Macarthur Minerals Limited (ASX: MIO)

(TSX-V: MMS) (OTCQB: MMSDF) (the

Company

or

Macarthur) is pleased to announce a maiden

Mineral Reserve Statement for the Lake Giles Iron Project as at 15

March 2022.

The Mineral Reserve defined for the Lake Giles

Iron Project, incorporates the Moonshine and Moonshine North

magnetite deposits. The Lake Giles Iron Project is 100% owned by

Macarthur Iron Ore Pty Ltd, (a wholly owned subsidiary of Macarthur

Minerals Limited). The Mineral Reserve has been incorporated into a

Feasibility Study which demonstrates a technically and economically

viable project. The final Feasibility Study will be released to the

market in the next 45 days. Mineral Reserves are reported in

accordance with the CIM Definition Standards on Mineral Resources

and Reserves (CIM Definition Standards).

|

HIGHLIGHTS • Maiden

Mineral Reserve totals 237 million tonnes of iron ore at

Probable/Proven classification. •

Mineral Reserve contains 74 million dry tonnes of iron ore

concentrate for a 25-year mine life, based on 87% of the Indicated

and Measured Mineral Resources. •

Mineral Reserves support a positive Feasibility Study (to be

released within 45 days of this release). |

Project Location

The Lake Giles Iron Project is located 250 km

northwest of Kalgoorlie in the Yilgarn region of Western

Australia.

Regional Geology and Geological

Interpretation

The Mineral Reserve forms part Indicated and

Measured Mineral Resources of the Lake Giles Iron Project

encompassing the Moonshine and Moonshine North magnetite deposits.

The Mineral Resource estimate was completed by CSA Global Pty Ltd

(CSA Global) and previously reported to the market on 11 August

2020. The Company confirms that all assumptions and technical

parameters underpinning the Mineral Resource estimates continue to

apply and have not materially changed. Detailed discussion of the

project geology and Mineral Resource estimation methodology are

detailed in release available here.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/7c40865c-f035-4503-84ec-20f68833c1a6

Mineral Resource and Mineral Reserve

Statement

The Mineral Resource estimate was completed by

CSA Global Pty Ltd (CSA Global) and previously reported to the

market on 11 August 2020. Mineral Resources for the Moonshine and

Moonshine North deposits are presented in Table 1.

Table 1. Mineral Resources – Lake Giles

Iron Project, Moonshine and Moonshine North, DTR

>15%

|

Category |

Tonnes (Mt) |

Head Grades (%) |

Concentrate Grades (%) |

|

Fe |

P |

SiO2 |

AI2O3 |

LOI |

DTR |

Fe |

P |

SiO2 |

AI2O3 |

LOI |

|

Measured |

53.9 |

30.8 |

0.05 |

45.4 |

1.6 |

2.7 |

32.2 |

66.0 |

0.031 |

6.2 |

0.2 |

-0.7 |

|

Indicated |

218.7 |

27.5 |

0.046 |

51.1 |

1.4 |

1.6 |

31.0 |

66.1 |

0.017 |

6.7 |

0.1 |

-0.1 |

|

Subtotal |

272.5 |

28.1 |

0.047 |

50.0 |

1.4 |

1.8 |

31.2 |

66.1 |

0.02 |

6.6 |

0.2 |

-0.2 |

|

Inferred |

449.1 |

27.1 |

0.047 |

52.6 |

1.0 |

1.4 |

29.2 |

65.0 |

0.026 |

8.4 |

0.1 |

0 |

Notes

(a) Figures

contained within the Tables have been rounded.

(b) Resource estimates are based on

block models constructed using three dimensional geological

wireframes. (c) Mineral Resources are

reported from the block models above a DTR cut-off grade of 15%.

(d) Mineral Resources are not Mineral

Reserves and do not have demonstrated economic

viability.(e) All Mineral Resources

are reported on a dry-tonnage

basis.(f) Mineral Resources are

reported inclusive of the Mineral Reserve.

The Mineral Reserve estimate was prepared by

Orelogy Consulting Pty Ltd (Orelogy) based on the diluted resource

block model. The Mineral Reserve for the Lake Giles Iron ore

Project is estimated at 237 Mt at an average grade of 28.2% Fe and

DTR of 31.3%, as presented in Table 2.

Table 2. Mineral Reserves – Lake Giles

Iron Project, Moonshine and Moonshine North, DTR

>15%

|

Category |

Tonnes (Mt) |

Head Grades (%) |

Concentrate Grades (%) |

|

Fe |

SiO2 |

AI2O3 |

P |

LOI |

DTR |

Fe |

SiO2 |

AI2O3 |

P |

LOI |

|

Moonshine |

|

Proven |

34.2 |

28.1 |

51.6 |

1.2 |

0.04 |

1.7 |

30.5 |

65.9 |

6.8 |

0.2 |

0.02 |

-0.6 |

|

Probable |

166.4 |

27.2 |

51.9 |

1.4 |

0.05 |

1.4 |

30.7 |

66.6 |

6.2 |

0.1 |

0.02 |

0.0 |

|

Sub-total |

200.6 |

27.4 |

51.9 |

1.4 |

0.04 |

1.4 |

30.6 |

66.5 |

6.3 |

0.1 |

0.02 |

-0.1 |

|

Moonshine Nth |

|

Proven |

17.8 |

35.4 |

35.4 |

2.2 |

0.06 |

4.2 |

34.3 |

66.5 |

5.0 |

0.3 |

0.03 |

-0.9 |

|

Probable |

18.2 |

30.4 |

44.7 |

1.3 |

0.05 |

2.9 |

35.9 |

63.2 |

9.4 |

0.2 |

0.04 |

-0.3 |

|

Sub-total |

36.0 |

32.9 |

40.1 |

1.7 |

0.05 |

3.5 |

35.1 |

64.8 |

7.3 |

0.3 |

0.05 |

-0.6 |

|

Combined |

|

Proven |

51.9 |

30.6 |

46.0 |

1.5 |

0.05 |

2.6 |

31.8 |

66.1 |

6.1 |

0.2 |

0.03 |

-0.7 |

|

Probable |

184.7 |

27.6 |

51.2 |

1.4 |

0.05 |

1.5 |

31.2 |

66.2 |

6.6 |

0.1 |

0.02 |

-0.1 |

|

TOTAL |

236.6 |

28.2 |

50.1 |

1.4 |

0.05 |

1.8 |

31.3 |

66.2 |

6.5 |

0.1 |

0.02 |

-0.2 |

Notes(a) The

Mineral Reserve is reported in accordance with JORC Code 2012 and

Canadian Institute of Mining, Metallurgy and Petroleum “CIM

Definition Standards for Mineral Resources and Mineral Reserves”

(CIM, 2014).(b) The Mineral Reserve

was evaluated using a 62% Fe benchmark price of USD100/dmt with a

20% premium for 65% Fe and concomitant Fe concentrate grade

bonus.(c) Mineral Reserves are based

on a Feasibility Study utilising Mineral Resources from Moonshine

and Moonshine North

deposits.(d) Mineral Reserves account

for mining dilution and mining ore

loss.(e) A Davis Tube Mass Recovery

(DTR MR) cut-off grade of 15% was applied prior to scheduling for

2022 reserves estimate. (f) Proven

Mineral Reserves are based on Measured Mineral Resources only and

Probable Mineral Reserves are based on Indicated Mineral Resources

only.(g) Mineral Reserves are reported

on a Dry Tonnage Basis.(h) Mineral

Reserves are a part of Mineral

Resources.(i) The sum of individual

amounts may not equal due to rounding.Mineral Reserves

Estimation Methodology

The mine design and Mineral Reserve estimate

have been completed to a level appropriate for a feasibility study

and are consistent with the CIM definitions for public reporting.

The Mineral Reserve estimate is based on Measured and Indicated

(MI) mineral resources only. Inferred material has been classified

as waste.

The mining strategy is based on Contractor

mining with Macarthur providing management and technical oversight.

Conventional open pit mining using 400 t excavators and 180 t rigid

dump trucks was selected as the most appropriate mining method for

the contract mining operation. Drill and blast will be undertaken

on 10 m bench and mined in 5 m flitches.

Waste will be hauled to external waste rock

dumps. Ore will be hauled to the ROM pad and either tipped directly

into the primary crusher feed bin or placed onto a ROM finger

stockpile for later rehandling using a front-end loader.

The two pits will be mined in a total of seven

stages – two for Moonshine North and five for Moonshine. Each stage

will require pre-stripping of the oxidised material to a depth of

approximately 55 m prior to commencing ore mining procedures. Each

stage has been designed with separate ramp access using dual lane

ramps except for the final two benches where single lanes were

adopted. The cutback distance between stages targeted a mining

width of 120 m to provide sufficient working room for the mining

equipment.

Pit Optimisation

A mining model was developed for a proposed open

pit mining method. Overall mining dilution was 2.5% at an average

grade of 14% DTR and ore losses were 2.0% at an average grade of

30% DTR.

Open pit optimisation was conducted to determine

the optimal economic geometry of the open pits. A cut-off grade of

15% DTR was used for ore definition. This was rounded up from the

calculated breakeven cut-off grade of 14.2% DTR. The pit

optimisation was undertaken in Whittle software using the

parameters presented in Table 3.

Table 3. Pit Optimisation

parameters

|

Optimisation Parameter |

|

Unit |

Value |

|

Financial Parameters |

|

Iron Ore Price for 66% Product |

|

USD/t concentrate |

125 |

|

Shipping and Insurance |

|

USD/t concentrate |

13.20 |

|

Price FOB |

|

USD/t |

111.80 |

|

Exchange rate |

|

USD: AUD (A$) |

0.73 |

|

Government Royalty |

|

% |

5.0 |

|

Net Price |

|

A$/t |

145.49 |

|

Discount Rate |

|

% |

8.0 |

|

Selling Parameters |

|

Concentrate Production |

|

Mt/a (wet) |

3.3 |

|

Road transport |

|

A$/wt concentrate |

9.09 |

|

Rail transport |

|

A$/wt concentrate |

15.64 |

|

Port Charges |

|

A$/wt concentrate |

7.58 |

|

Moisture content |

|

% |

9.0 |

|

Total selling cost |

|

A$/dt concentrate |

29.64 |

|

Processing Parameters |

|

|

|

|

Design throughput capacity |

|

Mt/a (dry) |

9.68 |

|

Owner Mining Overhead |

|

A$/dt ore |

1.26 |

|

Grade control |

|

A$/dt ore |

0.13 |

|

Ore mining premium: |

> 265 mRL:< 265 mRL: |

A$/dt ore A$/dt ore |

OMP = (5.093 x LN (Bench RL) – 30.32)/SGOMP = (-0.039 x (Bench RL)

+ 8.11)/SG |

|

Ore Blasting premium |

|

A$/dt ore |

0.33 |

|

Ore Feed Rehandle (55%) |

|

A$/dt ore |

0.80 |

|

Reclaim from Stockpile (20% of ore mined) |

|

A$/dt ore |

0.49 |

|

Dry reject rehandle (149 t/h) |

|

A$/dt ore |

0.31 |

|

Crushing |

|

A$/dt ore |

0.84 |

|

Processing |

|

A$/dt ore |

10.21 |

|

Tailings & Filtration |

|

A$/dt ore |

0.97 |

|

Site general and administration |

|

A$/dt ore |

1.13 |

|

Sustaining Capital |

|

A$/dt ore |

0.30 |

|

TOTAL Processing Cost (excl. OMP) |

|

A$/dt ore |

16.44 |

|

Mining parameters |

|

Mining rate |

|

Mt/a |

45 |

|

Slopes (OSA): |

Oxide Moonshine Nth HWOxide othersFresh FW (Domains1, 3, 4)Fresh HW

(Domain 6A)Fresh HW (Domains 2, 5, 6B) |

DegreesDegreesDegreesDegreesDegrees |

2733413741 |

|

Drill and Blast: |

Oxide wasteFresh Waste |

A$/dtA$/dt |

0.500.81 |

|

Load and Haul waste |

|

A$/dt |

MCAF = (0.0000736 x (Bench RL) 2 – 0.0723 x (Bench RL) +

22.58)/SG |

Scheduling Inventory

The shell with a revenue factor of 0.88 was

selected as the basis for design. Stage design was guided by the

nested pit shells and practical design considerations for the

selected mining fleet. The mine inventories for each stage, as

summarised in Table 4, were imported to Evolution scheduling

software to generate the LOM schedule. Figure 1 shows the nested

stage designs within the overall pit design.

Table 4. Scheduling Inventory reported

by Stage

|

Stage |

Ore |

Grades |

Waste |

Total |

Strip Ratio |

|

Mt |

Fe % |

SiO2 % |

Al2O3 % |

P % |

S % |

LOI % |

DTR % |

Mt |

Mt |

W:O |

|

1 |

22.4 |

28.3 |

50.5 |

1.5 |

0.05 |

1.2 |

1.2 |

31.2 |

81.9 |

110.2 |

2.9 |

|

2 |

7.8 |

31.3 |

44.3 |

1.3 |

0.05 |

1.3 |

3.0 |

35.1 |

53.6 |

61.3 |

6.9 |

|

3 |

28.2 |

33.3 |

39.0 |

1.8 |

0.06 |

1.5 |

3.7 |

35.1 |

64.0 |

86.2 |

2.9 |

|

4 |

22.2 |

27.8 |

51.6 |

1.2 |

0.05 |

0.9 |

1.4 |

31.2 |

52.8 |

75.2 |

2.4 |

|

5 |

69.9 |

27.3 |

51.9 |

1.3 |

0.05 |

1.0 |

1.4 |

30.7 |

152.6 |

222.5 |

2.2 |

|

6 |

55.9 |

27.4 |

52.1 |

1.3 |

0.05 |

0.9 |

1.4 |

31.1 |

133.9 |

189.9 |

2.4 |

|

7 |

30.2 |

26.7 |

52.7 |

1.8 |

0.04 |

1.1 |

1.7 |

28.5 |

77.9 |

108.1 |

2.6 |

|

TOTAL |

236.6 |

28.2 |

50.1 |

1.4 |

0.05 |

1.1 |

1.8 |

31.3 |

616.8 |

853.4 |

2.6 |

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/096dc047-d162-40eb-b3af-72c3d1b0d880

Mine Scheduling

The Moonshine North pit has ore with higher DTR

head grade and higher Silica in concentrate values than Moonshine

and consequently the two pits are scheduled to be mined at the same

time as part of the blending strategy.

The mine schedule has a 9-month pre-strip period

and requires a mining rate of approximately 43 Mt per year to

balance waste stripping requirements with continuous ore supply and

the blending strategy. The mining sequence is presented in Figure

3.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/de20c835-a728-4004-ae88-cf0b9e10d2a3

Approximately, 65% of the ore from both pits is

categorised as high DTR material and sent directly to the ROM pad

for processing. The low DTR material is split into high silica and

low silica stockpiles and used to control the silica content of the

concentrate. Figure 4 shows the ore feed blend with constant silica

grade and DTR grade gradually reducing over time.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f856192c-63c0-448a-bc57-b0e9e4600f8c

Processing Methods and

Assumptions

The proposed flow sheet is based on conventional

gyratory crushing/ cone crushing followed by HPGR grinding. Product

from the HPGR is screened with the +12 mm returning to the

HPGR, the -12 +3 mm material undergoes dry magnetic separation

with the magnetics returning to the HPGR and the non-magnetics

being discarded. The -3 mm material is fed to two ball mills

followed by magnetic separation with the magnetics undergoing

further size reduction to P80 38 microns in two vertimills

followed by magnetic separation. Reverse flotation of the magnetic

concentrate is followed by a final stage of magnetic separation.

The concentrate produced is dried using pressure filtration and

then transferred to the product stockpile.

The above process will yield a saleable

magnetite concentrate with a LOM grade of 66% Fe. The process is

well tested, widely used in the mining industry and there are no

novel steps in the flowsheet.

Tailings is directed to a wet tailings

impoundment from which process water is recovered. The tailings

storage facility (TSF) design was undertaken by engineering

consultants Stantec. The TSF utilises available topography at the

project with waste ore and borrow pits contemplated as construction

materials with future raises utilising processing by- products.

Mine closure and rehabilitation assume profiling and seeding of the

TSF based on high settling and local evaporation rates.

Environment and Approvals

An environmental impact assessment is required

to obtain environmental approval for development. The Company has

commenced the scoping process to identify the key environmental

risks and level of survey to be undertaken. The Company has mapped

out an approval pathway and schedule for the primary and secondary

approvals required and intends to commence desktop and baseline

surveys at the conclusion of the feasibility study. The Company has

previously gained EPA approval for its adjacent hematite project

and is not aware of any major environmental obstacles that would

prevent approval of the Project.

Native Title and Heritage

The Project sits within the Marlinyu Ghoorlie

native title claim. The claim was registered on 28 March 2019 but

is currently not determined. Native title rights in registration or

grant give claimants the right to negotiate during the grant of

mineral tenure. Macarthur’s Mining Leases were all granted prior to

registration of the Native Title claim and the current claim does

not confer rights to negotiate or affect the tenure. There were no

Native Title claims over the area at the time of grant and

therefore no access agreements were required to be negotiated with

Claimants.

Current applications for tenure as described

below are subject to native title. Macarthur is currently

progressing heritage agreements with the native title claimants to

progress the tenure to grant.

Heritage surveys have been conducted in

accordance with EPA Guidance Statement No. 41 (EPA 2004a) across

some areas, including both archaeological and ethnographical

surveys. To date, one archaeological site has been identified

within the Project area. The location of the heritage site does not

impact the Project and a suitable buffer distance has been employed

to avoid any impact to the site. Additional surveys will be

undertaken with the traditional owners across outstanding project

areas in due course.

Tenure

The Lake Giles Iron Project includes 15 granted

mining leases covering a total area of approximately 6,256 Ha. All

tenements are 100% controlled by Macarthur Iron Ore Pty Ltd (MIO),

a 100% owned subsidiary of Macarthur, as itemised in Table 5. MIO

has also made applications for miscellaneous licences to support

supporting infrastructure of the Project and to explore for

groundwater resources.

MIO has entered into an agreement with Arrow

Minerals to acquire adjacent tenure to locate the proposed

processing plant, waste rock dumps, tailings storage facility and

other supporting infrastructure. An application for a general

purpose lease is in progress.

The tenements are not subject to any royalty

agreements or encumbrances that would restrict the ability to

exploit the Mineral Reserve.

Table 5. MIO Tenure Details and

Expenditure Commitments

|

Tenement ID |

Holder |

Area (ha) |

Grant or (Application) Date |

Expiry date |

Annual expenditure Commitment

(A$) |

|

M30/0206 |

MIO |

189 |

02/07/2007 |

01/07/2028 |

$18,900 |

|

M30/0207 |

MIO |

171 |

02/07/2007 |

01/07/2028 |

$17,100 |

|

M30/0213 |

MIO |

258 |

13/06/2011 |

12/06/2032 |

$25,800 |

|

M30/0214 |

MIO |

260 |

13/06/2011 |

12/06/2032 |

$26,000 |

|

M30/0215 |

MIO |

521 |

13/06/2011 |

12/06/2032 |

$52,100 |

|

M30/0216 |

MIO |

55 |

13/06/2011 |

12/06/2032 |

$10,000 |

|

M30/0217 |

MIO |

114 |

13/06/2011 |

12/06/2032 |

$11,400 |

|

M30/0227 |

MIO |

504 |

13/06/2011 |

12/06/2032 |

$50,400 |

|

M30/0228 |

MIO |

362 |

02/07/2007 |

01/07/2028 |

$36,200 |

|

M30/0229 |

MIO |

205 |

02/07/2007 |

01/07/2028 |

$20,500 |

|

M30/0248 |

MIO |

585 |

22/02/2012 |

21/02/2033 |

$58,500 |

|

M30/0249 |

MIO |

1206 |

22/02/2012 |

21/02/2033 |

$120,600 |

|

M30/0250 |

MIO |

102 |

05/03/2013 |

04/03/2034 |

$10,200 |

|

M30/0251 |

MIO |

1246 |

27/11/2012 |

26/11/2033 |

$124,600 |

|

M30/0252 |

MIO |

478 |

27/05/2013 |

26/05/2034 |

$47,800 |

|

E15/7775 |

MIO |

590 |

(24/06/20) |

|

$15,000 |

|

L15/409 |

MIO |

97 |

(25/06/20) |

|

NA |

|

L16/133 |

MIO |

923 |

(25/06/20) |

|

NA |

|

L30/89 |

MIO |

23663 |

(26/03/21) |

|

NA |

|

L30/92 |

MIO |

31660 |

(26/03/21) |

|

NA |

Andrew Bruton, CEO of Macarthur Minerals

commented:

“The release of the Maiden Mineral Reserve

Statement for the Lake Giles Iron Project will support a positive

Feasibility Study for the project.

Macarthur has worked hard over the course of the

last 12 months to deliver this result, and the Company looks

forward to releasing the Feasibility Study shortly.”

On behalf of the Board of Directors, Mr Cameron McCall,

Chairman

For more information please contact:

Joe PhillipsManaging Director+61 7 3221

1796communications@macarthurminerals.com

| Investor Relations – Australia

Advisir Sarah Lenard, Managing

Partnersarah.lenard@advisir.com.au |

|

Investor Relations -

CanadaInvestor CubedNeil Simon, CEO+1 647 258

3310info@investor3.ca |

| |

|

|

Competent / Qualified Person

Statement

Mineral Resources: The Mineral

Resources for the Lake Giles Iron Project disclosed in this press

release have been estimated by Mr. David Williams, BSc (Hons), a

member of the Australian Institute of Geoscientists. Mr Williams,

an employee of CSA Global Pty Ltd and Independent Qualified Person,

has reviewed and approved the above technical information relating

to the Mineral Resource estimates contained in this release, in the

form and context in which it appears.

Mineral Reserves: The

information in this report relating to Mineral Reserves is based on

information compiled by Stephen Craig, a Fellow of the Australasian

Institute of Mining and Metallurgy. Mr Craig is a full-time

employee of Orelogy Consulting Pty Ltd. Mr. Craig has sufficient

experience that is relevant to the style of mineralisation and type

of deposit under consideration and to the activity being undertaken

to qualify as an independent Qualified Person as defined by

NI43-101. Mr Craig consents to the inclusion in the report of the

matters based on their information in the form and context in which

it appears.

Company profileMacarthur is an

iron ore development, gold and lithium exploration company that is

focused on bringing to production its Western Australia iron ore

projects. The Lake Giles Iron Project mineral resources include the

Ularring hematite resource (approved for development) comprising

Indicated resources of 54.5 million tonnes at 47.2% Fe and Inferred

resources of 26 million tonnes at 45.4% Fe; and the Lake Giles

magnetite resource of 53.9 million tonnes (Measured), 218.7 million

tonnes (Indicated) and 997 million tonnes (Inferred). Macarthur

also holds 24 square kilometre tenement area iron exploration

interests in the Pilbara region of Western Australia. In addition,

Macarthur has lithium brine Claims in the emerging Railroad Valley

region in Nevada, USA.

THIS NEWS RELEASE IS NOT FOR DISTRIBUTION

TO AUSTRALIAN NEWSWIRE SERVICES OR FOR DISSEMINATION IN

AUSTRALIA

This news release is not for distribution

to United States services or for dissemination in the United

States

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

Caution Regarding Forward Looking

StatementsCertain of the statements made and information

contained in this press release may constitute forward-looking

information and forward-looking statements (collectively,

“forward-looking statements”) within the meaning of applicable

securities laws. All statements herein, other than statements

of historical fact, that address activities, events or developments

that the Company believes, expects or anticipates will or may occur

in the future, including but not limited to statements regarding

expected completion of the Feasibility Study; conversion of Mineral

Resources to Mineral Reserves or the eventual mining of the

Project, are forward-looking statements. The forward-looking

statements in this press release reflect the current expectations,

assumptions or beliefs of the Company based upon information

currently available to the Company. Although the Company believes

the expectations expressed in such forward-looking statements are

based on reasonable assumptions, such statements are not guarantees

of future performance and no assurance can be given that these

expectations will prove to be correct as actual results or

developments may differ materially from those projected in the

forward-looking statements. Factors that could cause actual

results to differ materially from those in forward-looking

statements include but are not limited to: unforeseen

technology changes that results in a reduction in iron or magnetite

demand or substitution by other metals or materials; the discovery

of new large low cost deposits of iron magnetite; the general level

of global economic activity; failure to complete the FS; inability

to demonstrate economic viability of Mineral Resources; and failure

to obtain mining approvals. Readers are cautioned not to

place undue reliance on forward-looking statements due to the

inherent uncertainty thereof. Such statements relate to future

events and expectations and, as such, involve known and unknown

risks and uncertainties. The forward-looking statements contained

in this press release are made as of the date of this press release

and except as may otherwise be required pursuant to applicable

laws, the Company does not assume any obligation to update or

revise these forward-looking statements, whether as a result of new

information, future events or otherwise.

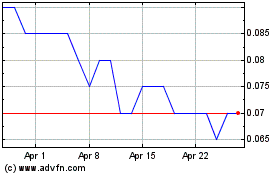

Macarthur Minerals (TSXV:MMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Macarthur Minerals (TSXV:MMS)

Historical Stock Chart

From Jul 2023 to Jul 2024