Kane Biotech Announces Fourth Quarter and Full Year 2021 Financial Results

March 24 2022 - 4:05PM

Kane Biotech Inc. (TSX- V:KNE; OTCQB:KNBIF) (the “Company” or “Kane

Biotech”), today announced its fourth quarter and full year 2021

financial results.

Fourth Quarter Financial Highlights

- Total Revenue for the three months

ended December 31, 2021 was $411,693, an increase of 60% compared

to $257,339 for the three months ended December 30, 2020. This

increase is primarily attributable to increased pet retail

sales.

- Gross profit for the fourth quarter

of 2021 was $187,315, an increase of 82% compared to $102,717 for

the quarter ended December 31, 2020.

- Total Operating expenses for the

three months ended December 31, 2021 were $1,490,686, an increase

of 28% compared to $1,168,493 for the quarter ended December 31,

2020. This increase is due primarily to increased research

expenditures related to the Company’s DispersinB® human wound care

program.

- Loss for the fourth quarter of 2021

was $(1,257,173) compared to $(945,795) for the quarter ended

December 31, 2020.

- Cash at December 31, 2021 was

$1,153,090 compared to $1,007,923 as of December 31, 2020.

2021 Full Year Financial Highlights

- Total Revenue for year ended

December 31, 2021 was $1,607,775, an increase of 20% compared to

$1,341,574 for the year ended December 31, 2020. This increase is

primarily attributable to increased pet retail sales and a lower

proportion of sales discounts recorded in the current period,

partially offset by the permanent US store closures in Q4 2020 of

one of the Company’s major pet retail customers.

- Gross profit for the year ended

December 31, 2021 was $568,441, an increase of 8% compared to

$526,859 for the year ended December 31, 2020.

- Total Operating expenses for the

year ended December 31, 2021 were $5,451,998, an increase of 15%

compared to $4,751,232 for the year ended December 31, 2020. This

increase is largely attributable to a $627,208 increase in non-cash

compensation expense recorded in the current period. Excluding this

non-cash expense, total operating expenses increased by 1% in 2021

over 2020.

- Loss for the year ended December

31, 2021 was ($4,849,912), an increase of 26% compared to

($3,845,976) for the year ended December 31, 2020.

2021 Corporate Highlights:

Wound Care and Surgical

- Announced positive results from

DispersinB® biocompatibility and in vivo safety studies in

preparation for human clinical trials set to begin later this year.

DispersinB® wound gel underwent an extensive pre-clinical testing

regimen showing it to be safe, non-toxic and non-irritating, as

well as passing all biocompatibility testing. In addition,

DispersinB® wound gel significantly accelerated the healing of both

infected and non-infected dermal wounds compared to controls.

- Signed a new manufacturing

partnership with Dow Development Laboratories, LLC ("DDL”) for

process scale up and the manufacture of DispersinB® wound gel under

Good Manufacturing Practices (GMP).

- Advanced product development

efforts relating to the Company’s coactiv+™ wound gel, positioning

Kane to receive 510(k) approval from the FDA in the second half of

2022.

- Received two patents from the

European Patent Office providing broad protection of the Company’s

coactiv+™ technology.

Animal Health

- Efficacy trials for STEM Animal

Health Inc.’s (“STEM”) pet oral care water additive have met the

primary endpoint. STEM’s pet oral care products are scientifically

formulated with Kane’s patented coactiv+™ technology to safely

break down plaque and tartar biofilm.

- STEM began shipping orders of

bluestem™ products to PetSmart® Canada, Canada’s largest specialty

pet retailer of services. Bluestem™ oral care products are

distributed to all 150 stores and available on PetSmart®’s online

store.

- Kane received a milestone payment

from Dechra Veterinary Products LLC in the amount of $125,000 USD

in anticipation of Dechra’s commercial launch in South America in

2022.

Dermatology

- Kane’s DermaKB™ scalp care products

gained significant traction, with Q4 2021 sales doubling Q3 2021

sales due to the Company’s retail expansion of products onto

Amazon.ca and Amazon.com and its strategic advertising

efforts.

- DermaKB™ was recognized by the

Canadian Dermatology Association Expert Advisory Board as part of

their Skin Health Program (SHP), which identifies skin care

products that are fragrance-free or unscented, have low potential

for irritation and do not contain the most common allergens.

Financing

- The Company entered into an amended

and restated credit agreement with Pivot Financial Inc. (“Pivot”)

which amends and restates the existing credit agreement with Pivot

dated November 5, 2020, increasing the credit facility to $2.5

million from $1.48 million.

- Subsequent to year end, the Company

announced its intention to undertake a $1 million capital raise in

March 2022.

“I am proud of Kane’s accomplishments realized

in 2021,” said Marc Edwards, President & CEO of Kane Biotech.

“Growth opportunities were seized across each of our strategic

pillars - animal health, dermatology, and wound and surgical care.

Combined with our Q4 results, we have exited 2021 poised for growth

and momentum that will further drive revenue in 2022.”

Kevin Cole, President and CEO of STEM, added, “2021 was a

foundation building year for STEM Animal Health, including the

rebuilding of our supply chain to support our future growth

plans. We look forward to continuing to accelerate the growth

realized in Q4 into 2022 and beyond.”

Detailed financial information about Kane Biotech can be found

in its December 31, 2021 Financial Statements and Management

Discussion and Analysis on SEDAR and the Company’s website.

Conference Call details:Kane Biotech is pleased

to invite all interested parties to participate in a conference

call on Thursday, March 24, 2022, at 4:30pm ET during which time

the results will be discussed.

Webcast https://edge.media-server.com/mmc/p/qd5coozw

|

Participant Dial In: |

|

|

Participant Toll-Free Dial-In Number: |

(877) 268-9044 |

| |

Participant International

Dial-In Number: |

(706) 679-2995 |

| |

Conference ID: |

6942136 |

| |

|

|

| Audio

Replay (7 Days valid after the live call) |

| |

Toll Free: |

(855) 859-2056 |

| |

International: |

(404) 537-3406 |

| |

Conference ID: |

6942136 |

A live and archived audio webcast of the conference call will

also be available on the investor relations page of Kane Biotech’s

corporate website. www.kanebiotech.com

About Kane Biotech

Kane Biotech is a biotechnology company engaged in the research,

development and commercialization of technologies and products that

prevent and remove microbial biofilms. The Company has a portfolio

of biotechnologies, intellectual property (81 patents and patents

pending, trade secrets and trademarks) and products developed by

the Company's own biofilm research expertise and acquired from

leading research institutions. StrixNB™, DispersinB®, Aledex™,

bluestem™, bluestem®, silkstem™, goldstem™, coactiv+™, coactiv+® ,

DermaKB™ and DermaKB Biofilm™ are trademarks of Kane Biotech Inc.

The Company is listed on the TSX Venture Exchange under the symbol

"KNE" and on the OTCQB Venture Market under the symbol “KNBIF”.

For more information:

| Marc

Edwards |

|

Ray Dupuis |

|

Nicole

Sendey |

| Chief Executive Officer |

|

Chief Financial Officer |

|

Investor Relations/PR |

| Kane Biotech Inc |

|

Kane Biotech Inc |

|

Kane Biotech Inc |

| medwards@kanebiotech.com |

|

rdupuis@kanebiotech.com |

|

nsendey@kanebiotech.com |

| +1 (514) 910-6991 |

|

+1 (204) 298-2200 |

|

+1 (250) 327-8675 |

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Caution Regarding Forward-Looking

InformationThis press release contains certain statements regarding

Kane Biotech Inc. that constitute forward-looking information under

applicable securities law. These statements reflect

management’s current beliefs and are based on information currently

available to management. Certain material factors or assumptions

are applied in making forward-looking statements, and actual

results may differ materially from those expressed or implied in

such statements. These risks and uncertainties include, but are not

limited to, risks relating to the Company’s: (a) financial

condition, including lack of significant revenues to date and

reliance on equity and other financing; (b) business, including its

early stage of development, government regulation, market

acceptance for its products, rapid technological change and

dependence on key personnel; (c) intellectual property including

the ability of the Company to protect its intellectual property and

dependence on its strategic partners; and (d) capital structure,

including its lack of dividends on its common shares, volatility of

the market price of its common shares and public company costs.

Further information about these and other risks and uncertainties

can be found in the disclosure documents filed by the Company with

applicable securities regulatory authorities, available

at www.sedar.com. The Company cautions that the foregoing list

of factors that may affect future results is

not exhaustive.

| |

|

|

|

|

|

|

|

|

KANE BIOTECH INC. |

|

|

|

|

|

|

|

|

Selected Financial Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Comprehensive Loss |

Three months ended December 31, |

|

Year ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

Total Revenue |

$ |

411,693 |

|

|

$ |

257,339 |

|

|

$ |

1,607,775 |

|

|

$ |

1,341,574 |

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

|

187,315 |

|

|

|

102,717 |

|

|

|

568,441 |

|

|

|

526,859 |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administration |

|

950,727 |

|

|

|

906,237 |

|

|

|

4,074,748 |

|

|

|

3,425,105 |

|

| |

|

|

|

|

|

|

|

|

Research |

|

532,648 |

|

|

|

262,256 |

|

|

|

1,369,939 |

|

|

|

1,326,127 |

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

1,483,375 |

|

|

|

1,168,493 |

|

|

|

5,444,687 |

|

|

|

4,751,232 |

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

$ |

(1,296,059 |

) |

|

$ |

(1,065,776 |

) |

|

$ |

(4,876,246 |

) |

|

$ |

(4,224,373 |

) |

|

|

|

|

|

|

|

|

|

|

Loss and comprehensive loss for the period |

$ |

(1,257,172 |

) |

|

$ |

(945,795 |

) |

|

$ |

(4,849,912 |

) |

|

$ |

(3,845,976 |

) |

|

|

|

|

|

|

|

|

|

|

Loss and comprehensive loss for the period attributable to

shareholders |

$ |

(1,268,816 |

) |

|

$ |

(816,505 |

) |

|

$ |

(4,604,566 |

) |

|

$ |

(3,716,686 |

) |

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share for the

period |

$ |

(0.01 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.03 |

) |

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic and

diluted |

|

114,813,535 |

|

|

|

108,613,535 |

|

|

|

114,813,535 |

|

|

|

108,613,535 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Financial Position |

December 31, |

|

December 31, |

|

|

|

|

| |

|

2021 |

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

1,153,090 |

|

|

$ |

1,007,923 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other current assets |

|

1,727,320 |

|

|

|

1,730,687 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

3,253,883 |

|

|

|

2,297,009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

$ |

6,134,293 |

|

|

$ |

5,035,619 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

$ |

4,721,009 |

|

|

$ |

2,924,174 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

2,980,298 |

|

|

|

1,036,709 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity |

|

(1,567,014 |

) |

|

|

1,074,736 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

6,134,293 |

|

|

$ |

5,035,619 |

|

|

|

|

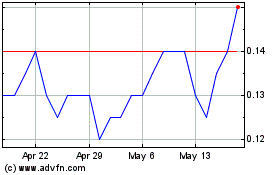

|

Kane Biotech (TSXV:KNE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kane Biotech (TSXV:KNE)

Historical Stock Chart

From Feb 2024 to Feb 2025