Third Quarter Financial Results-Baca Oil & Gas Environmental Study & Otish Uranium Exploration Update

November 30 2007 - 5:38PM

Marketwired

TORONTO, ONTARIO

LEXAM EXPLORATIONS INC. (TSX VENTURE: LEX) (PINK SHEETS: LEXEF)

(FRANKFURT: D2Q) is pleased to announce financial results for the

third quarter 2007, including an update on the Baca Oil and Gas

Project in Colorado, USA and Otish Uranium Project in Quebec,

Canada.

FINANCIAL HIGHLIGHTS & RESULTS

Third Quarter 2008

Lexam recorded a net loss of $1,589,986 ($0.03 per share basic

and diluted) during the three months ended September 30, 2007,

compared to net income of $11,599 ($0.00 per share basic and

diluted) during the corresponding period in 2006. The loss for the

quarter was the result of exploration expenditures, administrative

and corporate development costs, and unrealized foreign exchange

losses; this loss was partially offset by the realized gain on the

previously announced sale by Lexam's 62% owned subsidiary, MacPass

Resources, of the Jason property in the Yukon to HudBay

Minerals.

Major expenditures during the quarter included costs associated

with an Environmental Assessment (EA) being prepared in conjunction

with the Lexam's planned drilling at its Baca Project in Colorado,

exploration spending at the Otish Uranium Project in Quebec

including costs related to administration and corporate development

activities. For the year to date, net income was $8,742,933 ($0.18

per share and $0.17 per share diluted) compared to a loss of

$244,359 ($0.01 per share basic and diluted) in the corresponding

period in 2006. The gain for the year is the result of the sale of

the Nevada properties during the second quarter.

The complete third quarter report, including management's

discussion and analysis, financial statements, and notes can be

found on the Company's website at www.lexamexplorations.com and on

SEDAR at www.sedar.com.

BACA OIL & GAS PROJECT UPDATE

On May 25th, 2007 Lexam announced that the San Luis Valley

Ecosystem Council (SLVEC) had filed and served a Complaint against

the United States Fish and Wildlife Service (USFWS) in Federal

District Court in Denver, Colorado. The SLVEC claims that the USFWS

had not complied with the National Environmental Policy Act (NEPA)

in connection with certain exploration activities carried out and

proposed by Lexam on the Baca Oil & Gas Project.

Since the Complaint was filed, the USFWS engaged ENSR, a leading

environmental consultancy firm, to complete an EA pursuant to NEPA.

On August 17th 2007, USFWS held a public meeting to inform

interested parties about Lexam's activities and to seek initial

comments on the Company's proposed oil and gas drilling. The USFWS

and ENSR have reviewed the public's comments and have undertaken

the necessary actions to complete an EA in compliance with

NEPA.

Lexam has been informed by the USFWS and ENSR that the EA is now

being finalized. Once the final EA is complete it will be submitted

for a minimum 30 day public comment period. The USFWS will consider

all additional public comments before determining the level of

impact Lexam's proposed exploration activities will have on the

federal land.

OTISH URANIUM PROJECT

Initial Exploration Program

During the third quarter Lexam and its joint venture partner,

Golden Valley Mines, carried out their initial exploration program

on the Otish Uranium Project in north-central Quebec. Lexam's

properties are situated near Strateco Resources, which recently

announced a total resource estimate of 4.1 million lbs. of uranium

at an approximately grade of 0.7% U3O8 (Strateco News Release

October 1, 2007) and Cameco, the world's largest uranium producer,

which recently disclosed a drill result of 1.06% eU3O8 over nearly

16 meters (Cameco MD&A October 31, 2007). Lexam and Golden

Valley hold approximately 205,400 acres, making it the regions

largest land holder.

An airborne geophysical survey was completed over the Mistassini

portion of the project, which defined 5 new high priority target

areas for potential economic uranium mineralization that are

situated along the unconformity contact of the basin. The style of

mineralization that will be tested is similar to the high-grade

uranium deposits found in Saskatchewan's Athabasca Basin where 28%

of the world's annual uranium production is mined. Prior drilling

in the Mistassini section of Lexam and Golden Valley's land

position returned a uranium intersection of 0.16% U3O8over 1.40

meters. A second airborne survey was initiated on the Otish section

of the project before winter conditions set in. Approximately 27%

of the second airborne survey was completed before the program

concluded. Results from this survey are currently pending. The

survey is scheduled to be completed during the 2008 spring

season.

Lexam and Golden Valley also completed a detailed geological and

geophysical survey with the objective of re-locating and

re-sampling historical uranium showings on the project area.

Exploration focused on 7 of the most significant reported

historical showings on the project. Sampling over the Mistassini

section was also conducted to identify radioactive mineralized

zones for drill testing in early 2008 with surface samples over

both sections returning anomalous uranium values and path finder

elements.

Lexam and Golden Valley are now preparing to carry out their

first phase drill program to commence by the second quarter of

2008. The initial program of diamond drilling will consist of

approximately 3,500 ft (1,067 meters) of drilling. The results from

this initial program, along with exploration results obtained from

the second, full field season on the ground, will be used to

establish the size of the second, phase II drill program that is

scheduled for the second half of 2008.

Michael P. Rosatelli, P. Geo. is a "Qualified Person" as defined

in National Instrument 43-101 and is responsible for the technical

information related to uranium exploration presented in this news

release.

About Lexam

Lexam Explorations is a North American based energy exploration

company. The company is advancing the Baca Oil & Gas Project

located in south-central Colorado, USA, which is 75% owned by Lexam

and 25% by ConocoPhillips and has an option to earn 50% interest in

Golden Valley Mines Otish Basin uranium project located in Quebec,

Canada.

CAUTIONARY STATEMENT

Some of the statements contained in this release are

"forward-looking statements". Such forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to

differ materially from the anticipated results, performance or

achievements expressed or implied by such forwardlooking

statements. Factors that could cause actual results to differ

materially from anticipated results include risks and uncertainties

such as: ability to raise financing for further exploration and

development activities; risks relating to estimates of reserves,

deposits and production costs; extraction and development risks;

the risk of commodity price fluctuations; political, regulatory and

environmental risks; and other risks and uncertainties in the

reports and disclosure documents filed by Lexam from time-to-time

with Canadian securities regulatory authorities. The Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. The complete third quarter report

including management's discussion and analysis, financial

statements and notes can be found on our Company's website at

www.lexamexplorations.com and on SEDAR at www.sedar.com.

Contacts: Lexam Explorations Inc. Ian J. Ball Vice-President,

Corporate Development (647) 258-0395 or Toll Free: 1-866-441-0690

(647) 258-0408 (FAX) Email: ian@lexamexplorations.com Website:

www.lexamexplorations.com Lexam Explorations Inc. Corporate Head

Office 99 George Street, 3rd Floor Toronto, ON M5A 2N4

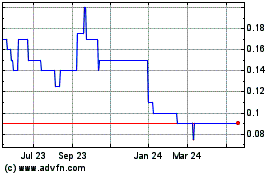

Longhorn Exploration (TSXV:LEX)

Historical Stock Chart

From Dec 2024 to Jan 2025

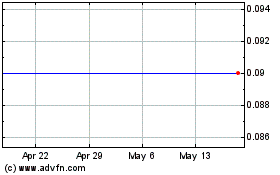

Longhorn Exploration (TSXV:LEX)

Historical Stock Chart

From Jan 2024 to Jan 2025