capacity and

did not draw down fluid levels in the well. The TWN JA is

connecting the Toko-2B high-volume lift to a permanent power source

and will gradually increase the pumping rate. The ESP is capable of

pumping up to 10,000 barrels of total fluid per day.

A number of wells on the TWN Permits, with previous production

from the Tikorangi Formation, have uphole completion potential in

the shallower Mt. Messenger Formation. The TWN JA has recompleted

one well uphole in the Mt. Messenger Formation (Waihapa-2) and

achieved production from that well in April 2014. This successful

recompletion confirms that production can be achieved from an

uphole reservoir. The TWN JA has identified three more wells with

uphole completion potential, and will continue to evaluate these

opportunities. One additional well offers production potential from

both the Tikorangi and Mt. Messenger formations. The TWN JA is

focusing first on reactivating production from the Tikorangi

Formation, but will proceed with an uphole completion in the Mt.

Messenger Formation if appropriate.

The TWN JA continues to identify opportunities to generate

revenue from the Waihapa Production Station and associated

infrastructure. Third-party revenue from the Waihapa Production

Station since closing the TWN Acquisition totals approximately NZ

$687,000 net to NZEC. In addition, during February 2014, the TWN JA

entered into an agreement with a gas marketing counterparty to

transport gas along a section of the TAW gas pipeline for a term of

four years with a five-year right of renewal. The arrangement is

expected to generate between NZ$250,000 and NZ$1 million revenue

per year (net to NZEC). First gas is expected to flow on May 5,

2014.

Eltham Permit

To date the Company has drilled ten exploration wells on the

Eltham Permit. Four have been advanced to production. At the date

of this MD&A, the Company has produced approximately 279,842

bbl from its Eltham Permit wells (including oil produced during

testing), with cumulative pre-tax oil sales from inception of

approximately $31.2 million (net results of operations are

discussed under Results of Operations). Of the remaining

six wells, one well (Copper Moki-4) made an oil discovery in the

Urenui Formation and has been shut-in pending additional economic

analysis and evaluation of artificial lift options. One well

(Arakamu-2) made an oil discovery in the Mt. Messenger Formation

and has been shut-in pending evaluation of artificial lift options.

One well (Wairere-1A) was drilled to the Mt. Messenger Formation

and encountered hydrocarbon shows, with completion pending.

Waitapu-1 is shut-in pending further testing or sidetrack to an

alternate target and Arakamu-1A, a Moki Formation well, is

suspending pending further evaluation. Only one well, Wairere-1,

failed to encounter hydrocarbons and was immediately

sidetracked.

All of the Eltham Permit wells produce light ~41° API oil from

the Mt. Messenger Formation. Oil is trucked to the Shell-operated

Omata tank farm and sold at Brent pricing less standard Shell

costs. During January 2014, NZEC began delivering natural gas

produced from wells on the Copper Moki site through a pipeline to

the Waihapa Production Station, where it is blended with gas

produced from the TWN Licenses and used by the TWN Partnership to

lift the TWN JA reactivated wells and run the Waihapa Production

Station compressors. Using internally generated gas for these

activities, rather than purchasing it, has significantly reduced

operating costs at the Waihapa Production Station and brought

modest natural gas revenue to the Company.

East Coast Basin

The East Coast Basin of New Zealand's North Island hosts two

prospective oil shale formations, the Waipawa and Whangai, which

are believed to be the source of more than 300 oil and gas seeps.

Within the East Coast Basin, NZEC holds a 100% interest in the

Castlepoint Permit, which covers approximately 551,042 onshore

acres (2,230 km2), and a 100% interest in the East Cape Permit

which covers approximately 1,048,406 onshore acres (4,243 km2) on

the northeast tip of the North Island. In addition, NZEC holds an

80% working interest in the Wairoa Permit, which covers

approximately 267,862 onshore acres (1,084 km2) south of the East

Cape Permit. NZEC is the operator of all three permits.

The Company has completed the coring of two test holes and

collected 35 line km of 2D seismic data on the Castlepoint Permit.

The Wairoa Permit has been actively explored for many years, with

extensive 2D seismic data across the permit and log data from more

than 16 wells drilled on the property. Members of NZEC's geological

and geophysical team understand the property well and had

previously provided extensive consulting services to previous

permit holders, assisting with seismic acquisition and

interpretation, well-site geology and regional prospectivity

evaluation. In addition, NZEC's team assisted with permitting and

land access agreements and worked extensively with local district

council, local service providers, land owners and iwi groups,

allowing the team to establish an excellent relationship with local

communities. During Q1-2013 the Company completed a 50 km 2D

seismic program on the Wairoa Permit.

OUTLOOK

Taranaki Basin

Completing the acquisition of the TWN Licenses and TWN Assets

has transformed NZEC into a fully integrated upstream/midstream

company. Having a 50% interest in a full-cycle production facility

and associated infrastructure should allow NZEC to optimize the

development of all of its Taranaki Basin permits. As NZEC continues

to explore its Taranaki Basin property portfolio, the Company will

focus on developing targets that are close to the Waihapa

Production Station and associated pipelines, allowing for

accelerated and cost effective tie‐in of both oil and gas

production.

The majority of the Company's near-term production and

exploration efforts will be focused on the TWN Licenses, where

existing wells offer low-cost, near-term production potential. The

TWN JA has already reactivated production from seven wells and

advanced one uphole completion to production. In addition, the TWN

JA expects to achieve an increase to production from one well

following installation of high-volume lift, and is considering

installing high-volume lift in additional wells. The TWN JA

continues to review well logs, historical drilling records and

seismic data across the TWN Licenses to identify additional

opportunities to advance existing wells to production. The TWN JA

has identified production potential from both the Tikorangi and Mt.

Messenger formations in additional existing wells, and will

continue to evaluate these opportunities. Reactivations and uphole

completions are significantly less expensive and faster than

drilling new wells, and economic discoveries can often be tied in

to the Waihapa Production Station using existing oil and gas

gathering pipelines.

During 2014, the Company plans to drill a new exploration well

on the Alton Permit. The current work program for the Alton Permit

requires the Company to drill an exploration well by June 22, 2014.

The Company has applied to NZPAM to extend the deadline by three

months to accommodate environmental consulting work. The Company

has identified a drill target in the Mt. Messenger Formation and

has initiated the community engagement and technical assessments

required to obtain land access consents and permits. In addition,

new exploration targets in the Mt. Messenger, Tikorangi and Kapuni

formations on the TWN Licenses and the Eltham and Alton permits

could be drilled in future exploration programs. NZEC is actively

seeking farm-in partnerships to advance both its Eltham and Alton

permits.

The Company announced its initial development plans for the TWN

Licenses and other permits in the Taranaki Basin on August 6, 2013.

NZEC and the TWN JA continue to review development plans for the

TWN Licenses and have identified new production opportunities in

existing wells. As a result, timing of a number of a planned

exploration and development activities has shifted. The TWN JA will

prioritize low-cost, low-risk opportunities that are expected to

bring near-term production and cash flow, and will defer

higher-cost, higher-risk operations until the TWN JA has

established a strong production and cash flow base.

NZEC believes that optimization efforts can increase production

from existing wells. The TWN JA is connecting the Toko-2B

high-volume lift to a permanent power source and will gradually

increase the pumping rate. The ESP is capable of pumping in excess

of 10,000 barrels of total fluid per day. Pumping rates are being

gradually increased at the Waihapa-2 well to maximize production.

The Waihapa-8 well is currently being produced using an existing

gas lift system that was installed by the previous operator, but

the TWN JA may consider installing more sophisticated artificial

lift. In addition, the Copper Moki-3 well on the Eltham Permit is

expected to resume production in Q2-2014 following installation of

a new pump. The TWN JA has identified four additional production

opportunities in existing wells on the TWN Licenses: three uphole

completions in the Mt. Messenger Formation and one well that offers

production potential from both a Tikorangi reactivation and a Mt.

Messenger uphole completion. The TWN JA will continue to evaluate

these opportunities with the objective of advancing these wells to

production.

NZEC remains focused on reducing costs while increasing

production from existing wells with the objective of organically

building up working capital through internally-generated cash flow.

In addition, NZEC is actively seeking farm-in partners for its

Eltham and Alton permits, with the intention that the farm-in

partner would fund the drilling of high-priority targets on the

properties in return for an interest in the permits.

The Company's ability to execute its exploration and development

activities is contingent on its financial capacity. Based on

available working capital, as well as forecasted positive net cash

flow from operations, management has estimated that the Company has

sufficient working capital to meet short-term operating

requirements. However, since these estimates rely on certain

development activities that are still underway as at the date of

this report, there are no assurances that these activities will be

successful, or that the Company will be able to attain sufficient

profitable operations from those activities. In light of the

reliance on successful completion of ongoing development

activities, there is significant doubt about the Company's ability

to continue as a going concern.

The Company is considering a number of options to increase its

financial capacity (including increasing cash flow from oil

production, credit facilities, joint arrangements, commercial

arrangements or other financing alternatives) in order to meet all

required and planned capital expenditures for the next 12

months.

East Coast Basin

The Company is actively seeking a farm-in partner for its East

Coast permits, to participate in and fund exploration and

development in the East Coast Basin in return for an interest in

the permits.

NZEC used information from two stratigraphic test holes and a 2D

seismic survey to focus its exploration plans for the Castlepoint

Permit. The current work program requires the Company to drill an

exploration well by May 23, 2014, but the Company expects NZPAM to

grant a six-month extension to this deadline. The Company has

identified its preferred drill location and has initiated the

community engagement and technical assessments required to obtain

land access and resource consents.

The current work program for the Wairoa Permit requires the

Company to drill an exploration well by July 2, 2014, but the

Company has applied to NZPAM for a six-month extension to this

deadline. The Company has identified the preferred drill location

and has initiated the community engagement and technical

assessments required to obtain land access and resource

consents.

The Company anticipates completing fieldwork and geochemical

studies on the East Cape Permit in 2014.

SUMMARY OF QUARTERLY RESULTS

|

|

2013-Q4 $ |

|

2013-Q3 $ |

|

2013-Q2 $ |

|

2013-Q1 $ |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

116,782,687 |

|

105,313,813 |

|

127,318,182 |

|

129,545,992 |

|

|

Exploration and evaluation assets |

51,500,037 |

|

55,859,632 |

|

52,357,470 |

|

49,610,922 |

|

|

Property, plant and equipment |

49,169,997 |

|

26,621,043 |

|

26,135,651 |

|

25,793,089 |

|

|

Working capital |

6,878,152 |

|

4,748,797 |

|

9,517,742 |

|

17,533,636 |

|

|

Revenues |

4,108,911 |

|

1,519,010 |

|

2,109,700 |

|

2,925,258 |

|

|

Accumulated deficit |

(35,099,834 |

) |

(27,292,947 |

) |

(24,616,053 |

) |

(22,386,089 |

) |

|

Total comprehensive income (loss) |

(5,963,723 |

) |

1,347,788 |

|

(6,000,775 |

) |

1,313,397 |

|

|

Basic (loss) earnings per share |

(0.06 |

) |

(0.02 |

) |

(0.02 |

) |

(0.02 |

) |

|

Diluted (loss) earnings per share |

(0.06 |

) |

(0.02 |

) |

(0.02 |

) |

(0.02 |

) |

|

|

|

|

2012-Q4 $ |

|

2012-Q3 $ |

|

2012-Q2 $ |

|

2012-Q1 $ |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

116,059,939 |

|

98,882,087 |

|

98,814,102 |

|

96,979,923 |

|

|

Exploration and evaluation assets |

37,379,726 |

|

26,377,188 |

|

25,373,718 |

|

12,103,712 |

|

|

Property, plant and equipment |

23,867,758 |

|

16,293,123 |

|

8,674,152 |

|

8,150,802 |

|

|

Working capital |

28,293,845 |

|

45,204,695 |

|

53,844,035 |

|

70,401,191 |

|

|

Revenues |

2,948,041 |

|

3,708,254 |

|

5,910,993 |

|

3,908,683 |

|

|

Accumulated deficit |

(19,992,243 |

) |

(17,804,045 |

) |

(15,613,594 |

) |

(16,548,180 |

) |

|

Total comprehensive income (loss) |

(1,333,805 |

) |

(2,018,634 |

) |

1,317,915 |

|

799,032 |

|

|

Basic (loss) earnings per share |

(0.02 |

) |

(0.02 |

) |

0.01 |

|

0.00 |

|

|

Diluted (loss) earnings per share |

(0.02 |

) |

(0.02 |

) |

0.01 |

|

0.00 |

|

RESULTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2013

Revenue

During the year ended December 31, 2013, the Company produced

77,484 (2012: 162,444) bbl and sold 77,820 (2012: 162,077) bbl for

total oil sales of $8,489,319 (2012: $17,295,853), or $109.09

(2012: $106.71) per bbl. Total recorded gross production revenue

was $8,023,973 (2012: $16,475,971), which accounted for royalties

of $465,346 (2012: $819,882), or $5.98 (2012: $5.06) per bbl

sold.

During the year ended December 31, 2013, the Company recorded

sales from purchased oil of $664,168 (2012: $nil) and purchased

condensate of $1,506,068 (2012: $nil). The Company also received

$468,671 (2012: $nil) of processing revenue from the Company's

interest in the Waihapa Production Station.

Total recorded revenue during the year ended December 31, 2013

was $10,662,879 (2012: $2,948,042), which is accounted for net of

royalties of $465,347 (2012: $161,164).

Expenses and Other Items

Production costs during the year ended December 31,

2013 totalled $4,570,294 (2012: $5,116,059), or $58.73 (2012:

$31.57) per bbl sold. Included in total production costs are all

site-related expenditures, including applicable equipment rental

fees, site services, overheads and labour; transportation and

storage costs including trucking, testing, tank storage, processing

and handling; and port dues as incurred prior to the sale of oil.

Other costs of $2,170,236 relate to purchased oil and condensates

which were on-sold by the Company to a third party. The Company

continues to see the positive effect on production costs from

installation of surface facilities as reflected in reduced

production costs related to the Copper Moki site since June

2013.

Depreciation costs incurred during the year ended

December 31, 2013 totalled $3,193,785 (2012: $4,103,405), or $41.04

(2012: $25.32) per bbl sold. Depreciation is calculated using the

unit-of-production method by reference to the ratio of production

in the period to the related total proved and probable reserves of

oil and natural gas, taking into account estimated future

development costs necessary to access those reserves. The increase

in per bbl depreciation during the period ended December 31, 2013

is reflective of the additional wells (and therefore additional

development costs associated with such wells) that achieved

commercial production since Q3-2012.

Stock-based compensation for the year ended December

31, 2013 totalled $685,257 compared to $1,594,780 during the same

period in 2012. The decrease in stock-based compensation

corresponds to fewer stock options granted and the reversal of

stock-based compensation related to employees who left the Company

during the period.

General and administrative expenses for the year ended

December 31, 2013 totalled $7,197,024 compared to $5,896,949

incurred in the same period in fiscal 2012. The increase in general

and administrative costs corresponds to salary increases related to

new employees, as the Company prepared for the expansion of

operations following the TWN Acquisition.

Transaction costs for the year ended December 31, 2013

totalled $1,823,243 compared to $1,161,657 incurred in the same

period in fiscal 2012. The transaction costs incurred during the

period include legal and professional fees incurred in relation to

the TWN Acquisition.

Net finance expense for the year ended December 31,

2013 totalled $97,598 compared to net finance income of $211,551 in

the same period in fiscal 2012. Finance expense relates to interest

payable on the Company's operating line of credit, and accretion of

the Company's asset retirement obligations, presented net of

interest earned on the Company's cash and cash-equivalent balances

held in treasury and on term deposits.

Foreign exchange loss for the year ended December 31,

2013 amounted to $452,176 compared to a $1,895,845 loss realized in

the same period of fiscal 2012. The decrease in foreign exchange

gain loss is a result of the weakening of the New Zealand dollar

against the US dollar, during a period in which the Company's

subsidiaries (which have a New Zealand dollar functional currency)

held US dollar denominated working capital in anticipation of

closing the TWN Acquisition.

Impairment - During the year, the Company made the

decision to focus its East Coast exploration efforts on the Wairoa,

Castlepoint and East Cape permits and relinquished the Ranui

Permit. As a result, the Company wrote off $6,708,960 of

exploration and evaluation assets previously capitalized to the

permit. An additional $275,484 was written down to determine the

fair value of the land and building held for sale.

Total Comprehensive Loss

Total comprehensive loss for the year ended December 31, 2013

totalled $9,303,312 after taking into account a gain on the

exchange difference on translation of foreign currency of

$5,804,279 which compared to total comprehensive loss for the year

ended December 31, 2012 of $1,235,492.

Based on a weighted average shares outstanding balance of

127,319,719, the Company realized a $0.12 basic and diluted loss

per share for the year ended December 31, 2013. During the year

ended December 31, 2012, based on a weighted average shares

outstanding balance of 117,131,297 the Company realized a $0.03

basic and diluted loss per share.

NEW STOCK OPTIONS

NZEC has issued a total of 800,000 incentive stock options to an

officer and a consultant of the Company. The options expire five

years from the date of grant and vest at a rate of 25% every six

months for a 24-month period. The options will have an exercise

price of $0.45 per share.

On behalf of the Board of Directors

John Proust, Chief Executive Officer & Director

About New Zealand Energy Corp.

NZEC is an oil and natural gas company engaged in the

production, development and exploration of petroleum and natural

gas assets in New Zealand. NZEC's property portfolio collectively

covers approximately 1.91 million acres of conventional and

unconventional prospects in the Taranaki Basin and East Coast Basin

of New Zealand's North Island. The Company's management team has

extensive experience exploring and developing oil and natural gas

fields in New Zealand and Canada, and takes a multi-disciplinary

approach to value creation with a track record of successful

discoveries. NZEC plans to add shareholder value by executing a

technically disciplined exploration and development program focused

on the onshore and offshore oil and natural gas resources in the

politically and fiscally stable country of New Zealand. NZEC is

listed on the TSX Venture Exchange under the symbol NZ and on the

OTCQX International under the symbol NZERF. More information is

available at www.newzealandenergy.com or by emailing

info@newzealandenergy.com.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as such term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

FORWARD-LOOKING INFORMATION

This document contains certain forward-looking information

and forward-looking statements within the meaning of applicable

securities legislation (collectively "forward-looking statements").

The use of the word "expectation", "will", "expect", "continue",

"continuing", "could", "should", "further", "pending",

"anticipates", "offers", "intend", "objective", "become",

"potential", "pursue", "look forward", "increasing" and similar

expressions are intended to identify forward-looking statements.

These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements including, without limitation, the speculative nature of

exploration, appraisal and development of oil and natural gas

properties; uncertainties associated with estimating oil and

natural gas reserves and resources; uncertainties in both daily and

long-term production rates and resulting cash flow; volatility in

market prices for oil and natural gas; changes in the cost of

operations, including costs of extracting and delivering oil and

natural gas to market, that affect potential profitability of oil

and natural gas exploration and production; the need to obtain

various approvals before exploring and producing oil and natural

gas resources; exploration hazards and risks inherent in oil and

natural gas exploration; operating hazards and risks inherent in

oil and natural gas operations; the Company's ability to generate

sufficient cash flow from production to fund future development

activities; market conditions that prevent the Company from raising

the funds necessary for exploration and development on acceptable

terms or at all; global financial market events that cause

significant volatility in commodity prices; unexpected costs or

liabilities for environmental matters; competition for, among other

things, capital, acquisitions of resources, skilled personnel, and

access to equipment and services required for exploration,

development and production; changes in exchange rates, laws of New

Zealand or laws of Canada affecting foreign trade, taxation and

investment; failure to realize the anticipated benefits of

acquisitions; and other factors as disclosed in documents released

by NZEC as part of its continuous disclosure obligations.

Such forward-looking statements should not be unduly relied

upon. The Company believes the expectations reflected in those

forward-looking statements are reasonable, but no assurance can be

given that these expectations will prove to be correct. Actual

results could differ materially from those anticipated in these

forward-looking statements. The forward-looking statements

contained in the document are expressly qualified by this

cautionary statement. These statements speak only as of the date of

this document and the Company does not undertake to update any

forward-looking statements that are contained in this document,

except in accordance with applicable securities laws.

CAUTIONARY NOTE REGARDING RESERVE ESTIMATES

The oil and gas reserves calculations and income projections

were estimated in accordance with the Canadian Oil and Gas

Evaluation Handbook ("COGEH") and National Instrument 51-101 ("NI

51-101"). The term barrels of oil equivalent ("boe") may be

misleading, particularly if used in isolation. A boe conversion

ratio of six Mcf: one bbl was used by NZEC. This conversion ratio

is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead. Reserves are estimated remaining

quantities of oil and natural gas and related substances

anticipated to be recoverable from known accumulations, as of a

given date, based on: the analysis of drilling, geological,

geophysical, and engineering data; the use of established

technology; and specified economic conditions, which are generally

accepted as being reasonable. Reserves are classified according to

the degree of certainty associated with the estimates. Proved

Reserves are those reserves that can be estimated with a high

degree of certainty to be recoverable. It is likely that the actual

remaining quantities recovered will exceed the estimated proved

reserves. Probable Reserves are those additional reserves that are

less certain to be recovered than proved reserves. It is equally

likely that the actual remaining quantities recovered will be

greater or less than the sum of the estimated proved plus probable

reserves. Revenue projections presented are based in part on

forecasts of market prices, current exchange rates, inflation,

market demand and government policy which are subject to

uncertainties and may in future differ materially from the

forecasts above. Present values of future net revenues do not

necessarily represent the fair market value of the reserves

evaluated. The report also contains forward-looking statements

including expectations of future production and capital

expenditures. Information concerning reserves may also be deemed to

be forward looking as estimates imply that the reserves described

can be profitably produced in the future. These statements are

based on current expectations that involve a number of risks and

uncertainties, which could cause the actual results to differ from

those anticipated.

New Zealand Energy Corp.John ProustChief Executive Officer &

DirectorNorth American toll-free: 1-855-630-8997New Zealand Energy

Corp.Rhylin BailieVice President Communications & Investor

RelationsNorth American toll-free:

1-855-630-8997info@newzealandenergy.comwww.newzealandenergy.com

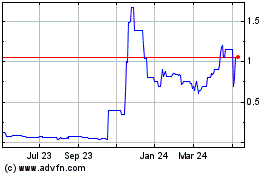

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

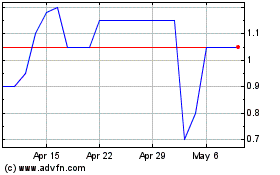

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Nov 2023 to Nov 2024