Newcore Gold Ltd. ("Newcore" or the "Company")

(TSX-V: NCAU, OTCQX: NCAUF) is pleased to announce additional drill

results from the 90,000 metre drill program underway at the

Company’s 100% owned Enchi Gold Project ("Enchi" or the "Project")

in Ghana. Drilling at the Nyam Gold Deposit ("Nyam") at Enchi has

intersected high-grade, oxide gold mineralization grading 2.04

grams per tonne gold ("g/t Au") over 35.0 metres ("m") from

surface, including 4.89 g/t Au over 8.0 m from 8 m. Drilling at

Nyam continues to encounter higher-grade gold mineralization from

surface, with wide zones encountered in both the oxide and sulphide

mineralization. These results also tested the southern extension at

Nyam, increasing the drill tested strike extent at Nyam to three

kilometres.

Highlights from Drilling at

Nyam

- Drilling

on the southern portion of Nyam encountered multiple wide zones of

near surface gold mineralization, including high-grade

cores.

- Hole NBRC075

intersected, from surface, an oxidized high-grade gold mineralized

structure grading 2.04 g/t Au over 35.0 m, including 4.89 g/t Au

over 8.0 m from 8 m.

- Hole NBRC073

intersected 0.78 g/t Au over 57.0 m from 74 m (sulphide zone).

- Hole NBRC076

intersected 0.85 g/t Au over 50.0 m from 1 m (oxide zone

transitioning to sulphide zone), including 1.18 g/t Au over 13.0 m

from 1 m and 2.10 g/t Au over 8.0 m from 31 m.

- Drilling

on the central portion of Nyam tested oxide and sulphide

mineralization and encountered multiple zones of shallow high-grade

gold mineralization.

- Hole NBRC087

intersected a high-grade gold mineralized structure in the sulphide

zone grading 2.14 g/t Au over 19.0 m from 84 m, including 4.14 g/t

Au over 2.0 m from 92 m.

- Hole NBRC088

intersected 0.88 g/t Au over 28.0 m from 57 m, including 5.09 g/t

Au over 2.0 m from 80 m (sulphide zone).

- Drilling

targeting the oxide zone continued to return strong results, with

hole NBRC085 intersecting 1.26 g/t Au over 18.0 m from surface and

hole NBRC086 intersecting 1.24 g/t Au over 19.0 m from 17

m.

- Step out

holes completed to test the southern extent of Nyam have extended

the drill tested portion of the Nyam structure by 800 metres to the

south.

- Hole NBRC066,

drilled 800 metres south of the current resource pit, intersected

0.52 g/t Au over 15.0 m from 89 m (sulphide zone).

- Results

from 59,559 metres of the total 90,000 metre drill program have

been received and released. Drilling continues at Enchi with recent

drilling testing Eradi and Sewum South, gold targets with no

defined mineral resource.

Luke Alexander, President and CEO of Newcore

stated, "Drilling at Nyam continues to deliver strong results,

demonstrating the potential for resource growth across our Enchi

Gold Project. We have increased the strike extent of drilled

mineralization at Nyam with mineralization now intersected along

more than three kilometres of strike length, remaining open along

strike and at depth. We also continue to encounter shallow,

higher-grade gold mineralization at Nyam with drilling intersecting

wide zones of mineralization in both the oxides and sulphides.

Given the success we have achieved to date with drilling at Nyam,

we will continue to test the potential to grow the shallow oxide

resource at this deposit while testing the potential for

higher-grade mineralization at depth."

This news release reports results for 34 Reverse

Circulation ("RC") holes totalling 5,245 m (NBRC056 to NBRC089)

targeting the Nyam Gold Deposit, with 30 of the 34 holes

intersecting gold mineralization.

Select assay results from the 34 holes of the

drill program reported in this release are below:

Table 1 - Enchi Gold Project Drill

Highlights

|

Hole ID |

Zone/Deposit |

From (m) |

To (m) |

Length (m) |

Au (g/t) |

|

NBRC075 |

Nyam |

0.0 |

35.0 |

35.0 |

2.04 |

| including |

|

8.0 |

16.0 |

8.0 |

4.89 |

| and

incl. |

|

9.0 |

11.0 |

2.0 |

9.60 |

|

NBRC073 |

Nyam |

74.0 |

131.0 |

57.0 |

0.78 |

|

including |

|

94.0 |

103.0 |

9.0 |

1.34 |

|

NBRC076 |

Nyam |

1.0 |

51.0 |

50.0 |

0.85 |

| including |

|

1.0 |

14.0 |

13.0 |

1.18 |

|

including |

|

31.0 |

39.0 |

8.0 |

2.10 |

|

NBRC078 |

Nyam |

36.0 |

115.0 |

79.0 |

0.53 |

|

NBRC087 |

Nyam |

84.0 |

103.0 |

19.0 |

2.14 |

|

NBRC077 |

Nyam |

69.0 |

98.0 |

29.0 |

1.13 |

|

NBRC088 |

Nyam |

57.0 |

85.0 |

28.0 |

0.88 |

|

NBRC079 |

Nyam |

92.0 |

119.0 |

27.0 |

0.89 |

|

including |

|

104.0 |

109.0 |

5.0 |

2.19 |

|

NBRC086 |

Nyam |

17.0 |

36.0 |

19.0 |

1.24 |

|

NBRC085 |

Nyam |

0.0 |

18.0 |

18.0 |

1.26 |

|

including |

|

11.0 |

13.0 |

2.0 |

6.46 |

| |

| Notes: |

|

1. See detailed table for complete results |

|

2. Intervals reported are hole lengths with true

width estimated to be 75 - 85% |

|

3. Length-weighted averages from uncut

assays |

A plan map showing the drill hole locations can

be viewed at:

https://newcoregold.com/site/assets/files/5739/2021_10-ncau-nr-enchi-plan-map-nyam-l.pdf

A cross section showing drill results and

highlights for hole NBRC075 can be viewed at:

https://newcoregold.com/site/assets/files/5739/2021_10_26-ncau-crosssection-nbrc075-l.pdf

A complete list of the 2020 - 2021 drill results

to date, including hole details, can be viewed

at:https://newcoregold.com/site/assets/files/5739/2021_10-ncau-enchi-2020-2021-drill-results-l.pdf

Drilling on the southern portion of the Nyam

Gold Deposit has encountered multiple zones of gold mineralization

including wide zones near surface and high-grade cores. Hole

NBRC075 intersected a near surface oxidized mineralized structure

grading 2.04 g/t Au over 35.0 m from surface, including 4.89 g/t Au

over 8.0 m from 8 m. Hole NBRC073 collared 50 metres south of

NBRC075 intersected a wide gold mineralized structure grading 0.78

g/t Au over 57.0 m from 74 m (sulphide zone), including 1.34 g/t Au

over 9.0 m from 94 m. Hole NBRC076 collared 75 metres north of

NBRC075 intersected a wide, near surface and oxidized transitioning

to sulphide, gold mineralized zone grading 0.85 g/t Au over 50.0 m

from 1 m, including 1.18 g/t Au over 13.0 m from 1 m and 2.10

g/t Au over 8.0 m from 31 m.

Hole NBRC078 collared 175 metres north of

NBRC075 intersected a wide gold mineralized structure grading 0.53

g/t Au over 79.0 m from 36 m (sulphide zone). Hole NBRC077 collared

150 metres north of NBRC075 intersected gold mineralization grading

1.13 g/t Au over 29.0 m from 69 m (sulphide zone). Hole NBRC067

collared 300 metres south of NBRC075 intersected gold

mineralization grading 0.54 g/t Au over 37.0 m from 147 m (sulphide

zone) and 1.69 g/t Au over 5.0 m from 159 m (sulphide zone).

Drilling on the central portion of Nyam

encountered multiple zones of gold mineralization, including

higher-grade structures. Hole NBRC087 intersected a high-grade gold

mineralized structure grading 2.14 g/t Au over 19.0 m from 84 m

(sulphide zone), including 4.14 g/t Au over 2.0 m from 92 m. Hole

NBRC088 collared 50 metres south of NBRC087 intersected a wide gold

mineralized structure grading 0.88 g/t Au over 28.0 m from 57 m

(sulphide zone), including 5.09 g/t Au over 2.0 m from 80 m. Hole

NBRC086 drilled on the same section as NBRC087 tested the up-dip,

near surface, oxidized portion of the gold zone and intersected

1.24 g/t Au over 19.0 m from 17 m. Hole NBRC085 drilled on the same

section as NBRC088 also tested the up-dip, near surface, oxidized

mineralization and intersected 1.26 g/t Au over 18.0 m from

surface, including 6.46 g/t Au over 2.0 m from 11 m. Additional new

intersections tested the down dip portion of the zone in the

sulphides, including hole NBRC082 that intersected 1.18 g/t Au over

15.0 m from 93 m and hole NBRC081 that intersected 1.68 g/t Au over

10.0 m from 120 m.

A series of holes were also completed testing

the southern extension of the structure 800 metres to the south.

Step out holes to the south have extended the drill tested portion

of the Nyam structure to three kilometres. Hole NBRC066 drilled 800

metres south of the existing pit constrained resource intersected

0.52 g/t Au over 15.0 m from 89 m (sulphide zone). Additional

results from this step out drilling included hole NBRC059B which

intersected 1.60 g/t Au over 10.0 m from 97 m (sulphide zone) and

hole NBRC058 which intersected 1.11 g/t Au over 2.0 m from 17 m

(oxide zone).

For the total planned 90,000 metre drill

program, assay results have now been received and released for 350

holes representing 59,559 metres.

Enchi Gold Project Mineral Resource

Estimate

The Enchi Gold Project hosts a pit constrained

Inferred Mineral Resource of 70.4 million tonnes grading 0.62 g/t

Au containing 1.41 million ounces gold (see Newcore news release

dated June 8, 2021). Mineral resource estimation practices are in

accordance with CIM Estimation of Mineral Resource and Mineral

Reserve Best Practice Guidelines (November 29, 2019) and follow CIM

Definition Standards for Mineral Resources and Mineral Reserves

(May 10, 2014), that are incorporated by reference into National

Instrument 43-101 ("NI 43-101"). The Mineral Resource Estimate was

prepared by independent qualified person Todd McCracken, P. Geo. of

BBA E&C Inc. The technical report, titled "Preliminary Economic

Assessment for the Enchi Gold Project, Enchi, Ghana" has an

effective date of June 8, 2021, and is available under the

Company’s profile on SEDAR at www.sedar.com.

2020 - 2021 Enchi Drilling

Program

A 90,000 metre discovery and resource expansion

drilling program is underway at Enchi. The program includes both RC

and diamond drilling and will include the first deeper drilling

planned on the Project. This drill program includes testing

extensions of the existing resource areas while also testing a

number of high priority exploration targets outside of the Inferred

Mineral Resource. Drilling is focused on step out extensions and

exploration drilling at the Sewum, Boin, Nyam and Kwakyekrom

Deposits. Additional drilling is planned at previously drilled

zones that are outside of the resource area (Kojina Hill and

Eradi), along with first pass drilling to test a series of

kilometre-scale gold-in-soil anomalous zones with no prior drilling

(Nkwanta, Sewum South and other anomalies). All zones represent

high priority targets based on geological, geochemical and

geophysical surface work and previous trenching and drilling.

Nyam Gold Zone

The Nyam Gold Deposit is one of the four

deposits which comprise the pit constrained Inferred Mineral

Resource Estimate at Enchi (4.9 million tonnes grading 0.82 g/t Au

containing 129,000 ounces). Nyam is located 15 kilometres south of

the town of Enchi, with nearby roads and power and further access

provided by a series of drill roads. An airborne geophysical

anomaly coincident with the Nyam Gold Deposit shows a complex

series of linear high conductivity trends, reflective of the

multiple sub-parallel gold-bearing structures. As part of the 2020

- 2021 drill program, a total of 83 holes totalling 12,649 metres

have been completed at Nyam.

Drill Hole Locations

Table 2 - Enchi Gold Project Drill Hole

Location Details

|

Hole ID |

UTM East |

UTM North |

Elevation |

Azimuth ° |

Dip ° |

Length (m) |

|

NBRC056 |

530086 |

637145 |

80 |

300 |

-60 |

153 |

|

NBRC057 |

530012 |

637064 |

77 |

300 |

-60 |

150 |

|

NBRC058 |

530119 |

637014 |

75 |

300 |

-60 |

162 |

|

NBRC059B |

530177 |

637089 |

73 |

300 |

-60 |

150 |

|

NBRC060 |

529938 |

636854 |

84 |

300 |

-60 |

174 |

|

NBRC061 |

529759 |

636735 |

106 |

300 |

-60 |

156 |

|

NBRC062 |

529834 |

636686 |

99 |

300 |

-60 |

162 |

|

NBRC063 |

529657 |

636560 |

114 |

300 |

-60 |

150 |

|

NBRC064 |

529735 |

636517 |

113 |

300 |

-60 |

150 |

|

NBRC065 |

529555 |

636386 |

117 |

300 |

-60 |

156 |

|

NBRC066 |

529631 |

636341 |

94 |

300 |

-60 |

153 |

|

NBRC067 |

530332 |

637356 |

79 |

300 |

-60 |

184 |

|

NBRC068 |

530363 |

637340 |

85 |

300 |

-60 |

252 |

|

NBRC069 |

530308 |

637454 |

89 |

300 |

-60 |

144 |

|

NBRC070 |

530251 |

637110 |

81 |

300 |

-60 |

240 |

|

NBRC071 |

530354 |

637456 |

93 |

300 |

-60 |

135 |

|

NBRC072 |

530402 |

637545 |

95 |

300 |

-60 |

140 |

|

NBRC073 |

530425 |

637572 |

98 |

300 |

-60 |

142 |

|

NBRC074 |

530457 |

637552 |

94 |

300 |

-60 |

197 |

|

NBRC075 |

530404 |

637629 |

99 |

300 |

-60 |

144 |

|

NBRC076 |

530442 |

637701 |

96 |

300 |

-60 |

120 |

|

NBRC077 |

530488 |

637722 |

83 |

300 |

-60 |

183 |

|

NBRC078 |

530501 |

637751 |

85 |

300 |

-55 |

144 |

|

NBRC079 |

530538 |

637730 |

93 |

300 |

-55 |

160 |

|

NBRC080 |

530536 |

637767 |

87 |

300 |

-60 |

180 |

|

NBRC081 |

530615 |

637853 |

83 |

300 |

-50 |

144 |

|

NBRC082 |

530599 |

637880 |

88 |

300 |

-60 |

162 |

|

NBRC083 |

530548 |

637941 |

84 |

300 |

-60 |

100 |

|

NBRC084 |

530634 |

637896 |

88 |

300 |

-50 |

126 |

|

NBRC085 |

530572 |

637961 |

89 |

300 |

-60 |

120 |

|

NBRC086 |

530597 |

637974 |

89 |

300 |

-60 |

130 |

|

NBRC087 |

530632 |

637952 |

95 |

300 |

-60 |

120 |

|

NBRC088 |

530616 |

637935 |

95 |

300 |

-60 |

110 |

|

NBRC089 |

530631 |

637994 |

103 |

300 |

-60 |

152 |

|

|

|

|

|

|

|

|

COVID-19 Protocols

Newcore’s first priority is the health and

safety of all employees, contractors, and local communities. The

Company is following all Ghana guidelines and requirements related

to COVID-19. The Company has implemented COVID-19 protocols for its

ongoing drill program consisting of the mandatory use of personal

protective equipment (including facemasks for all employees),

maintaining social distancing, frequent hand washing, and daily

temperature checks at the start of each shift.

Newcore Gold Best Practice

Newcore is committed to best practice standards

for all exploration, sampling and drilling activities. Drilling was

completed by an independent drilling firm using industry standard

RC and Diamond Drill equipment. Analytical quality assurance and

quality control procedures include the systematic insertion of

blanks, standards and duplicates into the sample strings. Samples

are placed in sealed bags and shipped directly to Intertek Labs

located in Tarkwa, Ghana for 50 gram gold fire

assay.

Qualified Person

Mr. Gregory Smith, P. Geo, Vice President of

Exploration of Newcore, is a Qualified Person as defined by NI

43-101, and has reviewed and approved the technical data and

information contained in this news release. Mr. Smith has verified

the technical and scientific data disclosed herein and has

conducted appropriate verification on the underlying data including

confirmation of the drillhole data files against the original

drillhole logs and assay certificates.

About Newcore Gold Ltd.

Newcore Gold is advancing its Enchi Gold Project

located in Ghana, Africa’s largest gold producer (1). The Project

currently hosts an Inferred Mineral Resource of 1.41 million ounces

of gold at 0.62 g/t (2). Newcore Gold offers investors a unique

combination of top-tier leadership, who are aligned with

shareholders through their 27% equity ownership, and prime district

scale exploration opportunities. Enchi’s 216 km2 land package

covers 40 kilometres of Ghana’s prolific Bibiani Shear Zone, a gold

belt which hosts several 5 million-ounce gold deposits, including

Kinross’ Chirano mine 50 kilometers to the north. Newcore’s vision

is to build a responsive, creative and powerful gold enterprise

that maximizes returns for shareholders.

On Behalf of the Board of Directors of

Newcore Gold Ltd.

Luke AlexanderPresident, CEO & Director

For further information, please

contact:

Mal Karwowska | Vice President, Corporate

Development and Investor Relations+1 604 484

4399info@newcoregold.com www.newcoregold.com

|

(1) |

Source: Production volumes for 2020 as sourced from the World Gold

Council |

|

(2) |

Notes for Inferred Mineral Resource Estimate: |

|

1. |

CIM definition standards were followed for the resource

estimate. |

|

2. |

The 2021 resource models used ordinary kriging (OK) grade

estimation within a three-dimensional block model with mineralized

zones defined by wireframed solids and constrained by pits shell

for Sewum, Boin and Nyam. Kwakyekrom used Inverse Distance squared

(ID2). |

|

3. |

A base cut-off grade of 0.2 g/t Au was used with a capping of gold

grades varied by deposit and zone. |

|

4. |

A US$1,650/ounce gold price, open pit with heap leach operation was

used to determine the cut-off grade of 0.2 g/t Au. Mining costs of

US$1.40 for oxides, US$2.10 for transition, and US$2.60 for fresh

rock per mined tonne and G&A and milling costs of

US$6.83/milled tonne. The Inferred Mineral Resource Estimate is pit

constrained. |

|

5. |

Metallurgical recoveries have been applied to four individual

deposits and in each case three material types (oxide, transition,

and fresh rock) with average recoveries of 77% for Sewum, 79% for

Boin, 60% for Nyam and 72% for Kwakyekrom. |

|

6. |

A density of 2.20 g/cm3 for oxide, 2.45 g/cm3 for transition, and

2.70 g/cm3 for fresh rock was applied. |

|

7. |

Optimization pit slope angles varied based on the rock types. |

|

8. |

Mineral Resources that are not mineral reserves do not have

economic viability. Numbers may not add due to rounding. |

|

9. |

These numbers are from the technical report titled "Preliminary

Economic Assessment for the Enchi Gold Project, Enchi, Ghana", with

an effective date of June 8, 2021, prepared for Newcore Gold by BBA

E&C Inc. in accordance with National Instrument 43-101

Standards of Disclosure for Mineral Projects and is available under

Newcore’s SEDAR profile at www.sedar.com. |

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Note Regarding

Forward-Looking Statements

This news release includes statements that

contain "forward-looking information" within the meaning of the

applicable Canadian securities legislation ("forward-looking

statements"). All statements, other than statements of historical

fact, are forward-looking statements and are based on expectations,

estimates and projections as at the date of this news release. Any

statement that involves discussion with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions,

future events or performance (often, but not always using phrases

such as "plans", "expects", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", or "believes"

or variations (including negative variations) of such words and

phrases, or state that certain actions, events or results "may",

"could", "would", "might" or "will" be taken, occur or be achieved)

are not statements of historical fact and may be forward-looking

statements. In this news release, forward-looking statements

relate, among other things, to: statements about the estimation of

mineral resources; results of our ongoing drill campaign, magnitude

or quality of mineral deposits; anticipated advancement of mineral

properties or programs; and future exploration prospects.

These forward-looking statements, and any

assumptions upon which they are based, are made in good faith and

reflect our current judgment regarding the direction of our

business. The assumptions underlying the forward-looking statements

are based on information currently available to Newcore. Although

the forward-looking statements contained in this news release are

based upon what management of Newcore believes, or believed at the

time, to be reasonable assumptions, Newcore cannot assure its

shareholders that actual results will be consistent with such

forward-looking statements, as there may be other factors that

cause results not to be as anticipated, estimated or intended.

Forward-looking information also involves known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking information. Such

factors include, among others: risks related to the speculative

nature of the Company’s business; the Company’s formative stage of

development; the Company’s financial position; possible variations

in mineralization, grade or recovery rates; actual results of

current exploration activities; fluctuations in general

macroeconomic conditions; fluctuations in securities markets;

fluctuations in spot and forward prices of gold and other

commodities; fluctuations in currency markets (such as the Canadian

dollar to United States dollar exchange rate); change in national

and local government, legislation, taxation, controls, regulations

and political or economic developments; risks and hazards

associated with the business of mineral exploration, development

and mining (including environmental hazards, unusual or unexpected

geological formations); the presence of laws and regulations that

may impose restrictions on mining; employee relations;

relationships with and claims by local communities; the speculative

nature of mineral exploration and development (including the risks

of obtaining necessary licenses, permits and approvals from

government authorities); and title to properties.

Forward-looking statements contained herein are

made as of the date of this news release and the Company disclaims

any obligation to update any forward-looking statements, whether as

a result of new information, future events or results, except as

may be required by applicable securities laws. There can be no

assurance that forward-looking information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

information.

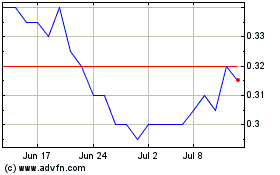

Newcore Gold (TSXV:NCAU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Newcore Gold (TSXV:NCAU)

Historical Stock Chart

From Nov 2023 to Nov 2024