NuLegacy Gold Corporation provides guidance on its 2022 corporate

objectives and exploration plans for its 100% controlled 108 sq.

km. Red Hill property located in the Cortez gold trend of

north-central Nevada. To view this news release with its graphics

displayed please link to:

https://nulegacygold.com/news/news-releases/nulegacy-gold-provides-guidance-for-2022-programs/

Highlights:

- After an extended period of review

NuLegacy is planning:

- An initial 6 (of a possible 12)

hole reverse circulation with core-tail drilling program totaling

approximately 12,000 ft. (3,700 meters for the first 6 holes) to

test newly defined targets within favorable host rock in the

Mid-Rift corridor between the Western Rift (focus of 2020-21

drilling) and the Serena/North and Central Iceberg corridor (see

map below and linked).

- An additional 5 holes into the

Western Rift to follow up on the widely spaced 11-hole 2020-21

drill program which encountered significant intervals of

Carlin-style alteration, trace element geochemistry and important

intercepts of anomalous gold in favorable host rocks and structural

settings. This data is interpreted as the margin of a robust

Carlin-type gold system, or systems.

- With gold approaching

US$2,000/ounce, 5 to 7 infill RC drill holes in the Serena/North

zones to further evaluate a possible gold resource in the Iceberg

corridor by drilling the ~ 430-meter gap between hole SR (Serena)

18-02 (16.9 grams gold over 8.7 meters) and WS (Western Slope)

19-02 (9.6 grams gold over 5.1 meters). (See news releases – Aug.

27/18 and Feb. 18/20).

- A leaner, focused exploration and

corporate management team.

- A modest cash position to commence

exploration and evaluate potential strategic alternatives.

2022 Summer Drill Program: Over the fall and

winter, our exploration team worked diligently to complete a full

review of NuLegacy’s exploration and drill results from the past 12

years, including re-logging of 150,000+ feet of core and RC drill

chips, analyzing countless assays and multi-element geochemistry

results and reviewing and re-mapping of key geological structures

and formations to update and refine the exploration model and

vector the drill plans towards the most prospective target zones

within our district scale 108 sq. km. Red Hill property.

https://nulegacygold.com/site/assets/files/6936/nulegacyredhill_drillplanmap_2022.png

Mid-Rift: As highlighted above, the geo-team has

identified key high priority drill targets in the area between the

Western Rift zones and the previously discovered Serena, North and

Central Iceberg zones (Iceberg corridor) and submitted permit

applications for these targets as well as new road

construction.

Cretaceous diorite intrusive bodies occur as

approximate north-northwest oriented dikes coincident within the

Iceberg corridor’s South, Central and North zones (associated

metamorphic alteration likely is enhancing host rock favorability).

One dike trend roughly follows the Iceberg fault, and another is

evidenced about 200 meters to the west.

The newly identified NNW trending fault zone

within the Mid-Rift targets is supported by air photo linears and

mapping data and is coincident with a change in CSAMT

characteristics of the Miocene basalt flows (western edge of

stronger alteration) – the same fault zone probably had high fluid

flow in the Eocene, and likely produced the Carlin-type

mineralization below.

The planned 2022 holes will be considerably

shallower (and much less expensive) than the deep 2,500 to

4,000-foot core holes drilled in 2021.

Charles Weakly said, “Much of the Carlin-style

alteration, structure and pathfinder element geochemistry we are

seeing in our exploratory drilling is consistent with what is seen

in holes just outside the deposits at Goldrush/4-Mile.” I

Western Rift: While the 11-hole 2020-21 program

failed to discover significant amounts of gold mineralization, all

that deep drilling provided NuLegacy’s geo-team with excellent data

instrumental to their understanding of key geological structures,

trends and zones of Carlin-style alteration and multi-element

traces for defining the 2022 drill targets.

This data, along with Colog, core logging, and

cross section work, points to a series of uplifted and down-dropped

blocks in the Paleozoic section caused by a swarm of west dipping

low angle faults that are favorably laden with deep tapping

lamprophyre type dikes.

Dr. Roger Steininger, NuLegacy Director,

Exploration, says, “We have the Central-mineralized zone type low

angle faults and have found numerous en-echelon faults like it, and

are now seeking steep Iceberg-type cross-faults (on echelon to the

west of the Iceberg fault) intersecting them to locate a possible

gold deposit in the Mid-Rift and Western Rift.”

Iceberg Corridor: With gold prices approaching

US$ 2,000/ounce we intend to complete 5 to 7 infill RC drill holes

in the Serena/North zones to further evaluate the potential for a

gold resource in the Iceberg corridor.

The Iceberg gold bearing corridor (deposit) is

approximately 3 km long and several hundred meters wide. Drilling

has defined three centers of gold concentrations (North, Central,

and South zones) with limited drilling between the higher-grade

intervals in the Serena and Western Slope zones just to the

west.

Much of the mineralization in the Iceberg

deposit is near surface and oxidized. Construction of cross

sections is in progress to determine the potential quantity of gold

mineralization in the deposit(s).

Drilling: More complete presentations on the

prospective targets will be provided as we prepare to drill them.

We are actively negotiating contract arrangements for drill rigs

and road construction for a planned start of our initial 2022 drill

program in late May-early June as final permits are received.

Leaner Exploration and Corporate Finance Team:

Over the fall and winter of 2021, the Company reduced its

exploration team from seven members (whilst drilling with 4 rigs at

Red Hill in summer 2021) to three key members required to review

and refine NuLegacy’s drilling model and exploration plans for

2022. Charles Weakly, NuLegacy’s Exploration Manager, continues to

lead our exploration team and remains fully focused and excited by

the Red Hill’s prospect for hosting a significant Carlin-style gold

deposit.

NuLegacy also reduced its corporate management

and associated “overheads” by approximately 40% and marketing

budget by close to 80% over the past 24 months to conserve cash and

is now undertaking certain strategic corporate hires and

re-introducing a modest marketing budget as we gear up for the 2022

summer drilling and exploration program. We also plan to supplement

the exploration team as necessary to ensure its ability to carry

out the 2022 summer-fall drill program and process results in an

effective and timely manner.

NuLegacy also announces that Mr. Edward Cope has

stepped down as a director of the Company for personal reasons. The

board of directors of NuLegacy expresses its sincere gratitude and

thanks to Ed for his faithful commitment and services during the

past five years, and Albert Matter, NuLegacy’s CEO, adds his

“appreciation for Ed’s sound guidance and the quality of people he

helped to attract to NuLegacy over the past five years. We wish him

all the best in his retirement.”

NuLegacy’s board of directors now consists of

four directors, Albert Matter, Alex Davidson, Roger Steininger and

John Budreski, and the Company plans to continue with this leaner

corporate structure for the foreseeable future.

Corporate Objectives: NuLegacy currently has a

modest cash position of C$5 million to commence its initial 2022

drill program and carry out corporate operations. Our immediate

focus is to finalize drill targets, engage contractors and complete

permitting with a view to commencing the 2022 exploration program

in late May or early June while preparing to augment the treasury

when appropriate.

After 12 years and ~ $50 million spent exploring

the Red Hill property, management is acutely aware of the

challenges facing a junior exploration company searching for

elephant sized Carlin-style gold deposits. The directors and

corporate management of NuLegacy are encouraged that the geo-team’s

work continues to support the Red Hill’s potential for hosting a

significant deposit. The highly concentrated, narrow footprints

associated with these large-ounce high-grade Carlin-style gold

deposits in the Cortez and Carlin trends of Nevada illustrate the

elusive nature of these “elephants”, as evidenced by the fact all

seven of the largest multi-million ounce deposits1 in the Carlin

and Cortez trends are owned by majors (Barrick and Newmont).

As part of NuLegacy’s corporate objectives,

management and the board of directors intend to explore alternative

corporate and strategic initiatives for financing the continued

exploration of the Red Hill property. This includes a possible

merger and/or buy-out by a Nevada focused mid-tier gold producer

and/or exploration company with the necessary funding capabilities

and additional expertise to carry out the continued exploration and

drilling necessary to fully explore the Red Hill property’s

potential for hosting a large Carlin-style gold deposit.

Stock Options: NuLegacy has granted stock

options to certain key directors and officers to purchase up to an

aggregate of 1,075,000 common shares exercisable for a period of

five years at a price of $0.05 per share, subject to certain

vesting requirements.

On trend: NuLegacy Gold is

focused on confirming potential high-grade Carlin-style gold

deposits within its flagship 108 sq. km (42 sq. mile) district

scale Red Hill Property in the Cortez gold trend of Nevada. The

Rift Anticline target is located on trend and adjacentI to three,

multi-million ounce Carlin-type gold deposits (the Pipeline, Cortez

Hills and Goldrush deposits) which are ranked amongst the world’s

thirty largest, lowest cost and politically safest gold mines and

are three of Nevada Gold Mines’ most profitable mines.II

1 All seven are amongst the world's thirty

largest gold mines.

I The similarity and proximity

of these deposits in the Cortez Trend including Goldrush are not

necessarily indicative of the gold mineralization in NuLegacy’s Red

Hill Property.

II As extracted from Barrick’s

Q4-2013 and Q1-2014 reports. As reported by Barrick, the Goldrush

resource contains 8,557,000 indicated ounces of gold within 25.78

million tonnes grading ~10.57 g/t and 1,650,000 inferred ounces

within 5.6 million tonnes grading ~9.0 g/t.

Dr. Roger Steininger, a Director of NuLegacy, is

a Certified Professional Geologist (CPG 7417) and the qualified

person as defined by NI 43-101, Standards of Disclosure for Mineral

Projects, responsible for approving the scientific and technical

information contained in this news release.

On Behalf of the Board of NuLegacy Gold

Corporation,

Albert Matter, Chief Executive Officer &

Founding DirectorTel: +1 (604) 639-3640; Email:

albert@nuggold.com

For more information about NuLegacy visit:

www.nulegacygold.com or www.sedar.com.

Cautionary Statement on Forward-Looking

Information: This news release contains forward-looking

information and statements under applicable securities laws, which

information and/or statements relate to future events or future

performance (including, but not limited to, the prospective nature

of the Red Hill Property and its potential to host a significant

Carlin-style gold deposit; the current modeling and proposed 2022

exploration and drill program for the Red Hill Property including

potential locations and number of drill sites/ targets, the nature

and type of drilling, number of holes, total meters, and the timing

and costs thereof; the existence of potential mineral resources;

and potential strategic alternatives to support future exploration

including the possible merger and/or buy out by a strategic

mid-tier gold producer or otherwise) and reflect management’s

current expectations and beliefs based on assumptions made by and

information currently available to the Company. Readers are

cautioned that such forward-looking information and statements are

neither promises nor guarantees, and are subject to risks and

uncertainties that may cause future results to differ materially

from those expected including, but not limited to, actual results

of exploration activities, unanticipated geological, stratigraphic

and structural formations, environmental risks, operating risks,

accidents, labor issues, delays in obtaining governmental approvals

and permits, delays in receipt of assay results from third party

laboratories, the availability of financing, market conditions,

inflation, future prices for gold, changes in personnel and other

risks in the mining industry. There are no known mineral resources

or reserves in the Red Hill Property, any proposed exploration

programs are exploratory searches for bodies of ore and the

presence of gold resources on properties adjacent or near the Red

Hill Property including Goldrush is not necessarily indicative of

the gold mineralization on the Red Hill Property. In addition, as

of the date hereof, the Company has not entered into an

understanding or arrangement with any potential strategic partner

for the continued exploration of the Red Hill Property, whether by

way of merger, buy-out or otherwise, and there are no assurances

that the Company will in fact pursue such an arrangement or

successfully complete same on commercially satisfactory terms or at

all. There is also uncertainty about the continued spread of

COVID-19 and the current war in Ukraine and the impact they will

have on the NuLegacy’s operations, personnel, supply chains,

ability to access properties or procure exploration equipment,

contractors and other personnel on a timely basis or at all and

economic activity in general. All the forward-looking information

and statements made in this news release are qualified by these

cautionary statements and those in our continuous disclosure

filings available on SEDAR at www.sedar.com. The forward-looking

information and statements in this news release are made as of the

date hereof and the Company does not assume any obligation to

update or revise them to reflect new events or circumstances save

as required by applicable law. Accordingly, readers should not

place undue reliance on forward-looking information and

statements.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

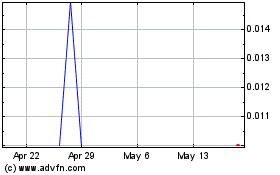

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Jan 2025 to Feb 2025

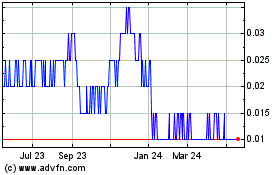

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Feb 2024 to Feb 2025