Newcore Gold Ltd. ("Newcore" or the "Company")

(TSX-V: NCAU, OTCQX: NCAUF) is pleased to announce positive results

from seven additional column tests completed as part of the

metallurgical testwork program underway at the Company’s 100%-owned

Enchi Gold Project ("Enchi" or the "Project") in Ghana. An average

gold recovery of 93.0% was achieved from column testwork completed

on five composite samples from the Sewum Gold Deposit ("Sewum") and

two composite samples from the Boin Gold Deposit ("Boin").

In addition to metallurgical testwork, further

exploration and development work is on-going at Enchi to continue

to de-risk the development of the Project and prove-out the

district scale exploration potential. This work includes a

10,000-metre reverse circulation drill program focused on resource

growth and infill drilling designed to improve the confidence level

of the existing Mineral Resource Estimate, drone surveys,

hydrogeological testing, condemnation drilling, geotechnical work,

environmental work, an airborne magnetic survey, trenching and soil

sampling.

Highlights from Column Test

Results

- Seven Column Tests

Completed, Average Gold Recovery of 93.0% Achieved.

- A total of seven column tests (five

from Sewum and two from Boin) returned an average gold recovery of

93.0%, with a recovery range of 82.6% to 97.2%.

- Testwork Further Defines

the Understanding of Recovery Parameters for Enchi.

- Testing completed on representative

samples of oxide mineralization from trenches taken from various

areas of the Boin and Sewum deposits, including areas not

previously included in column testwork.

- Samples had an overall average

assayed grade of 0.56 grams per tonne gold ("g/t Au"), with a range

of 0.32 g/t Au to 0.84 g/t Au.

- Testwork Continues to

Highlight Low Reagent Consumption.

- All samples showed modest cyanide

consumption with an average of 1.63 kilograms per tonne ("kg/t"),

with a 0.98 kg/t lime (hydrated) addition to maintain a pH above

10.5.

- Additional Metallurgical

Testwork Underway.

- Optimization work is planned on

both oxide and transition mineralization from the Sewum, Boin, and

Nyam gold deposits consisting of further tests on gold recoveries,

percolation rates, and reagent consumptions.

- Additional testing of sulphide

mineralization is in progress consisting of bottle rolls and column

tests, as well as additional testwork of rock properties such as

bond work indices.

Greg Smith, VP Exploration of Newcore stated,

"These additional column tests, completed on representative oxide

material from the two largest deposits on the Enchi Gold Project,

returned results that are consistent with prior testwork and

continue to confirm generally modest reagent consumption. The

testwork resulted in high recoveries for all seven composite

samples, with the results continuing to highlight the amenability

of Enchi to heap leach gold recovery and supporting the oxide

recovery assumptions used in the 2024 Preliminary Economic

Assessment study. Additional metallurgical testwork on oxide,

transitional and sulphide mineralization is underway as we continue

to de-risk and advance the development of the Enchi Gold

Project."

Metallurgical Testing

Summary

A total of seven composite samples, five from

Sewum and two from Boin, were submitted for column testwork to the

Intertek Lab located in Tarkwa, Ghana, approximately four hours by

paved road from the Enchi Gold Project. Material for the

metallurgical samples consisted of trench material collected for

metallurgical sampling. The samples were selected to represent the

two largest deposits on the Project, Sewum and Boin, and consisted

of blended oxide material with individual samples and composites

covering a range of gold grades. Composite grades closely compare

to the average grade of each of the deposits.

Recovery for the seven samples averaged 93.0%,

with a recovery range of 82.6% to 97.2%.

|

Table 1 – Column Tests Grade and Average

Recovery |

|

Sample |

Deposit |

Grade Au g/t |

Recovery Rate |

|

BnMetTr3 |

Boin |

0.60 |

95.66% |

|

BnMetTr4 |

Boin |

0.48 |

90.42% |

|

SwMetTr4 |

Sewum |

0.84 |

94.99% |

|

SwMetTr5 |

Sewum |

0.50 |

93.15% |

|

SwMetTr6 |

Sewum |

0.55 |

97.17% |

|

SwMetTr7 |

Sewum |

0.66 |

97.19% |

| SwMetTr8 |

Sewum |

0.32 |

82.57% |

|

|

Average |

0.56 |

93.02% |

Composites were prepared using multiple samples

from a previously selected trench interval with total individual

samples used for each composite as follows: BnMetTr3 (12 individual

samples), BnMetTr4 (17), SwMetTr4 (10), SwMetTr5 (10), SwMetTr6

(10), SwMetTr7 (12), and SwMetTr8 (9). Composites BNMetTr3,

BNMetTr4, SwMetTr4, SwMetTr5 and SwMetTr6 each weighed 60 kg;

composites SwMetTr7 and SwMetTr8 each weighed 100 kg. In all cases

45 kg of material was added to the column.

Composite samples were homogenized by mixing all

material from the individual samples and crushed to 70% passing

12.5 mm. Each composite sample was then split to provide

sub-samples weighing 4 kg each. Two samples were removed and again

split into a further four fractions of 2 kg for use in screening

and grading analysis, head sample analysis, and ten-day coarse

bottle roll leach tests.

Metallurgical Testing – Column

Tests

The primary goal of column tests is to simulate

the response to leaching of the sample with the emphasis on

establishing the gold dissolution characteristics (rate and

extent), reagent consumption, and the degree of slumping.

All samples showed amenability to heap leaching,

with recoveries averaging 93.0% after 90 to 120 days. A graph

showing the leach curve can be viewed at the following

link:https://newcoregold.com/site/assets/files/5885/2024_12-ncau-nr-met-graph.pdf

Seven 45 kg closed-cycle column leach tests were

conducted on the samples which were crushed to 12.5 mm. The test

charge was loaded into 150 mm-in-diameter by 1.5-metre-tall PVC

columns. 30 kg of the individual samples were agglomerated in a

rolling drum using Portland cement at a 10 kg/t addition rate and

then allowed to air dry for three days. After the samples had been

air dried, they were loaded into the columns with the columns

tilted at an angle to avoid compaction before being set upright.

The column was then allowed to sit for a day before the initial

level was taken to determine the slump.

The leaching parameters used in these column

leach tests included the addition of approximately 1.4 kg/t of lime

which was blended into each feed solution, and a cyanide

concentration of 1,000 ppm. The initial feed solution was prepared

by adding lime to tap water to obtain a solution pH above 10.5,

followed by the addition of one gram of sodium cyanide per litre of

solution with a solution application rate of 10L/h/m² for all

samples. The column testwork was conducted under a closed cycle for

90-120 days. All solution samples were assayed for gold and pH and

free sodium cyanide was analyzed and recorded. Leach residue was

thoroughly washed, dried, screened and analyzed for gold by fire

assay.

The samples showed low cyanide consumption

averaging 1.63 kg/t with a 0.98 kg/t lime (hydrated) addition to

maintain a pH above 10.5. The slumps were within acceptable

industry standards with an overall average of 7.09%. The sample

response to a percolation rate of 10L/m²/hr resulted in minimal

flooding. The percolation rate will continue to be studied and

optimized with further testwork.

|

Table 2 – Summary of Column Leach Tests |

|

Composite |

Leach Time |

Slump % |

Reagent Consumption kg/t |

|

NaCN |

Lime |

Cement |

|

BnMetTr3 |

120 days |

7.39% |

1.44 |

0.99 |

15 |

|

BnMetTr4 |

90 days |

8.01% |

0.59 |

0.89 |

15 |

|

SwMetTr4 |

90 days |

8.77% |

1.96 |

0.79 |

10 |

|

SwMetTr5 |

90 days |

4.86% |

1.88 |

0.50 |

10 |

|

SwMetTr6 |

90 days |

7.08% |

2.12 |

2.75 |

10 |

|

SwMetTr7 |

90 days |

6.10% |

1.89 |

0.66 |

10 |

| SwMetTr8 |

120 days |

7.40% |

1.52 |

0.30 |

10 |

|

|

Average |

7.09% |

1.63 |

0.98 |

11.4 |

The column leach test program has shown that the

gold in the samples tested is readily leachable and amenable to

heap leaching. The recoveries achieved are considered high and are

interpreted to indicate amenability to heap leaching. The particle

size distribution and size by size analysis performed on both the

head and residue after leach showed that the maximum gold recovery

occurred in the finer fractions as compared to the coarser size

fractions.

Screening and Grading Analysis of Head

Samples

A size analysis was done on each of the seven

composite samples. The samples were tested at eight screen sizes

and included analyses for percent mass.

The samples were assayed for gold which showed

that gold was present in all size fractions analysed. The

distribution shows relatively consistent gold grades for all size

fractions within average values in a range of 0.38 g/t Au to 1.02

g/t Au, averaging 0.59 g/t Au. Results include 4% to 56%, averaging

21.5%, passing 150 microns indicating that agglomeration is

warranted.

|

Table 3 – Size Analysis by Composite Sample |

|

Sieve |

BnMetTr3 |

BnMetTr4 |

SwMetTr4 |

SwMetTr5 |

SwMetTr6 |

SwMetTr7 |

SwMetTr8 |

|

%mass |

Aug/t |

%mass |

Aug/t |

%mass |

Aug/t |

%mass |

Aug/t |

%mass |

Aug/t |

%mass |

Aug/t |

%mass |

Aug/t |

|

+10.0mm |

0.98 |

0.09 |

1.50 |

0.17 |

8.2 |

3.50 |

9.4 |

0.48 |

41.4 |

0.69 |

18.0 |

0.18 |

43.7 |

0.37 |

|

+6.3mm |

8.23 |

1.02 |

8.90 |

1.62 |

8.9 |

2.18 |

12.9 |

0.51 |

17.7 |

0.77 |

9.5 |

0.78 |

13.1 |

0.29 |

|

+2.5mm |

25.1 |

0.72 |

15.5 |

1.02 |

29.5 |

1.15 |

31.4 |

0.51 |

19.7 |

0.53 |

18.7 |

0.74 |

11.9 |

0.52 |

|

+1.0mm |

14.5 |

0.55 |

8.89 |

0.71 |

23.8 |

0.99 |

22.3 |

0.33 |

9.0 |

0.24 |

11.4 |

0.69 |

6.3 |

0.29 |

|

+300µm |

10.7 |

0.63 |

6.70 |

0.81 |

18.2 |

0.38 |

15.1 |

0.24 |

6.3 |

0.24 |

10.4 |

0.64 |

6.5 |

0.27 |

|

+212µm |

1.93 |

0.39 |

1.49 |

0.53 |

2.5 |

0.32 |

2.1 |

0.24 |

1.1 |

0.30 |

2.4 |

0.57 |

1.9 |

0.55 |

|

+150µm |

2.11 |

0.47 |

1.41 |

0.38 |

1.9 |

0.37 |

1.6 |

0.17 |

0.9 |

0.24 |

2.0 |

0.75 |

1.9 |

0.44 |

|

-150µm |

36.4 |

0.35 |

55.6 |

0.17 |

6.9 |

0.51 |

5.2 |

0.28 |

4.0 |

0.19 |

27.7 |

0.95 |

14.7 |

0.24 |

Head Sample Analysis

Using the results of the sizing and grading

analysis, a head grade was calculated for each of the composite

samples. The results were then compared to the head grade assays

which were completed on the 50-gram subsamples. The results

compared well for six of the composites, with one sample within an

acceptable variance.

|

Table 4 – Grade Analysis by Composite Sample |

|

Gold Grade g/t |

BnMetTr3 |

BnMetTr4 |

SwMetTr4 |

SwMetTr5 |

SwMetTr6 |

SwMetTr7 |

SwMetTr8 |

Average |

|

Assayed Grade #1 |

0.60 |

0.49 |

0.85 |

0.50 |

0.52 |

0.68 |

0.29 |

0.56 |

|

Assayed Grade #2 |

0.60 |

0.47 |

0.83 |

0.50 |

0.57 |

0.64 |

0.35 |

0.57 |

|

Avg Assayed Grade |

0.60 |

0.48 |

0.84 |

0.50 |

0.55 |

0.66 |

0.32 |

0.56 |

|

Calculated |

0.56 |

0.53 |

1.18 |

0.40 |

0.58 |

0.68 |

0.35 |

0.61 |

Ten Day Coarse Bottle Roll

Leach

Simulated heap leach testing was conducted on

the composite samples using two-kilogram sub-samples which

underwent leaching for ten days. Batch dissolution tests (ten days,

intermittent rolling-bottle) were completed under excess leach

conditions (grind size – as received, 50% solids, leach time: ten

days, pH 10.5, NaCN (sodium cyanide) addition 1 gram/litre). The

final residue was dried, weighed, and assayed for gold. In 24-hour

leaching periods, solution assays were taken and analyzed, and

reagent consumption (cyanide and lime) was calculated. Recoveries

after ten days averaged 62.1% in a range of 30.0% to 82.8%. In all

cases, gold dissolution was continuing at the end of the ten-day

period with ultimate recoveries expected to continue to increase

with additional leaching time.

Screening and Grading Analysis of Tails

Samples

A size analysis was done on all the tails from

the composite sample column tests. The samples were tested at eight

screen sizes including analyses for percent mass and assayed for

gold. The distribution shows consistently low grades of gold for

all size fractions, in line with the high gold recoveries in the

column tests, within a range of 0.00 g/t Au to 0.15 g/t Au with

only one outlier of 0.48 g/t Au. The calculated grades for the

tails ranged between 0.01 and 0.09 g/t Au averaging 0.04 g/t

Au.

Multi-Element Analyses

The seven composites were tested for 33 elements

using multi-acid digestion and analysed by Inductively Coupled

Plasma Optical Emission Spectrometry ("ICP"). The samples show very

similar profiles for all elements analysed. All samples contain no

silver with every result below the detection limit of 0.2 g/t

silver. All samples reported low values for lead, zinc, and copper

averaging 18, 23, and 70 ppm respectively and mildly elevated

arsenic averaging 422 ppm with no relationship to the gold grade.

All samples reported below detection for mercury and cadmium

(<0.2 ppm), and bismuth (<2 ppm). The oxide material had

elevated concentrations of iron (average 8.8%) and aluminum

(average 1.1%), both within a normal range.

Boin and Sewum Oxide Sample

Details

Composite samples for this release were sourced

from four trenches dug manually for metallurgical testwork on the

Enchi Gold Project. The locations of the trenches were selected in

order to allow for wide gold mineralized intercepts approximating

the average grade in each of the two largest deposits, Sewum and

Boin. Material exposed in the trenches is consider representative

of the oxide portion for both deposits. Samples were assigned a new

unique number and submitted to the Intertek Lab located in Tarkwa,

Ghana.

Mineralized intervals from the four trenches

which supplied the material for the results reported in this

release are below:

|

Table 5 – Enchi Gold Project Trenching Results

Highlights |

|

Hole ID |

Zone/Deposit |

From (m) |

To (m) |

Length (m) |

Au (g/t) |

|

KBTR_MET_002 |

Boin |

92.0 |

122.0 |

26.0 |

0.52 |

|

KBTR_MET_003 |

Boin |

56.0 |

86.0 |

30.0 |

1.13 |

|

SWTR_MET_002 |

Sewum |

0.0 |

112.0 |

112.0 |

0.59 |

| including |

|

20.0 |

40.0 |

20.0 |

1.05 |

|

and |

|

154.0 |

194.0 |

40.0 |

0.73 |

|

SWTR_MET_004 |

Sewum |

0.0 |

36.0 |

36.0 |

0.58 |

|

and |

|

46.0 |

66.0 |

20.0 |

0.56 |

|

Notes:1. Intervals reported are trench

lengths with true width estimated to be 75 - 85%;

and2. Length-weighted averages from uncut assays. |

Trench KBTR_MET_002 supplied the mineralized

material for sample BnMetTr3; Trench KBTR_MET_003 supplied the

mineralized material for sample BnMetTr4; Trench SWTR_MET_002

supplied the mineralized material for samples SwMetTr4, SwMetTr5,

SwMetTr6; Trench SWTR_MET_004 supplied the mineralized material for

samples SwMetTr7 and SwMetTr8.

2024 Enchi Work Program

A 10,000-metre RC drill program is underway at

Enchi, targeting near-surface oxide and shallow sulphide

mineralization with a primary goal of infill drilling for resource

conversion to improve the confidence level of the existing Mineral

Resource Estimate. Most of the infill drilling is allocated to the

two largest deposits at Enchi, Boin and Sewum. Improving the

confidence level of the Mineral Resource Estimate at Enchi is a key

component of the development work required to be completed in

advance of commissioning a Pre-Feasibility Study for the Project. A

subset of the drill program will also focus on outlining resource

growth, with all deposit areas and pre-resource targets at Enchi

remaining open along strike and at depth, providing for future

resource growth across the district-scale property.

Additional exploration and development work is

on-going at Enchi, including metallurgical testwork, drone surveys,

an airborne magnetic survey, trenching, hydrogeological testing,

condemnation drilling, geotechnical work, environmental work and

soil sampling. Drone topographic surveys are underway, expanding on

previously completed work, at the Kwakyekrom and Tokosea deposit

areas to provide detailed topographic information required to

improve the confidence level of each deposit’s Mineral Resource

Estimate. Additionally, the drone survey will be completed across

the proposed heap leach facility area to contribute additional data

for future detailed engineering studies. An airborne magnetic

survey will test grass roots targets related to a series of

gold-in-soil anomalies and gold mineralization identified in

trenching. Soil sampling is also currently being completed on the

Omanpe and Abotia licenses with a goal of further defining

early-stage targets across Enchi for future trenching and

drilling.

Enchi Gold Project Mineral Resource

Estimate

The Enchi Gold Project hosts an Indicated

Mineral Resource of 41.7 million tonnes grading 0.55 g/t Au

containing 743,500 ounces gold and an Inferred Mineral Resource of

46.6 million tonnes grading 0.65 g/t Au containing 972,000 ounces

(see Newcore news release dated March 7, 2023). Mineral resource

estimation practices are in accordance with CIM Estimation of

Mineral Resource and Mineral Reserve Best Practice Guidelines

(November 29, 2019) and follow CIM Definition Standards for Mineral

Resources and Mineral Reserves (May 10, 2014), that are

incorporated by reference into National Instrument 43-101 ("NI

43-101"). The Mineral Resource Estimate is from the technical

report titled "Mineral Resource Estimate for the Enchi Gold

Project" with an effective date of January 25, 2023, which was

prepared for Newcore by Todd McCracken, P. Geo, of BBA E&C Inc.

and Simon Meadows Smith, P. Geo, of SEMS Exploration Services Ltd.

in accordance with NI 43-101 - Standards of Disclosure for Mineral

Projects, and is available under the Company’s profile on SEDAR+ at

www.sedarplus.ca. Todd McCracken and Simon Meadows Smith are

independent qualified persons ("QP") as defined by NI 43-101.

Newcore Gold Best Practice

Newcore is committed to best practice standards

for all exploration, sampling and drilling activities. Drilling was

completed by an independent drilling firm using industry standard

RC and Diamond Drill equipment. Analytical quality assurance and

quality control procedures include the systematic insertion of

blanks, standards and duplicates into the sample strings. Samples

are placed in sealed bags and shipped directly to Intertek Labs

located in Tarkwa, Ghana for 50 gram gold fire assay.

Qualified Person

Mr. Gregory Smith, P. Geo, Vice President of

Exploration at Newcore, is a Qualified Person as defined by NI

43-101, and has reviewed and approved the technical data and

information contained in this news release. Mr. Smith has verified

the technical and scientific data disclosed herein and has

conducted appropriate verification on the underlying data including

confirmation of the drillhole data files against the original

drillhole logs and assay certificates.

About Newcore Gold Ltd.

Newcore Gold is advancing its Enchi Gold Project

located in Ghana, Africa’s largest gold producer¹. Newcore Gold

offers investors a unique combination of top-tier leadership, who

are aligned with shareholders through their 18% equity ownership,

and prime district scale exploration opportunities. Enchi’s 248

km² land package covers 40 kilometres of Ghana’s prolific

Bibiani Shear Zone, a gold belt which hosts several

multi-million-ounce gold deposits, including the Chirano mine 50

kilometres to the north. Newcore’s vision is to build a responsive,

creative and powerful gold enterprise that maximizes returns for

shareholders.¹ Source: Production volumes for 2023 as sourced from

the World Gold Council.

On Behalf of the Board of Directors of

Newcore Gold Ltd.

Luke AlexanderPresident, CEO & Director

For further information, please

contact:

Mal Karwowska | Vice President, Corporate

Development and Investor Relations+1 604 484

4399info@newcoregold.comwww.newcoregold.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Note Regarding

Forward-Looking Statements

This news release includes statements that

contain "forward-looking information" within the meaning of the

applicable Canadian securities legislation ("forward-looking

statements"). All statements, other than statements of historical

fact, are forward-looking statements and are based on expectations,

estimates and projections as at the date of this news release. Any

statement that involves discussion with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions,

future events or performance (often, but not always using phrases

such as "plans", "expects", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", or "believes"

or variations (including negative variations) of such words and

phrases, or state that certain actions, events or results "may",

"could", "would", "might" or "will" be taken, occur or be achieved)

are not statements of historical fact and may be forward-looking

statements. In this news release, forward-looking statements

relate, among other things, to: statements about the estimation of

mineral resources; results of preliminary economic assessments;

completion of a pre-feasibility study; results of metallurgical

testwork; results of our ongoing drill campaign; results of

drilling, magnitude or quality of mineral deposits; anticipated

advancement of mineral properties or programs; and future

exploration prospects.

These forward-looking statements, and any

assumptions upon which they are based, are made in good faith and

reflect our current judgment regarding the direction of our

business. The assumptions underlying the forward-looking statements

are based on information currently available to Newcore. Although

the forward-looking statements contained in this news release are

based upon what management of Newcore believes, or believed at the

time, to be reasonable assumptions, Newcore cannot assure its

shareholders that actual results will be consistent with such

forward-looking statements, as there may be other factors that

cause results not to be as anticipated, estimated or intended.

Forward-looking information also involves known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking information. Such

factors include, among others: risks related to the speculative

nature of Newcore’s business; Newcore’s formative stage of

development; Newcore’s financial position; possible variations in

mineralization, grade or recovery rates; actual results of current

exploration activities; fluctuations in general macroeconomic

conditions; fluctuations in securities markets; fluctuations in

spot and forward prices of gold and other commodities; fluctuations

in currency markets (such as the Canadian dollar to United States

dollar exchange rate); change in national and local government,

legislation, taxation, controls, regulations and political or

economic developments; risks and hazards associated with the

business of mineral exploration, development and mining (including

environmental hazards, unusual or unexpected geological

formations); the presence of laws and regulations that may impose

restrictions on mining; employee relations; relationships with and

claims by local communities; the speculative nature of mineral

exploration and development (including the risks of obtaining

necessary licenses, permits and approvals from government

authorities); and title to properties.

Forward-looking statements contained herein are

made as of the date of this news release and Newcore disclaims any

obligation to update any forward-looking statements, whether as a

result of new information, future events or results, except as may

be required by applicable securities laws. There can be no

assurance that forward-looking information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

information.

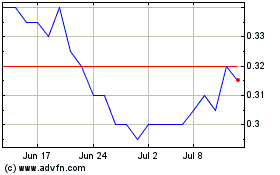

Newcore Gold (TSXV:NCAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Newcore Gold (TSXV:NCAU)

Historical Stock Chart

From Jan 2024 to Jan 2025