Regulatory News:

Maurel & Prom (Paris:MAU):

- M&P working interest production in 2024: 36,222 boepd,

up 29% on 2023, and up for each of the Group’s assets

- M&P working interest production of 15,582 bopd in Gabon, up

1% from 2023

- M&P working interest production of 4,302 bopd in Angola, up

5% from 2023

- M&P working interest gas production of 61.4 mmcfd in

Tanzania, up 19% from 2023

- M&P Iberoamerica working interest oil production of 6,098

bopd in Venezuela

- Valued production of $593 million and sales of $808

million

- Sale price of oil was $80.3/bbl for the period, up 1% versus

2023

- Contribution to sales of $39 million for the service

activities

- Sharp increase in oil trading activity: $125 million in 2024

compared to $26 million in 2023

- Acquisition underway of a stake in the Sinu-9 gas licence in

Colombia

- Letter of intent signed in January 2025 for the acquisition

from NG Energy of a 40% stake in the Sinu-9 licence for a

consideration of $150 million

- Onshore gas asset, in production and development, with proven

reserves and considerable exploration and upside potential

- Finalisation underway of the final agreement with NG Energy,

signature expected in February 2025

- Entry into the Quilemba Solar power plant project in Angola

finalised at the end of January

- 19% stake in the project of an 80 MWp solar power generation

project in Angola operated in partnership with TotalEnergies (51%,

operator) and Sonangol (30%)

- Phase 1 (35 MWp) is due to come on stream by early 2026

- With a positive net cash position, M&P is ideally

positioned to capture new growth opportunities in parallel to

shareholder returns

- Positive net cash position of $33 million as at 31 December

2024, up $153 million from end-2023 (net debt of $120 million as at

31 December 2023)

- Dividend of $64 million (€0.30 per share) paid in July

2024

- Available liquidity was $260 million as at 31 December 2024, of

which $193 million in cash

- Completion in December 2024 by Seplat Energy (20.46% owned

by M&P) of the acquisition of MPNU from ExxonMobil

- Transformative acquisition for Seplat Energy: 148% increase in

production to 120 kboepd, and 87% for 2P reserves to 878 mmboe

- Substantial increase expected in the net income contribution

and dividend

- M&P working interest 2P reserves at 31 December 2024:

243 mmboe

- Reserves up 42% after restatement of 2023 production

- Inclusion for the first time of 80 mmbbls for the 40% interest

in Urdaneta Oeste

Key indicators for 2024

Q1 2024

Q2 2024

Q3 2024

Q4 2024

2024

2023

Change 2024 vs.

2023

M&P working interest

production

Gabon (oil)

bopd

15,499

15,553

16,437

14,838

15,582

15,354

+1%

Angola (oil)

bopd

4,634

4,621

3,592

4,369

4,302

4,103

+5%

Tanzania (gas)

mmcfd

76.9

61.7

49.2

58.2

61.4

51.6

+19%

Total interests in consolidated

entities

boepd

32,953

30,450

28,226

28,904

30,125

28,057

+7%

Venezuela (oil)

bopd

5,353

5,472

5,993

7,558

6,098

N/A

N/A

Total production

boepd

38,305

35,922

34,219

36,461

36,222

28,057

+29%

Average sale price

Oil

$/bbl

84.3

83.6

81.5

74.2

80.3

79.3

+1%

Gas

$/mmBtu

3.91

3.89

3.91

3.90

3.90

3.76

+4%

Sales

Gabon

$M

109

115

118

95

437

442

-1%

Angola

$M

30

30

23

25

109

98

+11%

Tanzania

$M

14

12

11

12

48

68

-29%

Valued production

$M

153

157

151

132

593

608

-2%

Service activities

$M

9

10

10

10

39

23

Trading of third-party oil

$M

39

38

1

46

125

26

Restatement for lifting imbalances

& inventory revaluation

$M

11

-6

-15

61

51

25

Consolidated sales

$M

212

200

147

249

808

+19%

M&P working interest production in 2024 amounted to 36,222

boepd. The average sale price of oil was $80.3/bbl for the year, up

1% compared to 2023 ($79.3/bbl).

The Group's valued production (income from production

activities, excluding lifting imbalances and inventory revaluation)

was $593 million in 2024 versus $608 million in 2023. It should be

noted that the decline in valued production in Tanzania was due to

the expected desaturation of recoverable costs, following which a

larger share of production is allocated to TPDC in accordance with

the production sharing agreement.

The restatement of lifting imbalances, net of inventory

revaluation, had a positive impact of $51 million in 2024. The

Group also recorded $125 million in sales from the trading of

third-party oil.

After incorporating the $39 million in income relating to

service activities (drilling activities in Gabon and support for

the operations of the mixed company Petroregional del Lago in

Venezuela), consolidated sales for 2024 stood at $808 million.

Production activities

Gabon

M&P’s working interest oil production (80%) on the Ezanga

permit amounted to 15,582 bopd in 2024, up 1% on 2023.

Production in the fourth quarter of 2024 was impacted by

electrical problems that have now been resolved and by well

stoppages related to the progress of the stimulation campaign. This

campaign was finalised in January 2025 and helped to raise

production potential to above 16,800 bopd for M&P’s working

interest (gross: 21,000 bopd).

Tanzania

M&P’s working interest gas production (60%) on the Mnazi Bay

permit amounted to 61.4 mmcfd in 2024, up 19% compared to 2023.

As expected, gas nominations by TPDC rose significantly during

the fourth quarter, with production of 58.2 mmcfd for the M&P

share. This increase highlights the trend increase in gas demand in

Tanzania, despite the rise in hydropower generation in the

country.

Angola

M&P’s working interest production from Blocks 3/05 (20%) and

3/05A (26.7%) amounted to 4,302 bopd in 2024, up 5% compared to

2023.

Production gradually resumed in early October following the end

of scheduled maintenance operations that had affected production in

the third quarter of 2024. The production level is currently at its

highest, with M&P’s working interest production reaching 4,809

bopd for the months of November and December.

Venezuela

M&P Iberoamerica’s working interest oil production (40%) at

the Urdaneta Oeste field was 6,098 bopd in 2024. M&P

Iberoamerica’s working interest production amounted to 7,558 bopd

(gross: 18,894 bopd) in the fourth quarter of 2024, a sequential

increase of 26% compared to the third quarter of 2024.

Although the production target of 10,000 bopd for M&P’s

Iberoamerica working interest (gross: 25,000 bopd) at the end of

December 2024 was not reached, the production potential increased

considerably thanks to the work carried out, with a production peak

of 9,097 bopd for the M&P Iberoamerica working interest (gross:

22,742 bopd) reached in early January.

Information on the ongoing acquisition

of a stake in the Sinu-9 gas licence in Colombia

On 20 January, M&P announced that it had signed a letter of

intent with NG Energy for the acquisition of a 40% stake in the

Sinu-9 licence in Colombia.

The definitive agreement is being finalised by the parties, and

signature is expected in February. The closing of the transaction

will remain subject to obtaining regulatory approvals, including

approval from the Colombian National Hydrocarbon Agency (“ANH”),

and other customary closing conditions.

Completion of the acquisition of a

stake in the Quilemba Solar power plant project in

Angola

All the condition precedents to the acquisition of a 19%

interest by M&P in the Angolan company Quilemba Solar Lda

(“Quilemba Solar”), with TotalEnergies (51%, operator) and Sonangol

(30%) as partners, were satisfied on 29 January 2025.

Quilemba Solar has a concession and a fixed-price power purchase

agreement (“PPA”) for the construction of the 35 MWp Quilemba solar

plant, which is due to come on stream by early 2026, with the

possibility of adding 45 MWp in a second phase. M&P's share of

the construction costs for the first phase is estimated at $7

million.

Ideally located near Lubango in the south of the country, in one

of the sunniest regions on the planet, the plant will help to

decarbonise Angola's energy mix. From phase one (35 MWp), it will

eliminate around 55,000 tonnes of CO2 equivalent in annual

emissions (at 100%), and will enable Angola to make substantial

savings when compared with the cost of the fuel needed to run the

existing thermal power stations.

Group reserves at 31 December

2024

The Group’s reserves correspond to technically recoverable

hydrocarbon volumes representing the Group’s share of interests in

permits already in production and those revealed by discovery and

delineation wells that can be commercially exploited. These

reserves at 31 December 2024 were certified by DeGolyer and

MacNaughton.

The Group’s 2P reserves amounted to 243.0 mmboe at 31 December

2024, including 161.9 mmboe of proven reserves (1P).

M&P working interest 2P

reserves:

Gabon

Angola

Tanzania

Total consolidated

assets

Venezuela

Total Group

Oil (mmbbls)

Oil (mmbbls)

Gas (bcf)

Oil eq. (mmboe)

Oil (mmbbls)

Oil eq. (mmboe)

2P reserves at 31/12/2023

118.9

20.8

255.0

182.2

–

182.2

Production

-5.7

-1.6

-22.4

-11.0

–

-11.0

Revision

+0.6

+2.3

-66.8

-8.2

+80.0

+71.8

2P reserves at 31/12/2024

113.8

21.5

165.8

163.0

80.0

243.0

o/w 1P reserves

74.6

17.0

160.9

118.4

43.5

161.9

1P reserves as a % of 2P

66%

79%

97%

73%

54%

67%

Note: Gas-oil conversion rate of 6 bcf/mmboe

In Tanzania, the downward revision in 2P reserves of 66.8 bcf

(11.1 mmboe) is due to a change in methodology linked to the change

in the reserve certifier. The reserves previously certified

included an extension of the licence for Mnazi Bay beyond its

current term in 2031, for which M&P plans to apply to the

Tanzanian authorities in accordance with the terms of the

production sharing agreement. The new reserves certifier did not

incorporate this assumption and did not take into account

production after 2031. Taking into account the post-2031

production, M&P’s working interest in Tanzania’s producible

resources technically confirmed by DeGolyer and MacNaughton stood

at 288.2 bcf at the end of 2024, up 13% from the end of 2023.

The inaugural certification of the reserves of the Urdaneta

Oeste asset in Venezuela resulted in reserves of 80 mmbbls for the

40% stake in the asset held by M&P Iberoamerica, i.e. 200

mmbbls of 2P reserves at 100% (compatible with the 422 mmbbls

administratively approved for development at the end of 2022).

These figures do not take into account M&P’s 20.46% interest

in Seplat Energy, a leading Nigerian operator listed on the London

and Lagos stock exchanges. As a reminder, Seplat Energy’s 2P

reserves amounted to 591 mmbbls of oil and 1,719 bcf of gas at 30

June 2024, up 162% and 17% respectively thanks to the acquisition

of MPNU, giving a total of 878 mmboe (equivalent to 180 mmboe for

M&P’s 20.46% interest), up 87% compared to 31 December

2023.

Financial position

The Group had a positive net cash position of $33 million at 31

December 2024, compared with net debt of $120 million at 31

December 2023.

The cash position stood at $193 million at the end of December

2024. Available liquidity at 31 December 2024 was $260 million,

which included $67 million of undrawn RCF.

Gross debt stood at $160 million at 31 December 2024, including

$103 million related to a bank loan (excluding the $67 million

undrawn RCF) and $60 million related to a shareholder loan. M&P

repaid a total of $57 million of gross debt in 2024 ($43 million

bank loan and $15 million shareholder loan).

Glossary

Français

Anglais

pieds cubes

pc

cf

cubic feet

millions de pieds cubes par

jour

Mpc/j

mmcfd

million cubic feet per day

milliards de pieds cubes

Gpc

bcf

billion cubic feet

baril

b

bbl

Barrel

barils d’huile par jour

b/j

bopd

barrels of oil per day

millions de barils

Mb

mmbbls

million barrels

barils équivalent pétrole

bep

boe

barrels of oil equivalent

barils équivalent pétrole par

jour

bep/j

boepd

barrels of oil equivalent per day

millions de barils équivalent

pétrole

Mbep

mmboe

million barrels of oil equivalent

For more information, please visit www.maureletprom.fr/en/

This document may contain forecasts regarding the financial

position, results, business and industrial strategy of Maurel &

Prom. By their very nature, forecasts involve risk and uncertainty

insofar as they are based on events or circumstances which may or

may not occur in the future. These forecasts are based on

assumptions we believe to be reasonable, but which may prove to be

incorrect and which depend on a number of risk factors, such as

fluctuations in crude oil prices, changes in exchange rates,

uncertainties related to the valuation of our oil reserves, actual

rates of oil production and the related costs, operational

problems, political stability, legislative or regulatory reforms,

or even wars, terrorism and sabotage.

Maurel & Prom is listed on Euronext Paris

SBF 120 – CAC Mid 60 – CAC Mid & Small – CAC All-Tradable –

PEA-PME and SRD eligible Isin FR0000051070 / Bloomberg MAU.FP /

Reuters MAUP.PA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129140900/en/

Maurel & Prom Shareholder relations Tel.: +33 (0)1 53

83 16 45 ir@maureletprom.fr NewCap Investor/media relations

Tel.: +33 (0)1 44 71 98 53 maureletprom@newcap.eu

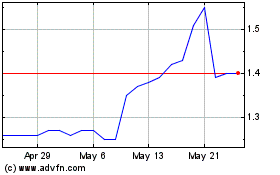

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Feb 2024 to Feb 2025