Iberian Minerals Corp. (TSX VENTURE:IZN) today announced financial and operating

results for the three month period ended March 31, 2011, with comparative

figures for the three month period ended March 31, 2010. The unaudited condensed

consolidated financial statements and related notes, and Management Discussion

and Analysis may be found on www.sedar.com. Unless stated otherwise, all

reported figures are in U.S. dollars. The Company reported net income of $30.16

million for Q1 2011, representing $0.08 per share.

Overview of Q1 2011:

Financial:

- Recorded net income of $30.16 million or $0.08 per registered share which

included:

- Sales of $37.23 million and gross margin of $(22.57) million;

- A realized loss of $58.64 million on commodity hedges (included in

sales);

- An unrealized non-cash gain of $63.08 million on derivative financial

instruments outstanding, principally as a result of commodity hedging

positions in copper and zinc that were delivered into during the period

and were thus retired.

- As at March 31, 2011 MATSA held 6,096 FMT of copper in concentrate and

2,951 FMT of zinc in concentrate at port awaiting shipment with

approximate market value of $64 million as at March 31, 2011. The Company

received payment in advance of sale of these metals in the amount of

$56.43 million during the period.

- Cash flow provided by operations was $34.05 million.

- Subsequent to the end of the period, on June 24, 2011 the Company

completed a CA$ 76 million equity financing which allows for the buy-out

of Trafigura's 45.96% net-profit interest in Condestable for 2011 to 2014

for $60 million.

Operational - CMC:

- Condestable Mine processed copper ore at budgeted rates. The average

copper ore grade was 1.12% in 2011 versus 1.10% in 2010.

- CMC processed 578,700 tonnes of ore in 2011 versus 551,700 tonnes of ore

in 2010 (increase of 5%).

- Copper concentrate production in 2011 was 23,400 DMT versus 21,300 DMT in

2010 (increase of 10%).

- Contained copper production in 2011 was 5,770 FMT versus 5,340 FMT tonnes

in the prior year.

- The Cash Operating Cost (non-IFRS measure; refer to note 1) in 2011 was

$1.08 per payable pound of copper versus prior year of $1.06.

Other

- Subsequent to the end of the period, in May 2011 completed an amendment to

its senior debt facility and increased the principal to $60 million and

extended the term by six months (to September 2013).

Operational - MATSA:

- MATSA processed 514,100 tonnes of ores in 2011 versus 357,600 tonnes of

ores in 2010 (increase of 44%).

- Produced 26,800 DMT of copper concentrate (2010 - 19,400 DMT), 17,400 DMT

of zinc concentrate (2010 - 6,000 DMT) and 10,400 DMT of lead concentrate

(2010 - nil). Contained metal production was 6,000 FMT of copper (2010 -

5,170 tonnes), 8,450 FMT of zinc (2010 - 2,930 tonnes), 1,950 FMT of lead

(2010 - nil) and 298,800 ounces of silver (2010 - 137,600 ounces).

- The Cash Operating Cost was $1.72 per payable pound of copper (2010 -

$2.23 per payable pound of copper).

Other

- Subsequent to the end of the period, in May 2011 MATSA was awarded the

exploration concessions by the local authorities for the Sotiel property.

The Sotiel mine, which forms part of the concessions, was a past producing

mine as is located approximately 25 km from the Aguas Tenidas operation.

Outlook

The first six months of 2011 has proven to be a very busy period for the

Company. Accomplishments included the following:

- Production results for Q1 that have met and in some cases exceeded

operating parameters.

- The decision to exercise the option to buy-out Trafigura's 45.96% Net

Profit Interest ("NPI"), which was contingent consideration to be paid by

Iberian to Trafigura as part of the acquisition of CMC in 2008, for $60

million.

- The receipt of the exploration concessions for the Sotiel Mine in Spain.

- Completion of a CA$ 76 million equity financing to fund both the NPI buy-

out and Sotiel Mine evaluation work plan.

For the balance of 2011 the Company's focus will be on numerous priorities both

with the Operations and with Developments as referred to in the following.

Operations

At both CMC and MATSA the Company expects to meet previously issued production

guidance for 2011. For CMC the priority is to complete the plant expansion

activities to allow for daily operations at 6,600 tpd by the end of Q3 2011.

For MATSA the priority remains optimization of metallurgical performance in the

processing plant. The 2011 budget parameters for the copper and polymetallic

circuits are substantially being met. The focus will be to further optimize both

concentrate grades and recoveries.

MATSA is currently engaged in contract negotiations with the labour unions

representing the operations' employees. The most recent contract expired on

December 31, 2010. While the company is optimistic that a new collective labour

agreement will be reached without a work stoppage any negative developments in

this regard may negatively impact on expected production from Aguas Tenidas in

2011.

Development

With the recent receipt of the exploration concessions for the Sotiel Mine in

Spain the Company will be actively studying a possible rehabilitation and

re-start of the Sotiel Mine together with a related expansion study for the

operations at Aguas Tenidas. A budget for this work program of approximately $20

million has been approved by the Board of Directors and is expected to be spent

over the remainder of 2011.

Summarized Financial Results

The following table presents a summarized Statement of Operations for the three

months ended March 31, 2011 with comparatives for the three months ended March

31, 2010.

Effective January 1, 2011, International Financial Reporting Standards ("IFRS")

became Canadian GAAP for publicly accountable enterprises. As a result, the

Company's condensed consolidated financial statements for the first quarter of

2011 are reported in accordance with IFRS, with comparative information for 2010

restated.

The condensed consolidated financial statements for the first quarter of 2011

include reconciliations from previous Canadian GAAP reporting to IFRS for the

Company's opening balance sheet as at January 1, 2010, and balance sheet as at

December 31, 2010 and the statements of loss for the three months ended March

31, 2010 and the year ended December 31, 2010. Also included are reconciliations

of equity as at January 1, 2010, as at March 31, 2010 and as at December 31,

2010.

----------------------------------------------------------------------------

Periods ended March 31, 2011 2010

----------------------------------------------------------------------------

$ $

Sales 37,230 55,799

Costs and expenses of mining operations 59,801 74,649

----------------------------------------------------------------------------

Gross loss (22,571) (18,850)

Expenses

Administrative expenses and other 1,446 1,235

Foreign exchange (gain) loss 3,141 (12,658)

Contingent consideration fair value - 5,233

Unrealized (gain) loss on derivative instruments (63,078) 12,159

----------------------------------------------------------------------------

Total expenses (other income) (58,491) 5,969

Operating income (loss) 35,920 (24,819)

Net finance costs 6,231 2,496

----------------------------------------------------------------------------

Profit (loss) before taxation 29,689 (27,315)

Income tax expense 843 1,422

Future income tax expense (recovery) (1,316) 9,030

----------------------------------------------------------------------------

Net income (loss) 30,162 (37,767)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic earnings (loss) per share ($) 0.083 (0.112)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Diluted earnings (loss) per share ($) 0.077 (0.112)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Key operating statistics

MATSA:

----------------------------------------------------------------------------

Three months

Periods ended March 31, Unit 2011 2010

----------------------------------------------------------------------------

Ore mined t 587,956 551,326

Ore processed t 578,738 551,683

Copper ore grade % 1.12 1.10

Concentrate grade % 25 25

Copper recovery rate % 89 88

Copper concentrate DMT 23,387 21,283

Copper contained in concentrate FMT 5,768 5,335

Gold contained in concentrate oz 3,406 3,259

Silver contained in concentrate oz 77,840 66,046

Payable copper contained in concentrate FMT 5,506 5,097

Payable gold contained in concentrate oz 3,084 2,951

Payable silver contained in concentrate oz 69,705 59,144

----------------------------------------------------------------------------

Cash Operating Cost per lb of payable

copper USD $ 1.08 $ 1.06

----------------------------------------------------------------------------

MATSA:

----------------------------------------------------------------------------

Three months

Periods ended March 31, Unit 2011 2010

----------------------------------------------------------------------------

Copper ore

----------

Ore mined t 304,687 285,212

Ore processed t 305,748 281,685

Copper ore grade % 2.17 1.88

Concentrate grade % 22 23

Copper recovery rate % 86 86

Copper concentrate DMT 25,403 19,403

Copper contained in concentrate FMT 5,713 4,538

Silver contained in concentrate oz 92,319 64,471

Payable copper contained in concentrate FMT 5,459 4,344

Payable silver contained in concentrate oz 67,476 45,756

Polymetallic ore

----------------

Ore mined t 214,180 61,659

Ore processed t 208,335 75,875

Zinc ore grade % 5.99 6.11

Zinc concentrate grade % 49 49

Zinc recovery rate % 68 64

Copper ore grade % 1.06 1.27

Copper concentrate grade % 21 -

Copper/lead concentrate grade % - 10

Copper recovery rate % 19 66

Lead ore grade % 1.87 -

Lead concentrate grade % 19 -

Lead recovery rate % 51 -

Zinc concentrate DMT 17,366 5,959

Copper concentrate DMT 1,358 -

Copper/lead concentrate DMT - 6,071

Lead concentrate DMT 10,412 -

Zinc contained in concentrate FMT 8,451 2,933

Copper contained in concentrate FMT 288 629

Lead contained in concentrate FMT 1,954 -

Silver contained in concentrate oz 206,504 73,095

Payable zinc contained in concentrate FMT 7,061 2,456

Payable coppper contained in concentrate FMT 275 568

Payable lead contained in concentrate FMT 1,641 -

Payable silver contained in concentrate oz 136,210 54,911

----------------------------------------------------------------------------

Cash Operating Cost per lb of payable

copper USD 1.72 2.23

----------------------------------------------------------------------------

About Iberian Minerals Corp.

Iberian Minerals Corp. is a Canadian listed global base metals company with

interests in Spain and Peru. The Condestable Mine, located in Peru approximately

90 km south of Lima operates at 2.2 million tonnes per year producing copper,

and associated silver and gold in a concentrate. The Aguas Tenidas Mine is in

the Andalucia region of Spain approximately 110 km north-west of Seville and

operates a 2.2 million tonnes per year underground mine and concentrator that

produces copper, zinc and lead concentrates that also contain gold and silver.

Note 1 - The Cash Operating Cost per pound of payable copper is a non-IFRS

performance measure. It includes cash operating costs, including treatment and

refining charges ("TC/RC"), freight and distribution costs, and is net of

by-product metal credits (zinc, gold and silver). The Cash Operating Cost per

pound of payable copper indicator is consistent with the widely accepted

industry standard established by Brook Hunt and is also known as the C1 cash

cost.

FORWARD LOOKING STATEMENTS:

This news release contains certain "forward-looking statements" and

"forward-looking information" under applicable securities laws. Except for

statements of historical fact, certain information contained herein constitutes

forward-looking statements. Forward-looking statements are frequently

characterized by words such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", and other similar words, or statements that certain

events or conditions "may" or "will" occur. Forward looking information may

include, but is not limited to, statements with respect to the future financial

or operating performances of the Corporation, its subsidiaries and their

respective projects, the timing and amount of estimated future production,

estimated costs of future production, capital, operating and exploration

expenditures, the future price of copper, gold and zinc, the estimation of

mineral reserves and resources, the realization of mineral reserve estimates,

the costs and timing of future exploration, requirements for additional capital,

government regulation of exploration, development and mining operations,

environmental risks, reclamation and rehabilitation expenses, title disputes or

claims, and limitations of insurance coverage. Forward-looking statements are

based on the opinions and estimates of management at the date the statements are

made, and are based on a number of assumptions and subject to a variety of risks

and uncertainties and other factors that could cause actual events or results to

differ materially from those projected in the forward-looking statements. Many

of these assumptions are based on factors and events that are not within the

control of the Corporation and there is no assurance they will prove to be

correct. Factors that could cause actual results to vary materially from results

anticipated by such forward-looking statements include changes in market

conditions and other risk factors discussed or referred to in the section

entitled "Risk Factors" in the Corporation's annual information form dated March

29, 2010. Although the Corporation has attempted to identify important factors

that could cause actual actions, events or results to differ materially from

those described in forward-looking statements, there may be other factors that

cause actions, events or results not to be anticipated, estimated or intended.

There can be no assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ materially from those

anticipated in such statements. The Corporation undertakes no obligation to

update forward-looking statements if circumstances or management's estimates or

opinions should change except as required by applicable securities laws. The

reader is cautioned not to place undue reliance on forward-looking statements.

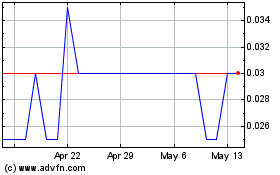

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Jun 2024 to Jul 2024

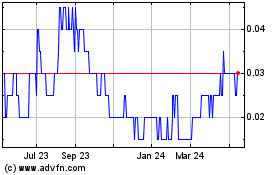

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Jul 2023 to Jul 2024