NowVertical Group Inc. (TSXV: NOW) (OTCQB: NOWVF)

(“

NOW” or the “

Company”), is

pleased to announce that NOW and Mostafa Hashem, NOW’s EVP Product

& Technology have agreed to amend the outstanding earnout

obligations governing NOW’s acquisition of Smartlytics Consultancy

Limited (“

Smartlytics”). In connection with the

amendment, the incentives that Mr. Hashem would have received as a

former owner of Smartlytics have been adjusted with the objective

of rewarding Mr. Hashem for building an integrated product group

that encompasses all of NOW’s existing software assets; whereas the

former earn-out provisions were based on performance of the

Smartlytics business unit only. Mr. Hashem was promoted to the EVP

Product & Technology role in early 2024.

“With the amendment of the purchase agreement,

we're shifting focus to commercializing NOW's software suite and

capitalizing on cross-selling opportunities across our NA, EMEA,

and LATAM markets. Mr. Hashem's commercial acumen and success in

generating revenue streams by combining NOW's software with

services for tangible business outcomes are commendable. This marks

a major step towards deeper integration within our business, with

NVG software playing a crucial role in expanding our footprint

within strategic accounts," remarked Sandeep Mendiratta, NOW's

CEO.

Transaction Details

In executing its integration strategy, the

Company has amended the share purchase agreement dated December 10,

2022, that governed the acquisition of Smartlytics, restructuring

its ongoing obligations with Mr. Hashem as follows:

- the future earn-out payments for

years 2024 and 2025 will be settled through a payment by the

Company tied to the EBITDA of NOW’s product group payable to Mr.

Hashem equally in cash and through the issuance of Class A

subordinate voting shares in the capital of NOW, subject to TSX

Venture Exchange approval prior to the time of each issuance;

and

- the deferral of the payment of the

previously due holdback amount of $100,000.

Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Related Party

Transactions

Mostafa Hashem is the EVP Product &

Technology of the Company (the “Related Party”).

As a result, the entering into of the Deed and certain of the

transactions contemplated thereby are considered to be “related

party transaction”, subject to Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). Notwithstanding the foregoing, the

Company is exempt from the formal valuation requirement per

sections 5.5(a) and 5.5(b) of MI 61-101, as neither the fair market

value of the subject matter of the transactions, nor the fair

market value of the consideration for the transactions, insofar as

it involves interested parties, exceeds 25% percent of the

Company’s market capitalization and Company is not listed on any of

the exchanges specified in Section 5.5(b) of MI 61-101, and the

Company confirms that it has not obtained any valuations relevant

to the transactions in the 24 months preceding entering into the

Deed. In addition, the Company is exempt from the requirement to

obtain minority shareholder approval per section 5.7(1)(a) of MI

61-101, as neither the fair market value of the subject matter of,

nor the fair market value of the consideration for, the

transaction, insofar as it involves interested parties, exceeds 25%

percent of the Company’s market capitalization.

The terms of the Deed were settled through arm’s

length negotiations between independent representatives of the

Company and the Related Party, with each party separately

represented by legal counsel. The entering into of the Deed and the

transactions contemplated thereby was considered and unanimously

approved by the Company’s board of directors, having regard to,

among other things, the impact of the transactions on the Company’s

balance sheet, liquidity and overall stability.

The Company did not file a material change

report 21 days in advance of implementing the transactions as the

negotiations were only recently concluded.

About NowVertical Group

Inc.

NowVertical Group is a Vertical Intelligence

(VI) software and services provider that delivers

vertically-specific data, technology, and artificial intelligence

(AI) applications to industry and governments through its global

platform. NOW's proprietary solutions sit at the foundation of the

modern enterprise by transforming AI investments into VI, enabling

its customers to minimize their risk, accelerate the time to value,

and reduce costs. NOW is rapidly growing organically and through

targeted acquisitions. For more information about NOW, visit

www.nowvertical.com.

Neither the TSXV nor its Regulation Services Provider (as that

term is defined in the policies of the TSXV) accepts responsibility

for the adequacy or accuracy of this release.For further

information, please contact:

Andre Garber, Chief Development OfficerIR@nowvertical.com

Glen Nelson, Investor Relations and Communicationse:

glen.nelson@nowvertical.com t: (403) 763-9797Non-IFRS

Measures

This news release refers to certain

non-international financial reporting standards

(“IFRS”) measures, including “EBITDA”. For the

purposes of this news release, EBITDA is defined as the

consolidated earnings before interest, taxes, depreciation and

amortization. These measures are not recognized measures under

IFRS, do not have a standardized meaning prescribed by IFRS and are

therefore unlikely to be comparable to similar measures presented

by other companies. Rather, these measures are provided as

additional information to complement those IFRS measures by

providing further understanding of the Company’s results of

operations from management’s perspective. The Company’s definitions

of non-IFRS measures used in this news release may not be the same

as the definitions for such measures used by other companies in

their reporting. Non-IFRS measures have limitations as analytical

tools and should not be considered in isolation nor as a substitute

for analysis of the Company’s financial information reported under

IFRS. These non-IFRS measures are used to provide investors with

supplemental measures of our operating performance and to eliminate

items that have less bearing on our operational performance or

operating conditions and thus highlight trends in our core business

that may not otherwise be apparent when relying solely on IFRS

measures. The Company believes that securities analysts, investors

and other interested parties frequently use non-IFRS financial

measures in the evaluation of issuers. The Company’s management

also uses non-IFRS financial measures to facilitate operating

performance comparisons from period to period and prepare annual

budgets and forecasts.Forward Looking

Statements

This news release contains forward-looking

information and forward-looking statements within the meaning of

applicable Canadian securities laws (together

“forward-looking statements”), including, without

limitation regarding the settlement of obligations owing to Mr.

Hashem, the form and amount of future payments to be made by the

Company, the number of Class A subordinate voting shares issuable

and the price at which such shares will be issuable, the payment of

the Future Earn-Outs, the alignment of management and the business

unit leaders, the approval of the TSXV and the ability and timing

of certain payments by the Company. Forward-looking statements are

necessarily based upon a number of estimates and assumptions that,

while considered reasonable by management, are inherently subject

to significant business, economic and competitive uncertainties,

and contingencies. Investors are cautioned that forward-looking

statements are not based on historical facts but instead reflect

the Company’s expectations, estimates or projections concerning

future results or events based on the opinions, assumptions and

estimates of management considered reasonable at the date the

statements are made. Forward-looking statements generally can

be identified by the use of forward-looking words such as “may”,

“should”, “will”, “could”, “intend”, “estimate”, “plan”,

“anticipate”, “expect”, “believe” or “continue”, or the negative

thereof or similar variations. Forward-looking statements involve

known and unknown risks, uncertainties and other factors that may

cause future results, performance, or achievements to be materially

different from the estimated future results, performance or

achievements expressed or implied by the forward-looking statements

and the forward-looking statements are not guarantees of future

performance. Although the Company believes that the expectations

reflected in such forward-looking statements are reasonable, such

statements involve risks and uncertainties, and undue reliance

should not be placed thereon, as unknown or unpredictable factors

could have material adverse effects on future results, performance

or achievements of the Company. Among the key factors that could

cause actual results to differ materially from those projected in

the forward-looking statements are the following: direct and

indirect material adverse effects from the COVID-19 pandemic;

timing and receipt of regulatory approvals, adverse market

conditions; risks inherent in the data analytics and artificial

intelligence sectors in general; regulatory and legislative

changes; that future results may vary from historical results;

inability to obtain any requisite future financing on suitable

terms; any inability to realize the expected benefits and synergies

of acquisitions; that market competition may affect the business,

results and financial condition of the Company and other risk

factors identified in documents filed by the Company under its

profile at www.sedarplus.ca, including the Company’s managements’

discussion and analysis for the year ended December 31, 2022 dated

April 28, 2023 and the prospectus supplement (including all

documents incorporated by reference therein) dated February 22,

2023. Should one or more of these risks or uncertainties

materialize, or should assumptions underlying the forward-looking

statements prove incorrect, actual results may vary materially from

those described herein as intended, planned, anticipated, believed,

estimated or expected. Although the Company has attempted to

identify important risks, uncertainties and factors which could

cause actual results to differ materially, there may be others that

cause results not to be as anticipated, estimated or intended and

such changes could be material. All of the forward-looking

statement contained in this press release are qualified by the

foregoing cautionary statements, and there can be no guarantee that

the results or developments that we anticipate will be realized or,

even if substantially realized, that they will have the expected

consequences or effects on our business, financial condition or

results of operation. Unless otherwise noted or the context

otherwise indicates, the forward-looking statements contained

herein are provided as of the date hereof, and the Company does not

intend, and does not assume any obligation, to update the

forward-looking statements except as otherwise required by

applicable law. Investors are cautioned that trading in the

securities of the Company should be considered highly

speculative.

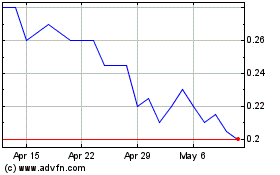

NowVertical (TSXV:NOW)

Historical Stock Chart

From Nov 2024 to Dec 2024

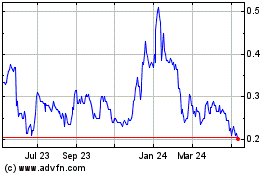

NowVertical (TSXV:NOW)

Historical Stock Chart

From Dec 2023 to Dec 2024